Minimum Import Price; Indian Steel Association moves Supreme Court

Steel Importers – Delhi HC – Taxscan

Steel Importers – Delhi HC – Taxscan

The Indian Steel Association moved the Supreme Court of India recently seeking transfer of all cases currently pending in the various high courts relating to minimum import price (MIP) of steel notified by the government this year.

In February through a notification, government has imposed a MIP ranging from $341 to $752 per tonne on 173 steel products to provide relief to local steel makers hurt by an increase in cheap imports of these items.

The Minimum Import price is currently being challenged in various high courts such as Delhi, Punjab & Haryana and Himachal Pradesh.

Recently a delhi high court bench comprising of Chief Justice G Rohini and Justice Jayant Nath Delhi High Court said that, Government notification on Minimum Import Price(MIP) for Steel is in Public Interest. The Court also refuses give any interim relief to Steel Importers.

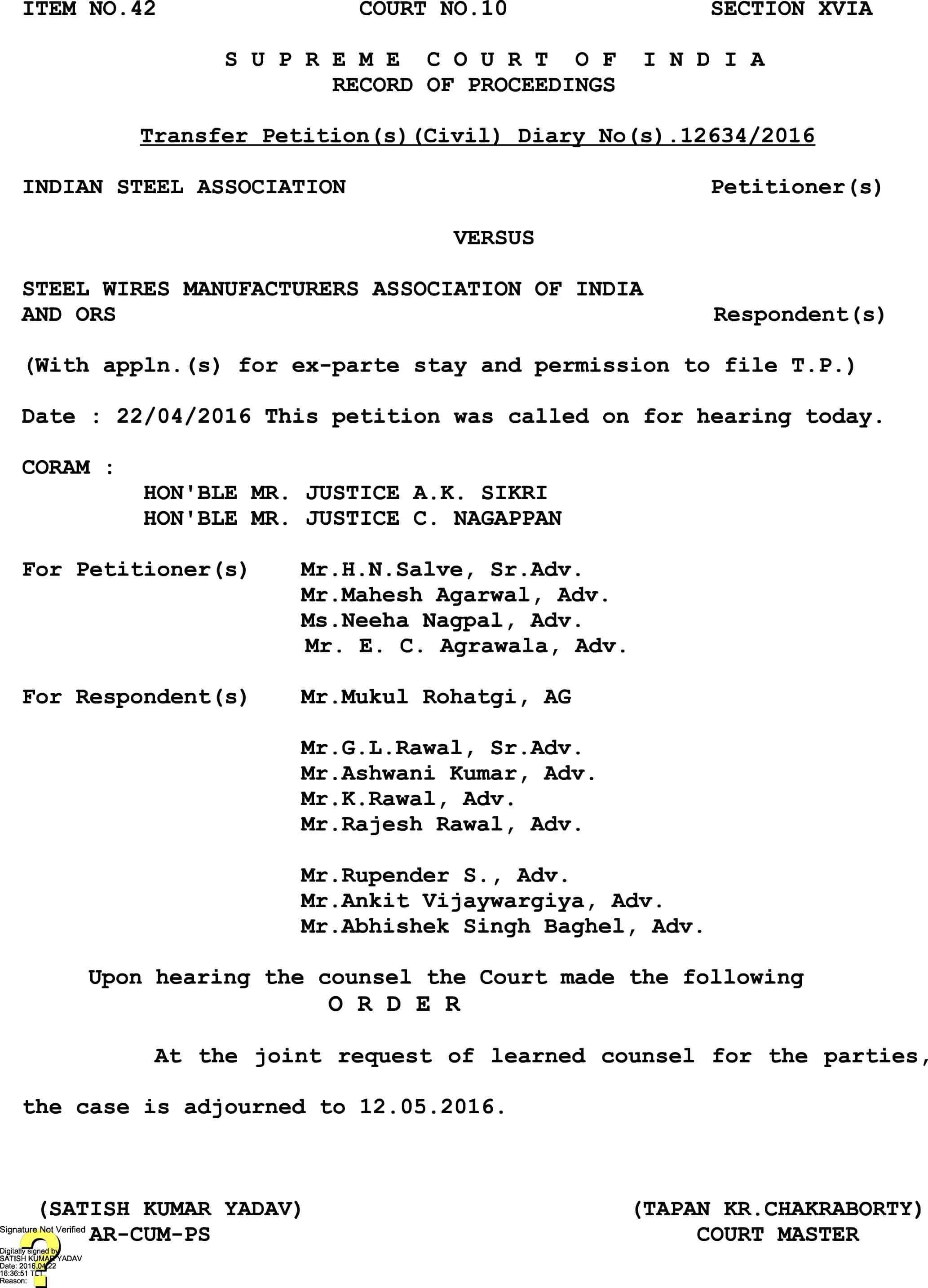

The bench of Justice A K Sikri and Justice C Nagappan heard the petitioners and listed the matter for further hearing on May 12.