In order to claim Input Tax Credit (ITC), the person carrying on regular business and holding stock of inputs, capital goods and finished goods at their place of business has to obtain GST registration. ITC cannot be claimed before the date of obtaining GST registration.

GST Form ITC-01 is a declaration form that is used to claim the ITC. An input tax credit means that a taxpayer can claim the amount that has been already paid as GST while making a GST payment to the Government which was collected from the customers.

According to Section 18(1) of the CGST Act 2017, the registered person can claim an input tax credit by filing declaration form GST ITC-01. For inputs in stock as finished, semi-finished or capital goods, the credits can be availed:

Step 1: The taxpayer has to login to the official GST Portal.

Step 2:The taxpayer has to enter the username and password.

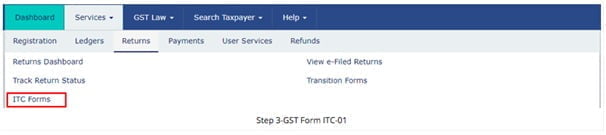

Step 3: From the ‘Services’ tab, the taxpayer has to select ‘Returns’ and then click on ‘ITC Forms’. The GST ITC Forms page is displayed on the screen.

Step 4: Under GST ITC – 01, click the ‘Prepare Online’ button if the taxpayer desires to provide a statement by making entries on the GST Portal.

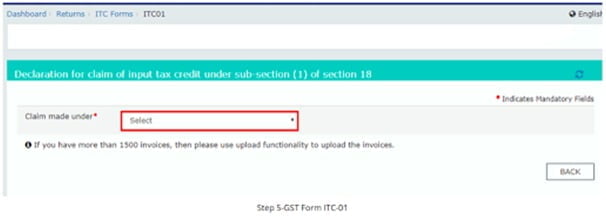

Step 5: The taxpayer has to select the appropriate section from the ‘Claim Made Under’ drop-down list.

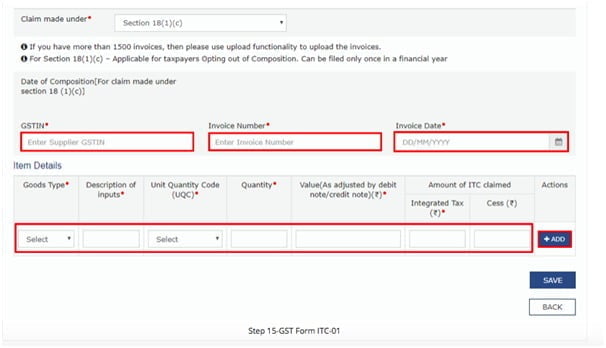

Proceed to file the necessary details invoice-wise as given below:

It is noteworthy, for claims made under Section 18(1)(d), a date on which goods become taxable must also be entered. Click on ‘Add’ button to continue adding more invoices or Click on ‘Save button’ to proceed to submit.

Step-6: After entering all invoices, click Preview > Submit > Proceed. Note that no modification is allowed after status turns are submitted or you click on Proceed.

Step-7: Upload CA certificate, if applicable.For claims of more than INR 2 lakhs, the details of Chartered Accountant or Cost Accountant need to be updated along with the certificate.

Step-8: File the form using DSC or EVC Once the form is successfully submitted, Click on ‘File using DSC’ or File using EVC’ button and select the authorized signatory from the drop-down list to file using DSC or EVC.Once filed, ARN is generated and sent to the taxpayer via SMS or Email. The status of GST ITC 01 is changed to ‘Filed’. The ITC claimed in Form ITC 01 is then made available in the electronic credit ledger.

Support our journalism by subscribing to Taxscan AdFree. Follow us on Telegram for quick updates.