Breaking: CBDT notifies Changes in Form ITR 7 [Read Notification]

![Breaking: CBDT notifies Changes in Form ITR 7 [Read Notification] Breaking: CBDT notifies Changes in Form ITR 7 [Read Notification]](https://www.taxscan.in/wp-content/uploads/2023/11/CBDT-notifies-Changes-in-Form-ITR-7-ITR-CBDT-Breaking-news-Taxscan.png)

The Central Board of Direct Taxes (CBDT), vide notification no. G.S.R. 813(E) issued on 31st October 2023 has notified new changes to the Form ITR-7. These rules may be called the Income Tax (Twenty-Seventh Amendment) Rules, 2023 and shall be deemed to have come into force from 1st day of April, 2023.

In the Income Tax Rules, 1962, in Appendix II, in Form ITR-7, in PART-B for the assessment year commencing on the 1st day of April, 2023—

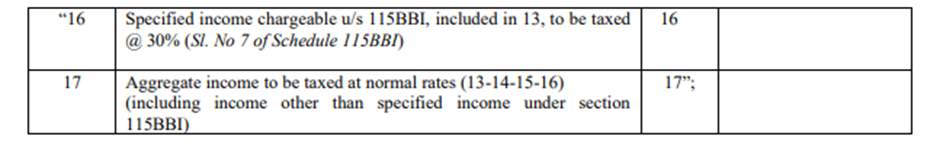

(a) in Part B–TI, the Part B1, for serial number 16 and entries relating thereto, the following serial number and entries thereto shall be substituted, namely:—

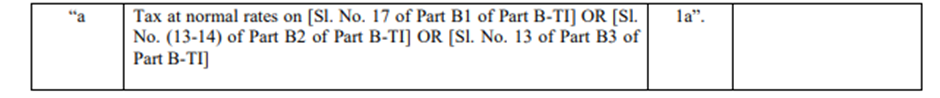

(b) in Part B–TTI, against serial number 1, for item a and entries relating thereto, the following item and entried thereto, shall be substituted, namely:—

The amendment takes effect from April 1, 2023, and is applicable for the assessment year 2023-24, which pertains to the preceding year, 2022-23. The ministry also affirmed that no individual is being detrimentally impacted by applying these rules retrospectively.

ITR 7

ITR-7 Form can be used by persons including companies who are required to furnish returns under section 139(4A) or section 139(4B) or section 139(4C) or section 139(4D). The category of persons whose income is unconditionally exempt under various clauses of section 10, and who are not mandatorily required to furnish their return of income under the provisions of section 139, may use relevant ITR form for filing return. From A.Y.2022-23 onwards ITR 7 will not be applicable to the persons whose income is unconditionally exempt.

The CBDT had officially announced the extension of the deadline for submitting ITR 7 for Assessment Year 2023-24 until 30th November 2023 and the ministry has notified the amendment on the form on 31st October 2023 which was the due date before.

To Read the full text of the Notification CLICK HERE

Want to explore further? Check out our related book here.

Notification No: 94/2023 , 31st October, 2023