The GST Council, in its 21st meeting held at Hyderabad on 9th September 2017, has recommended the following measures to facilitate taxpayers:

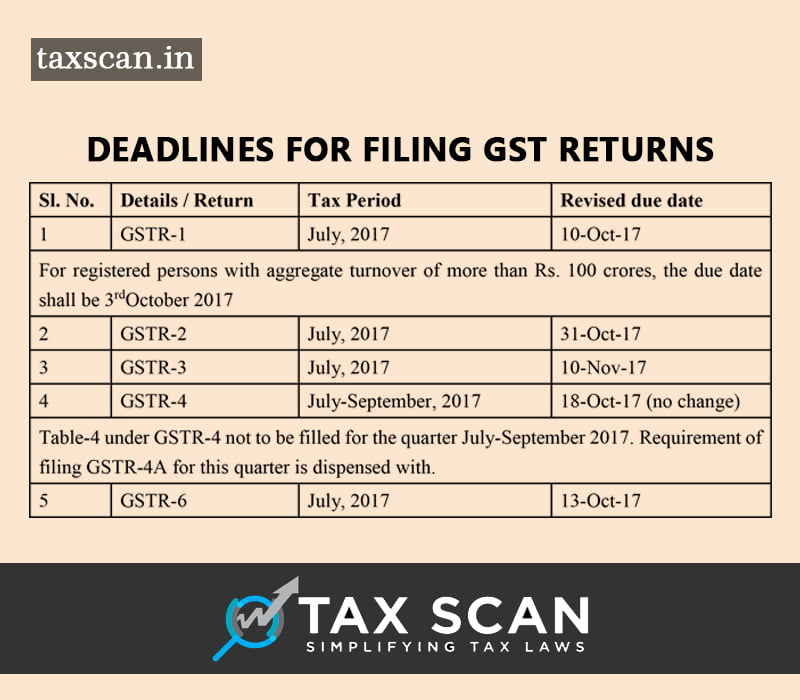

a) In view of the difficulties being faced by taxpayers in filing returns, the following revised schedule has been approved:

| Sl. No. | Details / Return | Tax Period | Revised due date |

| 1 | GSTR-1 | July, 2017 | 10-Oct-17 |

| For registered persons with aggregate turnover of more than Rs. 100 crores, the due date shall be 3rdOctober 2017 | |||

| 2 | GSTR-2 | July, 2017 | 31-Oct-17 |

| 3 | GSTR-3 | July, 2017 | 10-Nov-17 |

| 4 | GSTR-4 | July-September, 2017 | 18-Oct-17 (no change) |

| Table-4 under GSTR-4 not to be filled for the quarter July-September 2017. Requirement of filing GSTR-4A for this quarter is dispensed with. | |||

| 5 | GSTR-6 | July, 2017 | 13-Oct-17 |

Due dates for filing of the above mentioned returns for subsequent periods shall be notified at a later date.

b) GSTR-3B will continue to be filed for the months of August to December, 2017.

c) A registered person (whether migrated or new registrant), who could not opt for composition scheme, shall be given the option to avail composition till 30thSeptember 2017 and such registered person shall be permitted to avail the benefit of composition scheme with effect from 1stOctober, 2017.

d) Presently, any person making inter-state taxable supplies is not eligible for threshold exemption of Rs. 20 lacs (Rs. 10 lacs in special category states except J & K) and is liable for registration. It has been decided to allow an exemption from registration to persons making inter-State taxable supplies of handicraft goods upto aggregate turnover of Rs. 20 lacs as long as the person has a Permanent Account Number (PAN) and the goods move under the cover of an e-way bill, irrespective of the value of the consignment.

e) Presently, a job worker making inter-State taxable supply of job work service is not eligible for threshold exemption of Rs. 20 lacs (Rs. 10 lacs in special category states except J & K) and is liable for registration. It has been decided to exempt those job workers from obtaining registration who are making inter-State taxable supply of job work service to a registered person as long as the goods move under the cover of an e-way bill, irrespective of the value of the consignment. This exemption will not be available to job work in relation to jewellery, goldsmiths’ and silversmiths’ wares as covered under Chapter 71 which do not require e-way bill.

f) FORM GST TRAN-1 can be revised once.

g) The due date for submission of FORM GST TRAN-1 has been extended by one month i.e. 31stOctober, 2017.

h) The registration for persons liable to deduct tax at source (TDS) and collect tax at source (TCS) will commence from 18th September 2017. However, the date from which TDS and TCS will be deducted or collected will be notified by the Council later.

The GST Council has decided to set up a committee consisting of officers from both the Centre and the States under the chairmanship of the Revenue Secretary to examine the issues related to exports.

The GST Council has also decided to constitute a Group of Ministers to monitor and resolve the IT challenges faced during GST implementation.

The 21st meeting of the Goods and Services Tax (GST) Council held at Hyderabad on Saturday decided to re-open the registration window for composition scheme till 30th September.

The last date to avail the scheme was August 16, and to open the scheme again for taxpayers will need an amendment to the composition rules.

“A registered person (whether migrant or new registered) who could not opt for composition scheme shall be given the option to avail composition till 30th September and such registered person shall be permitted to avail the benefit of composition scheme from 1st October 2017,” a press release issued by the Government said today.

The Composition Scheme enables the traders, manufacturers and restaurant owners with annual turnover up to Rs 75 lakh in the preceding financial year, to pay tax at 1 percent, 2 percent and 5 percent, respectively. However, the persons who avail the benefit of the said scheme claim for input tax credit.

The Government on Saturday extended the due date for filing of GSTR 1 to 10th October from 10th September.

On the basis of the decision taken by the GST Council today, the government has also decided to form a 3-member inter-ministerial team to look at the technical issues around GSTN and the problems users were facing in uploading their returns on the portal.

In view of the difficulties being faced by taxpayers in filing returns, the following revised schedule has been approved:

| Sl. No. | Details / Return | Tax Period | Revised due date |

| 1 | GSTR-1 | July, 2017 | 10-Oct-17 |

| For registered persons with aggregate turnover of more than Rs. 100 crores, the due date shall be 3rdOctober 2017 | |||

| 2 | GSTR-2 | July, 2017 | 31-Oct-17 |

| 3 | GSTR-3 | July, 2017 | 10-Nov-17 |

| 4 | GSTR-4 | July-September, 2017 | 18-Oct-17 (no change) |

| Table-4 under GSTR-4 not to be filled for the quarter July-September 2017. Requirement of filing GSTR-4A for this quarter is dispensed with. | |||

| 5 | GSTR-6 | July, 2017 | 13-Oct-17 |

Due dates for filing of the above mentioned returns for subsequent periods shall be notified at a later date.

GSTR-3B will continue to be filed for the months of August to December, 2017.

According to the government 45 plus lakh GSTR-3B returns have been filed, and only 17 lakh GSTR-1 had been filed till Friday. Around 13 plus crore invoices had been filed. However, with the GST portal crashing frequently, there has been widespread outrage among taxpayers about their inability in filing returns.

The GST Network was down due to heavy rush of returns and several traders and businesses. Consequently, the Government, on September 4th, had extended the due date for filing returns for July, giving taxpayers extra time for compliance.

The filing of GSTR 1 for August was extended to October 5, GSTR 2 till October 10 and GSTR 3 till October 15.

Read the full text of the Notification below.

While dismissing a departmental appeal, a division bench of the Delhi ITAT held that receiving fee from non-members can’t be a ground for denying exemption under section 11(1) of the Income Tax Act, 1961.

Assessee, PHD Chamber Of Commerce And Industry, is an association of professional and businessman to protect and promote the interest of its members, has been enjoying the exemption u/s 11(1) of the Income Tax Act.

The source of assessees’ income was membership fees from its members, specialized services, services and facilities, meetings, seminars and training programmes, sale of publication etc.

For the relevant assessment year, the Assessing Officer noted that the assesse received fee from other non-members of the institution and such income is assessable under the Income Tax Act.

The first appellate authority also accepted the contentions of the assessee by finding that the principle of mutuality is apparently not applicable in the case of the assessee.

Upholding the order, the bench noted that the case of the assessee is covered in its favour by the orders of the Ld. CIT(A)’s predecessors for the Assessment years 2006-07 to 2011-12 and also by the order of the Hon’ble Delhi High Court in assessee’s own case for the AY 2006-07 & 2007-08. The Departmental Appeal for the AY 2008-09 & 2009-10 has also been dismissed by the Tribunal.

“Therefore, the Ld. CIT(A) has rightly observed that there is no sufficient reason to deviate from the appellate orders of the Ld. CIT(A) of the earlier years allowing the exemption u/s. 11(1) and accordingly, the AO was directed to allow the exemption u/s. 11(1) with all consequential benefits, which does not need any interference on our part, hence, we uphold the action of the Ld. CIT(A) on the issue in dispute and reject the grounds raised by the Revenue and accordingly, we dismiss the Appeal filed by the Revenue.”

Read the full text of the Order below.

The Central Board of Excise and Customs (CBEC) on Tuesday issued an advisory to its officials on taking defence against writ petitions and Public Interest Litigations (PILs) relating to the newly implemented Goods and Services Tax (GST) laws.

A large number of writ petitions and Public Interest Litigations have been filed before various High Courts across the country challenging or seeking clarifications on various aspects of GST law and rate of tax on some products.

It in this background, the Board said that “It is important to defend the issues effectively to defend the interest of the revenue,” the Board said.

In this regard, the Board directed the officials to follow its instructions contained in the circular dated 19.06.2015 and 08.12.2015 wherein the issues relating to ‘authorization’ of the Commissioners to represent Union of India and Others in the matters filed before the High Court was clarified.

It also asked the Principal Chief Commissioners to keep a special watch on these petitions and communicate with the lawyers representing the Government.

Read the full text of the Advisory below.

The Central Board of Excise and Customs (CBEC) today issued a detailed note on the procedures to be followed by the tax payers while filing statutory returns under the new Goods and Services Tax (GST) regime.

The Board advises the traders to not wait for the last date and file GSTR-1, 2 and 3 within the prescribed period.

Last time, the GST Network was down due to heavy rush of returns and several traders and businesses. Consequently, the Government again extended the due date for filing returns for July, giving taxpayers extra time for compliance.

Filing of GSTR-1 is mandatory for all normal and casual registered tax payers. It needs to be filed even if there is no business activity (Nil Return) during a given tax period.

It said that the supplier tax payer will not be able to upload invoices or submit form GSTR1, for the month of July, 2017, during the period of filing of Form GSTR-2 of July, 2017, viz. 11th to 25th September, 2017. Therefore it is necessary that supplier taxpayers files his Form GSTR 1 for the month of July, 2017, using EVC or DSC ( mandatory for companies, LLPs and FLLPs etc.), to avoid late fees payment by 10th September, 2017.

If supplier taxpayer does not submits his Form GSTR 1 of July , by 10th September 2017 and if these invoices are uploaded/added by his receiver tax payer in his Form GSTR 2, then he will be required to necessarily take action on (Accept or Reject), the invoices uploaded by Receiver taxpayer. However, such tax payers will not be able to Edit or Modify Receiver taxpayer uploaded invoices.

Further the same invoices uploaded, but not filed by the supplier taxpayer in his Form GSTR 1, will be marked as invalid.

It further explains the conditions, steps and methods and salient features of Form GSTR-1.

“Late fees of Rs 100/- for every day during which such failure continues subject to maximum of Rs 5000/- , (fees as per SGST Act will be charged separately as per respective SGST Act).” It said.

Read the Full Text of the Document Below

With the retire of GSTN Chairman Navin Kumar, Aadhaar authority UIDAI Chief Executive Ajay Bhushan Pandey was on Friday given additional charge as chairman of the Goods and Services Tax Network (GSTN).

“Dr Ajay Bhushan Pande will hold charge of chairman GSTN in place of Navin Kumar who retired recently. He is DG UIDAI (Aadhar)”, Revenue Secretary Hasmukh Adhia said in a tweet. Kumar retired as Chairman GSTN in the last week of August.

“He brings with him his vast experience of implementing complex IT projects. I welcome him to the Team GST of Revenue deptt,” the Secretary said in a separate tweet.

Pandey, a Senior officer of the Indian Administrative Service (IAS), has been associated with the Unique Identification Authority of India (UIDAI) since its launch in 2010. Pandey graduated from IIT Kanpur and holds an MS and PhD in Computer Science from the University of Minnesota in the US.

GSTN has created and operates the digital network for the Goods and Services Tax (GST) that has been implemented pan-India from July 1. The GSTN portal has been non-functional on several occasions in this period being unable to handle the rush to file returns coming closer to the deadline.

The government has extended the deadline for filing the GST sales return — GSTR-1 — which was to expire on Tuesday, for another five days till September 10.

The 21st meeting of the Goods and Services Tax (GST) Council to be held at Hyderabad may decide the issues on tax anomalies, hike of cess on Cars etc., tomorrow.

The most powerful body under the new indirect tax regime may also take up IT related issues in the GST network which has faced glitches.

The Council is also likely to consider lowering tax rates on over two dozen products, including idli/dosa batter, dried tamarind, custard powder and kitchen gas lighter after anomalies in their fixations were pointed out, officials said.

It will also formulate a mechanism to deal with businesses that are deregistering their brands to avoid taxes after the rollout of Goods and Services Tax from July 1.

Unbranded food items are exempted from GST, whereas branded and packaged food items attract 5 per cent rate. Hence, many businesses are deregistering their brands to avoid the levy.

During the meeting, the Council would discuss the issue of lowering tax structure on public projects and also on the beedi and Granite industry as requested earlier by the Telangana Government.

The Central Board of Excise and Customs ( CBEC ), on Thursday, directed its officials to follow its instructions and the legal provisions during physical verification of the premises and collection of duty.

The Board has issued a circular on Thursday in the light of the recent order of the Delhi High court in the case of DIGIPRO Import & Export Pvt. Ltd v. Union of India & Ors, wherein the Court criticized the Excise Department Officials for collecting undated cheques from assesses.

In the instant case, the petitioner-company, manufactures mobile phone batteries, chargers and LED bulbs, was paying excise duty @ 2% ad valorem on mobile phone battery and mobile phone charger, and 6% on LED bulbs. However, the department claimed that the tariff rate of duties on these products is 12.5% ad valorem.

According to the petitioners, they were eligible to avail an exemption as per a notification issued in March 2012 by the Central Excise department. In consequent to a search conducted by the Anti-Evasion Wing of Central Excise, Delhi some documents was seized and the officials collected five undated cheques amounting to a total of Rs. 12.5 crore.

The bench termed such action as “Illegal practice” which requires a deep investigation. The bench, further summoned the Commissioner of Central Excise, Delhi-II and directed him to file an affidavit showing the steps taken to curb this practice. He was also directed to conduct an enquiry immediately to find out which officers performed the “illegal exercise”. The bench also directed that a copy of this order be sent to the Central Vigilance Commissioner (CVC) in view of the seriousness of the issue.

In this background, the Board asked the concerned wings to issue instructions/directions to the officials time to time.

“In this regard, all concerned in CBEC are advised to strictly follow the legal provisions and instructions/ directions issued from time to time by the Board and not to deviate from the laid down procedure.”

Read the Full Text of the Circular Below

The Central Government is planning to utilize one per cent of its additional tax revenue for the development of the infrastructure of the Central Board of Direct Taxes (CBDT).

The Ministry of Finance, in a communication addressed to the CBDT officials, said that the Finance Minister had, in-principle approved the proposal to utilize 1% of the additional revenue generated by the Board during fiscal 2006-07 and in subsequent years to augment the infrastructure in the Income Tax Department so as to improve its operational efficiency, for better execution of the tax collection.

“As per the information collected from Directorate of Expenditure Budget, there is a possibility to utilize approximately Rs. 615 crores, after earlier expenditure incurred under this Out of this fund, proposals on Resource Centre cum Library, installation of ACs per range, Laptops to ITOs & above, Laptop for Inspectors, Laptops for AO/PS, smartphone for CIT & above & Mobile handsets for officers & officials of IT Department for approximately Rs. 264 crores are under process and active consideration,” the communication said.

“It is felt to explore the possibilities to initiate new schemes/proposals under 1% Schemes, looking to the need and necessity to improve efficiency & capabilities of the officers & officials of the Department.”

It therefore, directed the officials to submit fresh innovative proposals/ideas for enhancing the organizational efficiency and infrastructure under 1 % incentive scheme before 25th September.

Justices Alok Aradhe and B. S Walia, in a significant ruling, held that under the provisions of the Income Tax Act, the loss by embezzlement, being incidental to the banking business should be allowed as deduction in the year it is discovered.

In the present case, Assessees’ claim for deduction of loss incurred due to misappropriation of funds by its employee was denied by the Assessing Officer by holding that although the embezzlement came to the notice of the assessee on earlier dates yet the assessee has claimed the deduction in the assessment year 1997-1998. He noted that the claim is not admissible since the assessee had noted the details of occurrence of loss and had detected the loss in the previous accounting year.

It was contended on behalf of the assesse that the loss should be allowed as deduction from income in the year in which it was discovered for the reason that though it came to the knowledge of the assessee in a particular year, the exact amount may be ascertained after investigation in a subsequent year i.e. the date of discovery.

Citing a plethora of Apex Court rulings and the CBDT circular dated 24.11.1965, loss must be deemed to have arisen only when employer comes to know about it and it realizes that the amount embezzled cannot be recovered.

“The date of discovery in view of circular issued by CBDT has to be treated as the date from which the employer comes to know that the amount embezzled cannot be recovered,” the bench noted.

Therefore, the loss by embezzlement being incidental to the banking business should be allowed as deduction in the year it is discovered and the expression “discovered‟ has to be read in the context of Circular dated 24.11.1965 issued by Central Board of Direct Taxes.

Based on the above findings, the bench held that the expression detection and discovery have different and distinct connotations in law and the expression “discovery‟ has to be interpreted so as to mean that loss must be deemed to have arisen only when employer comes to know about it and realizes that the amount embezzled cannot be recovered and not merely from the date of acquiring knowledge in which that embezzlement has taken place.

Read the full text of the Judgment below.

A division bench of the ITAT Delhi, on Wednesday deleted penalty against the assesse, M/s. Bhayana Builders Pvt. Ltd, who mistakenly collected collected TDS on the gross billing amount including service tax.

The bench considered the fact that the assesse was able to explain the addition so made which is the basis for levy of the penalty.

Assesse, in the instant case, mistakenly collected TDS on the gross billing amount including service tax form its customers. Assessing Officer initiated penalty on the assessee on ground that it has furnished inaccurate particulars of income.

Before the appellate authorities, assesse-Company contended that the gross amount/total amount as per statement and the TDS figures are verifiable and matched with 26AS, which gives complete break-up in respect of M/s. Pioneer Urban Land & Infrastructure Ltd. They also duly explained the details of tax deducted at source. Assessee also explained that since service tax is not income of the assessee and therefore, it would not form part of total receipts of the assessee and has to be given treatment separately in the Balance Sheet.

The bench noticed the circular dated 19th July, 2017 wherein it was clarified that “in the light of fact that even under New GST Regime, the rational of excluding the tax component from the purview of TDS remains valid.”

The bench noted that “the assessee has declared in the return of income along with statement of taxable income, disallowance under section 43B in a sum of Rs.1,35,91,866 which is also adopted by the A.O. In the assessment order, would clearly prove that the same includes the service tax. When A.O. had taken the figure of the taxable income and made separate addition of Rs.38,39,628, it would certainly amount to double addition. It is well settled law that quantum and penalty proceedings are independent and distinct proceedings.”

It further noted that even if the addition is agreed by the assessee, if the assessee is able to explain the addition, then, penalty may not be leviable in the facts and circumstances of the case.

“The above facts clearly indicate that the explanation of assessee at the penalty stage was factually correct based on the material on record and assessee successfully explained the addition so made which is the basis for levy of the penalty. Since the difference is reconciled at the penalty stage and claim of assessee have not been doubted or rejected, therefore, Ld. CIT(A) was not justified in confirming the levy of penalty merely because assessee conceded for addition of the amount in question. Considering the totality of the facts and circumstances of the case, we are of the view that since the assessee explained the above addition, therefore, penalty need not be imposed in the facts and circumstances of the case.”

It further noted that the A.O. has not mentioned as for which limb, the penalty have been levied against the assessee, no penalty would be leviable.

Read the full text of the Order below.

The Chandigarh CESTAT, in Veer Overseas Limited v. CCE & ST Panchkula, held that the statutory limits prescribed under section 11B of the Central Excise Act, 1944 is not applicable to the amount of service tax collected by the department without authority of law.

As per Notification No. 13/2003-ST, Business Auxiliary Services provided by a Commission Agent in relation to sale or purchase of agricultural produce are exempted from the levy of service tax. Appellants, without knowing the same, paid service tax in connection with the export of sale.

Subsequently, they claimed refund of tax. However, the department rejected the claim on ground that the refund was filed beyond the statutory time limit of one year prescribed under Section 11B of the Central Excise Act, 1944.

Before the Tribunal, the assesse submitted that they had to deposit Service Tax on the impugned service being recipient of service provided by foreign commission agents. Subsequently, they filed refund claim on 01.02.2010 contending that the Service Tax was paid inadvertently.

After analyzing the facts and the arguments from both sides, the bench noted that the payments made by the appellants on the dates of payment were not on account of any mistake of law or mistake of fact. However it was only on 26.05.2011 that a clarification was issued by the CBEC, which clarified that “Also where the commission agents stationed abroad provide business auxiliary service to promote the export of rice, said business auxiliary service is covered by Notification No. 13/2003 ST (as amended) because, the word rice is mentioned under the explanation to the terms agricultural produce, in the inclusive portion along with other items like cereals, pulses, etc.”

“Thus, as a result of this clarification dt. 26.05.2011, the benefit of this exemption notification No. 13/2003 became available to the appellant and the amount collected by the Revenue was therefore without any authority. It is settled position in law that beneficial circular has to be applied retrospectively while oppressive circular has to be applied prospectively. “

With regard to the question of applicability of statutory limit, the bench noted that “the amount deposited by the assessee-Appellants without any authority of law cannot be considered as Service Tax. As per Article 265 of the Constitution, no tax can be collected without any authority of law. At the relevant time, there was no authority of law to collect Service Tax on the activity carried out by the assessee-Appellants. Hence, Section 11B of the Central Excise Act, 1944 is not applicable. The amount was deposited in the year 2006-2007 and the refund was filed on 02nd January, 2008. Hence, the claim has been made within the period of three years prescribed by Honble Delhi High Court. Therefore, we are of the view that the assessee-Appellants are entitled to get the refund and the same is not hit by the limitation prescribed under Section 11B of the Central Excise Act, 1944 read with Section 83 of the Finance Act, 1994.”

“In the instant case, we are of the view that it is not a case of refund of tax, but return of deposit for which limitation (Section 11B of the Act) is not applicable. Hence, we set aside the impugned order and direct the jurisdictional Commissioner to return the deposited amount, as per law.”

Relying on the decision in Parekh Bros Vs. CIT, the bench also pointed out that the Department should not take advantage of the ignorance of the assessee-Appellants.

Read the full text of the Order below.

A bench of Justices Anoop V Mohta and Anuja Prabhudessai, while dismissing a writ petition seeking waiver of pre-deposit under the Excise Act, held that pre-deposit cannot be waived due to poor financial condition of the assesse.

Before the High Court, the petitioners have sought direction that Appeal filled by them should be heard without insisting on monetary pre-deposit under Section 35 of the Central Excise Act, 1944.

The department strenuously contended that the writ petition is not maintainable since the petitioners have an alternative remedy to challenge the said order under the excise law.

The petitioners contended that existence of alternative remedy is not a bar to writ jurisdiction when the impugned order is arbitrary and is in violation of principles of natural justice.

The bench noted that the order of the Commissioner impugned by the petitioners is Appealable under Section 35B(a)(b) of the Excise Act. “Hence, there is no dispute that the Petitioners have the alternative and equally efficacious remedy to challenge the order passed by the Commissioner.”

The bench further observed that a plain reading section 35F of the of the Excise Act would make it clear that the deposit of certain percentage of duty or penalty is a prerequisite for filing the appeal.

“The provision does not confer any powers on the appellate authority to waive or reduce the mandatory prerequisite. Furthermore, the amounts which is required to be deposited, is 7.5% per cent of the duty demanded or fine imposed, which cannot stated to be exorbitant.

Overruling the contentions of the petitioners, the bench ruled that “the only ground for invoking the writ jurisdiction or seeking waiver of pre-deposit, is that the Petitioners are not in a financial condition to deposit the amount. However, this cannot be considered as an exceptional circumstance to invoke the writ jurisdiction or to waive the pre-deposit, particularly when the amount required to be deposited is 7.5 per cent of the duty demanded.”

Read the full text of the Judgment below.

The Financial Resolution and Deposit Insurance Bill, 2017 has been referred to a Joint Parliamentary Committee of both the Houses, under the Chairpersonship of Shri Bhupender Yadav, M.P for examination and presenting a Report to the Parliament. The Bill seeks to provide for the resolution of certain categories of financial service providers in distress; the deposit insurance to consumers of certain categories of financial services; designation of systemically important financial institutions; and establishment of a Resolution Corporation for protection of consumers of specified service providers and of public funds for ensuring the stability and resilience of the financial system and for matters connected therewith or incidental thereto. The proposed legislation together with the Insolvency and Bankruptcy Code, 2016 is expected to provide a comprehensive resolution mechanism for the economy.

It has been decided by the Joint Committee to seek views and suggestions from various stakeholders and public at large on the provisions of the aforesaid Bill. ‘The Financial Resolution and Deposit Insurance Bill, 2017’ has been uploaded on Lok Sabha website.

All those desirous of submitting their views/suggestions to the Committee may send two copies of their written Memoranda/suggestions either in English or Hindi on the Bill to Director (CB-I & JCs), Lok Sabha Secretariat, Room No. 339, Third Floor, Parliament House Annexe, New Delhi- 110001 or Fax at 23092092 or e-mail them at jcfrdi-Iss@sansad.nic.in by 29th September, 2017.

The Memoranda submitted to the Committee would form part of the records of the Committee and would be treated as “Confidential” and not circulated to anyone, as such an act would constitute a breach of privilege of the Committee.

Those who wish to appear before the Committee, besides submitting Memoranda, are also requested to specifically indicate so. However, the Committee’s decision in this regard shall be final.

A division bench of the Vishakha Patanam ITAT, on last day, ruled that tax must be deducted from source in case of payments made to a non-resident through his agent under section 195 of the Income Tax Act, 1961.

The assesse, in the instant case, purchased the property belonging to Shri Satish Kumar who is an NRI. Smt. Allam Baby is a GPA holder for the purpose of facilitating the transaction in India. Similarly, assesse took housing loan by the seller from Dewan Housing Limited. Assesse made payment to the GPA holder who is an agent of non- resident.

It was contended on behalf of the assessee that since the payment was made to the GPA holder and the Dewan Housing Finance Ltd. and it was not paid to NRI directly, it is not liable to deduct tax from source as per the provisions of section 195 of the Income Tax Act, 1961.

Overruling the above contentions, the bench said that the payments made to Dewan Housing Limited as well as with Smt. Allam Baby constitutes the payments made to the non-resident and the TDS is deductible as per the provisions of section 195 of the Act and this ground of appeal of the assessee is dismissed.

Read the full text of the Order below.

The Institute of Chartered Accountants in India (ICAI) has set up a group for suggesting ways and means to resolve Inter unit reconciliations including re-engineering the process/procedures, revenue sharing, between HO and branches, various grants payable and accounting entries thereof, especially in the recently rolled out Goods and Services Tax (GST) regime.

A six member group has been constituted for the above purpose, a statement appeared in the Official website of the ICAI said.

S. Sundaresan, CFO would be the Secretary to the aforesaid Group. CA. S.B. Zaware (Convenor), CA. Atul Kumar Gupta, CA. Babu Abraham Kallivayalil, CA. Sanjay Vasudeva, CA. Anil S. Bhandari are the orther members in the group.

While granting tax relief to the Indian Medical association (IMA), a division bench of the Delhi ITAT held that exemption under section 11(1) of the Income Tax Act cannot be denied to the assesse-society for receiving endorsement fee income for promoting consumer goods like Pepsi and Dabur.

The assesse, IMA, is an association of medical doctors and the main object of the society is to promote the interest of its members. The main objects of the society are to promote and advance medical science and to promote improvement of public health and medical education in India. All the activities carried out by IMA/Assessee can be regarded as falling within the scope of general public utility.

For the relevant assessment year, the AO observed that the assessee has received income out of commercial transaction with outsiders who are non-members of IMA/Assessee. The Officer noted that the assesee is involved in commercial activity as the assessee has been endorsing the products of consumer goods like Pepsi and Dabur etc and has been receiving endorsement fee income. Accordingly, he denied the exemption u/s. 11(1) of the Act to the assesse.

The department had approached the Tribunal against the order of the first appellate authority contending that assessee society has made commercial agreements with corporate entities and receiving contribution for specific endorsement which would result in the sale of their products. According to them, these activities are commercial in nature.

The bench noticed the assessees’ own case wherein similar issue was concluded in favour of the assessee. In that case, it was held that the assessee is not involved in any trade, commerce or business and is totally involved in charitable activity and falling within the definition of charitable purpose under section 2(15) under the head “medical relief’.

Further, relying on the decision in India Trade Promotion Organisation vs. DGIT(E), the bench upheld the view of the first appellate authority who granted exemption under section 11(1) to the assessee.

Read the full text of the Order below.

The Mumbai ITAT, in a recent ruling, held that ‘tax effect’ for the purpose of filing second appeal before the Income Tax Appellate Tribunal would not include interest.

In the instant case, the department filed a second appeal before the ITAT against the order of the first appellate authority who concluded the matter in favour of the assessee, Shri Ubaid Patel.

A two member bench of the ITAT found that the tax effect on the income under dispute is less than Rs.10 lakhs.

The bench noted that the Central Board of Direct Taxes vide Circular No. 21/2015 dated 10th December, 2015 file no.279 of Misc. 142/2007 – ITJ (PT) has issued the direction in supersession of the Instruction No.5/2014 dated 10/07/2014 in pursuance with the power entrusted u/s. 268A of the Income Tax Act, that no appeal should be filed before this Tribunal in case tax effect does not exceed Rs.10 lakhs.

Dismissing the appeal, the bench said that “the “tax effect” in this regard means the difference between the tax on the total income assessed and the tax that what have been chargeable had such total income been reduced by the amount of income in respect of issues against which appeal is intended to be filed. This circular further states that tax will not include any interest thereon the chargeability of interest itself is in dispute”.

Read the full text of the Order below.

A division bench of the Delhi ITAT, last day ruled that the loss on the sale of Mutual Fund can be treated as business loss and therefore, such loss can be set off against the business income under the provisions of the Income Tax Act, 1961.

Assessee, M/S Cosmos International Ltd, was engaged in the business of Exports of several items and also doing Commodity Business in Future Trading. For the year under consideration, the Assessing Officer rejected the Assessees’ claim for deduction of business loss on account of loss on the sale of Mutual Fund finding that the same amount to capital loss.

The division bench noted the fact that assessee is engaged in the business of trading in securities and shares.

The bench said that “It is undisputed fact that the loss has been incurred during the normal course of the business. Since the assessee’s only source of income was his interest and in this view the loss incurred on the sale of mutual fund has to be held as business loss. Therefore, this issue is covered by the judgment of the Hon’ble Supreme Court in the case of CIT vs CocanadaRadhaswami Bank Ltd. (1965) 57 ITR 306 (SC), wherein it was held that since the entire income of the assessee include interest on securities, the assessee was entitled to set off such losses out of its business income.”

The bench also noted that AO cannot dispute that the loss arising from sale of investment will be capital gain as against business loss claimed by the assessee. The same stand was followed by the assessee in the earlier years and there is no addition made by the AO in the earlier and succeeding years.

Read the Full Text of the Order Below

Finally, Gujarat got a second Tribunal after Ahmedabad bench. Shri. Ravi Shankar Prasad, Union Minister of Law & Justice has inaugurated the Surat bench of the Income Tax Appellate Tribunal, on 1 September, 2017.

Shri P.P.Chaudhary, Union Minister of State for Law & Jusce and Electronics & Informaon Technology, was the Guest of Honour of the function. Hon’ble Members of Parliament Shri C. R. Paal, Smt. Darshana Jarodsh, Dr. K. C. Patel, Shri Manuskhbhai D. Vasva, and Shri Nathubhai G. Patel were also present on the occasion.

Surat is the 28th city in the country to have a bench of the Income Tax Appellate Tribunal. As of now, it has over 3,000 appeals pending for disposal, which is more than double the average pendency per bench all over the country.

Owing to unsatisfactory air connectivity and taking road journey between Surat and Ahmedabad, tax professionals were finding it very difficult to make day trips to Ahmedabad in connection with the ITAT engagements. With the setting up of this bench, a long pending demand of tax professionals in South Gujarat is met.

The new bench will have jurisdiction of the districts like Bharuch, Dang, Narmada, Navsari, Tapi and Valsad along with the union territories of Diu, Daman and Dadra-Nagar Haveli (DNH). This will help people to file their appeals in Surat rather than coming all the way to Ahmedabad.

Shri G. D. Agrawal, Hon’ble President Income Tax Appellate Tribunal, Shri Pramod Kumar, Hon’ble Sr Member, Ahmedabad Zone, Shri C. M. Garg and Shri O. P. Meena, Hon’ble Members of the new bench, Shri Rajiv Nabar, Principal Commissioner of Income Tax, Shri P. M. Shah, President South Gujarat Chamber of Commerce and Industry, Shri R. N. Vyapari, President ITAT Bar Association, Shri Rases Shah, President, Surat Chartered Accountants Association, Hon’ble Members of the Income Tax Appellate Tribunal Ahmedabad benches, and, apart from eminent local citizens and Government officials, a large number of chartered accountants and lawyers from Surat, neighboring places in South Gujarat as well as Ahmedabad were present on the occasion.

The setting up of Surat bench is very well received, with enthusiasm, by all the stakeholders.