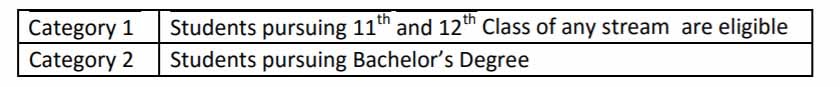

The Institute of Company Secretaries of India ( ICSI ) is organising online quiz on Current Affairs & General Knowledge for students of class 11th, 12th and students pursuing graduation. The Quiz will be conducted in three rounds i.e. Preliminary Round, Semi-Final Round and Final Round. The competition will have two categories:

The Online Quiz Competition shall be in MCQ Pattern in ‘Any Time Anywhere mode’.

The Online Quiz window will be open during 10.00 AM to 5:00 PM on the date of competition during which the students may login and appear in the competition.

Syllabus for Competition: General Knowledge and Current Affairs, Basic Knowledge about ICSI and CS Course. The registration for the quiz will close at 5.00 pm on Thursday, 31st October 2019.

Link for registration http://bit.ly/AllIndiaICSIQuiz

Top three students in each category will be shortlisted for Cash Award, Special Appreciation award and 10 consolation prizes will also be given in each category.

For more information visit www.icsi.edu at Latest @ICSI.

Existing Students of CS Course, employees of ICSI and their wards and spouse are not eligible to participate in the competition.

The Ministry of Corporate Affairs ( MCA ) has appointed Indian Institute of Corporate Affairs ( IICA) to create and maintain a data bank of Independent Directors.

The Notification said that, “the Indian Institute of Corporate Affairs at Manesar (Haryana), as an institute to create and maintain a data bank containing names, addresses and qualifications of persons who are eligible and willing to act as independent directors, for the use of the company making the appointment of such directors”.

The notification shall come into force with effect from the 1st day of December, 2019.

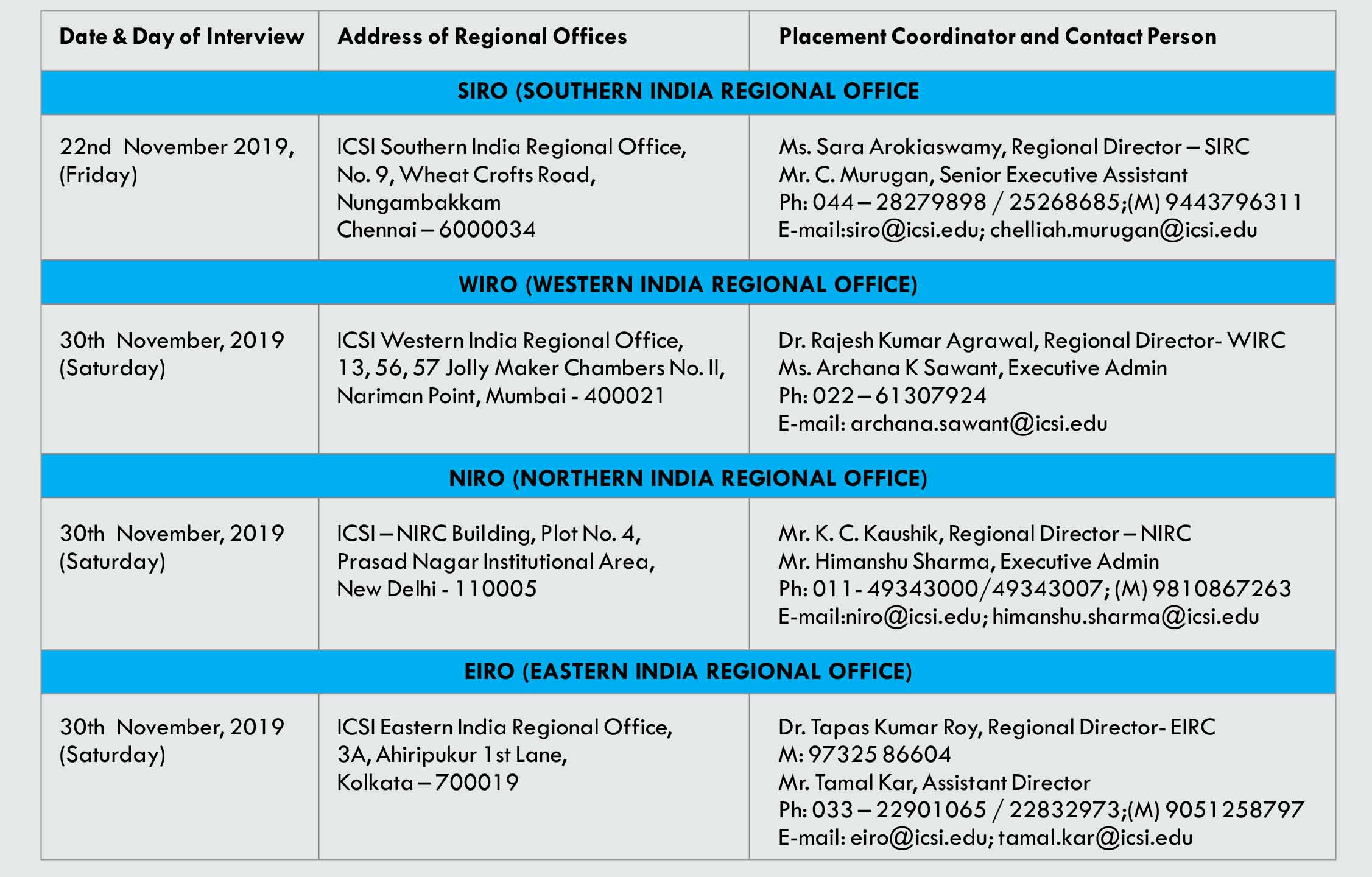

Subscribe Taxscan Premium to view the JudgmentThe Institute of Company Secretaries of India ( ICSI ) to organise Mega Placement Drive for Company Secretaries.

Mega Placement Drive has become the core Placement Support activity for our Members who are looking forward to being Young Professionals making a mark in Indian Economy. The Mega Placement Drive has, off lately, evolved into one of the important bi-annual activity of the Institute.

The Company Secretaries who got their ACS membership on or after 1st January, 2018 till 30th October, 2019 are eligible to participate in this drive.

MODALITIES:

For Further Information Click here.

The Gujarat High Court has ruled that, if upon verification of the documents and on verification of the goods, no discrepancy is found, the conveyance shall be allowed to move further.

The petitioner has challenged the order dated 08.04.2019 passed by the third respondent in the exercise of powers under section 130 of the Central Goods and Services Tax Act, 2017, whereby, the vehicle bearing registration No. DL-01-GC-4470 together with the goods contained therein is ordered to be confiscated and tax, penalty and fine in lieu of confiscation of the goods and conveyance as computed therein have been levied.

The petitioner contended that the driver of the truck was carrying invoice, e-way bill and lorry receipt while transporting brass electrical parts from Jamnagar to Delhi. The truck was intercepted by the third respondent – State Tax Officer on 14.01.2019 at 00:30 a.m. at Soyal Toll Gate. The driver of the truck had produced the documents relating to the goods which were being transported; however, the third respondent detained the truck on the ground that the genuineness of the goods in transit (its quantity etc.) and/or tender documents require further verification. Accordingly, on 14.01.2019, the third respondent issued an order in Form GST MOV-01 recording the statement of the driver as well as an order for physical verification/inspection of the conveyance and goods and the documents in Form GST MOV-02.

The division bench comprising of Justice Harsha Devani and Justice Sangeeta K. Vishen observed that, “The reasons for issuance of the notice for confiscation under section 130 of the CGST Act in Form GST MOV-10 are that upon preliminary verification of the dealer online, 42 e-way bills have been generated on December 2018, wherein, IGST has been shown to Rs.3,64,30,800/- and it appears that, dealers have not paid the same or that the purchases are not genuine. If that be so, nothing prevents the respondents from taking appropriate action against petitioner in accordance with law under the relevant provisions of the CGST Act. However, when the conveyance in question was carrying the goods which were duly accompanied by documents and no discrepancy was found in connection therewith, there was no reason for the third respondent to confiscate the same. The impugned order of confiscation passed by the third respondent under section 130 of the CGST Act, therefore, cannot be sustained”.

While quashing the order, the Court also clarified that the fact that this court has ordered release of the goods and conveyance will not, in any manner, come in the way of the respondents in proceeding against the petitioner in connection with the contravention of any provisions of the GST Acts and the rules framed thereunder which find reference in the affidavit-in-reply filed on behalf of the respondents.

Subscribe Taxscan Premium to view the JudgmentThe Delhi Transport Infrastructure Development Corporation Limited ( DTIDC ) has invited application for the post of Company Secretary and Chartered Accountant for filling up 01 Post of Company Secretary (Full time) & 01 Post of Chartered Accountant (Full time) on a contract basis.

DTIDC, an enterprise of Govt. of NCT of Delhi.

The applicants who have applied earlier for the post of chartered accountant against advertisement dated 17.08.2019, need not to apply further for the post of Chartered Accountant.

The last of receipt of application is 30.10.2019.

For Further Information Click here.

The Authority of Advance Ruling in Karnataka has ruled that, The providing of access to the online content by the applicant to his users is covered under SAC 998431 and is liable to tax at 9% CGST under the entry no.22 of Notification No.11/2017- Central Tax (Rate) dated 28.06.2017 and at 9% under the KGST Act as it is covered by entry no. 22 of Notification (11/2017) No. FD 48 CSL 2017 dated 29.06.2017. Since the transaction is not exempt, there is no restriction on input tax credit claims as per Section 17(1) or 17(2) of the CGST Act / SGST Act / IGST Act.

The Applicant M/s Informatics Publishing Limited is a Company and is registered under the Goods and Services Act, 2017. The Authority was considering the question, Whether the input tax credit is available when the online educational journals and periodicals are supplied to the Educational Institutions other than to pre-school and higher secondary school or equivalent, which is exempt by virtue of Notification No.2/2018 – Central Tax (Rate) dated 25.01.2018?

The applicant is only providing access to the articles published in various journals and papers to its subscribers. It itself is not publishing any online journal, but only maintaining a database of links to all the journals. It is seen that the links to the articles are maintained in a metadata form and the subscriber, when accesses to the platform, can access the individual articles published in any of the journals available on the platform after reading the catalogue of the article. The articles are catalogued and made available. Some of the articles are available for a full view while some are only available in the catalogued form and the subscriber needs to subscribe to the individual journal sites to gain access to the full article. The applicant is collecting the subscription fee which is nothing but the fee charged to gain access to the data available in the database and to download the articles or information. This is an online information and database access and retrieval service provided by the applicant to its subscriber and not a sale or supply of online journals.

The AAR also said that, the transaction is not covered under sub-item (v) of item (b) of serial no.66 of Notification No.12/2017- Central Tax (Rate) dated 28.06.2017 as amended by Notification No.2/2018- Central Tax (Rate) dated 25.01.2018 which reads as under “66. Services provided to an educational institution by way of -(v) supply of online educational journals and periodicals.”

The AAR also observed that, “the transaction of the applicant is covered under the Heading 9984 Telecommunications, broadcasting and information supply services under the Group 99843 and Service Accounting Code of 998631, the description of which is “online text-based information such as online books, newspapers, periodicals„ directories and the like”. The articles are covered under the items “and the like” and hence the SAC applicable for the providing access to the portal is 998431. This service is liable to tax at 9% CGST under the entry no.22 of Notification No.11/2017- Central Tax (Rate) dated 28.06.2017”.

Subscribe Taxscan Premium to view the JudgmentThe division bench of the Bombay High Court has set aside National Anti-Profiteering Authority ruling against McDonald’s franchisee Hardcastle Restaurants Pvt. Ltd.

The Petitioner operated quickservice restaurants under the brand name McDonald’s in Western and Southern India. The Petitioner serves around 2320 types of food and beverages items from its restaurants. The Petitioner is registered under the Goods and Services Tax Act, 2017 in ten States. After the commencement of GST Act till 14 November 2017, the services rendered by the Petitioner were subjected to 18% of GST. A notification was issued on 14 November 2017 reducing the rate of GST to 5% with effect from 15 November 2017. As a result, the Petitioner had to charge GST at 5% on the services rendered without availing impugned tax credit of the taxes paid on input, input services and capital goods.

Some customers of the Petitioner made complaints that, though the rate of GST on restaurant services was reduced from 18% to 5% with effect from 15 November 2017, the Petitioner had increased the prices of product sold, which was an act of illegal profiteering. The Standing Committee on Anti Profiteering examined the complaints. The Standing Committee referred the complaints to the Director-General of Safeguards. The DirectorGeneral called upon the Petitioner to submit a reply to the allegations levelled in the complaints and also to suo-motu determine the quantum of benefit the Petitioner had not passed on to the consumers between 15 November 2017 to 31 January 2018. The persons who had filed the complaints/applications were given the opportunity to inspect the evidence and reply furnished by the Petitioner. The applicants did not attend nor participated any further. The Petitioner filed a reply on 5 January 2018 and denied the allegations.

The NAA a held that Section 171 of the Central GST Act was applicable since there was a reduction in the rate of tax from 5% to 18%. The contention of the Petitioner that there was no methodology was negatived holding that the Authority framed its methodology. It held that only because the CGST was charged at 5% did not mean there was no anti-profiteering since the output tax invoices after 15 November 2017 did not show that benefit has been passed on. Authority observed that the Petitioner increased base prices overnight on 14 November 2017. It held that the Petitioner could not avail the input tax credit after 15 November 2017, and therefore, the benefit in input tax credit from December 2017 to March 2018 could not have been given. Authority held that the Director-General had correctly considered the incremental revenue. The Authority carried out the computation and profiteering amount was derived at Rs.7.49 crores for all products where price increase was over 5.11%. The Authority directed the Petitioners to reduce the prices of its products and to deposit an amount of Rs.7.49 crores to the Consumer Welfare Fund along with 18% interest. The Director-General was directed to continue investigation until the Petitioners reduced the prices commensurate to the reduction in tax and to submit a report. Directions were also issued to initiate penalty proceedings.

The company’s main contention was that relevant NAA order was pronounced by four members of the authority while only three of them were there for the hearing of the case, and thus the company was not given an opportunity to present its case before the fourth signatory.

The division bench comprising of Justice M.S Sanklecha and Justice Nitin Jamdar observed that, when the three members of the Authority had heard the Petitioner and participated in the entire hearing, the collectively signed decision, when the fourth member joined only for signing the order has resulted in violation of the principles of natural justice and fairness, and is liable to be set aside.

The Court relied on the case M/s. Kwality Restaurant and Ice-Cream Co. v/s. The Commissioner of VAT, Trade and Tax Department and Ors and said that, the importance of public confidence in the decision making by the courts and the tribunals. The Court observed that any practice which even remotely suggests a sense of unfairness must be eschewed. It held that our legal system mandates that no one can suffer an adverse order after being subjected to an unfair procedure.

The Court observed that procedural safeguards against executive excesses or apathy apply with equally to the Tribunals responsible for dispensing justice within their sphere of activity. Invoking this broader principle also that the Delhi High Court issued the directions. Thus, fairness and transparency in adjudication will enhance the credibility of the Authority.

While allowing the petition the Court also said that, “The term profiteering, under the Act and Rules, is used in a pejorative sense. Such a finding can severely dent the business reputation. The Authority is newly established. Therefore, as guidance to this Authority, highlighting the importance of fair decision-making is necessary”.

Subscribe Taxscan Premium to view the JudgmentThe Authority of Advance Ruling ( AAR ) in Karnataka has ruled that, the ” Pooja Oil “, classified under tariff heading 1518, being inedible mixture gets covered under entry number 27 of Schedule – II of the Notification No.01/2017-CT (R) dated 28.06.2017, as amended, and hence is taxable at 6% under CGST Act, 6% under KGST Act and 12% under the IGST Act.

The Applicant is a Partnership firm and is a wholesale dealer in edible oils, ered under the Goods and Services Act, 2017. The applicant, as part of their manufactures “Pooja Oil”, which is primarily a mixture of rice bran S.K Agrotech sesame oil (gingelly oil), coconut oil and mahua oil. A small quantity of fragrance also is mixed only for giving fragrance.

The AAR was considered the question, Whether “Pooja oil” can be classified under tariff item 1518 of Schedule-1 (taxable at 5%.) or Schedule-II (taxable at 12) of Notification No.01/2017- CT(R) dated 28.06.2017, as amended from time to time?

The AAR observed that, “It is an admitted fact that the said product is manufactured by mixing 5 edible oils i.e. rice bran oil, coconut oil, castor oil, mahua oil and Gingely Oil, in an agreed percentage and then blended with fragrance. The process of addition of perfume to the mixture of edible oils converts the said mixture into an inedible mixture”.

The AAR also said that, “Comparison of the two aforementioned entries clearly brings out that an inedible mixture of vegetable oils are specifically mentioned by and covered under Sl. No. 27 in Schedule II. The entry at Si. No. 90 in Schedule I applies to vegetable oils which have been subject to processes like boiling, oxidation, dehydration, sulphurisation, blowing, polymerization and by heat in vacuum or in inert gas or otherwise chemical modification. The resultant product remains edible despite undergoing the aforementioned processes. However, once the fragrance has been added to the mixture of several edible oils, the resultant product becomes inedible and entry at Si. No. 27 of Schedule II specifically covers inedible mixtures of vegetable oils. Therefore the product “pooja oil’ finds a very specific entry in Schedule II. Thus it is more appropriately covered under Sl. No. 27 in Schedule II of the said Notification and accordingly taxable at 12% GST”.

Subscribe Taxscan Premium to view the JudgmentThe Ministry of Corporate Affairs ( MCA ) has allowed filing of DIR-12 by ‘ACTIVE non-compliant’ company in some cases.

The MCA has notified the Companies (Incorporation) Eighth Amendment Rules, 2019 wherein Rule 25 A has been amended. Now, the ACTIVE non-compliant’ company can file e-form DIR-12 in case of appointment as well.

The eForm DIR-12 is required to be filed pursuant to Sections 7(1) (c), 168 & 170 (2) of the Companies Act, 2013 and Rule 17 Of Companies (Incorporation) Rules, Rule 8, 15 & 18 of Companies (Appointment and Qualification of Directors) Rules, 2014.

According to Rule 18, A return containing the particulars of appointment of a director or key managerial personnel and changes therein shall be filed with the Registrar in Form DIR–12 along with such fee as may be provided in the Companies (Registration Offices and Fees) Rules, 2014 within thirty days of such appointment or change.

The amendment has substituted the following provision in the rules:

“(iii) DIR-12 (changes in Director except in case of:

(a) cessation of any director or

(b) appointment of directors in such company where the total number of directors is less than the minimum number provided in clause (a) of sub- ‘ section (1) of section 149 on account of disqualification of all or any of the director under section 164.

(c) appointment of any director in such company where DINs of all or any its director(s) have been deactivated.

(d) appointment of director(s) for implementation of the order passed by the Court or Tribunal or Appellate Tribunal under the provisions of this Act or under the Insolvency and Bankruptcy Coder, 201.6).”.

The amendment also inserted some changes regarding Shifting of registered office within the same State, i.e.,

In rule 28, after sub-rule (1), the following rules shall be inserted, namely.-

“(2) The Regional Director shall examine the application referred to in sub-rule (l) and the application may be put up for orders without hearing and the order either approving or rejecting the application shall be passed within fifteen days of the receipt of application complete in all respects.

(3) The certified copy of the order of the Regional Director, approving the alternation of memorandum for transfer of registered office company within the same State, shall be filed in Form No.INC-28 along with fee with the Registrar of State within thirty days from the date of receipt of the certified copy of the order.”.

Subscribe Taxscan Premium to view the JudgmentThe State Bank of India (SBI) has invited applications from Chartered Accountants (CA) for various specialists posts.

The SBI has invited online application from Indian citizen for appointment in the following Specialist Cadre Officer posts on regular/ contract basis. Candidates are requested to apply on-line.

For Further Information Click here.

CGST Delhi-West has yesterday busted a racket of 9 export firms at Punjabi Bagh, Delhi, claiming a refund of Rs. 89 Crores on the basis of fake invoices worth Rs. 701 Crores, on which tax was never been paid to the Government.

They have availed fraudulent Input Tax Credit for seeking IGST Refunds from Custom formations. Investigations have revealed a novel modus operandi, wherein inferior/cheap goods were being exported by these firms to various countries such as Dubai, Nigeria, Germany etc., while her major suppliers, were non-existent and had taken GST registration on the basis of forged documents without paying any GST.

Inferior and cheap goods were manufactured by the accused at their factory at Kirti Nagar Industrial area of Delhi and overvalued but good-less invoices were taken from fictitious suppliers. Search operations were carried out on various firms such as M/s SSAP Overseas, M/s Raheja International, M/s Omnia Inc., M/s Raj International etc. across the jurisdiction of Central Tax GST Delhi West.

Their suppliers had taken the registrations of GST by using forged documents such as forged electricity bills, forged rent agreements, forged bank passbooks and scanned forged cheques having signatures of the different person on the same cheque made possible by misusing scanning technology etc.

In most of the cases even the addresses on which these are registered, do not exist at all. Jurisdictional Customs authorities have been requested to withhold pending scrolls of refund of almost 15 Crores. The accused has admitted fraud and undertook to pay all his dues. Overall, fraudulent ITC of Rs. 89 Crores seem to have been passed on from such fake invoices worth Rs.701 Crore. Revenue has been safeguarded to the tune of Rs.20.11 Crore. Investigations are underway. (Ranjan Khanna) Commissioner, CGST Delhi West

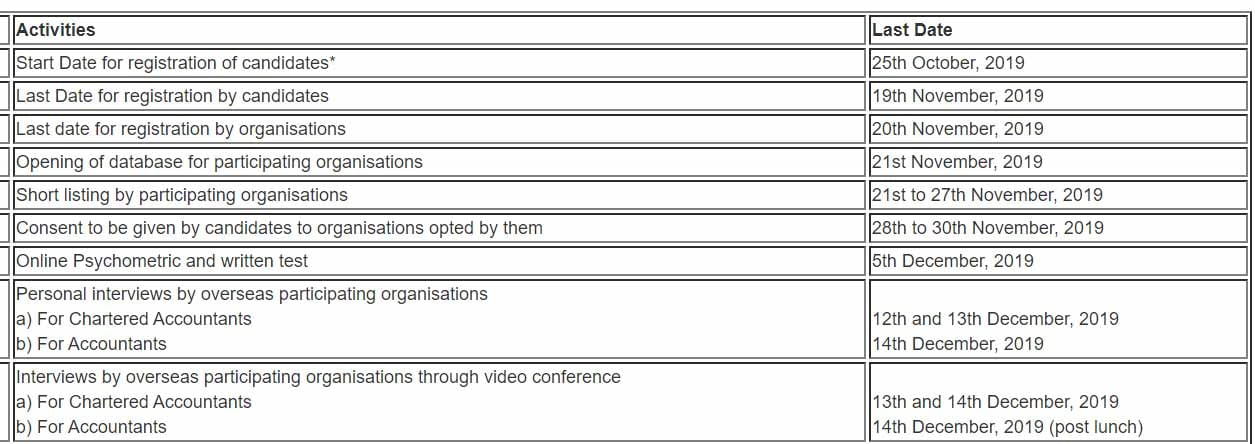

The Institute of Chartered Accountants of India ( ICAI ) has released a revised schedule of overseas campus placement for Chartered Accountants and Accountants.

In continuation to our earlier announcement dated 7th October, 2019, members and students are hereby informed that Overseas Campus Placement drive has been rescheduled to be held from 12th – 14th December, 2019.

The revised schedule of activities are as under:-

Please note that candidates who had already registered for October, 2019 drive need not register again. Please check your registration at:-

In case of any query, write to overseasjobs@icai.in.

The Central Board of Indirect Taxes and Customs ( CBIC ) has extended the filing returns by the composition dealers in Form CMP-08 to October 22nd, 2019.

The Notification said that, “Provided further that the due date for furnishing the statement containing the details of payment of self-assessed tax in said FORM GST CMP-08, for the quarter July, 2019 to September, 2019, or part thereof, shall be the 22nd day of October, 2019.”

The composition taxpayers shall furnish a statement, every quarter or, as the case may be, part thereof containing the details of payment of self-assessed tax in FORM GST CMP-08 of the Central Goods and Services Tax Rules, 2017, till the 18th day of the month succeeding such quarter.

Under the GST regime rolled out from 1st July 2017, the composition scheme is an alternative method of tax levy under GST designed to simplify compliance and reduce compliance costs for small taxpayers. The main feature of this scheme is that the business or person who has opted to pay tax under this scheme can pay tax at a flat percentage of turnover every quarter, instead of paying tax at a normal rate every month.

The Authority of Advance Ruling, Karnataka has ruled that, the printed textbooks, classifiable under HSN Code 4901, supplied to resellers are cover under Entry No. 119 of Notification No. 02/2017 – Central Tax (Rate) dated 28.06.2017 and are exempted from the payment of CGST and SGST.

The first question related to the supply of printed textbooks for the PUC Board. In this context, the applicant states that the Karnataka State Pre-University Board floated a tender for the printing of textbooks and the applicant participated in the tender and became the successful bidder. The PUC Board supplies the content on a DVD/CD which is copyright protected for which royalty is paid by the applicant. The materials, namely, the paper, board, manpower, Inks, Chemicals and machinery all belong to the applicant. The printing is carried out strictly adhering to the standards, quality, design, syllabus and content stipulated in the tender. The printing is done on a job work basis and once the printing is done, the textbooks are supplied to various authorized resellers of the textbooks across the State. The applicant contends that the activity performed by him is printing and supply of printed books to various resellers in the State. The activity of printing and supply of the textbooks is covered under Notification 2/2017- Central Tax (Rate) under entry No.119 reads as “Printed Books, including Braille Books.” and is exempt from the payment of CGST.

The second question relates to printing and binding of brochures, books, calendars, pamphlets, on job work basis. The applicant states that he undertakes printing of various items on the basis of content supplied by Government Authorities and other paper is also supplied by the recipient. The ink, plates, machines, manpower all belong to the applicant.

The Authority observed that, applicant participated in the tender called by the PUC board for printing and supply of textbooks and applicant obtained the job of printing and supply of textbooks. The PUC Board supplies the content of the textbook on a DID/CD. The content is copyright protected for which royalty is paid by the applicant whereas other materials, namely, the paper, board, manpower, Inks, chemicals and machinery used in the printing belongs to the applicant. The applicant printed the PUC textbooks and supplied to the various resellers in the state. This activity of printing and supply of the textbooks to the resellers by the applicant is covered under Notification 2/2017-Central Tax (Rate) dated 28/06/2017 under entry No.119 reads as “Printed Books, including Braille Books.” This is exempt from the payment of CGST and SGST.

The AAR also observed that, “The printing and binding of brochures, printed books and pamphlets, on a job work basis attracts 2.5% COST and 2.5% SGST under clause (ii) of entry no.26 of Notification No.11/2017 – Central Tax (Rate) dated 28.06.2017 as amended by Notification No. 20/2017 – Central Tax (Rate) dated 22.08.2017 whereas printing and binding of calendars attracts 6% CGST and 6% SGST under clause (iia) of Entry No. 26 of Notification No.11/2017 – Central Tax (Rate) dated 28.06.2017 as amended by Notification No. 31/2017 – Central Tax (Rate) dated 13.10.2017”.

“The binding of Diary, Catalogues and Books carried out on job work basis attracts CGST @ 9% and SGST @ 9% under clause (iii) of Entry no. 26 of Notification No.11/2017 – Central Tax (Rate) dated 28.06.2017 as amended by Notification No.31/2017 – Central Tax (Rate) dated 13.10.2017”.

“The printing of textbooks and workbooks and supplied back to State Government across the state attracts CGST @ 6% and SGST @ 6% under clause (i) of entry no.27 of Notification No.11/2017 – Central Tax (Rate) dated 28.06.2017 as amended by Notification No.31/2017 -Central Tax (Rate) dated 13.10.2017”.

“The printing and supply of periodicals and magazines to the Government Departments attracts CGST @ 6% and SGST @ 6% under clause (i) of entry no.27 of Notification No.11/2017 – Central Tax (Rate) dated 28.06.2017 as amended by Notification No.31/2017 -Central Tax (Rate) dated 13.10.2017”, the AAR also added.

Subscribe Taxscan Premium to view the JudgmentThe Society for Tax Analysis and Research (STAR) has submitted some of the foreseen issues in the newly introduced Rule 36(4) of Central Goods and Services Tax Rules 2017.

The Society for Tax Analysis and Research has submitted following the suggestions before Finance Minister Nirmala Sitharaman:

Impact on small suppliers filing GSTR 1 on a quarterly basis

1.1. It is humbly provided in the sub-rule that the input tax credit in respect of invoices or debit notes. the details of which have not been uploaded by the suppliers under sub-section (1) of section 37 shall not exceed 20 per cent, of the eligible credit. The issue is not addressed here. what will happen in a situation where the supplier is a small entity (Having turnover up to Rs. 1.5 Crores) and covered under the special class of persons who are required to file their outward supply return on a quarterly basis

1.2. In this situation the Input tax credit will get reflected in GSTR 2A of the recipient only after the end of quarter and hence the recipient may be deprived of the eligible credits (to the extent of 80% of the eligible credit as not so reflected) also just because the supplier is a small taxpayer required to file returns quarterly under the scheme of law

1.3 This may also lead to a situation where the recipient shall stop purchasing from such small taxpayer and hence this will cause a big loss to such small suppliers. This we believe is not at all the intention of the lawmakers but can emerge as a consequence.

The ‘STAR’ suggested that suitable amendment be made in the form GSTR-35 to provide a separate table/column for filling figures of Input Tax Credit related to purchases from small taxpayers. Further, to make it effective, the suitable amendment to this extent be made in the Rule to allow full credit during the quarter in respect of small taxpayers.

Regarding Input Tax Credit differences arising out of month-end movement of goods or services, the ‘STAR’ also suggested that, suitable amendment be made in the form GSTR-3B to provide a separate table/column for filling figures of Input Tax Credit of purchases whose amounts are reflected in GSTR 2A but are not claimed and are carried forward and such balances be added to GSTR 2A balance for all comparison purposes in subsequent periods. Also, the suitable amendment is made in the Rule to allow this limit of 20% to be considered at the quarter as a whole so that matching can be done at least at quarter rests which would decrease such kinds of movement differences.

The ’STAR’ also put forward concerns over Input Tax Credit reclaimed as reversed under Section 16 (2), Absence of Mechanism of verification of ineligible credits and Absence of matching tool shall put constrains on taxpayers resources.

Subscribe Taxscan Premium to view the JudgmentOn 16.10.2019, the Income Tax Department conducted search action under the Income-tax Act, 1961 in the case of a conglomerate of trusts and companies that run year-round “wellness courses” and training programmes in philosophy, spirituality, etc at various sprawling residential campuses in Varadaiahpalem in Andhra Pradesh (AP), and also in Chennai and Bengaluru.

The group which was founded by a spiritual guru in the 1980s with “oneness” philosophy has also diversified into several sectors including real estate, construction, sports, etc in India and abroad. The group is presently managed and controlled by the spiritual leader who laid the foundation of the group, and his son. The courses attract residential customers from abroad and the group earns substantial receipts in foreign exchange. There was intelligence that the group has been suppressing its receipts which are ploughed into investment in huge tracts of landed property in AP and Tamil Nadu (TN) and also in investments abroad. The search action which is still in progress has covered about 40 premises located in Chennai, Hyderabad, Bengaluru and Varadaiahpalem.

During the search proceedings, evidence has been found that the group has been regularly suppressing its receipts at its various centres or ashrams. Evidence has been found with key employees who maintained the record of cash collections that were kept outside the accounts for use in making investments elsewhere and also for paying for properties over and above documented values. It is learnt that the group also earned unaccounted income in receiving cash from property sales over and above documented values. A preliminary estimate of such unaccounted cash receipts is Rs 409 crore from FY 2014-15 onwards. Such unaccounted cash receipts are also evidenced by huge quantities of cash and other valuables found at the residences of the founder and his son, and at one of the campuses. A total sum of cash of Rs 43.9 crore has been found and seized by the Department at these premises.

Apart from the above, substantial sums of foreign currencies have also been found and seized. The total of such foreign exchange found at these premises is about $2.5 million which amounts to approximately Rs 18 crore. Foreign exchange in other currencies has also been found and seized. Substantial quantities of undisclosed gold in the form of jewellery, about 88 kg approximately valued at over Rs 26 crore, has also been found and seized. Undisclosed diamonds amounting to 1,271 carats valued approximately at about Rs 5 crore were also found and seized. The total value of seizure so far is approximately Rs 93 crore. The undisclosed income of the group detected so far is estimated at more than Rs 500 crore. The search proceedings are still in progress.

An important finding of the search is that the group has been investing in a number of companies in India and abroad, including in tax havens. Some of these companies based in China, USA, Singapore, UAE, etc are found to be receiving payments from foreign clients who attend the various residential “wellness” courses offered in India.

The Department is investigating the diversion of income taxable in India to offshore entities by the group in this process. Further, it is found that one of the group trusts may be providing accommodation entries for other parties by receiving donations from them and then returning the money back under the garb of expenses and receiving a small percentage as a fee. Instances have also been found where the group is not accounting for money received from foreign clients in cash in foreign currency and then exchanging the same in the grey market. All these leads are being pursued and the investigation is in progress.

The Directorate General of Taxpayer Services, NACIN Bengaluru is organising the open house for Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019.

The open house will be on 23rd (Wednesday) & 24th (Thursday) October 2019 on the Sabka Vishwas (Legacy Dispute Resolution) Scheme 2019 at the office of the Principal Commissioner, GST West Commissionerate, BMTC Building Banashankari, Bengaluru.

The program will be inaugurated by Principal Chief Commissioner at 10.30 AM on 23rd followed by a workshop for taxpayers & lunch for all the participants. The open house will be on both days where clarifications are given and to those who like to file the declaration, assistance would be extended on the spot.

Subscribe Taxscan Premium to view the JudgmentThe Maharashtra Authority of Advance Ruling ( AAR ) has ruled that, receipt of prize money from horse race conducting entities, in the event horse owned by the applicant wins the race, would amount to ‘supply under section 7 of the Central Goods and Service Tax Act, 2017.

The horses owned by the applicant Shri Vijay B. Shirke participate in races organized at different clubs. The horse races take place at Royal Western India Turf Club (RWITC) located in Mumbai and Pune. The applicant also participates in horse races held in Mysore Club, Bangalore Turf Club, Hyderabad Race Club, Royal Calcutta Turf Club and Madras Race Club. Upon winning such horse races, the applicant is awarded prize money in respect of horses, which win the race.

The Authority was dealing the Question, Whether receipt of prize money from horse race conducting entities, in the event horse owned by the applicant wins the race, would amount to ‘supply under section 7 of the Central Goods and Service Tax Act, 2017 or not and consequently, liable to GST or not?

The AAR observed that, “under Chapter III of the CGST Act 2017 provides for levy and collection of tax. Section 9 is the charging section. This charging section provides for levy of taxes on all intra-state supplies of services at such rates, as notified by the Government and collected in such manner as may be prescribed in the notification schedules. Under the GST Act, the Exemption Notification No. 12/2017 CT (Rate) dt. 28.6.2017 is issued by the government, by which a specific supply of services is exempted from taxes. The services A t than those notified services would naturally be covered under “Taxable supply of es”. The taxable supply of services are notified and classified under Notification No. 17 CT (Rate) dt.28.6.2017 and rate of taxes are prescribed therein. We find that the applicant’s services are not covered under exemption notification No.12/2017 of CGST ACT and therefore, this transaction is not covered under the exemption category of services. Hence, we have perused the Notification No.11/2017, which covers the taxable supply of services and rate of tax thereon. We find that the applicant’s activity and services rendered are not specifically described in the said notification 11/2017 and hence, it is covered by the entry at Sr. no. 35 i.e. “Other services and other miscellaneous services including services nowhere else classified” and are held taxable services @ 18 % (9% each of CGST and SGST). According to us, as discussed above, applicant’s transaction is a supply of services, under entry at Sr. no. 35 of notification no. 11/2017 i.e. “taxable services” and liable to tax @ 18% under GST Act”.

Subscribe Taxscan Premium to view the JudgmentThe Institute of Chartered Accountants of India ( ICAI ) has announced Change of Venue in respect of some of the Candidates of Foundation and Final Examinations at New Delhi, in respect of November 2019 Exams.

In a Press Release issued by ICAI said that, “It is hereby informed that due to unavoidable circumstances, the venue of Foundation and Final Examinations scheduled to be held from 1st November 2019 to 18th November 2019 in respect of some of the candidates at New Delhi is being shifted”.

Details are as follows: | ||||||

| ||||||

Accordingly, candidates of CA Foundation and Final Examination – November 2019, who are scheduled to appear in the said examination/s from 1st November 2019 to 18th November 2019 at the above mentioned examination centre in New Delhi are requested to take note of the above mentioned change in venue and appear in their examination/s, at the new venue only as mentioned above.

Such candidates may note that admit cards already issued for November 2019 examination will remain valid for the new venue also. All other details remain unchanged.

The Ministry of Corporate Affairs ( MCA ) has started the process of deactivating the non-compliant DINs.

The last date for filing DIR-3 KYC for the Financial year 2018-19 has expired on 14th October 2019. The process of deactivating the non-compliant DINs is in progress and will be completed shortly.

The form DIR-3 KYC and web service DIR-3 KYC will not be available for filing during the pendency of this activity. Filing of DIR-3 KYC and DIR-3 KYC WEB can be made after completion of the scheduled activity, as above when the form & service are re-deployed on the portal after payment of applicable fees.

The MCA said in a press release said that, “The DINs which have not complied with the requirement of filing DIR-3 KYC has since been marked as ‘Deactivated due to non-filing of DIR-3 KYC’. Such DINs are not allowed to be used for filing any eforms on MCA21 portal. In case the present status of your DIN is ‘Deactivated due to non-filing of DIR-3 KYC’, you are required to file ‘KYC’ using eform DIR-3 KYC or DIR-3-KYC-WEB service as applicable with prescribed fee of INR 5000 to re-activate your de-activated DIN”.

The Officers of the Directorate General of GST Intelligence IDGGII. Visakhapatnam on 16.10.2019 arrest. the 45-year-old Managing Director of a company engaged in infrastructure projects and government contracts. The company received and issued fake invoices without the actual supply of services to the tune of around 2 450 crores. This is one of the biggest GST frauds detected in recent times by DGGI, Visakhapatnam.

In coordinated searches conducted in various parts of Andhra Pradesh. Telangana and Tamil Nadu, incriminating documents were recovered. Upon interrogation, the accused confessed to having received and also raising fake invoices without actual supply or receipt of services. Besides artificially boosting the turnover of the company, input tax credit OTC, so availed on the basis of fake invoices was also passed on for further utilization by other major infrastructure companies. This same modus operandi was followed using multiple GST registrations of the company.

Preliminary quantification revealed that from September 2018 to August 2019, almost 2 450 crores worth of fake invoices were generated involving ineligible ITC worth Rs. 67crores (approximately. The accused has been an arrest. on 16.10.2019 under the provisions of GST laws and remanded to judicial custody till 30.10.2019. Since the inception of the GST regime, the Visakhapatnam Zonal Unit of DGGI has made similar detection of fake invoices of around 2 50 crores out of which about 2 40 crores have been realized.

Further investigation is in progress.