AI proposes, Tribunal Disposes! Bengaluru ITAT Bench in Soup after AI-generated Order cites non-existent Cases [Read Order]

It transpired that the decision relied on fabricated Supreme Court and Madras High Court judgments that were seemingly generated through ChatGPT

![AI proposes, Tribunal Disposes! Bengaluru ITAT Bench in Soup after AI-generated Order cites non-existent Cases [Read Order] AI proposes, Tribunal Disposes! Bengaluru ITAT Bench in Soup after AI-generated Order cites non-existent Cases [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/02/ITAT-ITAT-Bengaluru-AI-generated-Order-ITAT-Bengaluru-AI-generated-order-case-TAXSCAN.jpg)

In a shockingly interesting incident, the Bengaluru bench of the Income Tax Appellate Tribunal (ITAT) was forced to withdraw a tax ruling after discovering that it was based on legal precedents that do not exist. The tribunal had issued an order in December 2024, ruling in favor of the tax department. However, it later emerged that the decision relied on fabricated Supreme Court and Madras High Court judgments that were seemingly generated through ChatGPT.

According to a report by Mint, the tribunal cited three Supreme Court rulings and one Madras High Court judgment to support its decision, yet none of these cases could be found in official legal archives. Among the cited cases were K. Rukmani Ammal v. K. Balakrishnan (1973) 91 ITR 631 (Madras HC), S. Gurunarayana v. S. Narasinhulu (2004) 7 SCC 472 (SC), and Sudhir Gopi v. Usha Gopi (2018) 14 SCC 452 (SC)—all of which turned out to be fictitious. Additionally, a fourth reference, 57 ITR 232 (SC), was an actual case but was entirely unrelated to the matter at hand, as per the report.

Know Practical Aspects of Tax Planning, Click Here

The case revolved around the taxability of a ₹669 crore transaction, in which an individual transferred a partnership interest into a trust. Generally, transfers exceeding ₹50,000 without consideration are taxable unless made to a relative. The assessee’s lawyers argued that partnership interest is not classified as "property" under tax law, but the tribunal disagreed, ruling that such an interest was akin to a stock share and thus taxable. This decision was unusual, as similar cases have historically favored the assessee.

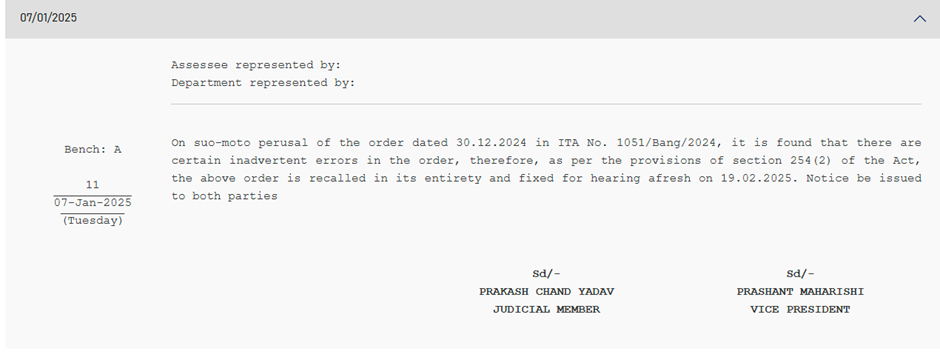

The order was delivered by the bench of Prashant Maharishi, Vice President and Prakash Chand Yadav, Judicial Member in the case bearing number ITA 1051/BANG/2024 pertaining to Assessment Year 2018-19.

Further scrutiny revealed that tax department representatives had used ChatGPT to search for legal precedents and submitted the AI-generated results without verification. Shockingly, the ITAT failed to cross-check the validity of these citations, effectively copy-pasting them into its ruling. Once the error was identified, the order was quietly withdrawn a week later through a notice citing “inadvertent errors.”

How to Audit Public Charitable Trusts under the Income Tax Act Click Here

This incident raises concerns over the increasing reliance on Artificial Intelligence for legal research. AI tools, including ChatGPT, are known to produce "hallucinations"—fabricated but plausible-looking information. While AI can be a valuable research aid, experts warn that legal professionals must rigorously fact-check AI-generated citations before relying on them in official proceedings.

The controversy comes just days after a major US law firm, Morgan & Morgan, issued an internal warning that AI can generate fake case law, leading to potential legal and professional consequences. In a separate US case, a federal judge fined three lawyers $5,000 after they submitted fictitious citations generated by AI in a lawsuit against Walmart.

Read More: Lawyers in Walmart lawsuit admit AI 'hallucinated' case citations | Reuters

The current ITAT matter has been now posted for hearing on 03-Apr-2025 (Thursday).

The retracted order can be accessed by clicking the blue button below. Detailed Story done earlier based on the retracted order available here.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Buckeye Trust vs PCIT-2 , 2025 TAXSCAN (ITAT) 511 , ITA No.1051/Bang/2024 , 30 December 2024 , Sri Sumit Khurana, A.R, Ms. Divya Motwani , Sri D.K. Mishra