More Late Fee payable for Delay in Filing GSTR-3B due to System Error: GSTN

The Goods and Services Tax Network ( GSTN ) portal recently clarified the liability to pay the late fee for filing GSTR-3B with delay.

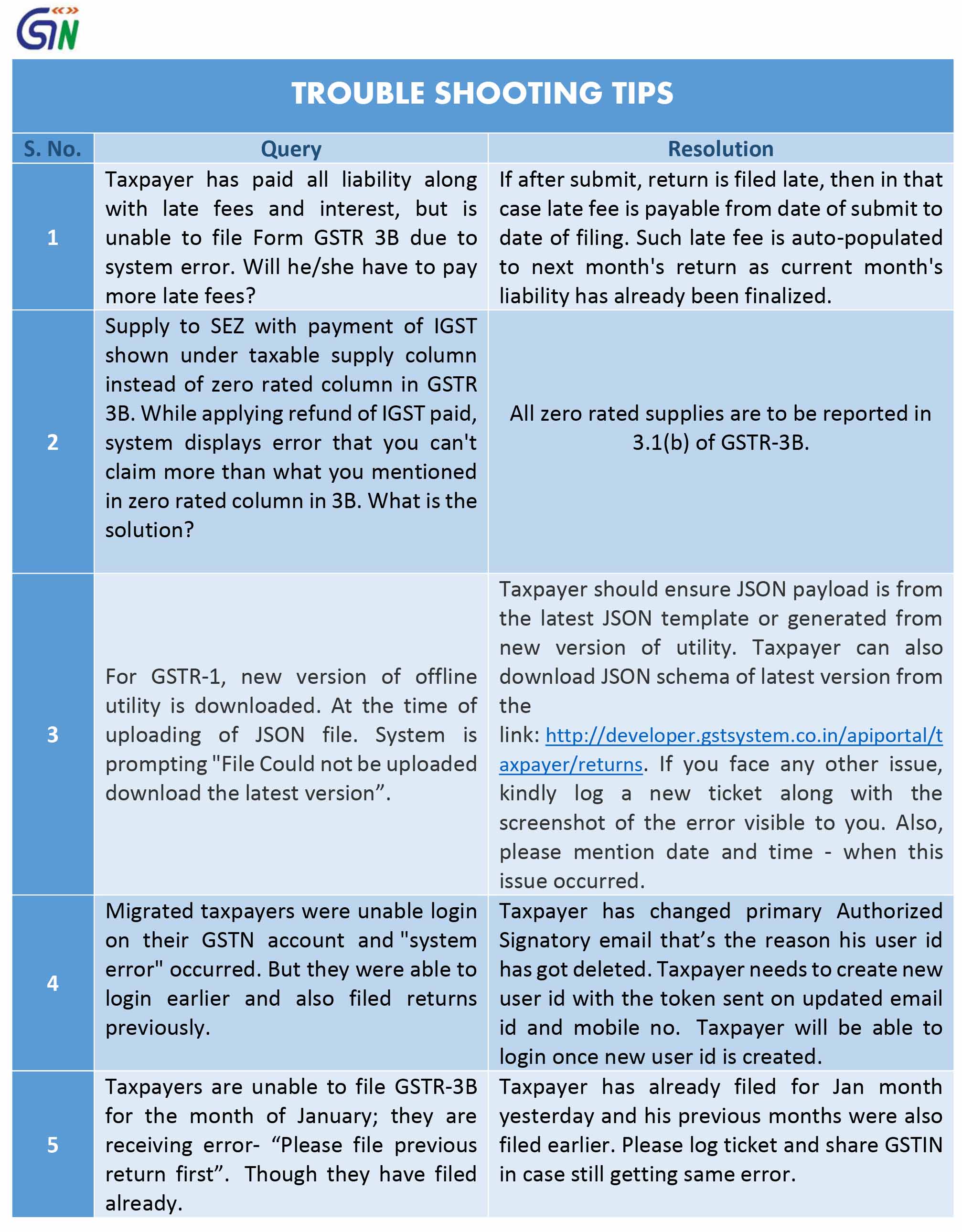

The question was that "The taxpayer has paid all liability along with late fees and interest but is unable to file Form GSTR 3B due to the system error. Will he/she have to pay more late fees?"

“If after submit, the return is filed late, then, in that case, the late fee is payable from the date of submission to date of filing. Such late fee is auto-populated to next month's return as current month's liability has already been finalized,” a monthly newsletter issued by the GSTN portal said.

A taxpayer asked, “Supply to SEZ with payment of IGST shown under taxable supply column instead of the zero-rated column in GSTR 3B. While applying the refund of IGST paid, the system displays error that you can't claim more than what you mentioned in the zero-rated column in 3B. What is the solution?”. To this, it was replied that all zero-rated supplies are to be reported in 3.1(b) of GSTR-3B.

It further said that the migrated taxpayers who are unable to access their GSTN account should ensure JSON payload is from the latest JSON template or generated from the new version of the utility. The taxpayer can also download JSON schema of the latest version from the link: http://developer.gstsystem.co.in/apiportal/taxpayer/returns. If you face any other issue, kindly log a new ticket along with the screenshot of the error visible to you. Also, please mention date and time - when this issue occurred.