The Advance Ruling Authority ( AAR ), West Bengal has held that the lodging along with food supplied to the students by a private boarding house, being a composite supply is not eligible for GST exemption and is taxable at 18% under the GST regime.

The Applicant is offering several individual services in two different combinations to the recipients, depending upon their need for lodging facility. Each of the recipients is charged a consolidated amount for the combination of services he wants to enjoy.

The applicant claimed that it has entered into an MOU with St. Michael’s School under the management of Sunshine Educational Society, for providing boarding facility exclusively to the students of the said school. The boarding facility shall include lodging, housekeeping, laundry, medical assistance and food. The consideration is a consolidated charge on the individual boarder for the combination of the services. The applicant claimed exemption by relying on the CBIC Circular wherein it was clarified that the accommodation service to students in a hostel having declared tariff below one thousand rupee per day is exempt.

The authority observed that “the combination of services is, therefore, offered as a mixed supply within the meaning of Section 2(74). In accordance with Section 8(b) of the GST Act it is stated that, “a mixed supply comprising two or more supplies shall be treated as a supply of that particular supply which attracts the highest rate of tax.” As has already been discussed, each of the combinations includes services taxable at 18% rate, which is the highest rate applicable to the services being offered to vide Section 8(b) of the GST Act. Being mixed supply, the value of the entire combination of services offered is taxable at 18% rate.”

While disposing of the application, the authority held that “the Applicant is offering several individual services in two different combinations to the recipients, depending upon their need for lodging facility. None of the combinations of services being offered is a composite supply, as defined under section 2(30) of the GST Act. They are mixed supplies within the meaning of section 2(74) and taxable in accordance with section 8(b) of the GST Act. Being mixed supply, the value of the entire combination of services offered is taxable at the applicable rate.”

Subscribe Taxscan Premium to view the JudgmentThe Income Tax Appellate Tribunal (ITAT), Ahmedabad bench has held that the payment to the film distributors by the assessee for the exhibition of the film would not amount to Fee for Technical services and thus, not subject to TDS under Section 194J of the Income Tax Act, 1961.

While concluding the assessment proceedings, the Assessing Officer observed that the payments made by the assessee to the distributors are in the nature of royalty. He, therefore, disallowed the expenses of Rs.4,76,27,714/- by invoking Section 40(a)(ia) of the Act by holding that the assessee failed to deduct tax at source under s.194J of the Act.

The question before the Tribunal was that whether payments made by the assessee to the Distributors of the Films constitutes fee for professional or technical services within the ambit of Section 194J of the Act.

Section 194J of the Act inter alia includes ‘royalty’ for the purposes of deduction of tax at source.

The assessee conteded that the revenue sharing expenses incurred by the assessee in the nature of royalty is not covered within the sweep of Section 194J of the Act in view of the specific exclusion provided for consideration for the sale, distribution or exhibition of cinematographic film. Thus, the payment in respect of exhibition films is specifically excluded under s.194J of the Act. It is thus conteded that provisions of Section 40(a)(ia) of the Act does not get triggered in the absence of any obligation to deduct TDS under s.194J of the Act.

“A perusal of the order of the CIT(A) would show that assessee is in the exhibition of films procured from distributors on revenue sharing basis. The Revenue shared by the assessee with the distributor to exhibit the cinematographic film is outside the scope of expression ‘royalty’ under Clause (v) to Explanation 2 to Section 9(1)(vi) of the Act referred to under the provisions of Section 194J of the Act. Therefore, such payment to distributor does not call for deduction of TDS. The CIT(A), in our view, has rightly held in applicability of Section 194J of the Act or other similar provisions of the Act and thus, rightly concluded that Section 40(a)(ia) of the Act do not come into play for disallowance of the expenses incurred by the assessee for exhibition of films,” the Tribunal said.

Subscribe Taxscan Premium to view the JudgmentThe Authority for Advance Rulings (AAR), Tamil Nadu has held that the value of the discounts as per C2FO software which is paid to the suppliers must be deducted from the invoice value for availing Input Tax Credit in view of Section 16 of the CGST Act 2O17/TNGST Act 2O17.

The question before the AAR was that whether the Applicant can avail the Input Tax Credit of the full GST charged on the supply of invoice or a proportionate reversal of the same is required in case of post purchase discount given by the supplier of the goods or services.

According to the assessee, the invoices are all raised before the payment dates, so the time of supply is the date of raising invoices. The discount is given after the invoices are raised and supply of goods is made and no discount is recorded in the invoice. Hence, the assessee claimed that Section 15 (3) (a) does not apply. All the invoices are uploaded by the supplier in the C2FO software after they are raised.

The C2FO platform is a marketplace model where both the Applicant/recipient and his suppliers are registered but the discounts offered are not mentioned in the supply contract between the applicant and his suppliers at the time of raising invoices or before, though the discounts are speci{ically linking the relevant invoices.

The authority observed that Section 16 states that where a recipient fails to pay to the supplier of goods or services or both, the amount towards the value of supply along with tax payable thereon within a period of one hundred and eighty days from the date of issue of invoice by the supplier, an amount equal to the input tax credit availed by the recipient shall be added to his output tax liability, along with interest thereon, and the recipient shall be entitled to avail of the credit of input tax on payment made by him of the amount towards the value of supply of goods or services or both along with tax payable thereon.

“In the instant case, the value of supply is the full undiscounted value indicated in the tax invoice and the recipient /Applicant only makes payment to the extent of invoice value less the discount thrown up by the C2FO software. As per proviso to Section 16, the recipient is entitled to avail the credit of input tax on the payment made by him alone and if any amount is not paid as per the value of supply and the recipient has availed full input tax credit, the same would be added to his output tax liability. Therefore, in the instant case, the Applicant can avail Input Tax Credit only to the extent of the invoice value less the discounts asper C2FO software. If he has availed input tax credit on the full amount, he should reverse the difference amount equal to the discount, to avoid adding to his output liability,” the authority said.

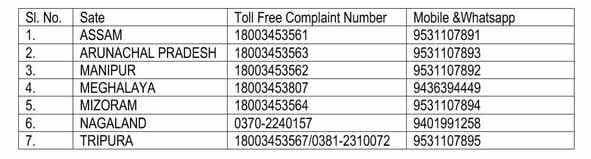

Subscribe Taxscan Premium to view the JudgmentThe lncome Tax Department (Investigation), NER has prepared itself to deal with any reported movement of unaccounted money ahead of the Lok. Sabha elections. Pursuant to the notifications for tickling Lok Sabha Elections 2019 by the Election Commission of India(ECI), the Investigation Directorate of the Income Tax Department, North East Region (NER) has deployed Surveillance -reams in Assam, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland and Tripura, Air Intelligence Units in all airports of the Seven slates and a 24X7 Control Room in the state c.apitals in terms of instructions and guidelines issued by the ECI.

The Income Tax Department is also working in close co-ordination with various teams constituted under GEO’DEOs and other law enforcement agencies.

As per the direction of Election Commission of India, the Income Tax Department is continuously gathering intelligence and keeping close surveillance over movement of cash/valuables or other items suspected to be used for bribing of electors during the ensuing Lok Sabha Elections 2019.

For this purpose, the Directorate of Income Tax (Investigation) NER. Guwahati has opened a 24 X 7 Control Room and Complaint monitoring Cell at all the Seven States of North Eastern Region. The contact details of the said cell are:

The IT department has requested the general public to communicate, to the said 24 X 7 Control Room, any infofmation pertaining to black money and movement of large amount of cash / valuables etc, during the election period which may likely be used for bribing of electors.

A dedicated email Id- incometax.electionner2019@gmail.com has also been opened for the purpose.

A two-judge bench of the Bombay High Court has held that mere reference of the term ‘agency’ in the agreement itself is not conclusive of the relationship between parties for attracting Section 28(ii)(c) of the Income Tax Act, 1961.

The assessee had entered into an agreement with US-based company Sealand Service Inc. by name. Under such agreement, the assessee was to solicit business on behalf of the said Sealand Service Inc. After some disputes between the parties, this contract was terminated pursuant to which, the assessee received compensation of Rs.2.25 crores during the period relevant to the assessment year in question.

According to the assessee, the receipt was capital in nature and therefore, not assessable to tax. The Assessment Officer, however, rejected such contention and held that it would be chargeable to tax in terms of section 28(ii)(c) of the Income Tax Act, 1961.

On the first appeal, the CIT(A) held that there was no principal-agent relationship between the parties and the contract was on principal to principal basis and therefore section 28(ii)(c) would not apply. Later, the Tribunal confirmed the said order on further appeal.

The department contended before the High Court that the agreement itself described the relationship between the parties as one of the agency.

Justices Akil Kureshi and Sarang V Kotwal rejected the contention and took a view that any such reference or the expression in the agreement.

The bench observed that “Section 28(ii)(c) of the Act makes any compensation or other payment due, the receipt of a person holding an agency in connection with the termination of the agency or the modification of the terms and conditions relating thereto, chargeable as profits and gains of business and profession. The essential requirement for application of section would therefore be that there was a correlation of agency principal between the assessee and the US based company.”

“The true character of the relationship from the agreement would have to be gathered from reading the document as a whole. This Court in case of Daruvala Bros. (P). Ltd. Vs. Commissioner of IncomeTax (Central), Bombay, reported in (1971) 80 ITR 213 had found that the agreement made between the parties, was of sole distribution and the agent was acting on his behalf and not on behalf of the principal. In that background, it was held that the agreement in question was not one of agency, though the document may have used such term to describe the relationship between the two sides,” the bench said.

Subscribe Taxscan Premium to view the JudgmentThe Directorate of Income Tax (Systems), while answering to an RTI query in connection with the proposed pre-filled income tax returns from the year 2020, clarified that Infosys will not have access to the information of income taxpayers as a pan of Integrated e filing & centralized Processing Centre 2.0 Project.

The Central Board of Direct Taxes (CBDT), a few weeks ago, announced that a new Pre-filled Income Tax Return Forms for taxpayers. It was also said that the project will be implemented by Infosys will take around 18 months, in time for filing of returns in 2020.

According to the CBDT Chief, the Board is presently working on pre-filled forms which will be based on tax deducted at source details filed with the department by the employer or any other entity. “You will be getting a pre-filled return form on which we are working because your TDS is with us. So, we are moving towards that direction,” he said.

“We want to make it (processing of return form) very fast, maybe in a day or a week. That system is also under preparation and it may take a year or so. So that you get a pre-filled form, and you can justify that form is correct. We will accept it, he said. He said that only 0.5 percent of cases had been taken up for scrutiny and even these cases have been selected by the computer system. There is no discretion (in selecting income tax-related cases). Our endeavor is to curtail the discretion of tax officials,” Chandra said.

There were doubts that since Infosys is developing the software for pre-filled returns, they might have access to the information of earlier returns filed by the taxpayers.

With regard to the role of Infosys in the proposal in the technical end, the Directorate of Income Tax (Systems) has said that “Infosys is the Managed Service provider (MSP) for the execution of the CPC-ITR 2.10.oject. The company is not given any access to information of Income Tax Payers.”

The department further said that there is no Memorandum of Understanding as per the terms of the RF till now.

Subscribe Taxscan Premium to view the JudgmentThe Institute of Chartered Accountants of India ( ICAI ), as part of the MoU signed with the IIM Hyderabad, is conducting a fully residential training programme for Young Chartered Accountants.

The program will be offered at IIMA campus from Sunday, April 07, 2019 to Saturday, May 11, 2019 (both days inclusive). The main objective of this program is to provide in-depth domain knowledge and also equip the participants with business and managerial orientation by acquiring perspectives and requisite skills so that they can make a difference.

Last year, the ICAI has signed a Memorandum of Understanding (MoU) with the Indian Institute of Management Ahmedabad (IIMA). This MOU would enable mutual co-operation between ICAI and IIM Ahmedabad for offering and co-hosting open-enrolment and customized training programs exclusively designed for Chartered Accountants to acquire managerial excellence in functional and operational areas.

The programme covers topics that will provide the participants with a basic understanding of functions such as marketing, operations, information systems, human resource management and organizational behavior in addition to honing personal skills such as computing, communication, self-awareness, social and leadership.

The last date for receiving the nominations from members and to avail the Early Bird Discount is 25th March 2019.

For more information about the programme, please visit https://resource.cdn.icai.org/54609pdc190319.pdf and for registrations please click here.

Alternatively, members can kindly get in touch with the Programme Coordinators of IIMA at E-mail: caprogram@iima.ac.in or feel free to call either Mr. Abhishek (9909038771) or Mr. Rahul (8758800397)

The Cochin bench of the Income Tax Appellate Tribunal ( ITAT ) has confirmed the penalty since assessee failed to furnish Audit Report despite CBDT extended due date.

The assessee M/s.The Vaikom Palliprethussery Service Cooperative Bank Limited Palliprethussery is a Primary Agricultural Credit Society registered under the Kerala Co-operative Societies Act, 1969. It is engaged in the business of banking.

For the assessment year 2014-2015, the return of income was filed on 15.01.2016 declaring Nil income after claiming deduction u/s 80P(2)(a)(i) of the I.T.Act amounting to Rs.3,44,41,274. The assessment u/s 143(3) of the I.T.Act was completed vide order dated 06.12.2016. During the course of assessment proceedings it was noticed that the assessee has not filed the Audit Report as mandated u/s 44AB of the I.T.Act. Therefore, penalty notice was issued u/s 274 r.w.s. 271B of the I.T.Act.

While dismissing the appeal, the Tribunal bench comprising of Judicial Member George George.K and Accountant Member Chandra Poojari observed that, “In the instant case for the relevant assessment year the Co-operative Department had audited the assessee’s case and submitted a report on 24.09.2014. The assessee had sufficient time to file audit report u/s 44AB of the I.T.Act within the specified date, which is 30th day of December, immediately following the financial year, i.e. 30.09.2014. However, for the relevant assessment year the Central Board of Direct Taxes vide its order dated 20.08.2014 had extended the due date of filing of the audit report from 30.09.2014 to 30.11.2014. The assessee had not filed the audit report in this case. The assessee was very casual and did not enter appearance for the show cause notice issued for imposition of penalty. The assessee has not made out a reasonable cause as mentioned u/s 273B of the I.T.Act for non-furnishing of audit report u/s 44AB of the I.T.Act. Hence, we are of the view that the penalty u/s 271B of the I.T.Act has been rightly imposed. It is ordered accordingly”.

Subscribe Taxscan Premium to view the JudgmentThe GST Council in the 34th meeting held on 19th March 2019 at New Delhi discussed the operational details for implementation of the recommendations made by the council in its 33rd meeting for lower effective GST rate of 1% in case of affordable houses and 5% on the construction of houses other than the affordable house. The council decided the modalities of the transition as follows.

Option in respect of ongoing projects:

New tax rates:

(i) New rate of 1% without input tax credit (ITC) on construction of affordable houses shall be available for,

(a) all houses which meet the definition of affordable houses as decided by GSTC (area 60 sqm in non- metros / 90 sqm in metros and value upto RS. 45 lakhs), and

(b) affordable houses being constructed in ongoing projects under the existing central and state housing schemes presently eligible for concessional rate of 8% GST (after 1/3rd land abatement).

(ii) New rate of 5% without input tax credit shall be applicable on construction of,-

Conditions for the new tax rates:

Transition for ongoing projects opting for the new tax rate:

6.1 Ongoing projects (buildings where construction and booking both had started before 01.04.2019) and have not been completed by 31.03.2019 opting for new tax rates shall transition the ITC as per the prescribed method.

6.2 The transition formula approved by the GST Council, for residential projects (refer to para 4(ii)) extrapolates ITC taken for percentage completion of construction as on 01.04.2019 to arrive at ITC for the entire project. Then based on percentage booking of flats and percentage invoicing, ITC eligibility is determined. Thus, transition would thus be on pro-rata basis based on a simple formula such that credit in proportion to booking of the flat and invoicing done for the booked flat is available subject to a few safeguards.

6.3 For a mixed project transition shall also allow ITC on pro-rata basis in proportion to carpet area of the commercial portion in the ongoing projects (on which tax will be payable @ 12% with ITC even after 1.4.2019) to the total carpet area of the project.

Treatment of TDR/ FSI and Long term lease for projects commencing after 01.04.2019

7.1 Supply of TDR, FSI, long term lease (premium) of land by a landowner to a developer shall be exempted subject to the condition that the constructed flats are sold before issuance of completion certificate and tax is paid on them. Exemption of TDR, FSI, long term lease (premium) shall be withdrawn in case of flats sold after issue of completion certificate, but such withdrawal shall be limited to 1% of value in case of affordable houses and 5% of value in case of other than affordable houses. This will achieve a fair degree of taxation parity between under construction and ready to move property.

7.2 The liability to pay tax on TDR, FSI, long term lease (premium) shall be shifted from land owner to builder underthe reverse charge mechanism (RCM).

7.3 The date on which builder shall be liable to pay tax on TDR, FSI, long term lease (premium) of land under RCM in respect of flats sold after completion certificate is being shifted to date of issue of completion certificate.

7.4 The liability of builder to pay tax on construction of houses given to land owner in a JDA is also being shifted to the date of completion. Decisions from para 7.1 to 7.4 are expected to address the problem of cash flow in the sector.

Amendment to ITC rules:

The GST Council meeting through video conference today approved the norms for relief to the realty firms allowed the builders to choose between two different tax rates in case of incomplete residential projects. The new changes and reduced tax rates will be applicable from 1st April.

The Council, today decided to give builders the option of choosing the tax rate of 12% with input tax credit facility or 5% without it, and in the case of affordable housing projects, 8% with tax rebates or 1% without it, revenue secretary Ajay Bhushan Pandey said.

The choice of tax rates in case of buildings that are not completed as on 1 April has to be exercised within a specified time, which will be notified later, Pandey said.

It was decided that from 1st April, lower tax rates will apply for incomplete projects.

Tuesday’s decisions bring clarity on taxation of under-construction houses sold during the transition to the new tax system.

The last GST Council meeting had suggested reducing the levy on under-construction residential projects to 5 percent without an input tax credit from the current 12 percent. In the same meeting, the Council had decided to lower the GST on the under-construction houses from 12% to 5% and for affordable housing from 8% to 1% without input tax credit (ITC) benefit.

Speaking to Taxscan, Mr Jigar Doshi, Partner – Indirect Tax, SKP Business Consulting LLP said that, “By providing an option available between new rates without ITC and old rates with ITC, the council has sought to address the concerns of the industry on the tax scheme applicable to under-construction projects during the transition phase from 1 April. Realtors can evaluate and choose the best scheme which minimizes the tax cost on each building of the project. Those who opt for the reduced rates would invariably be required to reverse credits on proportionate basis the full impact of which will be known once the rules are notified. The requirement to source 80 percent of the supplies from registered dealers and mandating tax on reverse charge basis in case of shortfall shows that the government is serious on curbing tax evasion at the back end. The net impact, however, of the new scheme and the transitional provision on developers and home buyers would depend on case to case basis and the fine print of the rules notified.”

The Insolvency and Bankruptcy Board of India (IBBI) signed a Memorandum of Understanding (MoU) today with the Securities and Exchange Board of India (SEBI).

The IBBI and the SEBI seek effective implementation of the Insolvency and Bankruptcy Code, 2016 (Code) and its allied rules and regulations, which have redefined the debt-equity relationship and aims to promote entrepreneurship and debt market. They have agreed under the MoU to assist and co-operate with each other for the effective implementation of the Code, subject to limitations imposed by the applicable laws.

The MoU provides for:

(a) sharing of information between the two parties, subject to the limitations imposed by the applicable laws;

(b) sharing of resources available with each other to the extent feasible and legally permissible;

(c) periodic meetings to discuss matters of mutual interest, including regulatory requirements that impact each party’s responsibilities, enforcement cases, research and data analysis, information technology and data sharing, or any other matter that the parties believe would be of interest to each other in fulfilling their respective statutory obligations;

(d) cross-training of staff in order to enhance each party’s understanding of the other’s mission for effective utilisation of collective resources;

(e) capacity building of insolvency professionals and financial creditors;

(f) joint efforts towards enhancing the level of awareness among financial creditors about the importance and necessity of swift insolvency resolution process of various types of borrowers in distress under the provisions of the Code, etc.

The MoU was signed by Shri Anand Baiwar, Executive Director, SEBI, and Shri Ritesh Kavdia, Executive Director, IBBI, at Mumbai.

The Delhi bench of the Income Tax Appellate Tribunal (ITAT) has confirmed an addition under Section 68 of the Income Tax Act since the share applicant entities were paper entities for providing entries to the assessee.

While concluding the assessment proceedings against the assessee, the Assessing Officer observed that there is an increase in the share capital of amount of Rs. 4,85,58, 000/- including share premium during the year under consideration. The officer made addition in respect of the same in view of no evidences with regard to creditworthiness or genuineness of the transaction required to be established by the assessee in terms of section 68 of the Act.

Before the authorities, the assessee submitted the documents including balance sheet and bank statement for the period from 01/12/2005 to 05.01.2010 alongwith list of signatories etc. downloaded from the Ministry of Company Affairs Portal.

Rejecting the above, the Tribunal noted that these are only documents in the form of paper trail of the alleged shareholders, which do not establish in any manner the creditworthiness or genuineness of the transaction.

Considering the facts and evidences, the Tribunal noted that the companies are not having creditworthiness for making such huge investment and genuineness of the transaction is also not getting established from the documentary evidences in respect of these companies.

“Merely presenting of documents of incorporation of the company and making payment for application of the shares through bank in itself or appearance by current director before the Assessing Officer and admitting the fact of share application made, is in itself not sufficient to justify the genuineness of the transaction. Assessee company for the year under consideration has shown losses of Rs. 9,903/-and in the immediately preceding year there was a small profit of Rs. 985/-. It is against the human probability that anyone will invest and pay share premium of Rs. 50/- per share without having any net worth of the company or any future prospectus of earning by the company. The current directors have not been able to justify, why the shares were purchased at high premium, without corresponding valuation of the company, which was having meagre income. It is impossible that directors of these nine companies are having either of the two addresses of the Paharganj area of New Delhi. In normal circumstances it is not possible until unless all these companies are being controlled remotely by one person. All the circumstances manifests that these are all paper companies not having sufficient worth and created for providing entries of share application money or share capital or loans by way of accommodation entries,” the Tribunal said.

Following the Delhi High Court decision in the case of NDR Promoters Pvt. Ltd, the Tribunal held that share applicant entities are paper entities created by some individuals for providing entries to the persons including the assessee, not having tax paid capital for promoting their ventures.

“As the entries of credit are appearing in the books of the assessee, it was the onus of the assessee to explain satisfactorily the nature and source of those credits. As the assessee failed to discharge its onus of explaining source and nature of the credit received and failed to establish creditworthiness and genuineness of the transaction as required u/s 68 of the Act, the assessee is liable for addition under section 68 of the Act,” the Tribunal said.

Subscribe Taxscan Premium to view the JudgmentIn a significant ruling under GST, the Allahabad High Court has held that the appellate authority is not empowered to condone delay beyond 30 days.

The first appeal filed by the petitioner against the order dated 03.12.2018 was beyond the period for which delay may have been condoned, by about nine days.

Under section 107 of the U.P. Goods and Services Tax Act, 2017, the period of limitation to file a first appeal is three months and the period for which the delay may be condoned is thirty days from the expiry of normal period of limitation. The appellate authority dismissed the appeal as the same was time barred.

“Clearly, no application for condonation of delay may have been entertained by the appellate authority beyond a period of thirty days from the date of expiry of normal period of limitation (three months),” the Court said.

Justice Saumitra Dayal Singh observed that “in view of the decision of the Supreme Court cited by Sri B.K. Pandey, learned Standing Counsel in the case of Singh Enterprises Vs. Commissioner of Central Excise, Jamshedpur reported in 2008 (3) SCC 70 paragraph no. 8 as also the Full Bench decision of this Court in Commissioner of Income Tax I; Commissioner of Income Tax Central; Janpad Thok Kendriya Upbhokta Sahkari Bhandar Limited Vs. Mohd Farooq; New Cawnpore Floor Mills Pvt Ltd; Commissioner of Income Tax reported in 2009 (317) ITR 305, the delay condonation application filed beyond the period of thirty days could not be condoned and it was clearly not maintainable by the appellate authority.

Consequently, there is no error in the order of the appellate authority dismissing the appeal as time barred.

The counsel for the petitioner conteded that if the remedy of appeal is held to be non-existant, still jurisdiction of the writ Court against the original order dated 03.12.2018 may not be ousted.

The department has accepted the notices on behalf of the respondents and sought for four weeks time to file counter affidavit.

After granting time to the department, the Court granted stay to the petitioner with a condition to deposit 50% of the disputed amount of tax and furnishing security for the balance amount of disputed tax in the shape of other than cash and bank guarantee within a period of one month.

Subscribe Taxscan Premium to view the JudgmentThe Bangalore bench of the Income Tax Appellate Tribunal ( ITAT ) said that, Tribunal can extend stay If Non-disposal of appeal is not attributable to the assessee.

The application was filed by the assessee M/s Inatech India Pvt. Ltd praying for an order extending the order of stay of recovery of outstanding demand passed by the Tribunal.

The ITAT bench comprising of Vice President N,V Vasudevan and Accountant Member A.K Garodia observed that “it is clear that the delay in non-disposal of the appeal is not attributable to any default on the part of the assessee. The law is by now well settled that if the delay in non-disposal of the appeal is not attributable to the assessee, then the Tribunal has the power to extend the period of stay even beyond the time limit laid down in the third proviso to Section 254(2A) of the Income Tax Act”.

“There is no change in the facts and circumstances of the case as it existed when the tribunal granted an order of stay. In these circumstances, we are of the view that there should be an order of stay for a period of 6 months from today or till the disposal of the appeal of the assessee, whichever is earlier”, the bench also said.

Subscribe Taxscan Premium to view the JudgmentIn a major relief to the realty firms, the 34th GST Council Meeting will meet today by Video Conferencing to frame realty rules.

The meeting had been approved by the Election Commission. As the date for Lok Sabha elections has been declared, there were reports that the meeting would violate the Code of Conduct rules.

The last GST Council meeting had suggested reducing the levy on under-construction residential projects to 5 percent without an input tax credit from the current 12 percent. In the same meeting, the Council had decided to lower the GST on the under-construction houses from 12% to 5% and for affordable housing from 8% to 1% without input tax credit (ITC) benefit.

However, on the important issue of transition of the existing under-construction projects, the Council had asked its fitment and the law committee to draft the rules and guidelines for a transition. The next meeting through video conference on Tuesday is expected to finalize the rules and regulations for the ongoing under-construction residential projects.

In the meeting, the council is likely to limit the usage of tax credits collected by builders and allow a concessional rate for up to 10 percent of commercial property such as shops in residential areas, expecting realtors to reduce prices. In February, the GST collections have been dropped to Rs. 97,247 crore from Rs. 1.02 lakh crore in the previous month.

In a significant ruling, a two-judge bench of the Supreme Court has confirmed an addition in respect of bogus share application money and premium and bogus capital gain.

The Income Tax Department finally won the case after the CIT (Appeal), the Tribunal and the Delhi High Court all decided this matter in favour of the assessee.

The Assessee Company in its Return showed that money aggregating to Rs. 17,60,00,000/- had been received through Share Capital/Premium during the Financial Year 2009-10 from the companies situated at Mumbai, Kolkatta, and Guwahati. The shares had a face value of Rs. 10 per share, were subscribed by the investor companies at Rs. 190 per share.

The Assessing Officer held that the amount of Rs. 17,60,00,000/-allegedly raised by the Respondent through share capital/premium were not genuine transactions and made additions under section 68 of the Act.

Before the Supreme Court, the assessee submitted that that entire Share Capital had been received by the Assessee through normal banking channels by account payee cheques/demand drafts, and produced documents such as income tax return acknowledgements to establish the identity and genuineness of the transaction. It was submitted that, there was no cause to take recourse to Section 68 of the Act, and that the onus on the Assessee Company stood fully discharged.

Justice Uday Umesh Lalit and Justice Indu Malhotra noted that the lower appellate authorities appear to have ignored the detailed findings of the AO from the field enquiry and investigations carried out by his office.

“The authorities below have erroneously held that merely because the Respondent Company – Assessee had filed all the primary evidence, the onus on the Assessee stood discharged,” the bench said.

“The practice of conversion of un-accounted money through the cloak of Share Capital/Premium must be subjected to careful scrutiny. This would be particularly so in the case of private placement of shares, where a higher onus is required to be placed on the Assessee since the information is within the personal knowledge of the Assessee. The Assessee is under a legal obligation to prove the receipt of share capital/premium to the satisfaction of the AO, failure of which, would justify the addition of the said amount to the income of the Assessee,” the Apex Court said.

Subscribe Taxscan Premium to view the JudgmentIn a recent ruling, the Income Tax Appellate Tribunal (ITAT), Delhi bench has held that no TDS can be levied on the enhanced compensation for the compulsory acquisition of the agricultural land. The Tribunal further directed the Assessing Officer to refund the TDS amount deducted by the department.

The assessee is an agriculturist and inherited land from his parents as an agricultural property. The land was acquired by the Government and the assessee had received enhanced compensation of Rs.4,69,20,146/- including interest. The assessee claimed exemption under section 10(37) of the Income-tax Act, 1961 and claimed refund of Rs.33,84,464/- in the return of income.

During the proceedings, the AO found that as per Form D issued by the Land Acquisition Officer, Panchkula, the assessee had received enhanced compensation of Rs.4,69,20,146/- which includes principal amount of Rs.2,70,33,074/- and interest amount of Rs.1,98,85,972/- from the LAO, Panchkula, during the year and on the enhanced compensation received, TDS amounting to Rs.93,84,030/- was deducted out of which amount of Rs.74,45,433/- was refunded to the assessee and credited in his account on 1.7.2011.

The Tribunal noticed that according to the decision of the Supreme Court in the case of Hari Singh that after examining the facts to apply the provisions contained in the Income-tax Act with a specific reference to the agricultural land stating that in case if it is found that the compensation was received in respect of the agricultural land, the tax deposited with the Income-tax Department shall be refunded to these depositors.

“When the Hon’ble Supreme Court specifically directs in the case of Hari Singh (supra), the learned AO shall examine the facts of the case and then apply the law as contained, CIT(A) has not stated that such an amount shall be brought to tax u/s 45(5) without applying the provisions under 10(37) of the Act, which exempts such receipts from being taxed. It could be noted that Section 45(5) makes no reference to the nature of property that is acquired but it deals with the category of cases which falls in the description of “capital assets”. However, Section 10(37) exempts specifically an income chargeable under the head “capital gains” arising from the transfer of agricultural land.”

“We, therefore, do not have any doubt in our mind as to the law in this aspect and while respectfully following the ratio laid down by the Hon’ble Supreme Court in the case of Ghanshyam and Hari Singh (supra) above, direct the ld. AO to refund the TDS amount that was deducted on account of the enhanced compensation. With these directions, we allow the appeal of the assessee,” the Tribunal said.

Subscribe Taxscan Premium to view the JudgmentThe Maharashtra Advance Ruling Authority (AAR) has ruled that the companies cannot avail input tax credit under the GST regime in respect of Gold Schemes offered to the customers to promote business.

The applicant, Biostadt India Ltd is a company engaged in manufacturing and distribution of crop inputs and hybrid seeds. They launched a scheme, namely, Kharif Gold Scheme, 2018 under which it offers 10 gm of gold coin to anyone buying a stipulated amount of products from it. Similarly, anyone buying these products worth a minimum sum was offered eight grams of gold coin. Gold attracts a 3 per cent goods and services tax (GST).

The applicant approached the authority seeking a ruling on whether the gold scheme announced by them eligible for input tax credit.

The authority held that since the scheme amount to gift, the company cannot claim input tax credit on the procurement of gold coins, which are to be distributed to customers.

“Input tax credit on gifts will not be available when no GST is paid on its disposal,” it said.

AAR relied on the Section 17(5)(h) of the Central GST Act, which says, “…input credit shall not be available in respect of goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples.”

“To sum up ITC on “gifts” will not be available when no GST is being paid on their disposal. Just because the applicant submits that they have satisfied Section 16 (1) of the CGST Act 2017 does not mean that they are entitled to credit since Section 17(5) starts with “Notwithstanding anything contained in sub-section (1) of Section 16 “. The implication is that in the subject case even if it seems, as per the applicant, that Section 16 (1) is applicable in their case and allows them credit, Section 17(5) shall block such credits.”

Subscribe Taxscan Premium to view the JudgmentIn India, there are so many companies which are under the Insolvency and Bankruptcy Code (IBC) and where the shareholders are thinking that to get a fair deal to secure their shares in the companies.

Preference shares are considered as quasi-debt instruments since they combine the features of equity as well as debt. On one side, they carry a preferential right over the ordinary shares to receive dividend at a fixed rate and on the other, they carry an equity risk of not being secured, except to the preferential right of repayment in case of winding-up of the company. Preference shares have proved beneficial for investors, since such quasi-debt instrument provides protection to their investment by possessing voting rights on matters affecting their interest, more so with the fixed rate of dividend. For the promoters, issue of preference shares to investors ensures access to capital without a need to provide any security, with a continued control.

Rights of Preference Shareholders under Companies Act, 2013

Some of the Rights of Preference Shareholders under companies Act, 2013 are as follows:

Redemption of Preference Shares

Section 55 of the companies Act, 2013 deals with issue and redemption of Preference Shares. No company limited by shares shall, after the commencement of this Act, issue any preference shares which are irredeemable. A company limited by shares may, if so authorized by its articles, issue preference shares which are liable to be redeemed within a period not exceeding twenty years from the date of their issue subject to such conditions as may be prescribed

A Company may issue preference shares for a period exceeding twenty years for infrastructure projects, subject to the redemption of such percentage of shares as may be prescribed on an annual basis at the option of such preferential shareholders:

Analysis of NCLAT on Redemption of Preference Shares without Prior Approval of Shareholders

The National Company Law Appellate Tribunal (NCLAT) in Brij Bhushan Singhal v Bhushan Steel Ltd. (August 10, 2018) allowed the preference shares to be redeemed outside the purview of section 55 of the Companies Act, 2013 when required by the resolution plan. In this case, with Tata Steel Ltd.

As the resolution applicant, the appellant, a preference shareholder of Bhushan Steel (corporate debtor), filed an appeal that the resolution plan sought to automatically redeem and cancel his preference shares, in contravention of section 55 of the Companies Act, 2013. That provision mandates that preference shares can only be redeemed in the manner, and after fulfillment of the conditions, prescribed in the terms of issue. According to section 30(2)(e) of the Insolvency and Bankruptcy Code, 2016 (IBC), a resolution plan cannot be approved if it contravenes any provision of law.

However the NCLAT, without a consideration of the question raised regarding section 55 of the Companies Act, 2013, upheld the impugned order of the National Company Law Tribunal (NCLT), which approved the resolution plan on April 17, 2018. Further, Paragraph 98 of the judgment states:

“98. The ‘Resolution Plan automatically does not amount to transfer or reduction of shares, including preferential shareholding. It is merely a proposal of one or other ‘Resolution Applicants’ and once it is approved by the ‘Committee of Creditors’ and thereafter by the ‘Adjudicating Authority’ under Section 31, will be binding on all the stakeholders, including the ‘Corporate Debtor’, ‘Members’ (shareholders), ‘Financial Creditors’, ‘Operational Creditors’ etc. If the provision of Section 55 of the Companies Act, 2013 is to be complied, it can be complied only after the approval of the ‘Resolution Plan’. Before the approval of the ‘Resolution Plan’ is approved by the Adjudicating Authority, the ‘Resolution Plan’ being mere a proposal, the question of following Section 55 of the Companies Act, 2013 does not arise.”

The decision considered the resolution plan to be a mere proposal that could not affect the position of Bhushan Steel’s preference shareholders until it was approved by the committee of creditors and the adjudicating authority. However, in order for it to be approved by the adjudicating authority, the resolution plan cannot contravene a position of law. Thus, it was essential for the NCLAT to decide upon the applicability of section 55 of the Companies Act, 2013 for the resolution plan to be approved in the first place. As a result, the contravention of section 55 of the Companies Act, 2013 was allowed without any consideration.

If such a position is held to be valid, a resolution plan may propose contravention of any law in force with full immunity and, if it receives approval like it did in Brij Bhushan Singhal, then, an aggrieved party may have no recourse at all since before approval it was merely a proposal, and after approval, it cannot be challenged.

According to section 30(2) of the Insolvency and Bankruptcy Code, 2016 a resolution plan must fulfill the mentioned conditions:

The explanation to section 30(2) the Insolvency and Bankruptcy Code, 2016 came into effect from June 06, 2018, through the Insolvency and Bankruptcy Code (Second Amendment) Act, 2018 while the resolution plan had been approved by the adjudicating authority on April 17, 2018. The explanation does not expressly mention retrospective application, unlike the proviso added to sub-section (4) dealing with rejection of resolution plans submitted by persons barred under section 29A.

The Supreme Court in Smt. Dayawati vs Inderjit 1966 has declared the law on retrospective application of legislation. A court of appeal cannot ordinarily take into account new law that came into force after the filing of the suit unless explicitly mentioned in the amendment.

Conclusion:

On a combined reading of section 55 of the Companies Act, 2013 read with Rule 9 of the Companies (Share Capital) Rules, 2014 and the explanation to section 30(2) of the Insolvency and Bankruptcy Code, 2016, preference shares may be redeemed without obtaining the approval of shareholders.

However, in the judgment in Brij Bhushan Singhal, the NCLAT erroneously denied any consideration of the question of contravention of section 55 of the Companies Act, 2013. While the judgment does not delve into the question of retrospective application of the explanation, the authors believe that the effect of the verdict may result in such an interpretation, and must thus be clarified.

Jaya Sharma and Niket Thakkar are Practising Company Secretaries in Mumbai.

The Institute of Chartered Accountants of India ( ICAI ) will conduct a Three-days Hands on Session on Practical Guide to ISA on 22nd, 23rd and 24th March 2019. The Course Duration is 3 Days and Fees is Rs. 5500/- (+ 18% GST) per participant who is a Member ICAI.

This session is designed for all the participants who have successfully cleared DISA ÈT or AT who want to do System’s Audit. This session will help in performing Vulnerability Analysis to identify security loopholes in the target organization’s Network, communication infrastructure, and end systems. Will explore the world of Cyber Security Audits for the Members by giving a practical hands on experience by using free open source tools. Will help in understanding the terminologies of the System Audit, performing system audit as per regulators requirements (RBI, SEBI, IRDA), Also understand & execute the various checklists given by the regulators for system audit.

The Participants shall be given the following course materials including, 1. Realistic data files, 2. Brainstorming and creative exercises 3. Open Source Tools 3. Stationery 4. Over 5 GB of materials would be provided in the form of: PowerPoint slides (step by Step Instructions on operating the tools), open source software, Video tutorials.

For more details, check the official website of ICAI.

The Central Government has appointed new members to the Appellate Authority to hear and dispose the cases relating to professional misconduct of Chartered Accountants, Company Secretaries and Cost Accountants.

The Appellate Authority is established by the Central Government in March 2009 vide its notification in the Official Gazette, in terms of Section 22A(1) of the Chartered Accountants Act, 1949, Section 22A of the Cost and Works Accountants Act, 1959 and Section 22A of the Company Secretaries Act, 1980.

Any member of the Institute, i.e., a Chartered Accountant, Company Secretary or Cost Accountant, held guilty of Professional or Other Misconduct, who is aggrieved by an Order of the Board of Discipline or the Disciplinary Committee of the Institute imposing a penalty on him, may appeal against the Order to the Appellate Authority.

According to the new notification, the Government has appointed nine members to the appellate authority including (1) Shri Praveen Garg, — Member Additional Secretary and Financial Advisor, Ministry of Environment, Forest and Climate Change, New Delhi. (2) Shri Anand Mohan Bajaj, Joint Secretary, Department of Economic Affairs, Ministry of Finance, New Delhi, (3) Shri. Anand Mohan Bajaj, Joint Secretary, Department of Economic Affairs, (4) Shri J. Venketeswarlu, (5) Shri Pankaj Tyagee, (6) Shri Pravakar Mohanty, (7) Shri B. M. Sharma, (8) Ms. Preeti Malhotra, (9) Shri Shyam Agarwal.

The appointment is valid with effect from 1st March 2019.

Subscribe Taxscan Premium to view the Judgment