CA Fee High or Low: Know Minimum Fee fixed by ICAI on Income Tax Returns Filing

Following the conclusion of the Income Tax Returns (ITR) filing period, discussions have emerged on social media concerning the fees levied by Chartered Accountants (CAs). Certain individuals have claimed that the professionals are charging low fees, while others have clarified that the fee structure is contingent upon the client's circumstances and the complexity of the tasks involved.

However, it is pertinent to know the minimum fee fixed by the Institute of Chartered Accountants of India (ICAI) on ITR Filing. The Committee for Capacity Building of Members in Practice (CCBMP) of the Institute of Chartered Accountants of India (ICAI) has prescribed the minimum recommended scale of fees for the professional assignments done by the members of CA Institute.

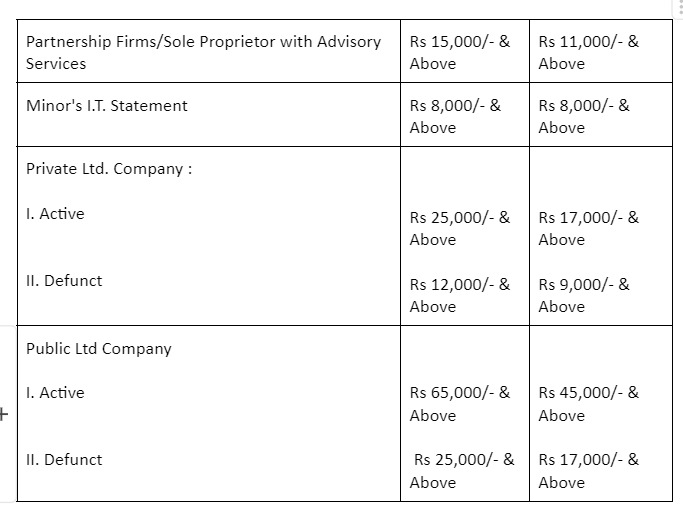

The Committee for Capacity Building of Members in Practice (CCBMP) of ICAI as a part of its commitment to strengthen the Small & Medium Practitioners has initiated the Revised Minimum Recommended Scale of Fees for the professional assignments done by members of ICAI. The committee has suggested the minimum fees for filing ITR separately for Class A Cities and Class B cities.

Fee for Income Tax Returns Filing

1. For Individuals/HUFs

2. For others

The aforementioned charges are established to bolster Small & Medium Practitioners. Professionals also have the flexibility to impose fees exceeding this rate based on their expertise, client base, and the extent of tasks to be undertaken.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates