[BREAKING] CBIC notifies Amendment for ITC Reconciliation from GSTR-2B instead of GSTR-2A from GSTR-9 [Read Notification]

Currently, the ITC information in Table 8(A) specifically refers to the details from FORM GSTR-2A, which was auto-populated from supplier details.

![[BREAKING] CBIC notifies Amendment for ITC Reconciliation from GSTR-2B instead of GSTR-2A from GSTR-9 [Read Notification] [BREAKING] CBIC notifies Amendment for ITC Reconciliation from GSTR-2B instead of GSTR-2A from GSTR-9 [Read Notification]](https://www.taxscan.in/wp-content/uploads/2024/10/CBIC-CBIC-BREAKING-ITC-from-GSTR-2B-Taxscan.jpg)

The Central Board of Indirect Taxes and Customs (CBIC) has recently amended the reconciliation process for Input Tax Credit (ITC) in Goods and Services Tax (GST) Return FORM GSTR-9, marking a shift from GSTR-2A to GSTR-2B for the reconciliation process. This update was notified through Notification No. 20/2024 – Central Tax dated October 8, 2024.

Previously, taxpayers were required to reconcile the ITC claimed in FORM GSTR-3B with the details in FORM GSTR-2A, as mandated by Rule 36(4) of the Central Goods and Services Tax (CGST) Rules, 2017, and reflected in Table 8 of FORM GSTR-9.

The ITC information in Table 8(A) specifically referred to the details from FORM GSTR-2A, which was auto-populated from supplier details.

Now, through this new notification, the reconciliation process will rely on FORM GSTR-2B instead of GSTR-2A. The modification applies to Table 8(A) of FORM GSTR-9, where the ITC details are to be based on GSTR-2B, an auto-drafted statement that consolidates all available ITC data for the recipient taxpayer.

Complete Supreme Court Judgment on GST from 2017 to 2024 with Free E-Book Access, Click here

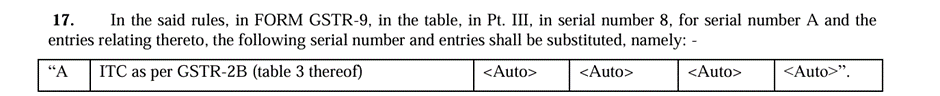

The specific change reads:

- The revised entry in FORM GSTR-9 states:

- "ITC as per GSTR-2B (Table 3 thereof)" replacing "ITC as per GSTR-2A."

GSTR-2B, introduced in January 2021, is a static document that reflects all ITC details, helping taxpayers by locking the data as of a specific period and avoiding discrepancies caused by ongoing updates in GSTR-2A.

This change aligns with the amendments introduced by the Finance Act, and ensures that taxpayers only claim ITC as reflected in FORM GSTR-2B. This amendment is expected to reduce errors in claiming ITC and simplify compliance with the Goods and Services Tax regime.

Complete Supreme Court Judgment on GST from 2017 to 2024 with Free E-Book Access, Click here

From now on, taxpayers will need to reconcile their ITC claims in FORM GSTR-3B with the figures in FORM GSTR-2B instead of GSTR-2A when filing FORM GSTR-9.

This amendment is effective immediately as per the notification date of October 8, 2024.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Notification No: 20/2024 � Central Tax , 8th October, 2024