5 Benefits GST will bring to Your Start-Up

Ever since the GST regime was rolled out in India, there has been a sense of relief among the taxpayers. Not only has the implementation of GST helped remove the cascading effect of various taxes, it has also aided the Government in adding numerous taxpayers across the nation and reducing tax evasion. But what has been the most significant impact is the fact that it has created opportunities – opportunities in the form of ease of doing business, cross-border trade, added employment prospects, and many more. No wonder India’s GDP growth rate is expected to be 7.36% in 2018 and the further rise in the years to come while the global GDP growth rate is hovering between 3% – 4%.

Recent developments with regards to GST implementation have now made it easier for companies to establish themselves in the growing Indian economy. The start-up ecosystem is also expected to benefit a lot from the ease of GST registration, tax filing, and compliance.

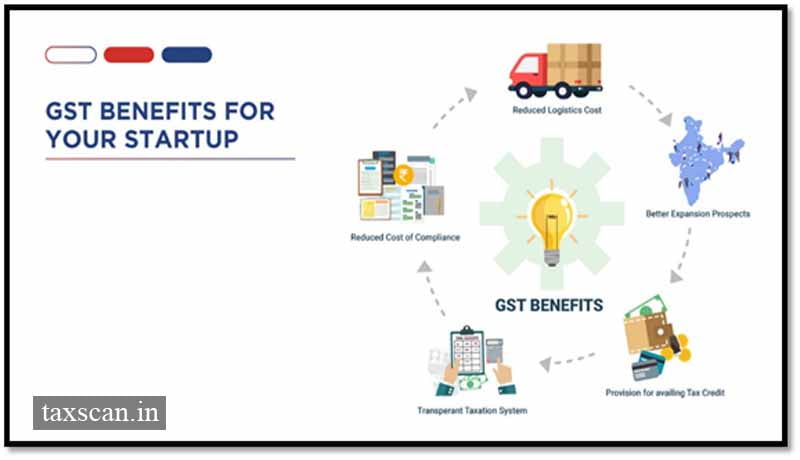

5 ways Start-ups will benefit under GST:

Transparent taxation system

Everything from GST registration to tax payments happens on the official online portal, GSTN (GST Network). Thus, there is no unnecessary human interference and scrutiny involved. It was challenging earlier on to explain the intricacies of a transaction to various tax officials from the VAT, Excise, CST and other departments. Also, there was a scope for corruption resulting in frustration for the business owners. GST is entirely paperless and transparent helping businesses stay away from these issues. Furthermore, the Government has recognized numerous GSPs (GST Suvidha Providers) across the country to help taxpayers register for GST, file taxes, and be GST compliant.

Reduced cost of compliance

With the subsuming of various taxes into one single tax – GST – there is less complexity in terms of the number of taxes to file. Hence, there is no need for start-up organizations to assign a separate department to take care of the taxation requirements. Of course, understanding GST and its dynamic rules seems like a tough task at this moment, but being compliant will cease to be a gigantic task once the tide settles in.

Provision for availing tax credit

In the pre-GST era, setting up a manufacturing facility was a capital and tax-intensive activity. Acquiring machinery, furniture, and office equipment required substantial capital and taxes to be paid in advance. While the need for capital still remains, start-ups have the option of availing input tax credit on the taxes paid. This comes as a relief for companies that are just starting up and have limited budget for their operations. The input tax credited can be put back into their working capital.

Reduced logistics cost

Long queues of logistic vehicles at state borders have been very common in the past. With all the state governments having different tax structures in terms of Octroi and CST for inter-state transportation of goods, implementation of GST comes as a much welcome move. The requirements for Octroi and CST have been done away with, and GST has taken over all the predominant tax requirements, whether it be on intra-state or inter-state transportation. Further, reduced taxes on transportation also reduces the overall cost of the goods. This makes it easier for start-ups to begin providing products across state boundaries right from the word GO.

Better expansion prospects

Most start-ups used to restrict their offices and operations to one particular state in order to save on the taxes and complexities arising out of setting up and operating multi-state offices. This limited their expansion capability giving them access to a much smaller customer-base and fiercer competition. While GST registration is still required in all the states they have offices in, there is no need to register for GST if they just sell their products in other states of the country. This enables them to reach a wider audience and offer their products/services across the nation, allowing them to compete better with the other established companies.

While GST implementation is bringing in a plethora of advantages, there is a fair share of disadvantages too that the start-ups will face. The multi-tier GST slabs, complexities in claiming input tax credit, and increased frequency of filing taxes will deter their operational efficiency until an equilibrium is reached. Access to ample start-up and working capital has always been a cause of concern for them. While the banks may continue to mitigate risks by asking for enhanced collateral or traditional equity, several trade finance organizations and Fintech companies are giving them easy, low-cost access to funds, helping them concentrate better on their core competence.

Amit Parmar is a Senior Vice President, Vayana Network, GST Platform.