GST and Central Excise Superintendent cannot Pass Order/SCN on wrongly availed ITC Exceeding Rs. 10 Lakhs : Allahabad HC [Read Order]

It was confirmed that the impugned order exceeded the Superintendent's jurisdiction, as per Circular No. 31/05/2018-GST. Consequently, the HC sets the order, allowing the respondents to proceed afresh within the prescribed jurisdiction

![GST and Central Excise Superintendent cannot Pass Order/SCN on wrongly availed ITC Exceeding Rs. 10 Lakhs : Allahabad HC [Read Order] GST and Central Excise Superintendent cannot Pass Order/SCN on wrongly availed ITC Exceeding Rs. 10 Lakhs : Allahabad HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/02/Allahabad-High-Court-GST-Central-Excise-Superintendent-Central-Excise-taxscan.jpg)

The Allahabad High Court has set aside the order issued by the Superintendent of Central Goods and Services Tax ( CGST ) and Central Excise. According to the High Court, the Superintendent was not the proper officer to issue order regarding the matter of wrong availment of Input Tax Credit ( ITC ) claim exceeding Rs. 10,00,000.

Presiding over the case, Justice Alok Mathur emphasised the circular issued by the Central Government that the authority of the Superintendent, Central Goods and Service Tax, and Central Excise is restricted to matters not exceeding Rs. 10,00,000. However, in the case at hand, the amount involved surpassed this threshold.

The petitioner, M/S Mansoori Enterprises had contested an order passed under Section 73 of the Central Goods and Services Tax Act, 2017 ( CGST Act ), which was issued by the Superintendent of Central Goods and Services Tax and Central Excise disallowing ITC Rs.1624246.88.

The petitioner, represented by Dheeraj Srivastava, challenged this order, primarily arguing that the Superintendent lacked jurisdiction to issue it.

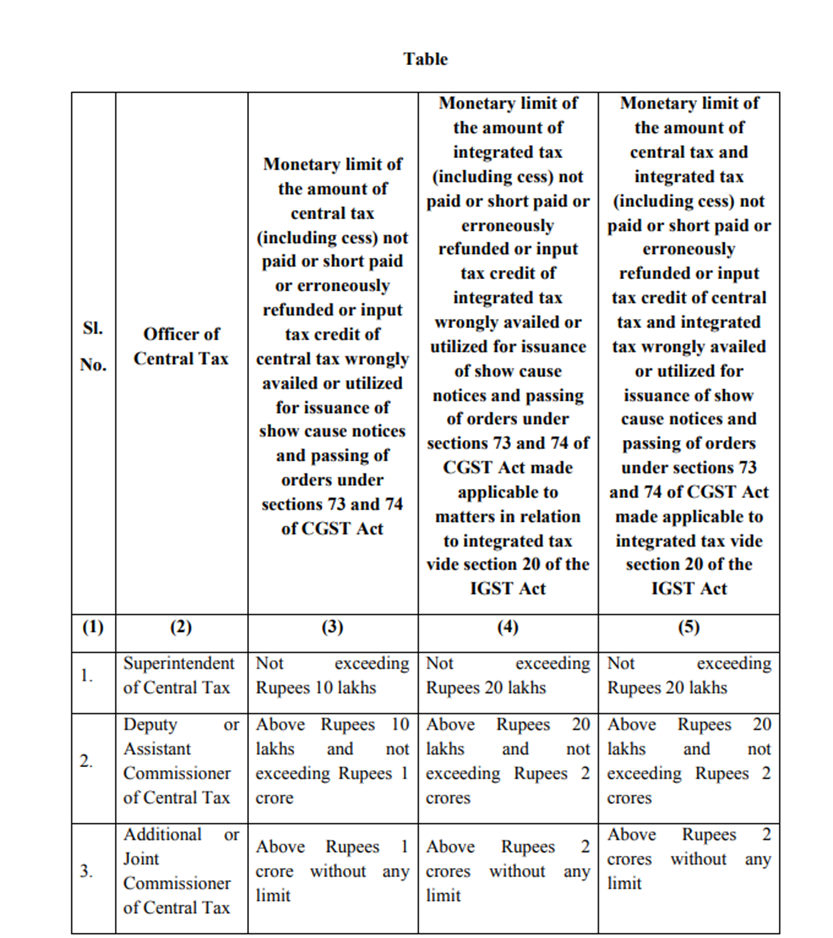

The crux of the challenge lay in a circular dated February 9, 2018, issued by the Government of India, Ministry of Finance, Department of Revenue. This circular delineated the jurisdiction of various authorities concerning the maximum amount of central tax not paid, short-paid, erroneously refunded, or wrongly availed or utilised as input tax credit.

The petitioner contended that as per this circular, the Superintendent's authority was limited to matters not exceeding Rs. 10,00,000. However, in this case, the amount involved exceeded Rs. 16,00,000, rendering the order beyond the Superintendent's jurisdiction.

Upon consideration, the court granted two days to the respondents, represented by K.D. Nag, to seek instructions.

Later, K. D. Nag, representing the respondents, referred to instructions received from the Assistant Commissioner, Central GST and Central Excise Division, highlighting that the order issued on November 20, 2023, was erroneous as it was not authorised by the proper officer, in accordance with Circular No. 31/05/2018-GST dated February 9, 2018. The circular stipulated a monetary limit of Rs. Ten Lakhs for both Central and State tax regarding the incorrect utilisation of input tax credit, totaling Rs. Twenty Lakhs, for the issuance of show cause notices and the passing of orders under Sections 73 and 74 of the CGST Act.

Consequently, the Allahabad High court ruled that the impugned order lacked jurisdiction and set it aside. The respondents were granted liberty to proceed afresh in accordance with the law, and the writ petition was allowed.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

M/S Mansoori Enterprises vs U.O.I , 2024 TAXSCAN (HC) 435 , Dheeraj Srivastava , Dipak Seth