All you need to know about New Functionality on GST Portal: How to Claim ITC which is not in GSTR-2A/2B?

In a major relief to the taxpayers, the new feature has been updated on the GST Portal wherein the taxpayer can claim the Input Tax Credit (ITC) even when it is not displayed in GSTR-2A or 2B.

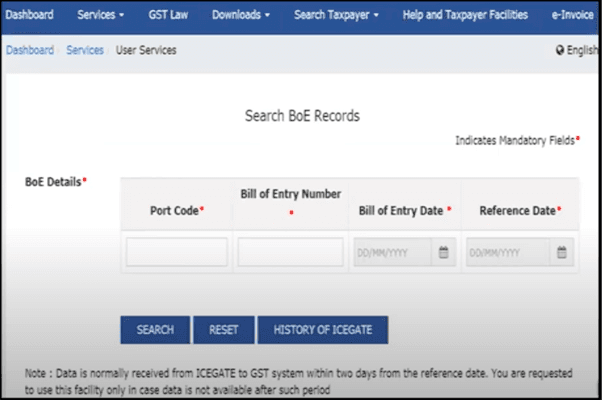

In order to help importers of goods, and recipients of supplies from SEZ, search Bill of Entry details, which did not auto-populate in GSTR-2A, a self-service functionality has been made available on the GST Portal that can be used to starch such records in GST System, and fetch the missing records from ICEGATE.

It is noteworthy that it usually takes 2 days (after the reference date) for BE details to get updated on GST Portal from ICEGATE. This functionality should, therefore, be used if data is not available after this period. Note: The reference date would be either Out of charge date, Duty payment date, or amendment date-whichever is later.

For records of type IMPG (Import of Goods), details of Period for Form GSTR-2A (system generated Statement of Inward Supplies); Reference Date; Bill of Entry Details like Port Code, BoE Number, BoE Date & Taxable Value; and Amount of Tax would be displayed.

For records of type IMPGSEZ (Import of Goods from SEZ), details of Period for Form GSTR-2A; Reference Date; GSTIN of Supplier; Trade Name of Supplier; Bill of Entry Details like Port Code, BoE Number, BoE Date & Taxable Value; and Amount of Tax would be displayed.

Taxpayers are advised to confirm correct details either from BE documents or using the ICEGATE portal

For more details, click here.

In case of any problem, please create a ticket at the GST Helpdesk or GST Self-service portal by including various details namely complete details of BE records, GSTIN, BE Number, BE Date, Port Code, Reference Number, and Screenshot of ICEGATE portal with BE record. Any error that they may have encountered while using the “Search BoE” functionality on GST Portal.

Steps to be Followed

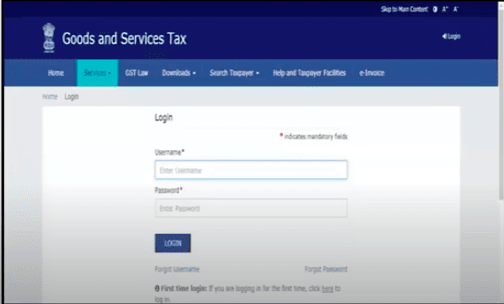

Step 1: The taxpayers' must login into the GST Portal.

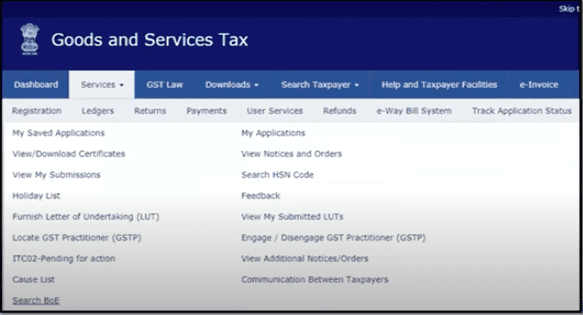

Step 2: Click on Service Tax and then choose ‘Search BoE’ which is a new functionality developed in the GST Portal.

Step 3: As soon as you click on ‘Search BoE’, you need to enter all the details related to the Bill of Entry namely Port code, Bill of Entry Number, Bill of Entry Date, and Reference Date. You may enter the details of the BoE whose ITC can’t be seen on the GSTR-2A or 2B.

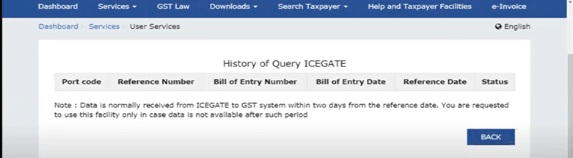

Step 4: History of fetched BOE details from ICEGATE along with the status of the query are displayed after 30 minutes from the time of triggering the query

Support our journalism by subscribing to Taxscan AdFree. Follow us on Telegram for quick updates.