The Mumbai Zonal Unit of the Directorate General of GST Intelligence (DGGI-MZU) on Tuesday (17th September) made an arrest for one Shri Sandeep alias Karan Arora, Managing Director of M/s High Ground Enterprises Ltd.; on charges of having availed & utilized, as well as having passed on fictitious lnput Tax Credit (ITC) by way of issuance of invoices without actual receipt or supply of goods or services.

The press note issued by Joint Director, DGGI-MZU, Smt Ujjwala Bhagwat in this regard states that – it is apparent, from the investigation conducted till date, that M/s High Ground Enterprises Ltd. has availed fake ITC to the tune of approximately Rs 77 Crores, on the basis of invoices having value of approximately Rs. 420 crores. During the course of the investigation, it was ascertained that several of the entities from whom M/s High Ground Enterprises Ltd. has availed invoices are actually shell companies having no capacity to conduct any business operations. Some of the entities from whom M/s High Ground Enterprises Ltd. has availed fake ITU were in existence, but it was ascertained that these entities have merely supplied invoices & other documents without actual supply of goods or services.

The investigation spanned multiple locations in various parts of the country including New Delhi, Kolkata, Hyderabad, Bangalore, Pune, etc. Based on the extensive documentary evidence available, and the statements recorded of several individuals, it was ascertained that Shri. Sandeep alias Karan Arora, Managing Director of the M/s High Ground Enterprises Ltd. is the key mastermind behind this entire operation. Accordingly, Shri Sandeep alias Karan Arora was arrested and presented before the Hon’ble Addl. Chief Metropolitan Magistrate, who ordered a judicial remand.

It is noteworthy to mention that Shri. Sandeep alias Karan Arora is also wanted by the U.K. Govt. for allegedly committing VAT fraud amounting to GBP 4.5 million. In an appeal put out by the Joint Fraud Taskforce consisting of the City of London Police, Metropolitan Police Service & the British National Crime Agency, it has been stated that Shri. Sandeep alias Karan Arora is guilty of wrongly claiming VAT & Film Tax refunds on the basis of films that either did not exists, or which he had no involvement. During the course of the investigation, it has also emerged that Shri. Sandeep alias Karan is under the scanner of other investigative agencies such as the Enforcement Directorate & Income Tax Department.

Further investigation in the matter is under progess.

The Institute of Chartered Accountants of India ( ICAI ) has extended the time limit of UDIN generation from 15 days to 30 days.

In response to the various representations received from Members at large for inability generating in which due to floods in many parts of the Country and related internet issues, the Council at its 386th Meeting held on 18th and 19th September, 2019 has decided to permit generation of UDIN within 30 days in place of 15 days.

“Members may kindly note that this is a one-time relaxation available on the Certificate / Report / Document signed between 20th August, 2019 to 31st December, 2019”, said CA. Jay Chhaira, Deputy Convenor, UDIN Monitoring Group.

Further, UDIN so generated has to be communicated to “Management” or “Those Charged with Governance” for disseminating it to the stakeholders from their end.

In line with the Government’s objective of promoting Ease of Living in the country by providing Ease of Doing Business to law-abiding corporates, fostering improved corporate compliance for stakeholders at large and also to address emerging issues having impact on the working of corporates in the country, it has been decided to constitute a Company Law Committee for examining and making recommendations to the Government on various provisions and issues pertaining to implementation of the Companies Act, 2013 and the Limited Liability Partnership Act, 2008.

The Company Law Committee shall comprise of the following members:-

| S. No. | Name of Person/ Institution | – Position |

| 1. | Secretary, MCA |

|

| 2. | Dr. T. K. Viswanathan, Ex- Secretary General, Lok Sabha |

|

| 3. | Shri Uday Kotak, MD, Kotak Mahindra Bank |

|

| 4. | Shri Shardul S Shroff, Executive Chairman, Shardul Amarchand Mangaldas & Co. |

|

| 5. | Shri Amarjit Chopra, Senior Partner, GSA Associates, New Delhi |

|

| 6. | Shri Rajib Sekhar Sahoo, Principal Partner, SRB & Associates, Chartered Accountants, Bhubaneswar |

|

| 7. | Shri Ajay Bahl, Founder and Managing Partner, AZB & Partners, Advocates & Solicitors |

|

| 8. | Shri G. Ramaswamy, Partner, G. Ramaswamy & Co. Chartered Accountants, Coimbatore |

|

| 9. | Shri Sidharth Birla, Chairman, Xpro India Limited |

|

| 10. | Ms. Preeti Malhotra, Group President, Corporate Affairs & Governance, Smart Group |

|

| 11. | Joint Secretary (Policy) | – Member Secretary |

The terms of reference of the Committee are as follows:-

The Committee shall submit its recommendations in phases and subject-wise to the Government from time to time as may be decided by the Chairperson of the Committee.

The Committee shall initially have a tenure of one year from the date of its first meeting.

Today, the Reserve Bank of India ( RBI ) released its annual publication titled “Handbook of Statistics (HBS) on the Indian Economy 2018-19”. This publication, the 21st in the series, disseminates time series data on various economic and financial indicators relating to the Indian economy. The current volume contains 240 statistical tables covering national income aggregates, output, prices, money, banking, financial markets, public finances, foreign trade and balance of payments and select socio-economic indicators.

Longer time-series are also available on our online portal “Database on Indian Economy (DBIE)”, the RBI’s Data Warehouse (https://dbie.rbi.org.in), where all data series are updated on a real time basis.

Feedback/ comments on the HBS are welcome and may kindly be addressed to the Director, Data Management and Dissemination Division, Department of Statistics and Information Management, Reserve Bank of India, C-9, 3rd Floor, Bandra-Kurla Complex, Bandra (East), Mumbai 400 051 or through e-mail / feedback button available on DBIE site.

Orders for the purchase of this publication may be placed with the Director, Division of Reports and Knowledge Dissemination (Sales Section), Department of Economic and Policy Research, Reserve Bank of India, Amar Building, Ground Floor, P. M. Road, Mumbai-400 001 on payment through demand draft or cheque drawn in favour of the Reserve Bank of India, payable at Mumbai only. The electronic form of the current and the preceding issues of the publication can also be downloaded free of cost from the Reserve Bank’s website (www.rbi.org.in).

The Reserve Bank of India (RBI) in its Second Bi-monthly Monetary Policy Statement, 2019-20 dated June 06, 2019 announced that it is proposed to issue Draft Guidelines for ‘on tap’ Licensing of Small Finance Banks.

Accordingly, RBI has today released on its website ‘Draft Guidelines for ‘on tap’ Licensing of Small Finance Banks in the Private Sector’ for comments of stakeholders and members of the public.

Suggestions and comments on the draft guidelines may be sent by October 12, 2019 to the Chief General Manager, Reserve Bank of India, Department of Banking Regulation, Central Office, 13th floor, Central Office Building, Shahid Bhagat Singh Marg, Mumbai, 400001. Suggestions/comments can also be emailed.

The Ernst & Young ( EY ) has invited applications from CA, LLB graduates for the post of Independence – Sr. Manager / Associate Director.

Independence support is the largest sub-service function within Risk Management Services (RMS) responsible for assisting Assurance and Risk Management teams in maintaining EY’s objectivity and integrity with respect to its current and future audit clients. RMS Independence team is currently 350 people strong and operating from 2 locations: Gurgaon, India and Wroclaw, Poland. This team is closely integrated with Global Independence organization and enjoys good visibility amongst various customer groups.

This position is to serve as the sub-service function lead for RMS – Independence group. The successful candidate will be responsible for managing overall service delivery & operations for the entire group, serving multiple customer groups & stakeholders across different EY geographies. He/she will be responsible for team’s productivity, efficiency & quality of service. Other responsibilities include onboarding new customer groups, process transition, business transformation initiatives, setting up billing & work order processes, performance management and development of the team members. He/she will also be responsible for defining & driving team’s strategy, headcount planning, recruitment of resources, developing new solutions and overall people as well as team management.

The position also involves some international travel to oversee team in Poland and to support business development initiatives.

Key responsibilities:

This is a senior leadership position requiring the candidate to manage number of concurrent activities, have strong multi-tasking skills, organizational and time management skills. Having an entrepreneurial mindset along with strong relationship building skills are other qualifications expected from this person.

Administration & organizational skills

Flexibility

EDUCATION: CA or LLB from a reputed institute or similar post- graduate experience

EXPERIENCE: At least 14 years of professional experience, out of which a minimum of 5 years should have been spent in:

• Compliance or research functions in Big 4 or other professional service organizations

• Business research and analysis

• Managing reasonably large teams ~ 300 people

For further information click here.

The Central Board of Direct Taxes (CBDT) has notified Rules 10UD & 10UE for the purpose of making reference to Approving Panel under section 144BA(4) of the Income Tax Act under General Anti Avoidance Rule ( GAAR ).

According to the New Amendment, Rule 10UD i.e., Reference to the Approving Panel.- A reference under sub-section (4) of section 144BA to an Approving Panel shall be,-

Section 144BA(4) provides for making reference to the Approving Panel for the purpose of the declaration of the arrangement as an impermissible avoidance arrangement. A reference to an Approving Panel shall be made in Form no. 3CEIA along with a copy of Form No. 3CEI.

Rule 10UE i.e., Procedure before the Approving Panel.-

Rule 10UF. Remuneration.- (1) For attending the meeting of an Approving Panel, the Chairperson and other members of the said Panel shall be entitled to- (i) a sitting fee of six thousand rupees per day; and (ii) travelling allowances including transportation charges for local travel and daily allowances (including accommodation) as admissible to an officer of the rank of Special Secretary to the Government of India.

The expenditure of an Approving Panel shall be met from the budgetary grants of the Department of Revenue in the Ministry of Finance of the Central Government.

The regulation allows tax officials to deny tax benefits if a deal is found without any commercial purpose other than tax avoidance. It allows tax officials to target participatory notes. Under GAAR, the investor has to prove that the participatory note was not set to avoid taxes.

Subscribe Taxscan Premium to view the JudgmentThe Institute of Chartered Accountants of India ( ICAI ) has issued Frequently Asked Questions (FAQs) on ‘Presentation of Dividend and Dividend Distribution Tax.

The ICAI has clarified the issues regarding the presentation requirement as per IndAS in India for dividend and dividend distribution tax.

“If a financial instrument is classified as debt, the dividend or interest paid thereon is in the nature of the interest which is recognised in profit or loss. Dividend or interest paid on a financial instrument which is classified as equity should be recognised in the Statement of Changes in Equity”, ICAI said.

Subscribe Taxscan Premium to view the Judgment

The Institute of Chartered Accountants of India ( ICAI ) has issued advisory on Auditor’s reporting on Section 197 (16) of the Companies Act, 2013.

Section 197(16) of the Companies Act, 2013 requires as under:

“The auditor of the company shall, in his report under section 143, make a statement as to whether the remuneration paid by the company to its directors is in accordance with the provisions of this section, whether remuneration paid to any director is in excess of the limit laid down under this section and give such other details as may be prescribed”

The ICAI has said that, The aforesaid reporting requirement for auditors of public companies needs to be covered in auditor’s report under the Section “Report on Other Legal and Regulatory Requirements”. Accordingly, auditors of public companies are advised to comply with the aforesaid reporting requirements in their auditor’s reports.

The ICAI has also said that, the Advisory will come into force from immediate effect.

The Institute of Chartered Accountants of India ( ICAI ) has extended Correction Window for, CA Exams November 2019.

In a announcement issued by ICAI has said that, Candidates who had applied for Chartered Accountant Examinations i.e. Foundation Course {Under New Scheme}, Intermediate (IPC) {Under Old Scheme}, Intermediate {Under New Scheme} and Final {Under Old & New Scheme} scheduled from 1st to 18th November, 2019 may kindly note that they can change their Examination City / Group / Medium through Correction Window from 12.9.2019 (11 Hrs) to 18.09.2019 on icaiexam.icai.org.

The Central Board of Direct Taxes ( CBDT ) has clarified that, circular on monetary limits for filing appeals not applicable in case of claiming bogus Long-Term Capital Gain ( LTCG ) / Short-term Capital Gain ( STCG ) through penny stocks.

The CBDT has issued office memorandum with direction to refer Circular no. 23 of 2019 issued by the board on 06-09-2019. The board reiterates that the monetary limits fixed for filing appeals before ITAT/HC and SC shall not apply in case of assessees claiming bogus LTCG/STCL through penny stocks and appeals / SLPs in such cases shall be filed on merits.

Subscribe Taxscan Premium to view the JudgmentThe Central Board of Direct Taxes ( CBDT ) has waived off lock-in period of 3 years on investment made by Non Residents in bonds of Infrastructure Debt Fund.

According to Rule 2F of the Income Tax Rules, 1962, provides that the investment made by a non-resident investor in bonds of Infrastructure Debt Fund shall be subject to a lock-in period of not less than three years.

However, the non-resident investor may transfer the bond to another non-resident investor within such lock-in period. In a notification issued yesterday, the CBDT vide Notification No. 66/2019, dated 16-09-2019 has removed such lock-in period of 3 years.

The provision came into force from yesterday.

Subscribe Taxscan Premium to view the JudgmentThe Central Board of Direct Taxes ( CBDT ) has notified that the tolerance range of 1 per cent for wholesale trading and 3 per cent in all other cases for the assessment year 2019-20.

In a notification issued by Finance Ministry said that, where the variation between the arm’s length price determined under section 92C of the said Act and the price at which the international transaction or specified domestic transaction has actually been undertaken does not exceed one per cent. of the latter in respect of wholesale trading and three per cent. of the latter in all other cases, the price at which the international transaction or specified domestic transaction has actually been undertaken shall be deemed to be the arm’s length price for assessment year 2019-2020.

“wholesale trading” means an international transaction or specified domestic transaction of trading in goods, which fulfils the following conditions, namely:-

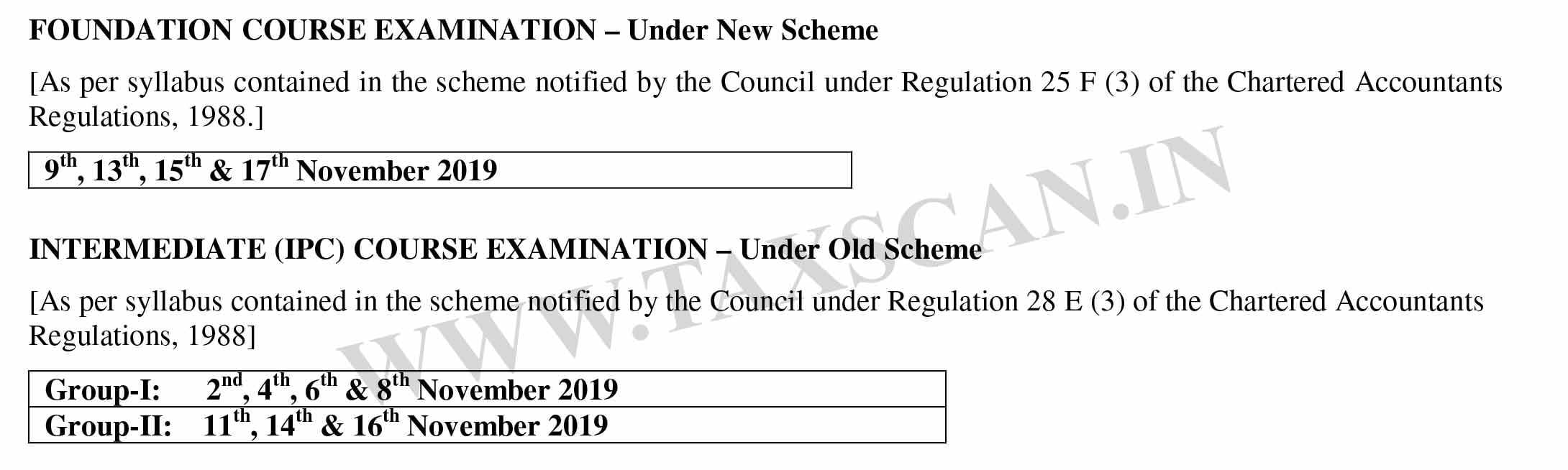

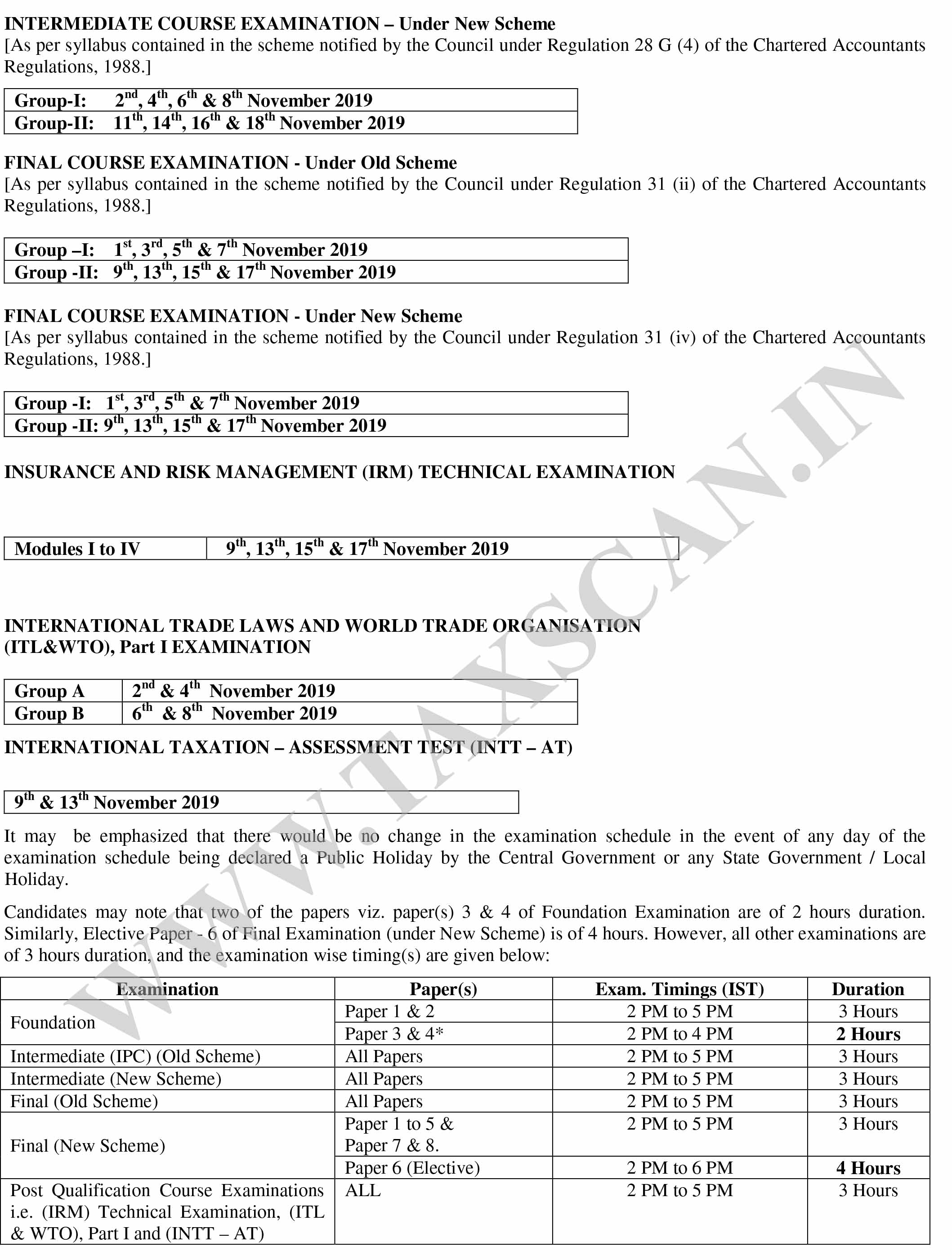

The Institute of Chartered Accountants of India ( ICAI ) has notified the dates of Chartered Accountants Foundation Course {Under New Scheme}, Intermediate (IPC) {Under Old Scheme}, Intermediate {Under New Scheme} and Final {Under Old & New Scheme} Examinations.

Similarly, Examinations in Post Qualification Course under Regulation 204, viz.: Insurance and Risk Management (IRM) Technical Examination, International Trade Laws and World Trade Organisation (ITL & WTO) and International Taxation – Assessment Test (INTT – AT) (which is open to the members of the Institute) will be held on the dates and places (centres in India only) which are given below provided that sufficient number of candidates offer themselves to appear.

Recently, ICAI had extended the last date for filing of online applications for the Chartered Accountants exams scheduled in November 2019.

The GST Network on Saturday decided to make Aadhaar authentication or physical verification mandatory for GST Registration from January 2020.

The 35th GST Council meeting held under the Finance Minister Nirmala Sitharaman has approved the use of the Aadhaar card for the enrollment on the Goods and Services Tax Network ( GSTN ). The use of Aadhaar card would be doing away with the requirements of various other documents.

“Aadhaar authentication of new dealers will be mandatory. Earlier it was optional. But we have noticed in two years that there’s a good number of fly-by-night operators. They make fake invoices,” Bihar deputy chief minister Sushil Kumar Modi, who heads the group of ministers of GST Network reportedly told.

“In the earlier system, people have to give various documents and submit them in physical and scan form. No, we have decided the use Aadhaar and several advantages will occur to businesses. The person applying can go online and using his Aadhaar number and OTP authentication can register himself in the GSTN portal and get GSTN registration number

Those who don’t want Aadhaar authentication, physical verification will be carried out, which will be completed in three days.

The GSTN also decided the much simplified new return system may be launched on January 1, 2020, the Bihar Deputy chief minister also said.

The GST Council meeting is scheduled in Goa on September 20, he added.

The Reserve Bank of India ( RBI ) had constituted a Committee on the Development of Housing Finance Securitisation Market, on May 29, 2019, with Dr. Harsh Vardhan, Senior Advisor, Bain & Co. as the Chairperson. The Committee was set up in recognition of the role of well-functioning securitisation markets for better management of credit and liquidity risks in the balance-sheets of banks as well as non-bank mortgage originators.

The Terms of Reference of the Committee were to review the existing state of mortgage securitisation market in India and make recommendations to address various issues relating to originators/investors as well as market microstructure.

The Committee has since submitted its report to the Governor. The key recommendations of the Committee, guided by the broad perspective of enhancing efficiency and transparency of securitisation transactions, are as follows:

The report is placed on the RBI website today for comments of stakeholders and members of the public. Comments on the report may be sent by September 30, 2019 through email.

The Amazon has invited application from Chartered Accountants and Certified Public Accountant for the post of Risk Specialist.

Amazon is seeking a Financial Analyst to support the Finance Operations Risk Management Services in Accounts Payable at Amazon.

BASIC QUALIFICATIONS

PREFERRED QUALIFICATIONS

The Reserve Bank of India ( RBI ) had constituted a Task Force on Development of Secondary Market for Corporate Loans under the Chairmanship of Shri T. N. Manoharan, Chairman, Canara Bank, on May 29, 2019.

The Terms of Reference of the Task Force were to review the existing state of market for loan sale/transfer in India as well as the international experience in loan trading and to make recommendations for the development of secondary market for corporate loans in India.

The Task Force has since submitted its report to the Governor. The key recommendations of the Task Force are as follows:

The report is placed on the RBI website today for comments of stakeholders and members of the public. Comments on the report may be sent by September 30, 2019 through email.

The Andhra Pradesh High Court has ordered revision in the Form GSTR-3B. GSTR-3B is a monthly self-declaration that has to be filed by a registered dealer from July 2017 till March 2018. Every person who has registered for GST must file the return GSTR-3B including nill returns.

All taxpayers, except those registered under the composition scheme, are required to file GSTR-3B and pay tax on a monthly basis. These have to be filed by the 20th day of the following month. Even assessees with ‘NIL’ returns are required to file GSTR-3B. As of now, there is no provision for revision, making things complicated for assessees.

The petitioner, a Vijayawada-based firm Panduranga Stone Crushers, approached the High Court with a plea to permit it to manually rectify GSTR-3B statements for four months — August and December, 2017 and January- February, 2018. It submitted GSTR-3B for the month of July 2017 to March 2018. However, according to the petitioner, while claiming IGST (Integrated Goods and Services Tax, levied on inter-States trade), it inadvertently and by mistake reported IGST input tax credit in a column related to goods and services.

The Petitioner also contended that, to issue an appropriate writ order or direction particularly in the nature of Writ of mandamus declaring the absence of any provision in section 39 under the CGST Act 2017 or the relevant rules 61 (5) made thereunder for rectifying any mistakes crept in GSTR-3B filed in terms of the law as illegal arbitrary improper and unjust that would violate articles 14, 19 (1) (g) of the Constitution of India and consequently direct the respondents to allow the Petitioner to rectify the mistake mentioned above in column 2 relating to import of services instead of placing it in column 5 relating to all other ITC claims in the relevant GSTR-3B returns for the period 201718 and grant such other relief or reliefs as are deemed fit and proper under the circumstances of the case.

While allowing the petition the division bench comprising of Justice M.Seetharama Murti and Justice J. Uma Devi permitted the petitioner to rectify GSTR-3B statements for the sought period.

CGST Delhi West and CGST Delhi North in a joint operation busted a racket of issuance of invoices without actual supply of goods. The taxpayer availed fraudulent Input Tax Credit for seeking IGST Refunds from Customs formations. Investigations revealed a novel modus operandi wherein the taxpayer showed supplies to SEZ for claiming a fraudulent refund from CGST formations.

Devender Kumar Yadav & Sanjeev Maheshwari were the masterminds who created dummy firms and also opened bank accounts. Sh. Bhawani Shanker Sharma, was the accountant who prepared the fake documents and also filed returns on the basis of fake invoices. One person, Vinod was shown as proprietor and assisted in the operations of these firms. All four have been arrested and remanded to Judicial Custody for 14 days by the Duty Magistrate at Patiala House Courts, New Delhi. Prima facie, fraudulent ITC of Rs.195 crores has been passed on using invoices involving an amount of Rs.847 crores.

Investigations revealed around 60 dummy firms were opened in the name of persons belonging to the lower income group. Some of these firms passed on fraudulent Input Tax Credit to firms within this group to avail IGST refund or refund against supplies made to SEZ. The accused had applied for IGST refunds from various ports across India and Rs.18.09 crores had been credited to their bank accounts. Also, three refund claims involving Rs.29.66 crores for supplies made to SEZ were filed in CGST North and West Divisional Offices which had not been sanctioned. During search operations, unaccounted cash of Rs.91.92 lakhs was also seized and two bank accounts having the amount of Rs.1.68 crores have been provisionally attached.

The accused have committed an offence under the provisions of Section 132(1)(b)&(c) of the CGST Act, 2017, which are cognizable and non-bailable under Section 132(5) and punishable under Section 132(1)(i) of the said Act. Accordingly, the four accused were arrested on 14.09.2019 and have been remanded to judicial custody for 14 days.

The Central Board of Direct Taxes ( CBDT ) has notified an ‘E-Assessment Scheme, 2019’ vide Notification no. 61/2019 & 62/2019, dated 12-09-2019 for the purpose of conducting e-assessments.

The scheme came into force with effect from September 12, 2019.

Any scrutiny assessment carried out on or after 12-09-2019 shall be governed by this ‘E-assessment Scheme, 2019’.

In the General Budget 2018-19 presented in Parliament had proposed to amend the Income Tax Act to notify a new scheme for e-assessment.

The assessment will be done in electronic mode which will almost eliminate person to person contact leading to greater efficiency and transparency. The Finance Minister added that the e-assessment system was introduced in 2016 on a pilot basis.

Faceless assessment and scrutiny of income tax returns eliminate the possibility of you knowing the tax officer dealing with your case. You might never get to know him as anonymity is maintained in processing your ITR.

Cases selected for scrutiny shall be allocated to assessment units in a random manner and notices shall be issued electronically by a Central Cell, without disclosing the name, designation or location of the assessing officer. The Central Cell shall be the single point of contact between the taxpayer and the Department. This new scheme of assessment will represent a paradigm shift in the functioning of the income tax department.

Moving to digital from the decades-old system of manual scrutiny, the tax department would use data analytics, artificial intelligence, machine learning and other latest tools to ascertain misreporting or evasion.

Subscribe Taxscan Premium to view the Judgment