A New Dawn in the GST Regime

SahiGST – Taxscan

SahiGST – Taxscan

An interesting conversation between two friends:- Krishna and Arjun

Krishna (Fictional Character):- Heyy Arjun, How are you? You look very worried, kind of disturbing. what happened? I might be able to provide solace to you. Tell me about your problem.

Arjun (Fictional Character) :- Hi Krishna, yes I am a bit confused. While GST was envisioned as a Good and Simple Tax by the government when it first came into the picture on the 1st July 2019. But, the industry and particularly the small and medium businessman like me, have felt a bit uncomfortable initially with the acceptance of this new law. Now, after nearly after 21 Months of this law, we have been able to understand the Law as well as its nitty-gritty.

Krishna:- So then, what is the problem now?

Arjun:- The real problem is the beginning of this new financial year, there are many changes that are coming into force from 1.4.2019 onwards. Who will help me understand these new provisions of GST?

Krishna:- Okay !! don’t worry I will help you understand these changes, you must have heard of all these as they were announced in various GST Council meetings, but are being applicable from 1st April 2019 onwards.

Arjun:- You mean these are not new provisions?

Krishna:- Yes! Let me walk you through each one of them.

Arjun, you remember telling me how one of your cousins has a turnover of only 22 Lacs but still had to register for GST as the limit for GST registration was 20 Lacs or more of turnover.

Arjun:- Was? I guess, it still is.

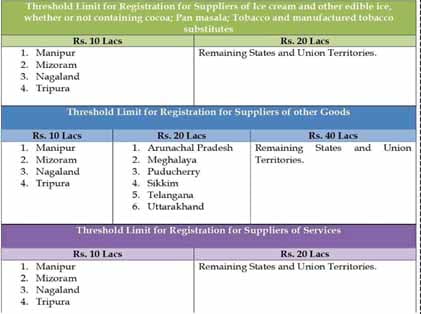

Krishna:- No Arjun, w.e.f 1st April 2019. The GST Registration limit has been increased to Rs 40 Lacs.

Arjun:- Are you Serious? This cannot be that simple, tell me what is the catch?

Krishna:- Arjun, you are smart, see this table, you will understand the catch.

Krishna:- Right Arjun, hence from 1st April 2019, a new Scheme is now available @ 6% to Intra-State Suppliers of Services. An Intra-State supplier can now pay GST at the rate of 6% (3% for Central and 3% for respective State) on first supplies of services for Rs. 50 lakhs. This is effective from 1 April 2019, provided the aggregate turnover of the supplier does not exceed Rs. 50 lakhs during the previous financial year.

Arjun:- Wow !! this is a good step by the government. Now my Services business can also come under the composition scheme net.

Krishna:- Have you created your compliance calendar for GST returns?

Arjun:- Not yet, I don’t know if the dates have been notified for GSTR -1 and 3B for April -19 have been notified?

Krishna:- Yes, they have been notified. Here are the details:-

For GSTR-1, If the turnover of registered person is up-to Rs. 1.50 crores for the months of April to June 2019, he shall file his GSTR-1 on a quarterly basis and the due date shall be 31st July 2019.

If the turnover of a registered person exceeds Rs. 1.50 crores for the months of April to June, 2019, he shall file his GSTR-1 on a monthly basis and the due date shall be 11th of succeeding month.

For GSTR-3B, Form GSTR-3B shall be filed on a monthly basis by every taxpayer who is required to file GSTR-3B and due date shall be 20th of the succeeding month.

Arjun:- I have some pending ITC to be Claimed for the year 2017-18. Can I Claim them now?

Krishna:- Yes Arjun, Last chance to avail Input Tax Credit relating to F.Y. 2017-18 is still 20 April 2019. (the due date of furnishing the return for the month of March 2019 i.e. by April 20, 2019)

Arjun:- Thanks Krishna, you have been a saviour for me. Anything else, you think I should keep in mind with the beginning of this F.Y. 2019-20?

Krishna:- Yes Arjun, Don’t forget that with the start of the new financial year 2019-20 (w.e.f. 01/04/2019), a new invoice series, unique for the financial year is to be started by the GST taxpayers

If the provisions of Rule 46 or Rule 49 are not adhered to, apart from being a compliance issue, taxpayers may face problem while generating E-Way Bill on E-way bill system or furnishing their Form GSTR 1 or for applying for a refund on GST Portal. It is, therefore, necessary that suitable modification may be made by the taxpayers in this regard in their invoices or bill of supply, to avoid any inconvenience in the future.

Arjun:- Ohh that’s great, Thanks Krishna for your help.

Krishna:- Ohh don’t mention that, what are friends for? I hope you are using (www.sahigst.com) for your GST Return filings?

Arjun:- Yes, SahiGST is a great GST compliance software for SMEs like us. Thanks for suggesting this solution in our previous meeting.