Begin typing your search above and press return to search.

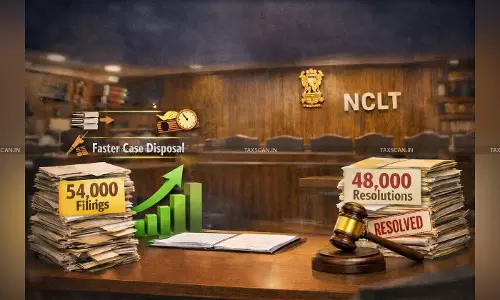

From 54,000 Filings to 48,000 Resolutions: NCLT Chief Bows Out after Transforming Tribunal Efficiency [Read Order]

Stepping down after more than 4 years at the helm, (Retd.)Chief Justice Ramalingam Sudhakar leaves behind an unforgettable legacy at the National...

![Madras HC Allows Deduction u/s 37 of Compensation Paid for Exchange Rate Fluctuation as Business Expenditure [Read Order] Madras HC Allows Deduction u/s 37 of Compensation Paid for Exchange Rate Fluctuation as Business Expenditure [Read Order]](https://images.taxscan.in/h-upload/2026/02/13/250x150_2125014-madras-hc-allows-deduction.webp)

![Affiliation Charges Collected by Universities Taxable under GST: Madras HC [Read Order] Affiliation Charges Collected by Universities Taxable under GST: Madras HC [Read Order]](https://images.taxscan.in/h-upload/2026/02/12/250x150_2124738-affiliation-charges-collected-universities-taxable-gst-madras-hc-taxscan.webp)

![OD Bank A/c Cannot be Attached for GST Dues: Madras HC allows Appeal Filing with 50% Deposit in Two Instalments [Read Order] OD Bank A/c Cannot be Attached for GST Dues: Madras HC allows Appeal Filing with 50% Deposit in Two Instalments [Read Order]](https://images.taxscan.in/h-upload/2026/02/12/250x150_2124742-od-bank-attached-gst-dues-madras-hc-allows-appeal-filing-deposit-instalments-taxscan.webp)

![Fish Meal GST Levy under Challenge Before Supreme Court Not Ground to Skip Pre-Deposit: Madras HC [Read Order] Fish Meal GST Levy under Challenge Before Supreme Court Not Ground to Skip Pre-Deposit: Madras HC [Read Order]](https://images.taxscan.in/h-upload/2026/02/11/500x300_2124621-fish-meal-gst-levy-under-challenge-before-supreme-court.webp)

![DRAT Defers PNB Housing Finance Move to Take possession of Mortgaged Property, Orders ₹20 lakh Deposit Within Two Weeks [Read Order] DRAT Defers PNB Housing Finance Move to Take possession of Mortgaged Property, Orders ₹20 lakh Deposit Within Two Weeks [Read Order]](https://images.taxscan.in/h-upload/2026/02/09/500x300_2124386-drat-defers-pnb-housing-finance.webp)

![Single GST SCN Covering Five Financial Years is Impermissible: Madras HC Quashes Order [Read Order] Single GST SCN Covering Five Financial Years is Impermissible: Madras HC Quashes Order [Read Order]](https://images.taxscan.in/h-upload/2026/02/06/500x300_2124010-single-gst-scn-covering-five-financial-years-impermissible-madras-hc-quashes-order-taxscan.webp)

![Early Judicial Signal on Section 74A: Madras HC decides S. 74 Order issued for FY 2024-25 [Read Order] Early Judicial Signal on Section 74A: Madras HC decides S. 74 Order issued for FY 2024-25 [Read Order]](https://images.taxscan.in/h-upload/2026/02/06/500x300_2123965-madras-high-court-judicial-signal-fy-2024-25-madras-hc-gst-madras-high-court-gst-ruling-taxscan.webp)

![Income Tax Return Figures Alone Insufficient for GST Demand: Madras HC Orders Forensic Verification [Read Order] Income Tax Return Figures Alone Insufficient for GST Demand: Madras HC Orders Forensic Verification [Read Order]](https://images.taxscan.in/h-upload/2026/02/02/500x300_2123399-income-tax-return-figures-alone-insufficient-gst-demand-taxscan.webp)

![Impugned Communication restricting F-Card Holder’s Practice has been Issued without Authority under Law: Madras HC Sets Aside Customs Restriction [Read Order] Impugned Communication restricting F-Card Holder’s Practice has been Issued without Authority under Law: Madras HC Sets Aside Customs Restriction [Read Order]](https://images.taxscan.in/h-upload/2026/01/31/500x300_2122742-impugned-communication-restricting-f-card-holders-practice-been-issued-taxscan.webp)