All you Need to Know about Newly introduced AIS on Income Tax E-Filing Portal

The Income Tax Department has rolled out the new Annual Information Statement (AIS) on the Income Tax E-Filing Portal. It provides a comprehensive view of information to taxpayers, with facility to capture online feedback.

The Taxpayers should remember that Annual Information Statement (AIS) includes information presently available with the Income Tax Department. There may be other transactions relating to the taxpayer which are not presently displayed in AIS.

The new AIS includes additional information relating to interest, dividend, securities transactions, mutual fund transactions and foreign remittance information, which gives a comprehensive view of the assessee’s financial transactions.

Advantages of AIS

Taxpayers can send online feedback to the Income Tax department about any incorrect entry in their transaction history captured in the new tax filing portal.

The transaction history captured in the new comprehensive annual information statement (AIS) has a facility for online feedback.

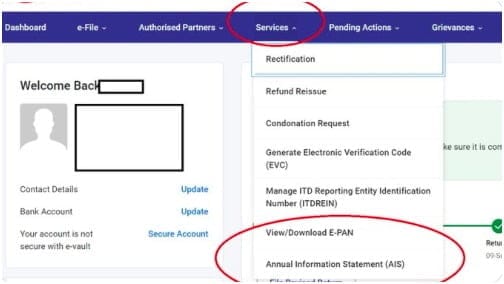

How to Access AIS on Income Tax Portal?

Step 1. Log in to your Income Tax account at //incometax.gov.in. Go to the Services Tab. Last option in this tab is the AIS option.

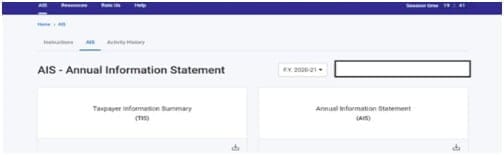

Step 2. When you click on the AIS option in the dropdown it will open a new tab with two options namely Left side - Tax Information Summary (TIS) and Right side - AIS. Both are the same. TIS is a summary and AIS is the detailed statement. You can download both.

Step 3. When you download you get a pdf statement.

Support our journalism by subscribing to Taxscan AdFree. Follow us on Telegram for quick updates.