Auditor’s Certificate mandatory only in case of Return of Deposits [Read Circular]

![Auditor’s Certificate mandatory only in case of Return of Deposits [Read Circular] Auditor’s Certificate mandatory only in case of Return of Deposits [Read Circular]](https://www.taxscan.in/wp-content/uploads/2018/02/Auditors-Taxscan.jpg)

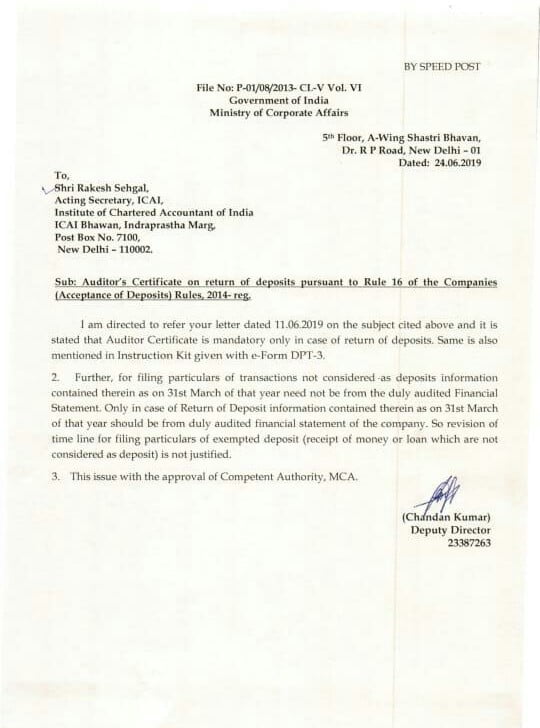

The Ministry of Corporate Affairs (MCA) has clarified the issues relating to Auditor’s Certificate on Return of Deposits pursuant to Rule 16 of the Companies (Acceptance of Deposits) Rules, 2014.

This has reference to Rule 16 of the Companies (Acceptance of Deposits) Rules, 2014 and further amendments.The Ministry of Corporate Affairs vide its letter no. File No: P-01/08/2013- CL-V Vol. VI dated June 24, 2019, has clarified that (i) The Auditor’s Certificate is mandatory only in case of return of deposits. (ii) For filing particulars of transactions not considered as deposits information contained therein as on 31st March of that year need not be from the duly audited Financial Statement, and (iii) Only in case of Return of Deposit information contained therein as on 31st March of that year should be from duly audited financial statement of the company.

Also in order to provide guidance to members, the Auditing and Assurance Standards Board of ICAI has issued Illustrative Auditor’s Certificate on Return of Deposits.