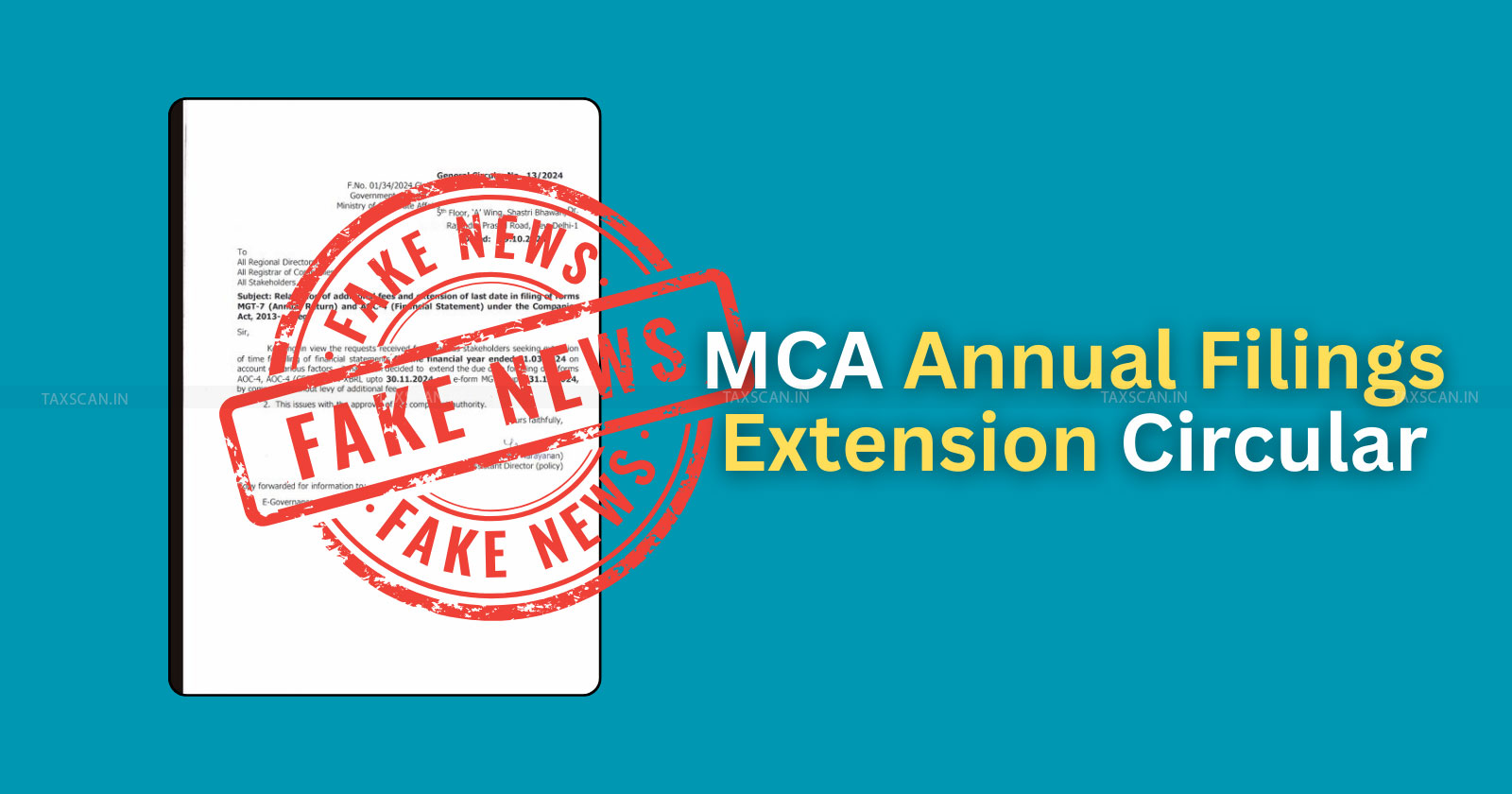

[BREAKING] Annual Filings of MCA Forms w/o Additional Fees not Extended, confirms MCA Official amidst Fake Circular Circulating on Social Media

MCA annual filing deadline – MCA – MCA official confirms filing deadline – MCA form filing fake circular – taxscan

MCA annual filing deadline – MCA – MCA official confirms filing deadline – MCA form filing fake circular – taxscan

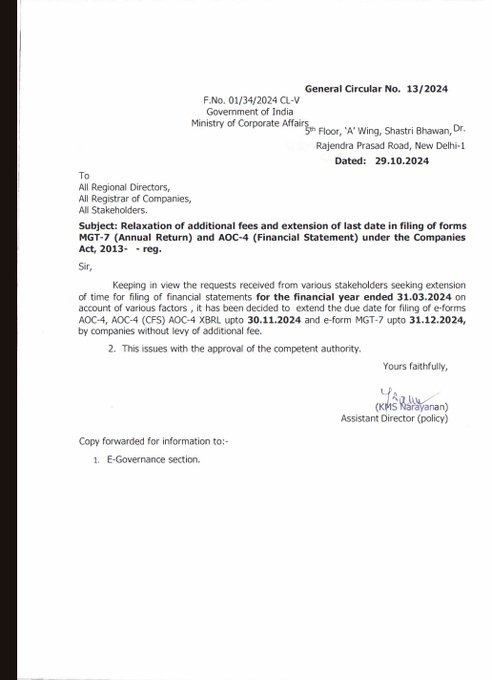

In a surprising update, an official from the Ministry of Corporate Affairs ( MCA ) has confirmed that there will be no extension for the filing deadlines of essential annual compliance forms for the financial year 2023-24.

Despite recent requests from industry bodies, companies must adhere to the original due dates for forms like AOC-4, AOC-4(CFS), AOC-4 XBRL, and MGT-7, without the benefit of additional time or fee waivers.

The above Circular circulating on Social media is confirmed to be a fake one by the signing authority of the same.

The clarification comes shortly after the Institute of Company Secretaries of India (ICSI) appealed to the MCA for an extension, citing technical issues and high filing volumes on the MCA portal. The ICSI highlighted difficulties with the complex XBRL filing process, which requires precise data formatting, alongside the challenges posed by portal downtimes during the October peak period.

Boost Your Business with SME IPO Funding Strategies - Enroll Now

In an official letter to MCA Secretary Ms. Deepti Gaur Mukerjee, ICSI President CS B. Narasimhan had also pointed out the festive season's impact on business schedules, as Diwali and Bhai Duj typically lead to delays in regular operations.

While MCA’s denial of an extension may surprise many, officials have emphasised the need for adherence to the compliance calendar to maintain regulatory standards.

With deadlines approaching, companies are now under increased pressure to complete filings promptly.

Boost Your Business with SME IPO Funding Strategies - Enroll Now

The decision not to extend deadlines diverges from recent moves by the Central Board of Direct Taxes (CBDT), which had granted an extension for income tax returns.

This latest update underscores the MCA’s stance on maintaining compliance schedules despite technical and logistical challenges faced by companies. Industry stakeholders are now urging their members to expedite filings to avoid late fees and penalties.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates