Avoid Sharing PAN and Personal Details on Social Media to Avoid Misuse: Income Tax Dept

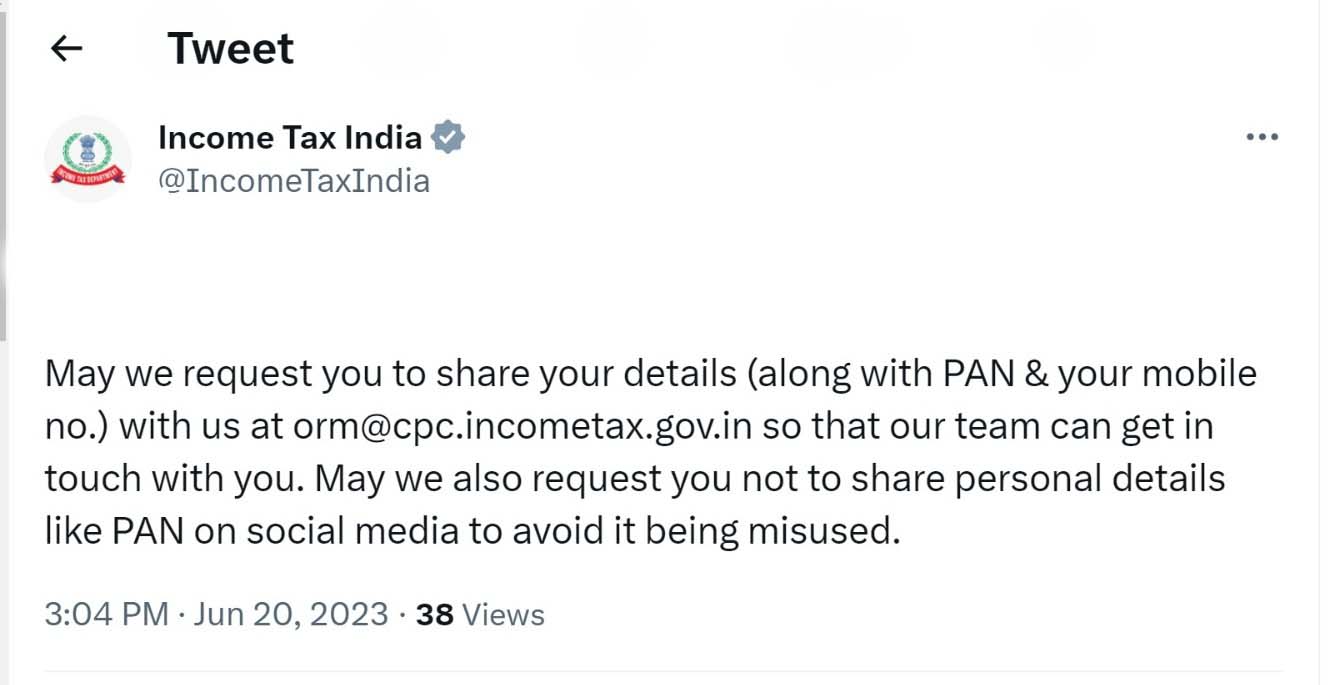

In a recent tweet, the income tax department advised the taxpayers not to share personal information such as PAN details on social media to avoid its misuse.

The income tax department was responding to a query by a taxpayer who was facing issues in filing Income Tax returns through the official e-filing portal by the income tax department. After an unsuccessful attempt to register, the taxpayer raised an inquiry via twitter to wich, the income tax department responded;

“May we request you to share your details (along with PAN & your mobile no.) with us at orm@cpc.incometax.gov.in so that our team can get in touch with you. May we also request you not to share personal details like PAN on social media to avoid it being misused.”

Similarly, the Central Board of Indirect Taxes and Customs (CBIC) recently cautioned the public against sharing Aadhaar and PAN details.

Fraudsters take the poor to Aadhaar Seva Kendras, collect fingerprints, and create fake entities with a different number, the CBIC said in a recent public announcement.

Once the Aadhaar-linked phone number is changed, the card's control will be on the other person. Meanwhile, the real owner won't realise the danger since the card is still with him/her. The victims will not realize that Aadhaar could be controlled using a mobile phone number.

The Union government recently said several shell companies used a single photograph to create multiple fake Aadhaar cards with different names to get fake GST registration. If any official agencies probe tax evasions, the unsuspecting owner will be in trouble.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates