The two-Judge Bench of the Supreme Court of India has dismissed the Income Tax Department’s plea from reassessing Deepak Kochhar and NuPower Renewables.

The income tax department sought to reopen the accounts of NuPower last year to examine the genuineness of investments of about Rs 50 crore by Firstland Holdings in 2011.

NuPower is being investigated for receiving quid pro quo investments for loans sanctioned to various industrial houses by ICICI when she was at the helm of affairs.

The tax department wanted to investigate the investment of Rs 49.9 crore by Mauritius-based Firstland Holdings in NuPower through the purchase of convertible preference shares in 2010-11. In mid-2018, the department claimed the source, genuineness and creditworthiness of Firstland Holdings remain unexplained and needed further investigation.

The revenue department also claimed NuPower had not fully and truly disclosed all material facts necessary for assessment.

NuPower challenged the department’s move in Bombay High Court on December 12, 2018. It argued that the reopening notice was time-barred since it was issued beyond the permissible period of four years.

“Without there being any new or additional material, reopening assessment on the basis of the said ground is not permissible.” The company argued that the information was not new for the assessing officer.

“Through a series of correspondence between the assessee and assessing officer, this information was highlighted time and again,” the company said in its response.

“The channel of movement of the fund, the source of the fund, purpose of investment and ultimate destination of the fund, were all part of the record during the assessment proceedings. There is nothing in the reason recorded by the assessing officer to suggest that such investment is bogus.”

A division bench of the Bombay High Court comprising Justice Akil Kureshi and Justice MS Sanklecha set aside the department’s reopening notice on March 7 and observed that the income tax officer had all the material information in hand when the assessment was framed. The high court had said there was nothing with the assessing officer to prima facie show that the investments were “not genuine.”

The high court rejected the department’s claim that it could reopen assessments even though it may not have additional grounds for doing so.

“The investigation into the source of genuineness and creditworthiness of the investor company would fall within the realm of fishing enquiries, which is wholly impermissible in law in the context of the reopening of the assessment,” the court said.

“This petition was called on for hearing today,” the two-judge bench of Justice Rohinton Fali Nariman and Justice Surya Kant said in its order “The special leave petition is dismissed.”

Subscribe Taxscan Premium to view the JudgmentThe Indian Institute of Petroleum and Energy (IIPE) has invited application for the post of Accountant from CA (Inter) qualified candidates.

Indian Institute of Petroleum and Energy (IIPE), is an Institute of National Importance at par with all other IITs and IIMs and enacted by Parliament vide the Indian Institute of Petroleum & Energy Act, 2017.

Qualifications and Experience

Minimum Qualification: Bachelor’s Degree in Commerce or CA (Inter) qualified with 3 years of relevant experience as a Junior Assistant in the GP of Rs. 2000 (in VI CPC) or equivalent level-4 in VII CPC or equivalent. Knowledge of Computer Office applications like MS Word, MS Excel, Tally, etc and exposure to office procedures like maintenance of Files, Noting and Drafting, etc are essential Computer Typing skill of 35 wpm (equiv. to 10500 KDPH) with an average of 5 key depressions for each work.

Preference will be given to the candidates who can have exposure with Tally and all commercial organizations work exposure with EPF, NPS, ESI, Income-Tax, GST, Auditing, Employees pay fixations, Leave Rules and all such other accountancy procedures. He is responsible to handle all the correspondence with the outside organizations relating to accountancy matters.

Maximum Age limit: 30 years.

For Further Information Click here.

The Income Tax Department carried out a search operation on 10th October 2019 covering six premises of two groups involved in the sale-purchase of hotel resort at Goa.

One of the groups covered currently owns a large property at Goa on which a 5-star resort project is being built. The group is engaged primarily in hotels & hospitality, real estate and construction. The buyer, a Delhi Based group of companies is into catering, restaurant and hotel business.

Search operations have been concluded. The search resulted in the seizure of undisclosed assets of Rs 4.39 crore comprising undisclosed cash of Rs 2.55 crore and jewellery/valuables worth Rs 1.84 crore. The group made a disclosure of a total amount of Rs 124.41 crore representing undisclosed income and also committed to paying taxes immediately.

The Supreme Court of India in the case of Indusind Media and Communications Ltd v. Commissioner of Customs held the value of software and the concerned services are to be taken as a part of the importation.

The appellant imported Multiplexor Satellite Receivers, test and measurement equipment at Delhi and on a subsequent receipt of information from SIIB Air Cargo Complex Mumbai that investigations had been commenced against the appellant for import of similar goods at Mumbai, the provisional assessment was ordered under Section 18 of the Customs Act. The investigation undertaken at Mumbai revealed that each set of equipment taken together constituted ‘Head End’ for cable TV operations meriting classification under Customs Tariff Heading 8543 8999 in light of Note 4 to Section XVI and hence were mis-declared.

The Department issued SCN alleging the importer to have fabricated documents by way of the splitting of the value of the goods and declared a lesser value to the Customs Department with the sole intention to evade payment of Customs Duties. Also, on the ground that the importer failed to make true declarations, the importer’s goods were liable to be confiscated. The Principal Commissioner of Customs further rejected the declaration by the appellant on the ground that the appellant intentionally did not declare the true and correct value and correct classification of imported goods and also imposed a penalty upon the appellant. The CESTAT also concluded in similar lines, against the appellant, stating that the imported consignment does not constitute a complete Head End and that each component is to be classified under the relevant Chapter Heading.

The issue before the Apex Court is the determination of whether the CESTAT has erred in failing to consider the primary submission of the Appellant, that the 19 different items imported by the Appellant, even if taken together do not form one composite ‘Head-end’ and that each item has an individual function, and each item is to be classified under the Chapter Headings CTH 85175010, CTH 85281299, CTH 85438910, CTH 84717010 and CTH 85249112.

Mr. Aman Lekhi, learned Additional Solicitor General appearing for the respondent submitted that though the invoices in the case did mention individual items, the dominant intent had to be seen whether the intended user was of individual items or they were supposed to be used collectively as part of one apparatus.

The Bench comprising of Justice Uday Umesh Lalit and Justice Vineet Saran upheld the view taken by the Department to conclude that the principle stated under Note 4 shall be applicable. The Bench considered the imported items as part of one apparatus or machine to be classifiable under the heading appropriate to the function.

The bench also observed that “after considering the purchase order in the instant case, the Tribunal found that apart from supply of equipment, necessary software had to be embedded in the equipment before the supply was effected. The facts also disclose that out of 19 items indicated in the Bill of Entry, only 8 items were physically presented while the rest were already embedded in the main unit. These facts are not only reflective that the individual components were intended to contribute together and attain a clearly defined function as dealt with in Note 4 of Section XVI as stated above, but also indicate that software that was embedded through cards in the main unit, was not any post-importation activity. The value of the software and the concerned services were therefore rightly included and taken as part of the importation.”

Subscribe Taxscan Premium to view the JudgmentThe Income Tax Department, conducted a search action on 11th October, 2019 in the case of a business group based in Namakkal, Tamil Nadu. The group is mainly into the running of educational institutions, and coaching institutes for competitive exams like NEET, etc. The group comprises several partnership firms and a trust controlled by a closely-knit group of individuals. The search action covered 17 premises including residential premises of the group’s promoters. The premises are located in Namakkal, Perundurai, Karur and Chennai in Tamil Nadu.

The search was undertaken on the basis of intelligence that the group was indulging in substantial tax evasion by suppression of fee receipts received from students. The modus operandi was to receive part of the fees in cash and such cash receipts were invariably not entered in the regular books of accounts. Instead, such receipts were maintained in a separate set of accounts. Incriminating evidence of such suppression of receipts has been found during the search in the form of accounts maintained in diaries, in electronic storage devices and also in the form of huge sums of unaccounted cash. It was found that cash was kept in lockers in banks in the names of employees who acted as Benami or name lenders.

A significant amount of cash was found in a safe inside an auditorium in the main school premises. Unaccounted cash of about Rs 30 crore has been found and seized. The unaccounted receipts are deployed for acquiring immovable properties as personal investments which are then leased for long term to the trust for expanding to other towns. It was also found that highly-priced faculty are hired and employed in the coaching institutes and they are paid outside the books. Based on preliminary findings, the undisclosed income of the group is estimated at more than Rs 150 crore. The search is still in progress.

The Oracle India Pvt. Ltd. Has invited applications for the post of Functional Consultant.

The primary regional functional and technical expertise concerning the general ledger. A resource for country controllers concerning technical and/or process issues that are related to the general ledger.

Provides liaison between the country controllers and App IT for technical issues, setups, and upgrades. The premier driver in the region for global consistency for GL processes. Provides recommendations to the GL Divisional Process Owner (DPO) or other module GPOs for process changes or technical enhancements. Understand and assessing local reporting requirements. The DFE needs to be able to articulate how these requests can be met with either standard reports, other tools (Discover, SEBL analytics), or through an enhancement. A resource for the line of business in determining if a process change or requirement will have some sort of implications to the general ledger.

Responsibilities:

Qualification

PG – M.Com – Commerce, MBA/PGDM – Any Specialization, CA – Any Specialization, CS, ICWA (CMA)

For Further Information Click here.

The Central Board of Indirect Taxes and Customs ( CBIC ) has issued a clarification regarding Goods and Services Tax ( GST ) on license fee charged by States for grant of liquor licenses to vendors.

Services proved by the Government to business entities including by way of grant of privileges, licences, mining rights, natural resources such as spectrum etc. against payment of consideration in the form of fee, royalty etc. are taxable under GST. Same was the position under Service Tax regime also with effect from 1st April, 2016. Tax is required to be paid by the business entities on such services under reverse charge.

In a Circular issued by the CBIC said that, GST Council in its 26th meeting held on 10.03.2018, recommended that GST was not leviable on license fee and application fee, by whatever name it is called, payable for alcoholic liquor for human consumption and that this would apply mutatis mutandis to the demand raised by Service Tax/Excise authorities on license fee for alcoholic liquor for human consumption in the pre-GST era, i.e. for the period from 01-04-2016 to 30-06-2017.

The Department also said that, Grant of liquor licences by State Government against payment of consideration in the form of licence fee, application fee etc. was a taxable service under Service Tax, therefore to implement GST Council’s recommendation, Central Government decided to exempt service provided or agreed to be provided by way of grant of liquor licence by the State Government, against consideration in the form of licence fee or application fee, by whatever name called, during the period from 01.04.2016 to 30.06.2017. Clause No. 117 of Finance (No. 2) Act, 2019 may be referred to in this regard.

GST Council in its 37th meeting held on 20.09.2019 further recommended that the decision of the 26th GST Council meeting be implemented by notifying service by way of grant of alcoholic liquor licence, against consideration in the form of licence fee or application fee or by whatever name it is called, by State Government as neither a supply of goods nor a supply of service. Therefore, in exercise of powers conferred under sub-section 2 (b) of section 7 of CGST Act, 2017, Notification No. 25/2019-Central Tax (Rate) dated 30th September, 2019 has been issued.

GST Council further decided in the 37th meeting held on 20.09.2019, to clarify that this special dispensation applies only to supply of service by way of grant of liquor licenses by the State Governments as an agreement between the Centre and States and has no applicability or precedence value in relation to grant of other licenses and privileges for a fee in other situations, where GST is payable, the Circular also added.

Subscribe Taxscan Premium to view the JudgmentThe Central Board of Indirect Taxes and Customs ( CBIC ) has clarified that, Goods and Services Tax ( GST ) is not applicable on the service of display of name or placing of name plates of the donor in the premises of charitable organisations receiving donation or gifts from individual donors.

In a Circular issued by the CBIC clarified that, Individual donors provide financial help or any other support in the form of donation or gift to institutions such as religious institutions, charitable organisations, schools, hospitals, orphanages, old age homes etc. The recipient institutions place a name plate or similar such acknowledgement in their premises to express the gratitude. When the name of the donor is displayed in recipient institution premises, in such a manner, which can be said to be an expression of gratitude and public recognition of donor’s act of philanthropy and is not aimed at giving publicity to the donor in such manner that it would be an advertising or promotion of his business, then it can be said that there is no supply of service for a consideration (in the form of donation). There is no obligation (quid pro quo) on part of recipient of the donation or gift to do anything (supply a service). Therefore, there is no GST liability on such consideration.

The CBIC has illustrated Some examples of cases:

(a) “Good wishes from Mr. Rajesh” printed underneath a digital blackboard donated by Mr. Rajesh to a charitable Yoga institution.

(b) “Donated by Smt. Malati Devi in the memory of her father” written on the door or floor of a room or any part of a temple complex which was constructed from such donation.

The CBIC also clarified that, In each of these examples, there is no reference or mention of any business activity of the donor which otherwise would have got advertised. Thus where all the three conditions are satisfied namely the gift or donation is made to a charitable organization, the payment has the character of gift or donation and the purpose is philanthropic (i.e. it leads to no commercial gain) and not an advertisement, GST is not leviable.

Subscribe Taxscan Premium to view the JudgmentThe Central Board of Indirect Taxes and Customs ( CBIC ) has issued a clarification on GST on airport levies and to clarify that airport levies do not form part of the value of services provided by the airlines and consequently, no GST should be charged by airlines on airport levies.

Section 2(31) of the CGST Act states that “consideration” in relation to the supply of goods or services or both includes any payment made or to be made, whether in money or otherwise, in respect of, in response to, or for the inducement of, the supply of goods or services or both, whether by the recipient or by any other person. Thus, Passenger Service Fee (PSF) and User Development Fee (UDF) charged by airport operators are a consideration for providing services to passengers.

The CBIC said that, “It is also clear from notification of Director General of Civil Aviation AIC Sl. No. 5 /2010 dated 13.09.2010, which states that UDF approved by MoCA, GoI is inclusive of service tax. It is also seen from the Air India website that the UDF is inclusive of service tax. Further in order No. AIC S. Nos. 3/2018 and 4/2018, both dated 27.2.2018, it has been laid down that GST is applicable on the charges of UDF and PSF”.

PSF and UDF being charges levied by airport operator for services provided to passengers, are collected by the airlines as an agent and is not a consideration for any service provided by the airlines. Thus, the airline is not responsible for payment of ST/GST on UDF or PSF provided the airline satisfies the conditions prescribed for a pure agent under Rule 33 of the CGST Rules. It is the licensee, that is the airport operator (AAI, DIAL, MIAL etc) which is liable to pay ST/GST on UDF and PSF.

Accordingly, the airline acting as a pure agent of the passenger should separately indicate the actual amount of PSF and UDF and GST payable on such PSF and UDF by the airport licensee, in the invoice issued by airlines to its passengers. The airline shall not take ITC of GST payable or paid on PSF and UDF. The airline would only recover the actual PSF and UDF and GST payable on such PSF and UDF by the airline operator. The amount so recovered will be excluded from the value of supplies made by the airline to its passengers. In other words, the airline shall not be liable to pay GST on the PSF and UDF (for airport services provided by airport licensee), provided the airline satisfies the conditions prescribed for a pure agent under Rule 33 of the CGST Rules. The registered passengers, who are the ultimate recipient of the airport services, may take ITC of GST paid on PSF and UDF on the basis of pure agent’s invoice issued by the airline to them.

The CBIC also clarified that, “The airport operators shall pay GST on the PSF and UDF collected by them from the passengers through the airlines. Since the airport operators are collecting PSF and UDF inclusive of ST/GST, there is no question of their not paying ST/GST collected by them to the Government”.

“The collection charges paid by airport operator to airlines are a consideration for the services provided by the airlines to the airport operator (AAI, DAIL, MAIL etc) and airlines shall be liable to pay GST on the same under forward charge. ITC of the same will be available with the airport operator”, the CBIC also added.

Subscribe Taxscan Premium to view the JudgmentThe Income Tax Department conducted a search on 9th October 2019 on a prominent business group in Karnataka which runs multiple educational institutions. During the course of the search, the modus operandi of conversion of seats which were originally to be allotted by merit through counselling by MCC maliciously into institutional quota seats through dropout system has been unearthed.

Incriminating evidence has been found in the search, substantiating conversion of seats, commission payments to brokers and sale of seats in exchange of receipt of cash. Evidences of use of multiple agents for the conversion of MBBS and PG seats have also been found. Diversion of funds in the form of payment of on-money for the purpose of purchase of immovable assets for the benefit of trustees has also been established including the finding of cash in the possession of the seller, the commission in the hands of the broker and strong written and audio evidence found in possession of the concerned parties. Evidences of handling of such cash generated, diversion for construction of hotels has also been found. Hawala transactions relating to the movement of such cash have also been established. A total of Rs.4.22 crore of unaccounted cash has so far been found including Rs.89 lakh in the house of the main trustee.

Certain students whose names were used in the conversion of seats have made statements establishing the modus operandi. Agents have admitted having aided in the sale of seats, brokers have admitted to being witness and accomplice to the diversion of such cash generated.

Modus operandi of making cash deposits in the accounts of certain employees & their families and diversion of them to fixed deposits which are used to services loans taken by trustees has been unearthed. Evidence has further brought to light the fact that trustees have opened bank accounts in the names of their employees to deposit some of the capitation fee received in cash. Fixed deposits amounting to Rs. 4.6 crore in the names of 8 employees made in the above manner has been seized. It was further found that the interest from such Benami fixed deposits have been used to service the loans taken by the trustees in their personal capacity.

Evidence also reveals undisclosed investments in real estate. Overall the total undisclosed income detected so far is around Rs.100 crore considering the cash donations received for 185 seats averaging Rs.50 lakh to Rs.65 lakh per seat and total seizure of undisclosed assets of Rs. 8.82 crore. Further investigations are in progress.

The Central Board of Direct Taxes ( CBDT ) has been releasing key statistics relating to direct tax collections and administration in public domain from time to time.

In continuation of its efforts to place more and more information in public domain, the Central Board of Direct Taxes has further released Time-series data updated up to F.Y. 2018-19 and income-distribution data for A.Y. 2018-19 (F.Y. 2017-18).

The availability of the Time-series data and the income-distribution data in the public domain will be useful for the academicians, research scholars, economists and the public at large in studying long-term trends of various indices of the effectiveness and efficiency of direct tax administration in India.

Subscribe Taxscan Premium to view the JudgmentThe Central Board of Indirect Taxes and Customs ( CBIC ) has issued Clarification on Scope of Support Services to Exploration, Mining or Drilling of Petroleum Crude or Natural Gas or both.

The Department has examined the activities associated with exploration, mining or drilling of petroleum crude or natural gas fall under heading 9986. A few services particularly technical and consulting services relating to exploration also fall under heading 9983. Therefore, following entry has been inserted under heading 9983 with effect from 1 st October 2019 vide Notification No. 20/2019- Central Tax(Rate) dated 30.09.2019; –

“(ia) Other professional, technical and business services relating to exploration, mining or drilling of petroleum crude or natural gas or both”

The CBIC has clarified that, the scope of the entry at Sr. 24 (ii) under heading 9986 of Notification No. 11/2017- Central Tax (Rate) dated 28.06.2017 shall be governed by the explanatory notes to service codes 998621 and 998622 of the Scheme of Classification of Services.

The CBIC also clarified that the scope of the entry at Sr. No. 21 (ia) under heading 9983 of Notification No. 11/2017- Central Tax (Rate) dated 28.06.2017 inserted with effect from 1 st October 2019 vide Notification No. 20/2019- CT(R) dated 30.09.2019 shall be governed by the explanatory notes to service codes 998341 and 998343 of the Scheme of Classification of Services.

“The services which do not fall under the said entries under heading 9983 and 9986 of the said notification shall be classified in their respective headings and taxed accordingly”, the Circular also added.

Subscribe Taxscan Premium to view the JudgmentThe Central Board of Indirect Taxes and Customs ( CBIC ) has issued a clarification on GST Rates and Classification (goods).

The CBIC has received Representations sought on clarification in respect of applicable GST rates on the following items:

Classification of leguminous vegetables when subject to mild heat treatment (parching):

The CBIC has clarified that, such leguminous vegetables which are subjected to mere heat treatment for removing moisture, or for softening and puffing or removing the skin, and not subject to any other processing or addition of any other ingredients such as salt and oil, would be classified under HS code 0713. Such goods if branded and packed in a unit container would attract GST at the rate of 5% [S. No. 25 of notification No. 1/2017- Central Tax (Rate) dated 28.06.2017]. In all other cases, such goods would be exempted from GST [S. No. 45 of notification No. 2/2017- Central Tax (Rate) dated 28.06.2017].

However, if the above dried leguminous vegetable is mixed with other ingredients (such as oil, salt etc) or sold as namkeens then the same would be classified under Subheading 2106 90 as namkeens, bhujia, chabena and similar edible preparations and attract applicable GST rate.

Classification and applicable GST rate on Almond Milk

Regarding GST rate on Almond Milk, the CBIC said that, Almond Milk is made by pulverizing almonds in a blender with water and is then strained. As such almond milk neither constitutes any fruit pulp or fruit juice. Therefore, it is not classifiable under tariff item 2202 99 20. Almond milk is classified under the residual entry in the tariff item 2202 99 90 and attract GST rate of 18%.

Applicable GST rate on Mechanical Sprayer

Regarding GST rate of Mechanical Sprayer, All goods of heading 8424 i.e. [Mechanical appliances (whether or not hand-operated) for projecting, dispersing or spraying liquids or powders; spray guns and similar appliances; steam or sand blasting machines and similar jet projecting machines (other than fire extinguishers, whether or not charged)] attracted GST @18% [S.No.325 of Schedule III] till 25th January, 2018. Subsequently, keeping in view various requests/ representations, the GST Council in its 25th meeting recommended 12% GST on mechanical sprayers. Accordingly, vide amending notification No. 6/2018- Central Tax (Rate), dated 25th January, 2018, GST at the rate of 12% was prescribed (entry No. 195B I Schedule II of Notification No. 1/2017-Central Tax (Rate) dated 28.6.2017) Simultaneously, mechanical sprayers were excluded from the ambit of the said S. No. 325 of Schedule III.

Accordingly, it is clarified that the S. No. 195B of the Schedule II to notification No. 1/2017- Central Tax (Rate), dated 28.06.2017 covers “mechanical sprayers” of all types whether or not hand-operated (like hand-operated sprayer, power-operated sprayers, battery-operated sprayers, foot sprayer, rocker etc.).

Clarification regarding taxability of imported stores by the Indian Navy

In accordance with letter No. 21/31/63-Cus-IV dated 17 Aug 1966 of the then Department of Revenue and Insurance, the Indian Naval ships were treated as “foreign going vessels” for the purposes of Customs Act, 1962, and the naval personnel serving onboard these naval ships were entitled to duty-free supplies of imported stores even when the ships were in Indian harbour. However, in the GST era, no such circular has been issued regarding exemption from IGST on purchase of imported stores by Indian Naval ships. The doubt has arisen as there is a no specific exemption, while there is a specific exemption for the Coast Guard (vide S. No. 4 of notification No. 37/2017-Customs dated 30.6.2017). Similar exemption has not been specifically provided for Navy.

Indian Naval ship stores are exempted from import duty in terms of section 90(1) of the Customs Act, 1962. Further, as per section 90(2), goods “taken on board a ship of the Indian Navy” shall be construed as exported to any place outside India. Also, section 90(1) and 90(3) of the Customs Act, 1962 provides that imported stores for the use of a ship of the Indian Navy and stores supplied free by the Government for the use of the crew of a ship of the Indian Navy in accordance with their conditions of service will be exempted from duty.

Accordingly, it is clarified that imported stores for use in navy ships are entitled to exemption from GST.

Clarification regarding taxability of goods imported under the lease

In respect of goods imported on temporary basis, aircrafts, aircraft engines and other aircraft parts imported into India under a transaction covered by item 1(b) or 5(f) of Schedule II of the Central Goods and Service Tax Act, 2017 are exempted from IGST vide S. No. 547A of Notification No. 50/2017-Customs dated 30.06.2017, subject to condition No. 102, which reads as under :-

The importer, by the execution of the bond, in such form and for such sum as may be specified by the Commissioner of Customs, binds himself, –

Similarly, rigs and ancillary items imported for oil or gas exploration and production taken on lease by the importer for use after import have also been exempted from IGST vide S. No. 557A of the said notification. Subsequently, all goods, vessels, ships (other than motor vehicles) imported under the lease, by the importer for use after import, were also exempted from IGST vide S. No. 557B of the said notification. Both these entries are subject to the same condition No. 102 of the said notification.

Accordingly, the CBIC has clarified that the expression “taken on lease/imported under lease” (in S. No. 557A and 557B respectively of notification No. 50/2017-Customs dated 30.06.2017) covers imports under an arrangement so as to supply services covered by item 1(b) or 5(f) of Schedule II of the CGST Act, 2017 to avoid double taxation. The above clarification holds for such transactions in the past.

Applicability of GST rate on parts for the manufacture Solar Water Heater and System

Applicability of GST rate on parts for the manufacture solar water heater and system, As per entry No 232, solar water heater and system attracts 5% GST. Further, as per S. No. 234 of the notification No. 1/2017-Central Tax (Rate) dated 28.6.2017, solar power-based devices and parts for their manufacture falling under chapter 84, 85 and 94 attract 5% concessional GST. Solar Power based devices function on the energy derived from Sun (in the form of electricity or heat). Thus, a solar water heater and system would also be covered under S. No 234 as solar power device. Thus, Solar Evacuated Tubes which falls under Chapter 84 and other parts falling under chapter 84, 85 and 94, used in the manufacture of solar water heater and system would be eligible for 5% GST under S. No. 234.

Accordingly, it is clarified that parts including Solar Evacuated Tube falling under chapter 84, 85 and 94 for the manufacture of solar water heater and the system will attract 5% GST.

Applicability of GST on the parts and accessories suitable for use solely or principally with a medical device

While concluding the Circular, the CBIC has clarified, Applicability of GST on the parts and accessories suitable for use solely or principally with a medical device.

The medical equipment falling under HS 9018, 9019, 9021 and 9022 attract 12% GST. The imports of parts of ophthalmic equipment suitable for use solely or principally with a piece of ophthalmic equipment were being assessed at 12% GST by classifying it under heading 9018. However, objection has been raised by Comptroller and Auditor General of India (CAG) on the said practice, suggesting that since such goods were not specifically mentioned in the GST rate notification, they fall under tariff item 9033 00 00 [residual entry] and should be assessed at 18% IGST.

The CBIC said that, 12% IGST would be applicable on the parts and accessories suitable for use solely or principally with a medical device falling under heading 9018, 9019, 9021 or 9022 in terms of chapter note 2 (b).

Subscribe Taxscan Premium to view the JudgmentThe Central Government has enabled the feature of making the payment on a Voluntary basis in Form GST DRC-03 on GST Portal.

The Gujarat High Court has quashed an order of detention of goods citing the Ground that it is a Non-Speaking Order.

The petitioner has challenged the notice dated 16.5.2019 issued in Form GST MOV-10 as well as the detention/confiscation order dated 16.5.2019/28.5.2019 issued by the Department in Form GST MOV-11 and seeks a direction to the respondent authorities to forthwith release truck along with the goods contained therein.

The petitioner, a sole proprietorship firm, which is inter alia engaged in the business of transport, procured about 61 different customers. On 16.5.2019 at 13:50 hours while the goods were in transit in vehicle No.GJ-27-X-3752, the third respondent – State Tax Officer, Mobile Squad, Enforcement, Division-2, Ahmedabad intercepted the vehicle at Narol Char Rasta and found that the e-way bills of three parties, namely, Anjani Synthetics Limited dated 30.4.2019, Neelam Fabrics dated 15.5.2019 and Bhansali Cotfab dated 16.5.2019 were not generated. The statement of the driver in charge of the vehicle came to be recorded in Form GST MOV-1. It appears that the goods in respect of 58 customers wherein there were valid e-way bills came to be released; however, the vehicle with the goods in respect of the above three parties came to be detained on the spot on 16.5.2019 by issuing a notice in Form GST MOV -10 under section 130 of the Central Goods and Services Tax Act, 2017 as well as the Gujarat Goods and Services Tax Act, 2017.

The division bench comprising of Justice Harsha Devani and Justice Sangeeta K. Vishen observed that, the department without applying his mind to the facts of the case appears to have mechanically passed the impugned order without assigning any reasons worth the name for confiscating the goods and conveyance.

The Court also criticised the department that, the least that is expected of the authorities discharging duties under these Acts is that they should properly apply their minds to the facts of the case before taking drastic action under the provisions of section 130 of the CGST Act/ GGST Act. Passing orders in a perfunctory manner has been done in the present case without considering the explanations tendered by the affected parties and without assigning reasons, therefore, amounts to an abdication of duties on the part of the concerned officer and causes immense prejudice to the parties.

The Court also said that, “it was incumbent upon the third respondent to give reasons in support of his conclusion that the goods in question and the conveyance are required to be confiscated. However, the impugned order is totally bereft of any reasons, in the absence of which the order stands vitiated due to nonapplication of mind on the part of the maker of the order. The impugned order dated 28.5.2019, therefore, cannot be sustained. Since the court is inclined to set aside the impugned order on the ground that it is a non-speaking order, ordinarily, it would remand the matter to the authority to decide the same afresh by assigning proper reasons. However, in the facts of the present case, the third respondent has filed an affidavit-in-reply which has been extensively referred to hereinabove. As discussed earlier, on the grounds set forth in the affidavit-in-reply, the goods in question could not have been confiscated. Under the circumstances, no useful purpose would be served in remanding the matter to the third respondent”.

Subscribe Taxscan Premium to view the JudgmentThe GST Council has approved the introduction of ‘ E-invoice ’ or ‘electronic invoicing’ in a phased manner for reporting of business to business (B2B) invoices to GST System, starting from 1st January 2020 on a voluntary basis.

Since there was no standard for e-invoice existing in the country, the standard for the same has been finalized after consultation with trade/industry bodies as well as ICAI after keeping the draft in public place. Having a standard is a must to ensure complete interoperability of e-invoices across the entire GST eco-system so that e-invoices generated by one software can be read by any other software, thereby eliminating the need of fresh data entry – which is a norm and standard expectation today.

The machine readability and uniform interpretation is the key objective. This is also important for reporting the details to the GST System as part of Return. Apart from the GST System, adoption of a standard will also ensure that an e-invoice shared by a seller with his buyer or bank or agent or any other player in the whole business eco-system can be read by machines and obviate and hence eliminate data entry errors.

The GST Council approved the standard of e-invoice in its 37th meeting held on 20th Sept 2019 and the same along with schema has been published on GST portal. Standards are generally abstruse and thus an explanation document is required to present the same in common man’s language. Also, there is a lot of myth or misconception about e-Invoice.

The present document is an attempt to explain the concept of e-invoice, how it operates and basics of standards. It also contains FAQs which answer the questions raised by people who responded to the draft e-invoice standard used for public consultation. It is expected that the document will also be useful for the taxpayers, tax consultants and the software companies to adopt the designed standard.

For details on ‘E-Invoicing’ or ‘electronic invoicing’, please click here

For downloading schema & template of ‘E-Invoicing’, please click here

The Central Board of Indirect Taxes and Customs ( CBIC ) has notified Central Goods and Services Tax (Sixth Amendment) Rules, 2019.

On October 9, 2019, vide Notification No. 49/2019-Central Tax, the amendment rules have provided that total unmatched credit cannot exceed 20% of ITC available in GSTR 2A, prescribed Form GST DRC-01A for intimation of tax ascertained by proper officer as payable in fraud and non-fraud cases and other changes made in the CGST Rules, 2017.

The Notification issued by the CBIC reads as, “Input tax credit to be availed by a registered person in respect of invoices or debit notes, the details of which have not been uploaded by the suppliers under sub-section (1) of section 37, shall not exceed 20 per cent. of the eligible credit available in respect of invoices or debit notes the details of which have been uploaded by the suppliers under sub-section (1) of section 37”.

The Notification also reads as, “Where the time limit for furnishing of details in FORM GSTR-1 under section 37 or in FORM GSTR-2 under section 38 has been extended, the return specified in sub-section (1) of section 39 shall, in such manner and subject to such conditions as the Commissioner may, by notification, specify, be furnished in FORM GSTR-3B electronically through the common portal, either directly or through a Facilitation Centre notified by the Commissioner”.

“In the said rules, in rule 83A, in sub-rule (6), for clause (i), the following clause shall be substituted, namely:- “(i) Every person referred to in clause (b) of sub-rule (1) of rule 83 and who is enrolled as a goods and services tax practitioner under sub-rule (2) of the said rule is required to pass the examination within the period as specified in the second proviso of sub-rule (3) of the said rule.”.

The Committee shall make available to the Board 50 per cent. of the amount credited to the Fund each year, for publicity or consumer awareness on Goods and Services Tax, provided the availability of funds for consumer welfare activities of the Department of Consumer Affairs is not less than twenty-five crore rupees per annum, the Notification said.

The proper officer shall, before service of notice to the person chargeable with tax, interest and penalty, under sub-section (1) of Section 73 or sub-section (1) of Section 74, as the case may be, shall communicate the details of any tax, interest and penalty as ascertained by the said officer, in Part A of FORM GST DRC-01A, the notification also added.

Subscribe Taxscan Premium to view the JudgmentThe Ernst & Young ( EY ) has invited applications for the job post of Transfer Pricing – Assistant Manager from the CA/ ICWA/CS Inter/ Final candidates.

Practice management:

Requirements:

Qualifications:

For Further Information Click here.

The Central Board of Indirect Taxes and Customs ( CBIC ) has waived off late fees for filing of GSTR-1, GSTR-7 and GSTR-3B for the registered persons in Jammu and Kashmir.

The Notification issued by the CBIC said that, the registered persons whose principal place of business is in the State of Jammu and Kashmir, having aggregate turnover of more than 1.5 crore rupees in the preceding financial year or the current financial year, who have furnished, electronically through the common portal, details of outward supplies in FORM GSTR-1 of the Central Goods and Services Tax Rules, 2017 for the month of August, 2019, on or before the 11th October, 2019, for failure to furnish the said FORM GSTR-1 by the due date.

The Notification also said that, “the registered persons whose principal place of business is in the State of Jammu and Kashmir, required to deduct tax at source under the provisions of section 51 of the said Act, who have furnished electronically through the common portal, return in FORM GSTR-7 of the said rules under sub-section (3) of section 39 of the said Act read with rule 66 of the said rules, for the month of July, 2019, on or before the 10 th October, 2019, for failure to furnish the said FORM GSTR-7 by the due date”.

The Notification reads as, “the registered persons whose principal place of business is in the State of Jammu and Kashmir, required to deduct tax at source under the provisions of section 51 of the said Act, who have furnished electronically through the common portal, return in FORM GSTR-7 of the said rules under sub-section (3) of section 39 of the said Act read with rule 66 of the said rules, for the month of August, 2019, on or before the 10 th October, 2019, for failure to furnish the said FORM GSTR-7 by the due date”.

The Notification also reads as, “the registered persons whose principal place of business is in the State of Jammu and Kashmir, who have furnished, electronically through the common portal, return in FORM GSTR-3B of the said rules, for the month of July, 2019, on or before the 20th October, 2019, for failure to furnish the said FORM GSTR-3B by the due date”.

“the registered persons whose principal place of business is in the State of Jammu and Kashmir, who have furnished, electronically through the common portal, return in FORM GSTR-3B of the said rules, for the month of August, 2019, on or before the 20th October, 2019, for failure to furnish the said FORM GSTR-3B by the due date”, the notification also added.

Subscribe Taxscan Premium to view the JudgmentThe Central Board of Indirect Taxes and Customs ( CBIC ) has notified due date for furnishing of Return in Form GSTR-3B for the months of October, 2019 to March, 2020.

The Notification issued by the CBIC said that, “the return in FORM GSTR-3B of the said rules for each of the months from October, 2019 to March, 2020 shall be furnished electronically through the common portal, on or before the twentieth day of the month succeeding such month”.

Regarding the Payment of taxes for discharge of tax liability as per FORM GSTR-3B, the Notification said that, “Every registered person furnishing the return in FORM GSTR-3B of the said rules shall, subject to the provisions of section 49 of the said Act, discharge his liability towards tax, interest, penalty, fees or any other amount payable under the said Act by debiting the electronic cash ledger or electronic credit ledger, as the case may be, not later than the last date, as specified in the first paragraph, on which he is required to furnish the said return”.

GSTR-3B is a monthly self-declaration that has to be filed by a registered dealer. Every person who has registered for GST must file the return GSTR-3B including nill returns.

However, the following registrants do not have to file GSTR-3B

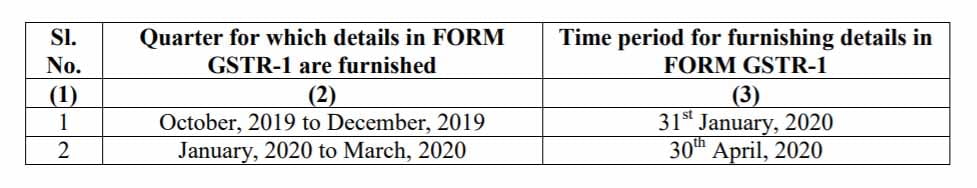

The Central Board of Indirect Taxes and Customs ( CBIC ) has notified due date for Form GSTR-1 for the months of October 2019 to March, 2020.

In Notification Number issued CBIC said that, “registered persons having aggregate turnover of up to 1.5 crore rupees in the preceding financial year or the current financial year, as the class of registered persons who shall follow the special procedure as mentioned below for furnishing the details of outward supply of goods or services or both”.

In the notification No.46 issued by CBIC said that, “the time limit for furnishing the details of outward supplies in FORM GSTR-1 of the Central Goods and Services Tax Rules, 2017, by such class of registered persons having aggregate turnover of more than 1.5 crore rupees in the preceding financial year or the current financial year, for each of the months from October, 2019 to March, 2020 till the eleventh day of the month succeeding such month”.

The Notification also said that “time limit for furnishing the details of return, as the case may be, under sub-section (2) of section 38 of the said Act, for the months of October, 2019 to March, 2020 shall be subsequently notified”.

GSTR-1 is a monthly or quarterly return that should be filed by every registered dealer. It contains details of all outward supplies i.e sales.

Every registered person is required to file GSTR-1 irrespective of whether there are any transactions during the month or not.

The following registered persons are exempt from filing the return: