The Central Board of Indirect Taxes and Customs ( CBIC ) has directed Officers to strictly implement the notification regarding E-Cigarettes.

In a Circular issued by CBIC has said that, Considering the adverse health impact of e-Cigarettes/ENDS and in order to prevent the initiation of nicotine through e-cigarettes by non-smokers and youth, with special attention to vulnerable groups, the Directorate General of Foreign Trade, Department of Commerce, Ministry of Commerce & Industry has issued the aforesaid Notifications to ensure that Import and Export of c-Cigarettes or any parts or components thereof such as refill pods, atomisers, cartridges etc. including all forms of Electronic Nicotine Delivery Systems (ENDS), Heat not burn products, e-hookah and the like devices, by whatever name and shape, size or form it may have, but does not include any product licensed under the Drugs and Cosmetics Act, 1940 under ITC HS Code: 8543 is prohibited in accordance with the Prohibition of Electronic Cigarettes(Prohibition, Manufacture, Import, Export, Transport, Sale Distribution, Storage and Advertisement) Ordinance, 2019.

The CBIC also said that, all the officers under your jurisdiction may be directed to ensure strict implementation of the aforesaid notifications so that any attempts of Import/ Export of such goods can be effectively prevented.

Earlier Central Government had banned E-Cigarettes through an ordinance of the Prohibition of Electronic Cigarettes (production, manufacture, import, export, transport, sale, distribution, storage and advertisement) Ordinance, 2019.

Electronic-cigarettes are battery-operated devices that produce an aerosol by heating a solution containing nicotine, which is the addictive substance in combustible cigarettes. These include all forms of Electronic Nicotine Delivery Systems, Heat Not Burn Products, e-Hookah and the like devices. These novel products come with attractive appearances and multiple flavours and their use has increased exponentially and has acquired epidemic proportions in developed countries, especially among youth and children.

Upon promulgation of the Ordinance, any production, manufacturing, import, export, transport, sale (including online sale), distribution or advertisement (including online advertisement) of e-cigarettes shall be a cognizable offence punishable with an imprisonment of up to one year or fine up to Rs. 1 lakh or both for the first offence; and imprisonment of up to three years and fine up to Rs. 5 lakh for a subsequent offence. Storage of electronic-cigarettes shall also be punishable with imprisonment up to 6 months or fine up to Rs 50,000 or both.

The owners of existing stocks of e-cigarettes on the date of commencement of the Ordinance will have to suo moto declare and deposit these stocks with the nearest police station. The Sub-Inspector of Police has been designated as the Authorized Officer to take action under the Ordinance. The Central or State Governments may also designate any other equivalent officer(s) as Authorized Officer for enforcement of the provisions of the Ordinance.

Subscribe Taxscan Premium to view the JudgmentThe Income Tax Department is ushering in a paradigm shift in its working by introducing faceless e-assessment to impart greater efficiency, transparency and accountability in the assessment process. There would be no physical interface between the taxpayers and the tax officers.

The setting up of National e-Assessment Centre (NeAC) of the Income Tax Department is a momentous step towards the larger objectives of better taxpayer service, reduction of taxpayer grievances in line with Prime Minister’s vision of ‘Digital India’ and promotion of ease of doing business.

Union Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman will inaugurate National e-Assessment Centre ( NeAC) in New Delhi tomorrow in the presence of Shri Anurag Singh Thakur, Minister of State for Finance & Corporate Affairs. Dr. Ajay Bhushan Pandey, Revenue Secretary, Shri Pramod Chandra Mody, Chairman, CBDT will also be present. Officers of the Income Tax Department and other dignitaries shall also be linked through Multimedia Video Conferencing at Mumbai, Chennai, Kolkata, Delhi, Ahmedabad, Hyderabad, Pune and Bengaluru.

Under the new system, taxpayers have received notices on their registered emails as well as on registered accounts on the web portal www.incometaxindiaefiling.gov.in with real-time alert by way of SMS on their registered mobile number, specifying the issues for which their cases have been selected for scrutiny. The replies to the notices can be prepared at ease by the taxpayers at their own residence or office and be sent by email to the National e-Assessment Centre by uploading the same on the designated web portal.

This is another initiative by CBDT in the field of ease of compliance for our taxpayers.

The Central Board of Indirect Taxes and Customs ( CBIC ) has issued clarifications on the procedure to be followed by a registered person to claim refund subsequent to a favourable order in appeal or any other forum against the rejection of a refund claim in FORM GST RFD-06.

In a Circular issued on 3rd October, the CBIC has clarified that “Appeals against the rejection of refund claims are being disposed of offline as the electronic module for the same is yet to be made operational. As per rule 93 of the Central Goods and Services Tax Rules, 2017, where an appeal is filed against the rejection of a refund claim, re-crediting of the amount debited from the electronic credit ledger, if any, is not done till the appeal is finally rejected. Therefore, such rejected amount remains debited in respect of the particular refund claim filed in FORM GST RFD-01”.

“In case a favourable order is received by a registered person in appeal or in any other forum in respect of a refund claim rejected through issuance of an order in FORM GST RFD-06, the registered person would file a fresh refund application under the category “Refund on account of assessment/provisional assessment/appeal/any other order” claiming refund of the amount allowed in appeal or any other forum. Since the amount debited, if any, at the time of filing of the refund application was not re-credited, the registered person shall not be required to debit the said amount again from his electronic credit ledger at the time of filing of the fresh refund application under the category “Refund on account of assessment/provisional assessment/appeal/any other order”. The registered person shall be required to give details of the type of the Order (appeal/any other order), Order No., Order date and the Order Issuing Authority. The registered person would also be required to upload a copy of the order of the Appellate or other authority, copy of the refund rejection order in FORM GST RFD 06 issued by the proper officer or such other order against which appeal has been preferred and other related documents”.

The CBIC also said that, “Upon receipt of the application for refund under the category “Refund on account of assessment/provisional assessment/appeal/any other order” the proper officer would sanction the amount of refund as allowed in appeal or in subsequent forum which was originally rejected and shall make an order in FORM GST RFD 06 and issue payment order in FORM GST RFD 05 accordingly. The proper officer disposing of the application for refund under the category “Refund on account of assessment/provisional assessment/appeal/any other order” shall also ensure re-credit of any amount which remains rejected in the order of the appellate (or any other authority). However, such re-credit shall be made following the guideline as laid down in para 4.2 of Circular no. 59/33/2018 – GST dated 04/09/2018”.

Subscribe Taxscan Premium to view the JudgmentThe Central Board of Indirect Taxes and Customs ( CBIC ) has withdrawn Circular clarifying Treatment of Secondary of Post-Sales Discounts under Goods and Services Tax ( GST ).

In Circular issued on 3rd October 2019 said that, the Board, in the exercise of its powers conferred by section 168(1) of the Central Goods and Services Tax Act, 2017, has withdrawn, ab-initio, Circular No. 105/24/2019-GST dated 28.06.2019.

Earlier Circular had clarified that, “if the post-sale discount is given by the supplier of goods to the dealer without any further obligation or action required at the dealer’s end, then the post-sales discount given by the said supplier will be related to the original supply of goods and it would not be included in the value of supply, in the hands of supplier of goods, subject to the fulfilment of provisions of sub-section (3) of section 15 of the CGST Act. However, if the additional discount given by the supplier of goods to the dealer is the post-sale incentive requiring the dealer to do some act like undertaking special sales drive, advertisement campaign, exhibition etc., then such transaction would be a separate transaction and the additional discount will be the consideration for undertaking such activity and therefore would be in relation to supply of service by dealer to the supplier of goods. The dealer, being the supplier of services, would be required to charge applicable GST on the value of such additional discount and the supplier of goods, being the recipient of services, will be eligible to claim an input tax credit of the GST so charged by the dealer”.

Subscribe Taxscan Premium to view the JudgmentThe Central Board of Indirect Taxes ( CBIC ) has issued Clarifications to allow Re-Filing of Refund Claim where NIL Refund Claim was filed inadvertently under Goods and Services Tax ( GST ).

In a Circular issued by CBIC said that, “Whenever a registered person proceeds to claim a refund in FORM GST RFD-01A/RFD-01 under a category for a particular period on the common portal, the system pops up a message box asking whether he wants to apply for ‘NIL’ refund for the selected period. This is to ensure that all refund applications under a particular category are filed chronologically. However, certain registered persons may have inadvertently opted for filing of ‘NIL’ refund. Once a ‘NIL’ refund claim has been filed for a period under a particular category, the common portal does not allow the registered person to re-file the refund claim for that period under the said category”.

The CBIC also clarified that a registered person who has filed a NIL refund claim in FORM GST RFD-01A/RFD-01 for a given period under a particular category, may again apply for refund for the said period under the same category only if he satisfies the following two conditions:

It may be noted that condition (b) shall apply only for refund claims falling under the following categories:

In all other cases, registered persons shall be allowed to re-apply even if the condition (b) is not satisfied

While concluding the Circular, the CBIC also said that, “Registered persons satisfying the above conditions may file the refund claim under “Any Other” category instead of the category under which the NIL refund claim has already been filed. However, the refund claim should pertain to the same period for which the NIL application was filed. The application under the “Any Other” category shall also be accompanied by all the supporting documents which would be required to be otherwise submitted with the refund claim”.

“On receipt of the claim, the proper officer shall calculate the admissible refund amount as per the applicable rules and in the manner detailed in para 3 of Circular, No.59/33/2018-GST dated 04.09.2018, wherever applicable. Further, upon scrutiny of the application for completeness and eligibility, if the proper officer is satisfied that the whole or any part of the amount claimed is payable as the refund, he shall request the taxpayer in writing, if required, to debit the said amount from his electronic credit ledger through FORM GST DRC-03. Once the proof of such debit is received by the proper officer, he shall proceed to issue the refund order in FORM GST RFD-06 and the payment order in FORM GST RFD-05”, the department also added.

Subscribe Taxscan Premium to view the JudgmentThe President of India, Shri Ram Nath Kovind, graced and addressed the 51st Foundation Day of the Institute of Company Secretaries of India ( ICSI ) in New Delhi today (October 5, 2019).

Speaking on the occasion, the president said that in recent times, we have seen how some business enterprises have broken the trust of the people. Companies have either faltered or have come to a standstill. In the process, common people have had to suffer. He said that company secretaries play the role of a governance professional and an internal business partner. They must foster responsible business and balance economic objectives with larger socio-economic goals. They must ensure that the stakeholders understand the difference between profit and profiteering, and comply by laws. And they must deliberate on issues where we need to improve so that mistakes or limitations of the past are adequately addressed.

The President said that the concept of corporate governance is complex but the principles on which it is based are clear and well marked. Transparency, accountability, integrity and fairness are its four pillars. Company secretaries should responsibly determine how these principles are put into practice. India has drawn a blueprint to enhance its brand value as a destination for international business and investment. In this effort, how they implement company laws in a transparent manner has a critical bearing.

The President said that an efficient, fair and just corporate governance system forms a key component of our nation-building matrix. And company secretaries have a seminal responsibility to fulfil on this account. Their integrity and honesty determine our commitment to a just society.

The Indira Gandhi Institute of Development Research (IGIDR) has invited applications for the post of Finance Officer from professionally qualified Chartered Accountants.

Last Date: 15th November 2019

Number of Vacancies: 1 Posts

Educational Qualification: Qualified Chartered Accountant from the Institute of Chartered Accountants of India (ICAI).

Pay Scale: Pay Scale:

INR 37400-67000 + Grade Pay Rs.10000/-

How to Apply:

Candidates possessing the requisite qualification and experience may submit their application mentioning the ‘Post applied for ……….. on the envelope, along with application form and all relevant documents showing proof of age, experience, qualifications and two references on or before 15th November 2019 to:

The Registrar,

Indira Gandhi Institute of Development Research,

Santosh Nagar, Film City Road,

Goregaon-E, Mumbai-400 065.

For Further Information Click here

The Central Board of Direct Taxes (CBDT) has amended rule 10CB which provide for computation of interest income pursuant to secondary adjustments.

In order to make the actual allocation of funds consistent with that of the primary adjustment, section 92CE was inserted in the Income-tax Act, 1961 vide Finance Act, 2017 with effect from 1st April, 2018, to provide for secondary adjustment by attributing income to the excess money lying in the hands of the associated enterprise (AE).

The time within which the excess money, which is available with the associated enterprise of an assessee as a result of primary adjustment to the transfer price, which leads to an increase in the total income or reduction in the loss of the assessee, shall be repatriated to India, was prescribed in accordance with the provisions of section 92CE(2) by inserting Rule 10CB of the Income-tax Rules, 1962 vide Notification No. GSR 590(E) dated 15th June 2017.

Under Rule 10CB(1), a uniform time limit of 90 days, starting from different dates, is prescribed for repatriation of excess money. This is done in order to provide for uniform treatment in respect of the different types/situations of primary adjustments specified under sub-section (1) of section 92CE.

Subscribe Taxscan Premium to view the JudgmentThe Central Board of Direct Taxes (CBDT) has notified the Income Tax Authorities of Regional e-Assessment Centres. ‘E-Assessment Scheme, 2019’ vide Notification no. 61/2019 & 62/2019, dated 12-09-2019 for the purpose of conducting e-assessments.

Any scrutiny assessment carried out on or after 12-09-2019 shall be governed by this ‘E-assessment Scheme, 2019’.

The assessment will be done in electronic mode which will almost eliminate person to person contact leading to greater efficiency and transparency. The Finance Minister added that the e-assessment system was introduced in 2016 on a pilot basis.

Faceless assessment and scrutiny of income tax returns eliminate the possibility of you knowing the tax officer dealing with your case. You might never get to know him as anonymity is maintained in processing your ITR.

Subscribe Taxscan Premium to view the JudgmentThe Central Board of Direct Taxes ( CBDT ) has extended date for CIT to disposing off belated applications in the filing of Audit Report ( Form 10B ) to 31st March 2020 from September 30th.

As per Circular No. 10, dated 22-5-2019, the Commissioners of Income-tax are authorized to admit applications for condonation of delay in filing Form No. 10B for years prior to AY 2018-19 and are required to dispose off same by 30-9-2019.

Under the provisions of Section 12A of Income Tax Act, 1961 where the total income of a trust or institution as computed under the Act without giving effect to the provisions of section 1 1 and section 12 exceeds the maximum amount which is not chargeable to income-tax in any previous year, the accounts of the trust or institution for that year have to be audited by an accountant is required to furnish along with the return of income for the relevant assessment year the report of such audit in the prescribed form duly signed and verified by such accountant.

As per Rule 17B of the Income-tax Rules, 1962 the audit report of the accounts of such a trust or institution is to be furnished in Form no. 1013. As per Rule 12(2) of the Rules, such audit report is to be furnished electronically. The failure to furnish such report in the prescribed form along with the return of income results in disentitlement of the trust from claiming an exemption under sections 11 and 12 of the Act.

The delay in filing of Form no. 1013 for AY 2016 17 and AY 2017-18, in all such cases where the Audit Report for the previous year has been obtained before the filing of return of income and, has been furnished subsequent to the filing of the return of income but before the date specified under section 139 of the Act is condoned. In all other cases of belated applications in filing Form no.1013 for years prior to AY 2018-19, the Commissioners of Income-tax are authorized to admit such applications for condonation of delay u/s 119(2)(b) of the Act. The Commissioners will while entertaining such belated applications in filing Form no.1013 shall satisfy themselves that the assessee was prevented by reasonable cause from filing such application within the stipulated time.

Subscribe Taxscan Premium to view the JudgmentThe Central Board of Direct Taxes ( CBDT ) has issued clarifications in respect of option exercised under Section 115BAA of the Income Tax Act, 1961 inserted through the Taxation Laws (Amendment) Ordinance, 2019.

The Ordinance amended section 115JB of the Act relating to Minimum Alternate Tax ( MAT ) so as to, inter alia provide that the provisions of said section shall not apply to a person who has exercised the option referred to under newly inserted section 115BAA:

The CBDT clarified that, as regards allowability of brought forward loss on account of additional depreciation. it may be noted that clause (i) of sub-section (2) of the newly inserted section 115 BAA. infer alia. provides that the total income shall be computed without claiming any deduction under clause (iia) of sub-section ( I) of section 32 (additional depreciation): and clause (ii) of the said sub section provide that the total income shall be computed without claiming set off of any loss carried forward from any earlier assessment year if the same is attributable interalia to additional depreciation.

Therefore, a domestic company which would exercise option for availing benefit of lower tax rate under section 115BAA shall not be allowed to claim Set off of any brought forward loss on account of additional depreciation for an Assessment Year for which the option has been exercised and [or any subsequent Assessment Year.

The CBDT also said that, there is no timeline within which option under section 115BAA can be exercised. it may be noted that a domestic company having brought forward losses on account of additional depreciation may, if it so desires, exercise the option after set-off of the losses so accumulated.

As regards allowability of brought forward MAT credit, it may be noted that as the provisions of Section 115JB relating to MAT itself shall not be applicable to the domestic company which exercises option under Section 115BAA. it is hereby clarified that the tax credit of MAT paid by the domestic company exercising option under section 115BAA of the Act shall not be available consequent to exercising of such option.

Further, as there is no lime line within which option under section 115BAA can be exercised, it may be noted that a domestic company having credit of MAT may, if it so desires exercise the option after utilising the said credit against the regular tax payable under the taxation regime existing prior to promulgation of the ordinance, the board also added.

Subscribe Taxscan Premium to view the JudgmentThe Flipkart has invited applications from Chartered Accountants ( CA ) or Cost Accountants ( CMA ) for the post of Senior Associate.

Flipkart is India’s largest e-commerce marketplace with a registered customer base of over 100 million. In the 10 years since it started, Flipkart has come to offer over 80 million products across 80+ categories including Smartphones, Books, Media, Consumer Electronics, Furniture, Fashion and Lifestyle.

Job Description:

| Expectation: | |||||

| Performing Pre-MEC and MEC reporting and Book Closure along with relevant schedules | |||||

| Performing Variance Analysis, identify trends and recommend improvements | |||||

| Handling Internal Audit, Statutory Audit | |||||

| Ensuring compliance to Company Accounting policies and accounting standard framework | |||||

| Co-ordinating with stakeholders and resolving issues/escalations on timely manner | |||||

| Ensure maintenance of data archives for easy consumption in future | |||||

| Automation of current practices wherever possible to ensure timeliness and accuracy

|

For Further Information click here.

The Institute of Chartered Accountants of India ( ICAI ) has clarified that, there will be no postponement of CA Exams Novemner 2019.

The ICAI said that, “It has been brought to our notice that certain announcement is being circulated on social media that the CA Exams will be held in December instead of November 2019”.

The ICAI also clarified that the above announcement has not been issued by the Institute and the exams slated for November 2019 will commence from 1st November 2019 as per schedule mentioned in the Institute’s announcement hosted at www.icai.org under “Important Announcement – CA Examinations November 2019 – (14-08-2019)”

Students are requested not to pay heed to such unfounded rumours and get misled. They are hereby advised to refer only to the official web site www.icai.org for any announcement.

The West Bengal Authority of Advance Ruling in an application filed by Kay Pee Equipments Pvt Ltd held that composite goods manufactured by the Applicant that is used primarily as parts of railway locomotives are to be classified under heading 8607 and taxable @ 5% GST with no refund of the unutilized input tax credit.

The applicant seeks a ruling on the classification of railway locomotive spare parts manufactured by him for the applicable rate of tax on them.

The applicant submits that he has been classifying the manufactured goods under the Heading 8607 of the First Schedule to the Customs Tariff Act, 1975 to which the GST Act is aligned for classification in accordance with Circular no. 30/4/2018-GST and relevant Memo issued by the Railway Board.

The Department states that only the goods classifiable under Chapter 86 when supplied to the railways shall attract 5% GST with no refund. Other goods, even if supplied to the railways, will attract the applicable rate for such goods.

The Bench constituting of Ms Susmita Bhattacharya, the Joint Commissioner and Mr Parthasarathi Dey, the Senior Joint Commissioner held that “the composite goods manufactured by the Applicant that are used primarily as parts of railway locomotives are to be classified under heading 8607 and taxable @ 5% GST with no refund of the unutilized input tax credit. The same classification will apply to the Applicant’s other supplies to the railways if they are used primarily as parts of railway locomotives, provide they are not excluded by Note 2 of Section XVll. Supplies other than the above two categories, if any, shall not be classified under heading 8607.”

The Bench discussed that the interpretation Notes 2 and 3 of Section XVII, which constitutes of Chapters 86 to 89 prohibits classification of ‘parts’ or ‘accessories’…Therefore, components of railway locomotives should be classified under heading 8607 subject to the provisions of Notes 2 and 3 of Section XVll.” Further, “Heading 8607 inter alia refers to parts of railway locomotives (such as bogies, bissel-bogies, axels and wheels and parts thereof). A combined reading of the above notes, therefore, reveals that any parts of locomotives, unless specifically excluded by Note 2 of Section XVll should be classified under heading 8607, provided they are used solely or principally as parts of railway locomotives in terms with Note 3 of Section XVll.”

Subscribe Taxscan Premium to view the JudgmentThe West Bengal Authority of Advance Ruling in an application filed by Sumitabha Ray held that service by the applicant in pursuance of government projects pertaining to improving water management and construction of State Highways are eligible for exemption under GST – Service Exemption Notification.

The issue before the present Authority is whether the exemption in terms of Sl. No. 3 of Notification No. 9/2017 – IT (Rate) is available to the service as a Financial Management Specialist and Institutional Development Specialist engaged by the Government of Mizoram.

Government of Tamil Nadu, Water Resource Department, is implementing a project namely, ‘Climate Adaptation in Vennar Sub-basin in Cauvery Delta’ with fund from Asia Development Bank (ADB) for which the applicant has been engaged as a Financial Management Specialist to look after the financial management of the project fund. Also, Government of Mizoram, Public Works Department is implementing under the regional Transport Connectivity Project, which carries forward and depends various institutional development initiatives I the road sector and the applicant as the Institutional Development Specialist handles its implementation.

The applicant contends that since he is supplying services to the government involving no supply of goods, these services are in relation to the functions enlisted under the Eleventh and Twelfth Schedules of the Constitution.

The Bench constituting of Joint Commissioner Ms Susmita Bhattacharya and Mr Parthasarathi Dey held that the applicant involved in government project aiming at improving water management and in government project for improvement and construction of State highways involve functions entrusted to a Panchayat or a Municipality and hence are eligible for exemption.

The Bench analyzed that the with respect to the application of the Exemption Notification, in both the cases stated above, “the Applicant’s service is that of a consultant and does not apparently involve supply of any goods.” On whether the Applicant’s service is relatable to a function listed under the Eleventh or Twelfth Schedule it has been held that Entry 3 of the Eleventh Schedule of the Constitution includes minor irrigation, water management and watershed development and hence the applicant is providing pure service to the State government. Further, Entry 13 of the Eleventh Schedule lists roads, etc., but since Article 243M(2) states that the provision would not apply to the State of Mizoram, a reference to Entry 4 of the Mizoram Municipalities Act, 2007 which includes roads and bridges, etc. it can be inferred that the project involves a function entrusted to a Municipality.

Subscribe Taxscan Premium to view the JudgmentThe Institute of Chartered Accountants of India ( ICAI ) renewed its Memorandum of Understanding (MOU) with the Institute of Chartered Accountants in England and Wales ( ICAEW ) on historic day of October 2, 2019 at London, UK to recognize the qualification, training of each other and admit the members in good standing by prescribing a bridging mechanism. The renewal of this MOU demonstrates the strengthening ties and further commitment of ICAI and ICAEW to work even more closely to build a World of Strong Economies with the best professional skills.

Speaking on the renewal of the agreement with ICAEW, CA. Prafulla P. Chhajed, President ICAI in his address remarked “Signing of this MoU would renew India’s focus for facilitating the export of Accountancy Services and promotion of Accountancy Services in the digital world which is earmarked as one of the important Champion Sector initiatives of the Government of India. It would help in increasing the professional avenues for Indian professionals by facilitating recognition of Indian accounting professionals with local Accountancy qualification in the UK in addition to existing ICAI qualification.”

President ICAI further added “The MoU would facilitate global mobility of members and further strengthen the ties between India and United Kingdom (U.K.). Our mission is to make the next decade as a decade of accounting professionals. It is befitting that we are signing this MoU on Gandhi Jayanti, the birthday of Mahatma Gandhi. He united India and we are uniting together to give our members greater opportunities in each other’s countries.”

Ms. Fiona Wilkinson, President, ICAEW said “ This MOU will further strengthen the relationship between ICAEW and ICAI. In the modern, globally connected world, professional bodies need to work together across country borders, ensuring we learn from each other and support our members in different jurisdictions.”

He further added “Accountants and auditors play important roles in delivering business confidence, a very valuable commodity which is crucial for the continuing growth of economies and financial markets worldwide. ICAEW works in partnership with national accountancy bodies around the world to help promote and develop best practice, and we are happy to be working closely with ICAI too. We look forward to working closely with each other and to collaborate further in the field of research & accounting.”

Recently, various Media reports were reported about major financial irregularities and failure of internal control systems leading to the downfall of PMC Bank. Considering the enormity of the matter, the Institute of Chartered Accountants of India (ICAI) in consonance with its role as a Regulator has triggered its Disciplinary mechanism by writing to the concerned Bank and also to all concerned regulatory agencies i.e. the Vigilance Department of RBI and the Commissioner of Maharashtra Co-operative Societies, requesting them to provide requisite details of their findings related to it along with details of any member/firm alleged to be involved in the said matter.

ICAI has also written to the Statutory Auditor of PMC Bank pertaining to financial years 2017-18 and 2018-19 seeking clarification on the matter.

ICAI would be actively pursuing the issue with the concerned regulators so as to examine the matter in detail and would also take action through its proactive Disciplinary process against any member, if so, found to be involved in the matter.

The National Anti-Profiteering Authority ( NAA ) in its case number 47/2019 i.e. Shri Gaurav Gulati v M/s Paramount Propbuilt held Paramount Propbuilt Pvt. Ltd. to be liable of anti-profiteering for not passing on the benefit of ITC arising out of the reduction in the price of flat, on the introduction of GST.

The applicant had filed a complaint on 19.06.2018 before the Uttar Pradesh State Screening Committee on Anti-profiteering alleging that he was not passed the benefit of Input Tax Credit by way of reduction in the price of flat, on the introduction of GST on his booking a flat in the respondent’s project “Paramount Emotions”. The DGAP after computing the amount of ITC not passed on/required to be passed on claimed that the profiteering had been examined w.r.t. the 1557 buyers who had made bookings either during the pre-GST period or during the post-GST period but before the receipt of Completion Certificate.

The respondent submitted that the assumptions made and the criteria used by the DGAP to assess the profiteered amount was incorrect. He stated that in case of a real estate development company, there were multiple kinds of inputs some of which were eligible for ITC in the pre-GST regime, however post-GST, while many of the indirect taxes had been subsumed and ITC was available on inputs, there were constraints/conditions on utilizing the ITC especially when any excess ITC was not available as a refund and further submitted documentary evidence to support other contentions relating to completion certificate and passing of benefit.

The Quorum consisting of Sh B.N. Sharma as the Chairman, Sh J.C. Chauhan and Sh Amand Shah as the technical members held that the Respondent has denied benefit of ITC to the buyers of the flats being constructed by him in the present project and resorted to profiteering on the basis of the following contentions raised by the parties:

The Applications are invited for the Empanelment of Chartered Accountants for the office of the Official Liquidator, High Court of Gujarat.

The prescribed application form for empanelment of Chartered Accountants for the Office of the Official Liquidator, High Court of Gujarat may be obtained from the website of the Hon’ble High Court of Gujarat, Ministry of Corporate Affairs, ICAI and National Company Law Tribunal from 30.09.2019 to 18.10.2019. The duly filled in physical application along-with supporting documents in all respect should be submitted in sealed cover to the Office of the undersigned on or before 21.10.2019 upto 04.00 PM. who are already on the panel of the undersigned are also required to submit fresh application for consideration.

Submission of application does not give a guarantee of empanelment. The applications may be rejected by the selection committee without assigning any reason to applicants. However, after shortlisting of suitable Chartered Accountants by the Selection Committee, the same shall be placed before the Hon’ble High Court of Gujarat for approval name of it in the panel of the Office of the Official Liquidator as per the scheme of Chartered Accountants approved by the Hon’ble High Court of Gujarat.

For further Information click here.

The Documentation Identification Number ( DIN ) system of Central Board of Direct Taxes (CBDT) has come into existence from today with the generation of about 17,500 communications with DIN on the very first day. This path-breaking DIN system has been created as per the direction of Finance Minister Ms. Nirmala Sitharaman and from now onwards every CBDT communication will have to have a documentation identification number.

Revenue Secretary Dr Ajay Bhushan Pandey said, “From today, any communication from Income Tax Department without a computer-generated DIN, be it a notice, letter, order and summon or any other correspondence, would be treated as invalid and shall be non est in law or deemed to be as if it has never been issued. The DIN system would ensure greater accountability and transparency in tax administration.”

“Now from today onwards, all such communications with DIN would be verifiable on the e-filing portal and no communication would be issued manually without DIN except only if it is in the specified exceptional circumstances”, said Dr. Pandey.

It would be pertinent to mention here that while specifying such exceptional circumstances the CBDT Circular related to DIN dated 14.08.2019 says that whenever any such manual communication would be issued, it would be necessarily required to specify reason of issuing such a communication without DIN along with the date of obtaining written approval of the Chief Commissioner/Director General of Income Tax in a particular format. Any communication which is not in conformity of with the prescribed guidelines shall be treated as invalid and non est in law.

The CBDT has specified that any communication issued manually under exceptional circumstances would have to be uploaded and regularised on the system portal within 15 days of its issuance.

The CBDT has also stated that all pending assessment proceedings, where notices were earlier issued manually, prior to the DIN related Circular dated 14.08.2019 coming into existence, all such cases would be identified and notices so sent would be uploaded on ITBA by the end of this month, i.e., by 31st Oct 2019.

This is in pursuance of the directions by the Hon’ble Prime Minister in which he has asked the Department of Revenue to come up with specific measures to ensure that the honest taxpayers are not harassed and served better. It may be noted that earlier there have been some instances where it was not possible to maintain the audit trail of the manually issued communication which in some cases caused inconvenience to taxpayers sometime. However, with the present system of attaching a DIN to every notice or communication of CBDT would result in better services to taxpayers without any possible harassment.

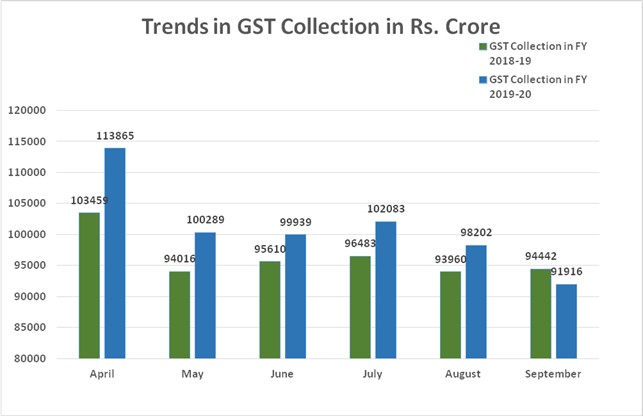

The total gross GST revenue collected in the month of September, 2019 is ₹ 91,916 crore of which CGST is ₹ 16,630 crore, SGST is ₹ 22,598 crore, IGST is ₹ 45,069 crore (including ₹ 22,097 crores collected on imports) and Cess is ₹7,620 crores (including ₹ 728 crores collected on imports). The total number of GSTR 3B Returns filed for the month of August up to 30th September, 2019 is 75.94lakh.

The government has settled ₹ 21,131 crores to CGST and ₹ 15,121 crores to SGST from IGST as regular settlement. The total revenue earned by Central Government and the State Governments after regular settlement in the month of September 2019 is ₹ 37,761 crores for CGST and ₹ 37,719 crores for the SGST.

The revenue during September, 2019 is declined by 2.67% in comparison to the revenue during September, 2018. During April-September, 2019 vis-à-vis 2018, the domestic component has grown by 7.82% while the GST on imports has shown negative growth and the total collection has grown by 4.90%.

The chart shows trends in revenue during the current year.