Assam Govt issues Guidelines for Enrolment of GST Practitioners [Read Memo]

![Assam Govt issues Guidelines for Enrolment of GST Practitioners [Read Memo] Assam Govt issues Guidelines for Enrolment of GST Practitioners [Read Memo]](https://www.taxscan.in/wp-content/uploads/2016/07/GST-Goods-and-Service-Tax-TaxScan.jpg)

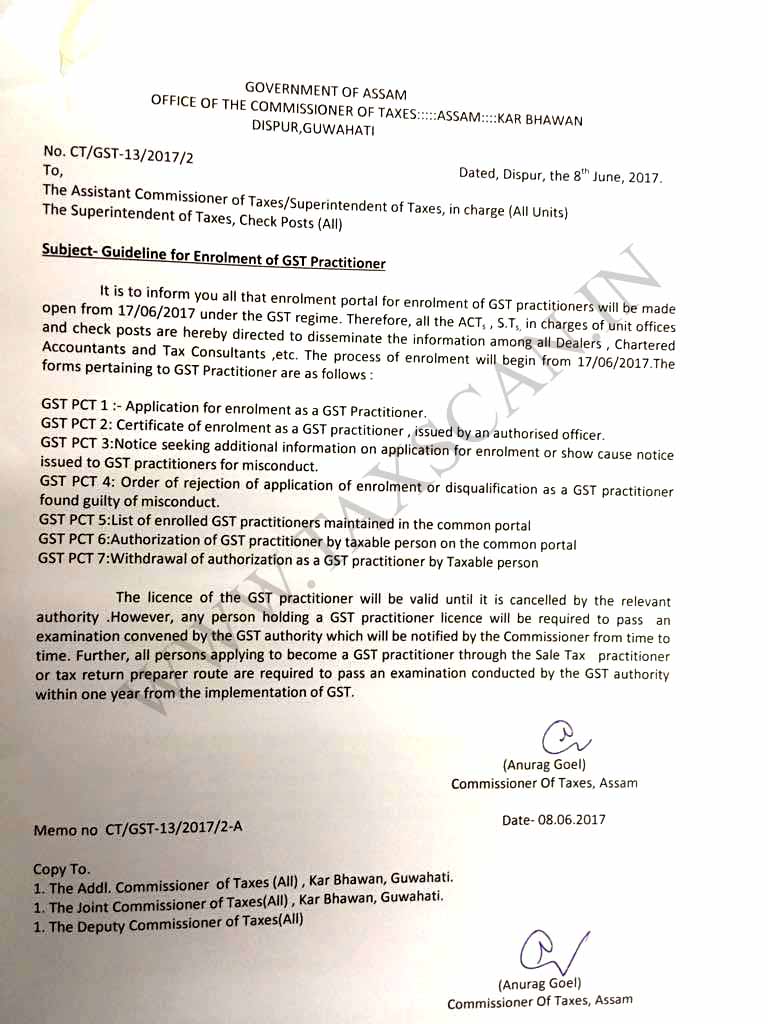

The Assam State Government, yesterday issued a memo containing guidelines for the enrolment of GST practitioners. As per the memo, the enrolment portal for the enrolment of GST practitioners will be made open from 17.06.2017.

In connection with this, the Government directed all its Assistant Commissioner of Taxes (ACIT) of all Units and Superintendent of Taxes Check Posts to disseminate the information among all dealers, Chartered Accountants, and Tax Practitioners, etc.

The process of enrolment will begin from 17.06.2017. The forms pertaining to GST practitioners are prescribed in the memo.

It stated that the license of the GST practitioner will be valid until it is canceled by the relevant authority. “However, any person holding a GST practitioner license will be required to pass an examination convened by the GST authority which will be notified by the Commissioner from time to time. Further, all persons applying to become a GST Practitioner through the Sales Tax Practitioner or Tax Return preparer route are required to pass an exam conducted by the GST authority within one year from the implementation of GST.”

Read the full text of the Memo below.