Budget 2023: Existing Income Tax Regimes and Expected Changes

After the 48th GST Council Meeting was held on 17th December, 2022, the next set of big changes to the tax-verse is anticipated in the Union Budget 2023. The Union Finance Minister, Nirmala Sitaraman will present the Budget on 1st February 2023.

Not many changes are expected in the tax slabs, as experts of the field point out, however, some beneficial measures are anticipated for the salaried class. As of now, no official confirmation is available on the changes.

At present, two income tax regimes exist in India, namely the Old Regime and the New Regime.

From FY 2020-2021, the taxpayers have the opportunity to choose either of the regimes. However, the choice is to be based entirely on the annual earnings and financial situation of the taxpayer, taking into consideration the deductions also.

Employees can choose between the available regimes and switch regimes every year as of now. However, in case of income from profession or business, the option to choose between regimes is available only once.

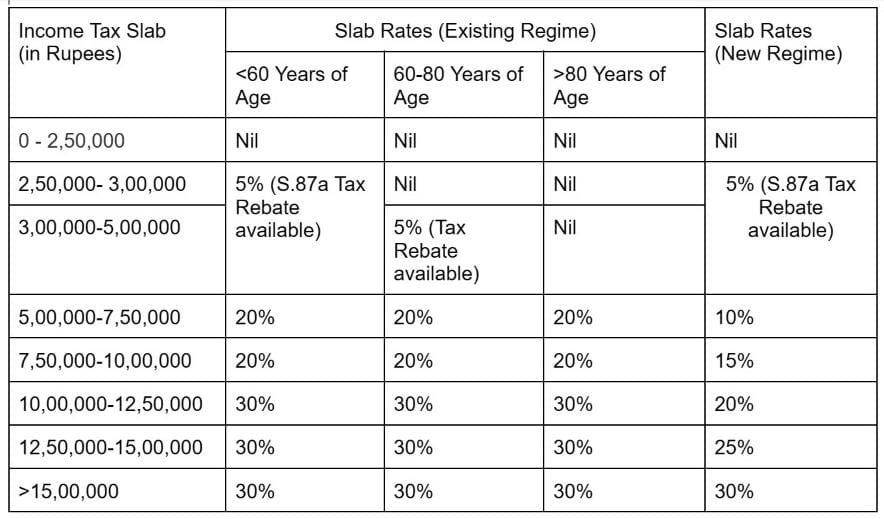

The Current Rates of Income Tax as per old and new regimes are as given below: –

Even though no major changes are expected in the slabs and tax rates, the following beneficial measures are anticipated and recommended by field experts: –

- Increase in the threshold of Rs. 15 Lakhs for the highest slab rate to Rs. 20 Lakhs.

- Waiver of cess and surcharges for lower categories of high income earners.

- Moving tuition fees of children from a separate provision from the Section 80C deductions, which already covers a lot of other investments/expenses to the tune of Rs. 1.5 Lakhs.

- Increase in health insurance tax exemption limit under Section 80D.

- With the advent of Electronic Vehicles (EVs), the Government could also introduce deduction on purchase of the same, apart from subsidies already in place, as a gesture to promote green transportation.

- An increased deduction in lieu of House Rent Allowance (HRA) or total house rent payable is also recommended as the rents are higher after the Covid-19 pandemic.

It is noteworthy that these are only expected and recommended changes and no official confirmation is available on the same, at present.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates