Blocked Credit under GST

Blocked Credit under GST – Blocked Credit – GST – CertificateCourse – onlinecertificatecourse – certificatecourse2023 – taxscan academy – Taxscan

Blocked Credit under GST – Blocked Credit – GST – CertificateCourse – onlinecertificatecourse – certificatecourse2023 – taxscan academy – Taxscan

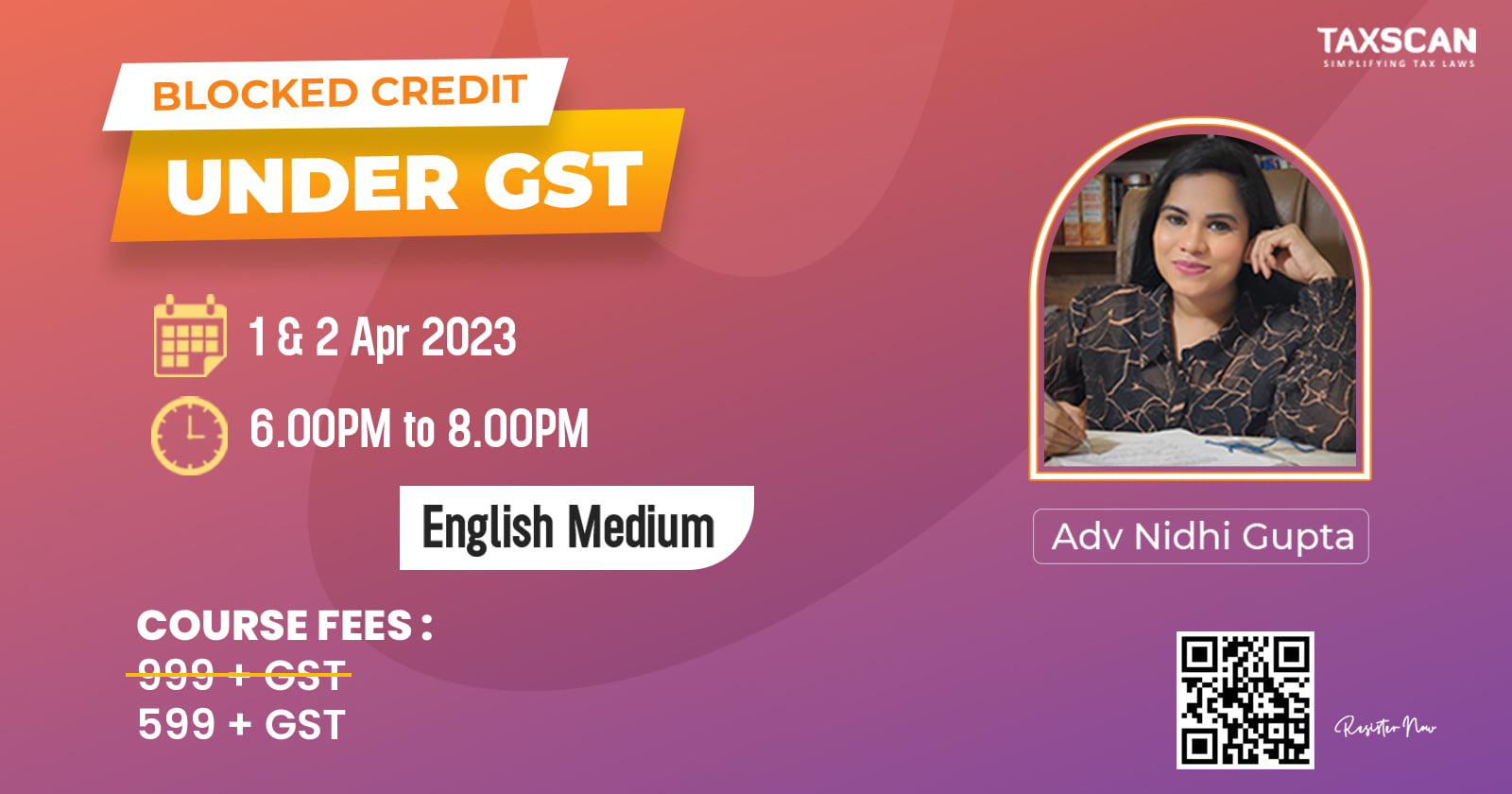

Faculty - Adv Nidhi Gupta

📆 1 & 2 Apr 2023

⏰ 6.00PM to 8.00PM

Course Fees999 + GST

599 + GST

Click Here To Pay

Key Features

✅English Medium

✅Duration 4 Hours

✅E Notes available

✅The Recordings will be provided

What Will Be Covered in the Course

1 Eligibility conditions for availing ITC.

2 Apportionment of Credit

◼Meaning of Taxable & Exempt Supply

◼Credit used exclusively for Taxable supply / exempt supply.

◼Common Credit.

◼Supplies for personal consumption etc.

◼How to apportion the credit

3 Blockage of Credit in respect of

◼Motor Vehicles, Vessels and Aircraft; their servicing repair & maintenance.

◼Food & Beverages, Outdoor Catering,

◼Beauty Treatment, Health Services, Cosmetic & Plastic Surgery.

◼Membership of Club, Health and Fitness Centre.

◼Goods & Services provided to employees.

◼Travel benefits to employee.

4 ITC on Works Contract and Construction of Immovable Property related issues such as:

◼Installation of lift

◼Overhead crane.

◼Construction of warehouse for leasing.

◼Civil construction for installation of machinery etc.

5 Credit on free gifts, samples, goods lost, stolen or destroyed etc.

6 ITC & Tax paid under Section 74, 129 and 130.

For Queries - 8891 128 677, 89434 16272, info@taxscan.in