The Central Board of Indirect Taxes and Customs ( CBIC ) has notified Annual Return GSTR-9 made optional for certain registered persons for Financial Years 2017-18 and 2018 – 2019.

The registered persons whose aggregate turnover in a financial year does not exceed Rs. 2 crores shall have the option to furnish the annual return in Form GSTR-9 for the Financial Years 2017-18 and F.Y. 2018-19 on or before the due date prescribed.

It is an annual return to be filed yearly by taxpayers registered under GST. It consists of details regarding the outward and inward supplies made/received during the relevant previous year under different tax heads i.e. CGST, SGST & IGST and HSN codes. Basically, it is a consolidation of all the monthly/quarterly returns (GSTR-1, GSTR-2A, GSTR-3B) filed in that year. Though complex, this return helps in extensive reconciliation of data for 100% transparent disclosures.

Subscribe Taxscan Premium to view the JudgmentThe Bombay High Court has ruled that, Goods and Services Tax (GST) is not applicable on the Duty-Free Shop (DFS) at Mumbai International Airport for goods sold to outgoing passengers.

The Petitioners has sought a declaration that the consideration being paid by it to Mumbai International Airport Ltd (MIAL) under a concession agreement dated 17th February 2014 towards the minimum guaranteed fees/ concession fees for grant of rights and use of licensed premises of duty free shops in the departure or arrival area of international airport, is not liable to GST and hence the MIAL is not entitled to collect GST from the Petitioner.

The Petitioner in DFSs sells goods to international passengers, who are either leaving India (departing passengers) or arriving into India (arriving passengers). The goods – generally chocolates, perfumes, cosmetics, cigarettes, alcohol etc. are primarily imported or occasionally procured from SEZ units in India (hereinafter collectively referred to as ‘the warehoused goods’). However, the bulk of the sales (almost 98%) are of the imported/warehoused goods, before they cross customs frontiers or barriers. Further goods procured from the domestic market were never sold to the arriving passengers.

The DFSs also receive various input services such as leave and licence arrangements of areas/space, maintenance services, CHA services, professional services, etc., from different service providers located inside or outside the DFS area.

The petitioner submitted that, the provisions of CGST Act, MGST Act and IGST Act do not provide that supply in the area beyond custom frontiers are not liable for GST or are ‘export’. The relevance of custom frontier is different in GST law. Section 7(2) provides that such supply shall be inter-state supply liable to IGST.

The Petitioner also contended that nomenclature Duty-Free Shop does not entitle the Petitioner to be free from the entire indirect tax burden under every law. The input tax credit is restricted to the tax borne by the Petitioner only on the value of goods supplied, and other GST paid on services can not be allowed to be given as input tax credit qualifying for a refund. The import of goods for sale at DFS may not attract customs duty since the same is not at all cleared for home consumption, but that does not mean that the same is not liable to GST.

While allowing the petition, the division bench comprising of Justice Bharati H. Dangre and Justice Ranjit More observed that, “We find sufficient merit in the submissions of the petitioner that import of goods in terms of section 2(10) of the IGST Act means bringing the goods into India from a place outside India. As per Section 7(2) of the IGST Act, goods imported into the territory of India, till such time it crosses the customs frontier of India, shall be treated to be a supply of goods in the course of inter-State trade and commerce. As per Section 2(4) of the IGST Act, the customs frontier of India means the limits of a customs area as defined in section 2 of the Customs Act. The duty-free warehouse and DFS of the petitioner are only within the limits of the customs area and therefore, the goods lying therein do not cross the customs frontier and consequently, the importation will continue to be only in the state of inter-State trade and commerce in terms of Section 7(2)”.

The Court also said that, “petitioner only files the bill of entry for warehousing. No liability under section 12 read with section 3(12) of the Customs Tariff Act would get triggered at all by filing the bill of entry for warehousing. The customs duty and IGST is leviable only on removal of warehoused goods from the customs area, which happens when the arriving passengers leave the customs area. Since the goods sold by DFS to arriving passengers do not leave the customs area, DFS is neither liable to pay customs duty nor IGST”.

“After the introduction of GST, the sales to arriving passengers continue to be sales in and/or from the customs area, as at the point of sale in DFS, the goods have neither crossed the customs frontier nor have they been cleared for home consumption by DFS. Accordingly, neither customs duty, nor Integrated Tax, is payable by DFS”, the Court also added.

Quashing the show cause notices the Court also said that, “Arriving passenger’s baggage is exempt from the integrated tax in view of the Customs Notification No. 43/2017-Cus dated 30th June 2017 and IGST Notification No. 2/2017 IGST (rate) dated 28th June 2017. In view of the above exemption read with the duty-free allowance available under the Baggage Rules applicable to arriving passengers, neither customs duty (up to the permitted baggage allowance) nor IGST is levied on such goods. Such import of goods by arriving passengers across the custom frontier as passenger baggage is, therefore, an exempt supply under the GST, hence no IGST is payable by either the DFS on its imports, or on supply to arriving passengers. The arriving passengers are also not required to pay any IGST on crossing the customs frontiers, in view of the above exemption read with the duty-free allowance under the Baggage Rules”.

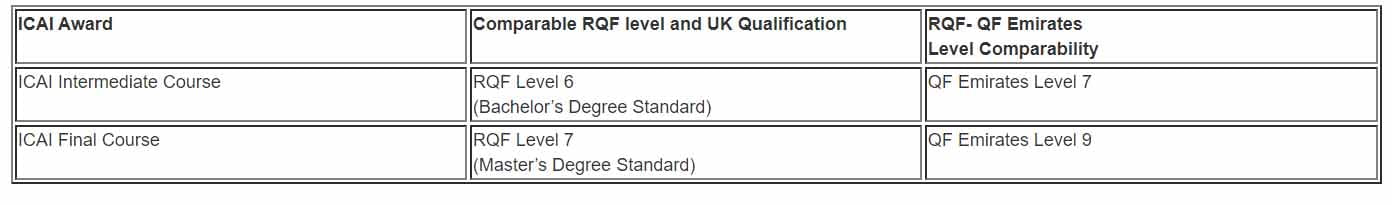

Subscribe Taxscan Premium to view the JudgmentThe Institute of Chartered Accountants of India ( ICAI ) has always strived for academic and professional excellence for its key stakeholders i.e. Students and Members. With the aim of expanding the opportunities for Professionals in foreign jurisdictions, the Institute had engaged UK NARIC (The National Recognition Information Centre for the United Kingdom) a renowned UK national agency responsible for providing information and expert opinion on qualifications and skills worldwide, to conduct an independent benchmarking study, evaluating the comparability of the ICAI Intermediate and Final level in the context of the UK and UAE education systems.

Pursuant to the same, UK NARIC has announced that ICAI qualification is comparable to:

Speaking on the UK NARIC benchmarking, CA. Prafulla P. Chhajed, President ICAI, remarked “ The benchmarking of the CA qualification comparable to RQF Level 7, Master’s degree standard not only would strengthen the position of ICAI members, but would also help aspiring Chartered Accountants and even corporates gain a better understanding of the relevance and standing of the CA qualification. It would also provide opportunities for higher studies and enhanced professional opportunities for ICAI members/ semi-qualified professionals in the UK, Middle East & other foreign jurisdictions accepting NARIC evaluation.”

He further added that “ICAI members abroad are facing difficulty in settling abroad. This evaluation would help them in deciding the stage of a professional qualification for ICAI members because now they know that they not only possess a professional qualification of relevance, but it is also a qualification that is comparable to RQF Level 7, Master’s degree standard.”

CA. Atul Kumar Gupta, Vice-President, ICAI remarked that “As India is increasingly focusing on facilitating the export of accountancy services, the promotion of global mobility of accountancy services in the digital world is one of the important Champion Sector initiatives of the Government of India. This evaluation would increase the professional avenues for our members by facilitating recognition of Indian accountancy qualification.”

The Institute of Chartered Accountants of India ( ICAI ) through its Committee on Public Finance and Accounting Standards for Local Bodies is organizing two days National Summit on “Transparency and Accountability in Government Financial Management” on 11th-12th October 2019.

The Program will be held on The Leela Ambience Convention Hotel, New Delhi

The Hon’ble Governor of Himachal Pradesh Shri Bandaru Dattareya will the Chief Guest of the Event. Ms. Sadhvi Niranjan Jyoti, Hon’ble Minister of State for Rural Development, Government of India will be the Guest of Honour.

Also present would be CA. Atul Kumar Gupta, Vice-President, ICAI; CA Dhiraj Kumar Khandelwal, Chairman & CA Sanjeev Kumar Singhal, Vice-Chairman, CPF & ASLB, ICAI.

The Tamil Nadu Authority for Advance Rulings in an application filed by HP India Sales Pvt Ltd held Desktop Computer known as Central processing unit along with its connected peripheral units is a single supply leviable to 9% GST.

The applicant is a subsidiary of HP Inc headquartered in California, USA and is engaged in the import and sale of IT products primarily personal computers (i.e., desktops and laptops) and printers

The issue for consideration before the present Authority is the determination of the applicable rate on supply of desktops consisting of CPU, monitor, keyboard and mouse or any combination of input/output unit. It involves the determination of whether the CPU along with the Monitor or other input/output units supplied by the applicant is a ‘single supply’.

The applicant submitted that Desktops are personal computers designed for regular use and generally houses a CPU along with other input and output units and are classified under 8471 of the Customs Tariff Act, 1962. Under GST these goods are liable to be taxed under 9% under Sl no 360 of Schedule III to Notification 1/2017-Central tax (rate) dated 28.06.2017

The Bench constituting of Hon’ble members Ms Manasa Gangotri Kata and Thiru Kurinji Selvaan V.S. held that Desktop Computer in common parlance and technical sense known as a system unit which is otherwise known as a Central processing unit along with its connected peripheral units give essential character to the product and hence is a single supply leviable to 9% GST.

On a perusal of relevant Section notes, it is evident that CTH 8471 covers ‘Automatic Data Processing Machines’ consisting of at least CPU, keyboard and Visual Display, the same housing or otherwise.

“As per Note 5A to Chapter 84, desktops supplied by the applicant are automatic data processing machines. The Desktops can consist of the variable number of units such as the keyboard, mouse monitor etc’ as per Chapter Note 58. Keyboards, mouse and monitors all qualify to be called as a unit of the automatic data processing machine as they satisfy the conditions of Chapter Note 5(C) in that they are of a kind solely or principally used in an automatic data processing system, they are connectable to the central processing unit either directly or through one or more other units; and are able to accept or deliver data in a form (codes or signals) which can be used by the system. As per Chapter Notes 5(c) keyboards and mouse if presented separately are to be classified under 8477. However, as per the Chapter Note 5(D) mentioned above, monitors, when supplied separately, do not fall under CTH 847L In the event the applicant supplies monitors separately under a different purchase order or invoice or a different line item in an invoice, they cannot be classified under 84ZL In that case they would have to be classified under 8528 depending on the type of monitor.”

“In the instant case in the tax invoice submitted by the applicant, the product description is given as Desktop Computer which in common parlance and technical sense known as a system unit which is otherwise known as a central processing unit along with its connected peripheral units of input & output devices. In this case, the processing unit gives the essential character to the product in question. Hence, the desktop consisting of CPU, monitor, Keyboard and mouse supplied by the applicant is a single supply classified under CTH 847I.”

Subscribe Taxscan Premium to view the JudgmentThe Kerala Authority for Advance Ruling in an application filed by M/s Spacelance office Solutions Pvt ltd held that separate GST registration can be allowed to multiple companies functioning in a “co-working space” and which provide services alone. However, such companies shall upload the rental agreement with the landlord or lessee. If there is any sub-lease, then the rental agreement between lessee and sublessee should also be uploaded as proof of address of the principal place of business of respective suit or desk number assigned to them.

The applicant is engaged in the business of subleasing of office spaces as “co-working spaces” to their clients. In such a model, the petitioner offers dedicated distinct and identifiable space, tables and chairs to each clients working there. Each client company is working as a separate and identifiable office within the main office. They are maintaining their electronic financial records which are accessible all the time.

The issue before the Authority is the determination of the issue that whether GST registrations can be allowed for multiple companies (service rendering start-ups where no stock has to be maintained) from the same address, provided they follow all GST rules related to “Principal place of business”

The Bench constituting of Hon’ble Members Shri S. Anil Kumar and B.S. Thyagarajababu held that “separate GST registration can be allowed to multiple companies functioning in a “co-working space” and which provide services alone. Such companies shall upload the rental agreement with the landlord or lessee. If there is any sub-lease, then the rental agreement between lessee and sublessee should also be uploaded as proof of address of the principal place of business of respective suit or desk number assigned to them. In addition to this, the applicants can upload a copy of “monthly utility bill” in connection with payment towards electricity charges, water charges or other common services availed by the prospective suit or desk number.”

Subscribe Taxscan Premium to view the JudgmentThe Kerala Authority for Advance Ruling in an application filed by M/s Abad Fisheries Pvt Ltd held that supply of frozen seafood in packages without a brand name to institutional customers who enter into an agreement with the supplier considering the quality offered by the brand, shall not be covered under the exemption notification.

The applicant is engaged in the processing and sale of frozen seafood in India as well as export out of India. The company sells its products through retail outlets and institutional customers. The company is a registered brand name holder and sells frozen seafood in packed unit containers under the brand name of “Seasparkle/ Brillar/ Wildfish/ ABAD” to retail customers. In addition to this, they sell the seafood in packages/ unit containers in frozen form without a brand name to institutional customers.

An advance ruling is sought on the issue that whether the frozen seafood sold in packages to institutional customers, without bearing the brand name, is eligible for exemption under Notification No. 2/2017.

The Applicant submits that the sale of frozen seafood in unit containers to institutional customers are covered by the notification exempting supply of fresh or chilled fish and are not concerned with the branding of the product, has no relevance, since the ultimate consumers are hotels, restaurants and catering houses.

The Bench constituting of Shri S. Anil Kumar and Shri. B.S. Thyagarajababu held that supply of frozen seafood in packages without a brand name to institutional customers who enter into an agreement with the supplier considering the quality offered by the brand, shall not be covered under the exemption notification. In a sale by the applicant to institutional customers were discussed to be under a different setting wherein, institutional customers enter into an agreement with the supplier for the supply of frozen seafood solely for the reason that such company brand acquires distinctiveness and can supply quality products. In such a situation, the argument of the applicant of the absence of inscription of the brand on the packet fails.

Further, it has been held that the exemption under the relevant notification is only available for supply of fresh or chilled fish and not frozen fish. Frozen fish sold in the unit container under the brand name is taxable. The Authority pointed out to the difference between chilling and freezing to be that of temperature. The Hon’ble Authority explained that ice crystals are formed while freezing and it is not so in the case of chilling. While freezing constitutes long term preservation of food products, chilling is just for short term preservation and others.

Subscribe Taxscan Premium to view the JudgmentThe West Bengal Appellate Authority of Advance Ruling in an appeal filed by the Assistant Commissioner of State Tax against the order in an application filed by M/s Bengal Peerless Housing Development Co Ltd (BPHDCL) held that that no abatement has been prescribed for construction service under Sl No. 3(i) read with para 2 of Notification Number 11/2017 – Central Tax (Rate) dated 28.06.2017 is applicable on the value of PLS realized separately from the buyers.

BPHDCL, a joint venture of the West Bengal Housing Board and the Peerless General Finance and Investment Company Ltd for developing real estate projects in West Bengal is engaged in the development of a residential housing project named ‘Avidipta II’ and supplying construction service to the recipients for possession of dwelling units in the year 2023. In addition to the construction service, BPHDCL provides services like preferential location services (PLS), which includes services of floor rise and directional advantage.

The issue before the present authority is the determination of whether the supply of these services of PLS including floor rise, directional advantage constitutes a composite supply with construction service as the principal supply and whether abatement prescribed for construction service is applicable on the entire value of such composite supply.

The Appellant submitted that the PLS charges cannot be traced directly to the value of any goods or value of land but are a result of the development of complex as a whole and the position of a particular unit in context with that of the complex.

The WBAAR in its order accepted the claim of the builder that they are providing a composite supply, construction service being the main supply and the other ones are incidental or ancillary to the construction service further stating the supply to be naturally bundled.

The Bench constituting of Hon’ble Members Mr. APS Suri and Ms. Smaraki Mahapatra held that no abatement has been prescribed for construction service under Sl No. 3(i) read with para 2 of Notification Number 11/2017 – Central Tax (Rate) dated 28.06.2017 is applicable on the value of PLS realized separately from the buyers.

Subscribe Taxscan Premium to view the JudgmentThe Directorate General of GST Intelligence (DGGI), Gurugram Zonal Unit (GZU), Haryana has arrested two persons namely Sh. Gulshan Dhingra resident of Ramesh Nagar, New Delhi and Sh. Sanjay Dhingra resident of Punjabi Bagh, New Delhi who were found involved in fake invoices racket having a taxable value of Rs. 931 crore and fraudulently passing/ availing Input Tax Credit (ITC) amounting to Rs. 127 crore through a complex web chain of various entities.

Many of these entities were under their control and they also formed separate entities in the name of their employees/ dummy persons and generated fake invoices without actual movement of goods, namely ferrous/ non-ferrous scrap, ingots, nickel cathode etc., thereby causing loss to exchequer by evasion of GST.

They availed this fraudulent ITC to offset their GST liability and also passed on such fraudulent ITC to further buyers who availed the same to discharge their GST liability against their outward supplies with an ulterior motive to defraud the Government exchequer. During the course of the investigation, their employees/ dummy persons admitted of having no knowledge of the movement of above-mentioned goods.

Thus, Sh. Gulshan Dhingra and Sh. Sanjay Dhingra has committed offences under the provisions of Section 132(1)(b) & (c) of the Central Goods & Services Tax Act (CGST), 2017, which are cognizable and non-bailable offences and punishable under Section 132 of the CGST Act, 2017. Consequently, Sh. Gulshan Dhingra and Sh. Sanjay Dhingra was arrested on 07th October, 2019 under Section 69(1) of the CGST Act, 2017 and produced before Judicial Magistrate in Gurugram Court on 07th October, 2019. Court has sent them to judicial custody till 19th October, 2019. Further investigation in the matter is in progress.

The Eastern Coalfields Limited (ECL) has invited applications for the post of Cost Accountant / Accountant Vacancies.

Eastern Coalfields Limited, a subsidiary of Coal India Limited engaged in coal mining activities in West Bengal & Jharkhand.

Last Date of Application: 23rd October 2019

Number of Vacancy: 57 Posts (Gen-25, EWS-5, OBC-15, SC-08, ST-4)

Educational Qualification: Candidates Should have Intermediate Examination of ICWA Or CA Passed.

Age Limit: 18-30 years.

How to Apply:

Applications for this job are to be filled online. Please follow the link is given below to apply (or visit original job details page): http://www.easterncoal.gov.in/notices/recruitmentheader.html

For Further Information Click here.

The Madhya Pradesh Authority of Advance Ruling in an application filed by M/s Emrald Heights international School held that GST shall be leviable on consideration received by the school for participation in a conference organized.

The issue before the Authority is whether the consideration received by the school from the participant school(s) for the participation of their students and staff in the conference would be exempted under Entry No. 66/1/80 of the Notification No. 12/2017-Central Tax (Rate). The second issue is concerning the applicable tax rate if the supply is not exempted.

The bench constituting of Hon’ble Members Shri Rajiv Agrawal and Shri Manoj Kumar Choubey held that the activities of holding Educational conference/ gathering of students, faculty and staff of other Schools are not exempt under relevant clauses of Entry 66/1/8 of the above-mentioned notification for the simple reason that the education conference does not fall under any of the categories so listed. Hence, GST shall be chargeable on the consideration received by the school from the participant school(s) for the participation of their students and staff in the impugned conference

The Hon’ble Bench further stated that various services provided for organizing an educational conference/gathering of students and staff of other Schools, shall be liable to tax at the rate applicable to the respective services. For example, the catering services shall be liable to tax @ 5% without eligibility for Input Tax Credit.

Subscribe Taxscan Premium to view the JudgmentThe Maharashtra Authority of Advance Ruling in an application filed by Soma-Mohite Joint Venture held that construction of the tunnel under joint venture shall be the composite supply of works contract and not earthwork. The supply is hence not leviable to a concessional rate under the below-stated notification.

The applicant is engaged in the business of construction of infrastructure projects and was entitled to undertake the construction of the tunnel under the joint venture. The work order is consisting of Earth Work such as Excavation for Tunnel, removing of excavated stuff, providing steel support, rock bolting, reinforcement, fixing of chain link, cement concerting, etc wherein total earthwork is approximately 93%.

The issue is the determination of whether the said contract is covered under Sl. No. 3A, Chapter No. 99 as per Notification No. 2/2018 – Central Tax (Rate) dated 25.01.2018 w.e.f. 25.01.2018

The Hon’ble Bench constituting of Shri B. Timothy and Shri B.V. Borhade held the concessional rate of tax as per this entry is available to those composite supply of works contract where the earthwork constitute more than 75% of the value of the works contract. On the issue of whether the contract involves earthwork, various dictionaries were referred to. It was observed that the term earthwork means the structure made from earth especially an embankment or construction made of earth. It hence held that the construction of the tunnel and its allied work cannot be considered as earthwork contemplated by Entry 3(vii) and Entry 3(iii) descripted as “Composite supply of works contract… supplied to the Central Government, Government Authority, … by way of construction, erection, commissioning, installation, completion, fitting out, repair, maintenance, renovation, or alteration of …(b) pipeline, conduit or plant.

Subscribe Taxscan Premium to view the JudgmentThe Mumbai Bench of the Income Tax Appellate Tribunal (ITAT) in the case of M/s. Karanja Terminal and Logistics Pvt. Ltd. held that interest received on FDRs/ICDs with bank/NBFCs made out of unutilized funds which could not be used in the development of port terminal is the capital receipt and hence is not taxable.

The assessee company was incorporated to develop, operate a multipurpose port terminal at Karanja Creek, Maharashtra. For the purpose of the port terminal project, the assessee raised share capital as foreign inward remittance from a Cypriot Intermediate company. The capital was raised as an IPO for the specific purpose of developing a multipurpose port terminal facility and logistics facility at Karanja Creek. However, the port terminal could not be developed as envisaged and planned and hence the funds received from IPO were put in fixed deposits and ICDs till the resumption of work. Further, interest was received on such deposits, it was treated as capital in nature and no return for income was filed by the assessee.

The assessee filed his nil return when was notice issued and submitted before the Assessing Authority (‘AO’) that the interest received on FDR/ICDs with banks and NBFC being a capital receipt is not liable to income tax. He further submitted that even if the interest was credited to the profit and loss account resulting into book profit during the year would not change the character of the receipt from capital to revenue and cannot be taxed both under normal provisions and under Section 115JB of the Income Tax Act. The AO rejected the contentions of the assessee and similar findings were drawn by the Commissioner of Income Tax (Appeals) (CIT(A))

The assessee has challenged the order of the CIT(A) on the ground that Interest of Rs. 44.45 Cr has wrongly been held to be a revenue receipt by ignoring the fact that the interest was received on FDRs/ICDs during the period prior to the commissioning of the port terminal at Karanja Creek which has to be reduced from the pre-operative capital expenditure as the development of the port is still under progress and not commissioned.

The Bench constituting of Hon’ble members Shri Rajesh Kumar as the accountant member and Shri Ramlal Negi as the judicial member held that “the interest income received by the assessee from the FDRs/ICDs made out of funds are inextricably linked to the development of port terminal and other infrastructure at Karanja Creek which is yet to be completed and commissioned. We would like to add that the these funds could not be used for the development work of the port due to late issuance of permissions/clearances by the Govt authorities and also due to some local issues. Therefore, in our considered view the interest income is a capital receipt and is not taxable at all both under the normal provisions of the Act as well as u/s 115JB of the Act. The appeal of the assessee is allowed.”

Subscribe Taxscan Premium to view the JudgmentThe Maharashtra Authority of Advance Ruling in an application filed by Alligo Agrovet Pvt Ltd held that Shyam Samruddhi derived from an organic source is an Organic Fertilizer classifiable under HSN 3105 liable to 5% GST.

The applicant is engaged in the manufacture of various Agro Chemicals claimed as Organic Fertilizers. The issue before the present authority is with respect to the determination of the correct classification of goods produced by the applicant. These are Autus, SJ Ninja, SJ-Eraser, Oprax, Telnar, VK’s Nemo and Stressout.

The applicant submits that the impugned goods contain Animal or Seaweed plant extract, Nitrogenous, Potasic Fertilizers and Micro Nutrients which helps in enhancing the immunity of plant against several diseases and are in the nature of organic fertilizers classifiable under HSN 3101 or 3105.

The Bench constituting of Hon’ble members B. Timothy and B.V. Borhade held that the above products are classifiable under HSN Code – 3808 under the head ‘Plant Growth Regulators’ and are liable to the rate of 18% under Notification Number 1 of 2017 – Central Tax (Rate) dated 28.06.2017 each respectively. Further, that the good Shyam Samruddhi is an organic fertilizer classifiable under HSN – 3105 and is liable to a rate of 5% as per Sl. Number 182D of Schedule I of Notification Number 1 of 2017 Central Tax (Rate) dated 28.06.2017.

The Hon’ble bench analyzed the characteristics of fertilizer, organic fertilizer, plant growth regulator, insecticides and pesticides and made a product by product examination of the same. It has been discussed that Plant Growth Regulators are either natural or synthetic compounds that are applied directly to a target plant to alter its life processes or its structure to improve quality, increase yields, etc and hence the product – Autus is in conformity with the characteristics of the heading, shall be classified as such.

On the contrary, the product ‘Shyam Samruddhi’ in absence of any growth regulator and since constitutes of plant nutrient N,P,K are derived from an organic source, classifiable under HSN – 3105 and liable to 5% GST. Further, SJ-Ninja and SJ-Eraser eradicating most common insect pest was held to satisfy attributes of an insecticide classifiable under HSN Heading 3808.

Subscribe Taxscan Premium to view the JudgmentThe Competition Commission of India ( CCI ) received the first green channel combination filed under sub-section (2) of Section 6 of the Competition Act, 2002 (Act) read with regulations 5 and 5A of the Competition Commission of India (Procedure in regard to the transactions of business relating to combinations) Regulations, 2011 (Combination Regulations), 3rd October, 2019.

The notification relates to the acquisition of the Essel Mutual Fund (Essel MF), a mutual fund registered under the SEBI (Mutual Funds) Regulations, 1996 (MF Regulations) by an entity forming a part of the Sachin Bansal Group.

Essel Finance AMC Limited acts as an investment manager to Essel MF. Essel MF Trustee Limited is the trustee of Essel MF. It ensures that the transactions entered into by Essel AMC are in accordance with the MF Regulations and also reviews the activities carried on by Essel AMC. Essel Finance Wealth Zone Private Limited is the sponsoring entity for Essel MF and the parent entity of both Essel AMC and Essel Trustee.

The Proposed Combination filed in terms of Regulation 5A of the Combination Regulations (i.e. notice for approval of Combinations under Green Channel) shall be deemed to have been approved upon filing an acknowledgement thereof.

Subscribe Taxscan Premium to view the JudgmentRevenue Secretary Ajay Bhushan Pandey inaugurated National e-Assessment Scheme (NeAC) here today in the presence of CBDT Chairman Shri P.C. Mody and Members Shri P.K. Das, Shri Akhilesh Ranjan and Shri Prabhash Shankar.

While inaugurating the NeAC, Shri Pandey said that it is a matter of great pride and achievement for the Income Tax Department to bring NeAC to life in a small span of time. Retracing the origins of NeAC in 2017, Shri Pandey lauded the IT Department for striving to achieve transparency with speed.

Shri Pandey said that with the launch of National e-Assessment Centre (NeAC), the Income Tax Department will usher in a paradigm shift in its working by introducing faceless e-assessment to impart greater efficiency, transparency and accountability in the assessment process. He said that with NeAC, there would be no physical interface between the tax payers and the tax officers.

The setting up of NeAC of the Income Tax Department is a momentous step towards the larger objectives of better taxpayer service, reduction of taxpayer grievances in line with Prime Minister’s vision of ‘Digital India’ and promotion of Ease of Doing Business.

In the first phase, the Income Tax Department has selected 58,322 cases for scrutiny under the faceless e-Assessment Scheme 2019 and the e-notices have been served before 30th of September 2019 for the cases of Assessment Year 2018-19.

The taxpayers have been advised to check their registered e-filing accounts/ email ids and have been requested to furnish a reply within 15 days. The Department hopes that with the ease of compliance for taxpayers, the cases would be disposed of expeditiously.

Benefits of Faceless Assessment:

About National e-Assessment Centre (NeAC) :

NeAC will be an independent office that will look after the work of e-Assessment scheme which is recently notified for faceless e-assessment for income taxpayers. There would be a NeAC in Delhi to be headed by Principal Chief Commissioner of Income Tax (Pr.CCIT). There are 8 Regional e-Assessment Centres (ReAC) set up at Delhi, Mumbai, Chennai, Kolkata Ahmedabad, Pune, Bengaluru and Hyderabad which would comprise Assessment unit, Review unit, Technical unit and Verification units. Each ReAC will be headed by Chief Commissioner of Income Tax (CCIT). Cases for the specified work shall be assigned by the NeAC to different units by way of automated allocation systems. In view of the dynamic and all India jurisdiction of all officers of NeAC and ReAC, this kind of connective and collaborative effort of officers is likely to lead to a better quality of assessments.

About Faceless e-Assessment:

Centre Government had recently notified the e-Assessment scheme to facilitate the faceless assessment of income tax returns through completely electronic communication between tax officials and taxpayers.

Under the new system of faceless e-Assessment, taxpayers will receive notices on their registered emails as well as on registered accounts on the web portal www.incometaxindiaefiling.gov.in with real-time alert by way of SMS on their registered mobile number, specifying the issues for which their cases have been selected for scrutiny. The replies to the notices can be prepared at ease by the taxpayers at their own residence or office and be sent by email to the National e-Assessment Centre by uploading the same on the designated web portal.

This new initiative of faceless assessment is expected to increase ease of compliance for taxpayers as the cost and anxiety of taxpayers are likely to be greatly reduced. No human interface with the Department would be a game-changer. This is another initiative by CBDT in the field of ease of compliance for our taxpayers.

The Institute of Chartered Accountants of India ( ICAI ) has postponed overseas campus placement for Chartered Accountants and Accountants.

On account of requests received from various stakeholders the Overseas Campus Placement drive from 18th – 22nd, October 2019 has been postponed. The revised dates along with the detailed procedure will be uploaded soon.

The six-member Monetary Policy Committee (MPC) of the RBI has said that the online money transfer through National Electronic Funds Transfer ( NEFT ) will be available 24×7 from last friday onwards.

Presently, the facility is available till 7:45 pm on all working days except 2nd and 4th Saturdays of the month.

In a Statement issued by RBI has said that, “On payment and settlement systems, several measures have been announced. First, collateralised liquidity support, which is currently available till 7.45 pm, will now be available round the clock on all NEFT working days in order to facilitate smooth settlement of National Electronic Funds Transfer on 24×7 basis for members of public from December, 2019”.

“The RBI also said that, “in order to strengthen the grievance redressal mechanism for customer complaints, it has been decided to institutionalise an internal ombudsman scheme at the large non-bank pre-paid payment instruments (PPI) issuers (entities who have more than 10 million pre-paid payment instruments outstanding)”.

“Third, in order to increase digitisation in Tier III to Tier VI centres through wider acceptance infrastructure, and as indicated in the Payment System Vision Document 2021 of RBI and also recommended by the Committee on Deepening of Digital Payments (Chairperson: Shri Nandan Nilekani), it has been decided to create an Acceptance Development Fund (ADF)”, the RBI also added.

The Reserve Bank of India ( RBI ) has enhanced withdrawal limit for depositors of Punjab and Maharashtra Cooperative Bank Limited to Rupees 25,000.

It may be recalled that the Reserve Bank of India had permitted the depositors of Punjab and Maharashtra Cooperative Bank Ltd to withdraw up to ₹ 10,000/- (Rupees Ten Thousand Only) of the total balance in their accounts.

The Reserve Bank of India again reviewed the bank’s liquidity position and, with a view to reducing the hardship of the depositors, has decided to further enhance the limit for withdrawal to ₹ 25000 (Rupees Twenty Five Thousand Only).

With the above relaxation, more than 70% of the depositors of the bank will be able to withdraw their entire account balance. The Reserve Bank is monitoring the position of the bank and will continue to take the necessary steps in the interest of depositors.

The Reserve Bank has also decided to appoint a Committee of three Members in terms of section 36AAA(5)(a) read with Section 56 of the Banking Regulation Act 1949, to assist the Administrator of Punjab and Maharashtra Cooperative Bank Ltd.

Two people have been arrested by the Headquarter Preventive Wing of the Central GST Commissionerate for allegedly issuing fake GST invoices of approximately Rs 700 crore.

CGST officials acted upon intelligence and busted the modus operandi of issuing fake GST invoices without receiving or supplying any goods.

According to the statement issued by VN Mangaraju, Joint Commissioner, Pune CGST II Commissionerate, the accused Amit Ashok Thepde and Vilas M Atal were arrested on Thursday under Section 69 (1) of CGST ACT, 2017.

“Two firms — Reliable Multi trading and Himalaya Tradelinks — obtained GST registration and have together issued fake GST invoices of approximately Rs 700 crore with GST of Rs 54 crore to facilitate bogus Input Tax Credit (ITC) claims and duped the government exchequer,” said Mangaraju in the statement.

Both the accused are partners in these firms and have committed offences under the provision of Sections 123(1)(b) and (c) of GST Act, 2017, which is cognizable and non-bailable, said the official further.

The Headquarter Preventive Unit (HPU) of Pune has seized incriminating documents from their premises.

The MasterCard has invited applications for the post of Senior Accountant from qualified Chartered Accountants.

The MasterCard is the global technology company behind the world’s fastest payments processing network. The Company is a vehicle for commerce, a connection to financial systems for the previously excluded, a technology innovation lab, and the home of Priceless®.

Overview

Education/Certification:

• Bachelor’s degree in Accounting or Finance

• Chartered accountant – Preferred

Knowledge/Experience/Skills:

• Experience reviewing and analyzing work for appropriate accounting treatment

• Experience performing basic issue resolution; gains exposure to the resolution of complex issues

• Strong bias on executing controls and assessing their effectiveness, makes recommendations to improve upon areas of concern

• Proactively builds relationships with business partners

• Knowledge of US GAAP and current accounting concepts

• Strong verbal and written communication skills

• Results orientated with an ability to work under pressure and have a structured approach to deliverables

• Robust understanding of MS Excel and financial/ERP systems, preferably direct experience with Oracle

• Progressive accounting experience preferably in a large, global environment

• Prior experience in supporting business process transitions and process improvements projects

• Capable of working within a changing environment with excellent analytical, planning and organization skills

• Focused on achieving key outputs, with a sense of urgency and in a professional manner

• Able to adjust to changing processes and systems – should be agile to adapt e.g. changing accounting system will change established work procedures.

For Further Information Click here.