Adjudication of Notices issued to Multiple-Noticees under GST: CBIC revises Circular on Proper Officer [Read Circular]

The board revised the circular on Proper Officers u/s 73 and 74 of CGST and IGST Act, further clarifying the jurisdiction of the officers

![Adjudication of Notices issued to Multiple-Noticees under GST: CBIC revises Circular on Proper Officer [Read Circular] Adjudication of Notices issued to Multiple-Noticees under GST: CBIC revises Circular on Proper Officer [Read Circular]](https://www.taxscan.in/wp-content/uploads/2024/12/CBIC-Central-Board-of-Indirect-Taxes-and-Customs-Adjudication-of-multiple-notices-GST-update-taxscan.jpg)

The Central Board of Indirect Taxes and Customs ( CBIC ) has revised the circular on the proper officers under Section 73 and 74 of the GST Act to address the adjudication of notices issued to the multiple noticees under GST.

The Notification No. 02/2022-Central Tax, dated March 11, 2022, introduced a new provision (para 3A) to Notification No. 02/2017-Central Tax, empowering Additional Commissioners and Joint Commissioners of Central Tax from specified Commissionerates with all-India jurisdiction to adjudicate show-cause notices ( SCNs ) issued by officers of the Directorate General of Goods and Services Tax Intelligence ( DGGI ).

Later, Notification No. 27/2024-Central Tax, dated November 25, 2024, replaced Table V of Notification No. 02/2017, further increasing the number of such empowered officers. This amendment, effective from December 1, 2024.

Become a PF & ESIC expert with our comprehensive course - Enroll Now

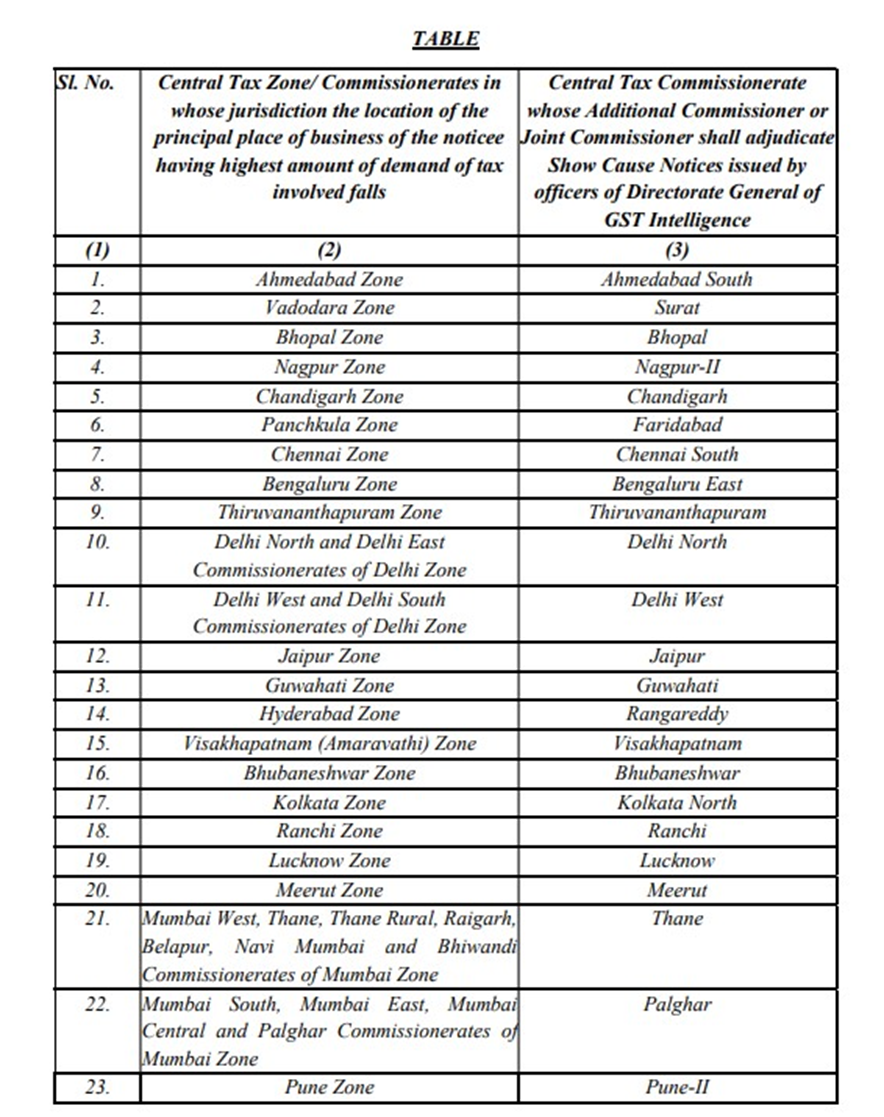

With regards to the amendment to the Para 7.1 of the Circular No. Circular No. 31/05/2018-GST dated 9th February, 2018 (as amended by Circular No. 169/01/2022-GST dated 12th March, 2022), it was stated that SCNs issued by DGGI officers may involve multiple noticees with the same or different PANs or multiple SCNs on the same issue for noticees with the same PAN, often spanning jurisdictions of multiple Central Tax Commissionerates. To streamline adjudication in such cases, Additional/Joint Commissioners of Central Tax from specified Commissionerates have been granted all-India jurisdiction through amendments via Notification No. 02/2022-Central Tax and Notification No. 27/2024-Central Tax. These officers can adjudicate SCNs regardless of the tax amount involved. Principal Commissioners/Commissioners allocate these cases to the designated Additional/Joint Commissioners in their zones based on specified criteria, such as the highest tax demand among noticees.

For subsequent SCNs on the same issue involving different PANs, adjudication depends on whether the noticee is singular or multiple. Singular noticees' SCNs are handled by their jurisdictional adjudicating authority, while those involving multiple noticees fall under a common adjudicating authority, determined by the same criteria as outlined above.

The amendment is as follows:

“7.1 In respect of show cause notices issued by officers of DGGI, there may be cases where,

(i) a show cause notice is issued to multiple noticees, either having the same or different PANs; or

(ii) multiple show cause notices are issued on the same issue to multiple noticees having the same PAN

and the principal place of business of such noticees fall under the jurisdiction of multiple Central Tax Commissionerates. For the purpose of adjudication of such show cause notices, Additional/Joint Commissioners of Central Tax of specified Commissionerates have been empowered with All India jurisdiction through amendment in the Notification No. 02/2027 dated 19th June, 2017 vide Notification No. 02/2022-Central Tax dated 11th March, 2022, as further amended vide Notification No. 27/2024-Central Tax dated 25th November, 2024. Such show cause notices may be adjudicated, irrespective of the amount involved in the show cause notice(s), by one of the Additional/Joint Commissioners of Central Tax empowered with All India jurisdiction vide the above mentioned notifications. Principal Commissioners/ Commissioners of the Central Tax Commissionerates specified in the said notification will allocate charge of Adjudication (DGGI cases) to one or more Additional Commissioners/ Joint Commissioners posted in their Commissionerates. Where the location of principal place of business of the noticee, having the highest amount of demand of tax in the said show cause notice(s), falls under the jurisdiction of a Central Tax Zone/Commissionerate mentioned in column 2 of the table below, the show cause notice(s) may be adjudicated by one of the Additional Commissioners/ Joint Commissioners of Central Tax, holding the charge of Adjudication (DGGI cases), of the Central Tax Commissionerate mentioned in column 3 of the said table corresponding to the said Central Tax Zone/Commissionerate. Such show cause notice(s) may, accordingly, be made answerable by the officers of DGGI to the concerned Additional/ Joint Commissioners of Central Tax.

Become a PF & ESIC expert with our comprehensive course - Enroll Now

7.1.1 It is further clarified that in cases where a show cause notice has been issued to multiple noticees, either having same or different PANs, and the said show cause notice is required to be adjudicated by a common adjudicating authority as per the highest amount of demand of tax in accordance with the criteria mentioned in para 7.1 above, then if any show cause notice(s) is issued subsequently on the same issue to some other noticee(s) having PAN(s) different from the PANs of the noticees included in the earlier show cause notice, the said later show cause notices is to be adjudicated,

(i) by the jurisdictional adjudicating authority of the noticee, if there is only one noticee (GSTIN) involved in the said later show cause notice; or

(ii) by the common adjudicating authority in accordance with the criteria mentioned in para 7.1 above as applicable independently based on the highest amount of tax demand in the said later show cause notice, if there are multiple noticees (GSTINs) involved in the said later show cause notice having principal place of business under the jurisdiction of multiple Central Tax Commissionerates.’’

Become a PF & ESIC expert with our comprehensive course - Enroll Now

Further para 7.3 of the Circular No. 31/05/2018-GST dated 9th February, 2018 (as amended by Circular No. 169/01/2022-GST dated 12th March, 2022) is substituted as below:

“7.3 In respect of show cause notices issued by the officers of DGGI prior to Notification No. 27/2024-Central Tax dated 25th November, 2024 coming into effect, involving cases mentioned in para 7.1 read with para 7.1.1 above and where no adjudication order has been issued upto 30th November, 2024, the same may be made answerable to the Additional/Joint Commissioners of Central Tax, having All India jurisdiction, in accordance with the criteria mentioned in para 7.1 read with para 7.1.1 above, by issuing corrigendum to such show cause notices.”

The board will issue further trade notices.

To Read the full text of the Circular CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Circular No: 239/33/2024-GST , 4 December 2024