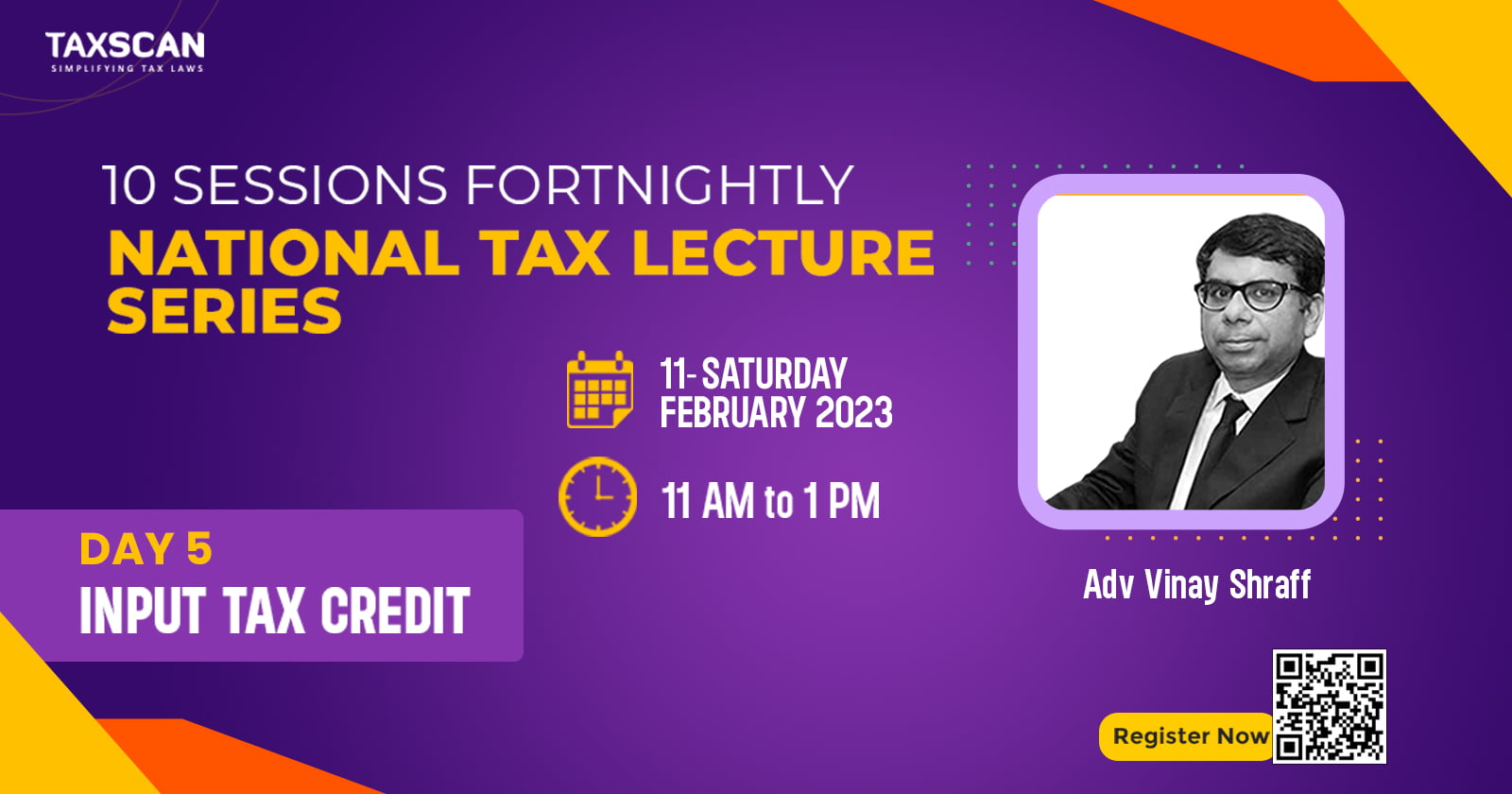

10 Sessions Fortnightly National Tax Lecture Series

10 Sessions Fortnightly National Tax Lecture Series – Taxscan – taxscan Academy

10 Sessions Fortnightly National Tax Lecture Series – Taxscan – taxscan Academy

Free Live Webinars on Jurisprudence in the erstwhile indirect tax regime to handle potential litigation issues under GST

(Central Excise, VAT, Service Tax, Central Sales Tax laws etc)

Faculty - Adv Vinay Shraff

DAY 3

Valuation disputes

📆 Feb 11, Saturday

🕔11.00 AM - 01.00 PM

What will be covered in the series

▪️ Classification disputes

▪️ Disputes surrounding definition of supply and other fundamental concepts

▪️ Valuation disputes

▪️ Place and Time of supply

▪️ Input tax credit

▪️ Exemptions, exports, zero rating & refunds

▪️ Summons, inspection, search and seizure & audit

▪️ Arrest and prosecutions

▪️ Handling litigation – Reply to SCN, appeals, Writs & SLPs

▪️ Constitutional aspects & Interpretation of statues

For Queries - 8891 128 677, 89434 16272, info@taxscan.in