'BRANDED' to 'PRE-PACKED & LABELLED' – What does it actually mean?

BRANDED -PRE-PACKED & LABELLED – GST – Taxscan

BRANDED -PRE-PACKED & LABELLED – GST – Taxscan

GST implications on pre-packaged and labelled commodity has been a subject matter of discussion amongst the trade post the 47th GST Council meeting. To remove ambiguity in interpreting various clauses pertaining to pre-packaged and labelled commodity especially due to interplay between Legal Metrology (Packaged Commodity) Rules, 2011 (‘LMPC Rules’) and GST Notifications, basis the representations from the industries, CBIC also issued FAQs on July 17, 2022.

The CBIC has been issuing notifications from time to time, particularly in respect of food items like pulses, flour, cereals, etc. (specified items falling under the Chapters 1 to 21 of the Tariff) including the recent ones viz. Notification No. 6/2022-Central Tax (Rate) and Notification No. 7/2022-Central Tax (Rate), dated the July 13, 2022.

In this article we shall analyse the impact of the said change and related FAQs. The change so introduced vis-à-vis old provision is tabulated below:

| Prior to July 18, 2022 (i.e., before clarification) | W.e.f. July 18, 2022 (i.e., after clarification) |

| GST applied on specified goods: When they were put up in a unit container; andWhen they were bearing a registered brand name or were bearing brand name in respect of which an actionable claim or enforceable right in a court of law is available. For example: items like pulses, cereals like rice, wheat, and flour (aata), etc., attracted GST at the rate of 5% when branded and packed in unit container. | GST has been made applicable: On supply of such "pre-packaged and labelled" commodities attracting the provisions of Legal Metrology Act.Additionally, certain other items such as Curd, Lassi, puffed rice etc when “pre-packaged and labelled” would attract GST at the rate of 5%.For example: items like pulses, cereals like rice, wheat, and flour (aata), etc., would attract GST when “pre-packaged and labelled”. |

Since the applicability of GST is linked with the term ‘pre-packaged and labelled’. It becomes important to understand such terms first.

As per GST Law, ‘pre-packaged and labelled’ means a ‘pre-packaged commodity’ as defined in clause (l) of Section 2 of the Legal Metrology Act, 2009 (herein after referred to as ‘LMA’). Clause (l) of section 2 of the Legal Metrology Act reads as below:

“Section 2(l) “pre-packaged commodity” means a commodity which without the purchaser being present is placed in a package of whatever nature, whether sealed or not, so that the product contained therein has a pre-determined quantity.”

Basis the reading of the above, it is clear that Supply of such specified commodity having the following two attributes would attract GST:

- Pre-packaged

- Labelled (with prescribed declaration)

- Such packages have declaration (where it is required to bear declarations under the provisions of LMA and the Rules made thereunder)

- Such packages do not have declaration (where it is not required to bear the declarations under the provisions of LMA and the Rules made thereunder)

Further, from LMPC Rules perspective, the provisions are bifurcated in seven chapters. For ready reference, the chapter wise heading is provided as follows:

- CHAPTER I – Short title, and Commencement and Definitions (Rule 1 and Rule 2)

- CHAPTER II - Provisions Applicable to Packages Intended for Retail Sale (Rule 3 to Rule 23)

- CHAPTER III - Provisions Applicable to Wholesale Packages (Rule 24)

- CHAPTER IV - Export of Packaged Commodities (Rule 25)

- CHAPTER V - Exemptions (Rule 26)

- CHAPTER VI - Registration of Manufacturers, packers, and Importers (Rule 27 to Rule 30)

- CHAPTER VII - General ((Rule 31 to Rule 34)

As per the FAQ, it has further been clarified that:

- GST is applicable on Supply of specified goods by any person, i.e., manufacturer supplying to distributor, or distributor/dealer supplying to retailer, or retailer supplying to individual consumer and input tax credit shall be available to the person supplying the goods.

- As per Rule 3 (a) of LMPC Rules read with Rule 6, a single package of these items [cereals, pulses, flour etc.] containing a quantity of more than 25 Kg/25 litre would not fall in the category of pre-packaged and labelled commodity for the purposes of GST and would therefore not attract GST. Rule 3(c) of LMPC Rules has been reiterated below for ease of reference:

“Chapter II - Provisions Applicable to Packages Intended for Retail Sale

[3. Application of Chapter. - The provisions of this chapter shall not apply to-

(a) packages of commodities containing quantity of more than 25 kilogram or 25 litre;

(b) cement, fertilizer and agricultural farm produce sold in bags above 50 kilogram; and

(c) packaged commodities meant for industrial consumers or institutional consumers.]”

Basis the above, supply of packaged commodity for consumption by industrial consumer or institutional consumer, packages above 25 Kgs/litre. quantity and cement, fertilizer and agricultural farm produce sold in bags above 50 kgs are excluded from the law and will not be considered as pre-packaged. Therefore, such category of items would not be taxable under GST law as well.

- Further, the condition of goods being pre-packed goods should be always present to levy tax. In other words, if the retailer supplies the item in loose quantity from pre-packed goods, then such sale by retailer is not a Supply of packaged commodity for the purpose of GST levy.

- Multiple retail packages sold in a large pack to ultimate consumer would also attract GST. Whereas a larger pack (i.e., one individual package) would not be considered a pre-packaged and labelled commodity for the purposes of GST levy (even if rule 24 mandates certain declarations). Here the relevant provisions from LMPC Rules are as follows:

“CHAPTER-II- Provisions Applicable to Packages Intended for Retail Sale

Rule 4(2) When one or more packages intended for retail sale are grouped together for being sold as a retail package on promotional offer, every package of the group shall comply with provisions of rule 6.]”

“CHAPTER-III-Provisions Applicable to Wholesale Packages

Rule 24. Declarations applicable to be made on every wholesale package. - Every wholesale package shall bear thereon a legible, definite, plain and conspicuous declaration as to -

(a) The name and address of the manufacturer or importer or where the manufacturer or importer is not the packer, of the packer;

(b) the identity of the commodity contained in the package; and

(c) the total number of retail package contained in such wholesale package or the net quantity in terms of standard units of weights, measures or number of the commodity contained in wholesale package;

Provided that nothing in this rule shall apply in relation to a wholesale package if a declaration Similar to the declarations specified in this rule, is required to be made on such wholesale packages by or under any other law for the time being in force.”

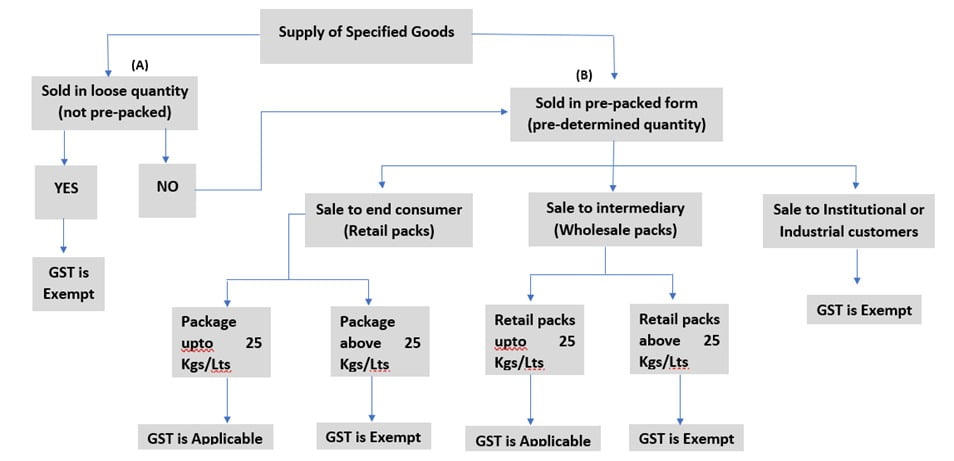

To decipher the above FAQs better, we have encapsulated the applicability of LMA & GST on specified Pre-Packed Commodities in the flowchart below:

As per LMA provision, wholesale package qualifies to be pre-packaged commodity which requires declarations under Rule 24 of the LMPC Rules. However, the question that arises is that by conjoint reading of Rule 3 (a) read with Rule 24, can we conclude that the LMA provisions as application to retail packs are also applicable to wholesale packs? Further, from GST perspective, the exemption to wholesale package is not coming from the exemption notification, however, the FAQs cite such exemption. Can it be said that in so far as the FAQ provide exemption to wholesale packs, is it going beyond what is envisaged in the LMA?

Conclusion:

The biggest slogan of Indian socialism is ‘Roti, kapda aur makaan’. Till now the government has taxed Kapda and makaan. However, roti or essential food ingredients remained outside the purview of GST. This is the first time that basic food items are being brought under the tax net in the garb of pre-packaged goods. Due to the same reason, there is an uproar in the food trader industry. The implications of this taxability would be grave. The common man or the ‘aam aadmi’ will be directly hit by this withdrawal of exemption. Grocery stores or kirana traders would certainly prefer selling items in loose quantities as against the pre-packed ones for the simple reason of being competitive and escaping taxes. However, this could have certain non-tax implications such as hygiene factors, fraudulent weight systems and unregulated quality of food items. Moreover, small players dealing in unbranded food items shall bear a brunt of this decision. Till date they did not have to obtain registration under GST and conduct compliances. However, with this change they will be obligated to obtain registration under GST (if threshold is crossed).

From a tax point of view, Section 14 of the CGST Act, 2017 needs to be evaluated. The said section prescribes time of supply in cases where there is a change in rate of tax on specified goods and/or services.

While the Government has issued FAQs in the said matter, there are still some issues which require clarifications. Moreover, as the time shall pass, the industry would face practical challenges and would have to approach the ministry for the same. Nonetheless, since the levy is in force now, better watch your grocery bills for some ITC that can be availed.

Mr. Jigar Doshi, Founding partner

Ms. Nirali Gada Manager at TMSL

Ms. Sakshi Hasija Assistant Manager at TMSL

The views are personal and the authors can be reached at jigar.doshi@tmsl.in.