CA Fresher Campus Placement Salary Packages over the Years: An Analysis

The Institute of Chartered Accountants of India (ICAI) has successfully conducted 58 Campus Placement programmes. Know the evolution of Salary Offered to Fresher CAs over the Years

CA Fresher – Campus Placement – Salary Packages – TAXSCAN

CA Fresher – Campus Placement – Salary Packages – TAXSCAN

In a significant achievement, the Institute of Chartered Accountants of India (ICAI) has successfully concluded its 58th Campus Placement Program, awarding an impressive annual package of about INR 50 Lakhs to Chartered Accountants securing placements.

Read More: CA Fresher bags INR 49.20 Lakhs Package in 58th ICAI Campus Placement Event

57th ICAI Campus Placement Programme Statistics:

The 57th edition of the Campus Placement Programme for newly qualified Chartered Accountants (CAs), conducted in February-March 2023, witnessed remarkable success with 5813 job offers and a highest salary of INR 28 lakhs per annum. The event, held across 27 centers (comprising 9 Big Centres and 18 Small Centres), showcased the strong demand for qualified professionals in the financial domain.

Number of Candidates: A staggering 10,228 candidates registered for the placement drive, reflecting the growing interest and participation in the program.

Participating Organizations: The program saw active engagement from 189 organizations, underscoring its significance in the industry.

Job Offers: A total of 5813 job opportunities were extended by the participating organizations, showcasing a plethora of opportunities for aspiring CAs.

Accepted Jobs: 4248 candidates successfully secured placements, signifying a commendable placement rate.

Top Salary Offered: The highest salary offered stood at an impressive INR 28 lakhs per annum for domestic postings, reflecting the premium placed on top-tier talent.

Average Salary: The average cost to the company (CTC) offered during the placement drive was INR 12.45 lakhs per annum, indicative of the lucrative opportunities available.

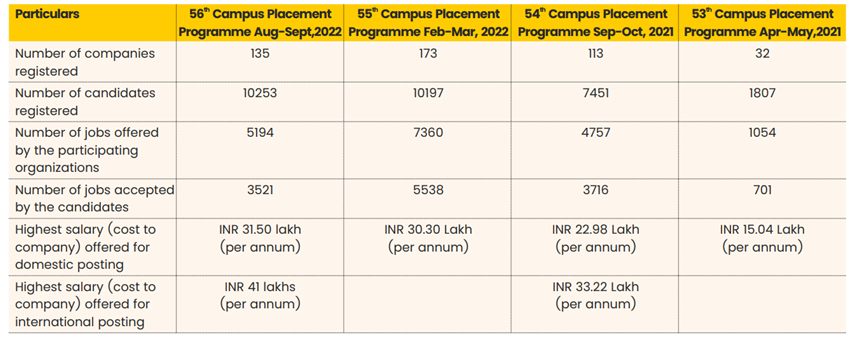

The Particulars of the last four campus placement programmes held in 2021 and 2022 are as follows: –

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates