Can Extended Limitations override Statutory Time Limits? Uncovering the Potential Unconstitutionality of Notification Extending Deadline for GST Orders u/s 73

The CBIC Notification extending deadline for demand Orders under Section 73 in Non-Fraud Cases is potentially unconstitutional and ultra vires of GST Act itself. Know Why.

The Central Board of Indirect Taxes and Customs (CBIC) has extended the deadline for issuing demand orders under Section 73(9) of the Goods and Services Tax Act on 28/12/2023 through Notification 56/2023.

Read More: CBIC extends Time Limit for Issuance of GST Orders u/s 73

The Issue

Issuance of Goods and Services Tax Demand Order under Section 73(9) of Central Goods and Services Tax (CGST) Act as per limitation periods under Section 73(10) extended in line with the following Notifications —

- Notification No. 35/2020 – Central Tax [3rd April, 2020],

- Notification No. 14/2021 – Central Tax [1st May, 2021],

- Notification No. 13/2022 - Central Tax [5th July. 2022],

- Notification No. 09/2023 - Central Tax [31st March, 2023] and

- Notification No. 56/2023 - Central Tax [28th December, 2023].

The Extended limits as per Notifications —

| Changes in time limit for issuance of Order under Section 73 (9) | |||||

| FY Concerned | Time-Limit (Original) - 3 Yrs from Annual Return (GSTR-9) Deadline | Revised in 14/2021 | Revised in 13/2022 | Revised in 09/2023 | Revised in 56/2023 |

| 2017-2018 | 5/7 February 2023-3 yrs from 5/7 February 2020 | Covid Extension | 30 September 2023 | 31 December 2023 | - |

| 2018-2019 | 31 December 2023 - 3 yrs from 31 December 2020 | Covid Extension | - | 31 March 2024 | 30 April 2024 |

| 2019-2020 | 31 March 2024 - 3 Yrs from 31 March 2021 | Covid Extension | - | 30 June 2024 | 31 Aug 2024 |

Legal Provisions for Issuance of Demand Orders under Goods and Services Tax Law

—Section 73 of Central Goods and Services Tax Act, 2017

Determination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilized for any reason other than fraud or any willful-misstatement or suppression of facts —

[Sections 73(1) to 73(8) omitted for convenience]

(9) The proper officer shall, after considering the representation, if any, made by person chargeable with tax, determine the amount of tax, interest and a penalty equivalent to ten percent of tax or ten thousand rupees, whichever is higher, due from such person and issue an order.

(10) The proper officer shall issue the order under sub-section (9) within three years from the due date for furnishing of annual return for the financial year to which the tax not paid or short paid or input tax credit wrongly availed or utilized relates to or within three years from the date of erroneous refund.

Notably, the new notifications are issued as per the amendments made to Section 168 by inserting the Section 168A.

“The Troublemaker” – The Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020

Amendment inserting Section 168A to CGST Act

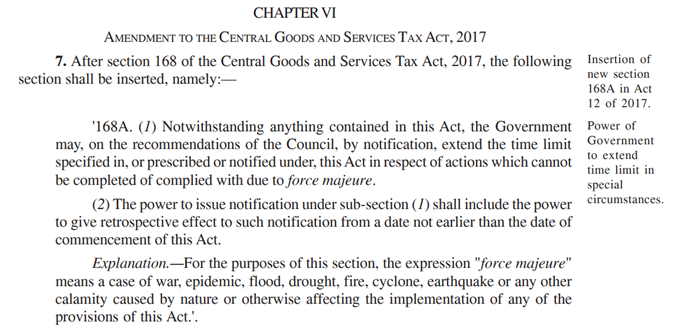

Specifically, the Insertion of Section 168A of the Central Goods and Services Tax Act as per Section 7 of The Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020.

The amendment itself came in 2020 and currently, the matters pertaining to Financial Years 2017-18.

And the newly inserted Section 168A(2) defines the retrospective applicability of the power to issue notification under sub-section (1) — “shall include the power to give retrospective effect to such notification from a date not earlier than the date of commencement of this Act.”

To Learn More About GST Laws and Practice, attend the GST Practitioner Certificate Course - Technical & Analytical (One Course – to Finalize Everything in GST with LIVE Practical Examples)

Section 168A of Central Goods and Services Tax Act, 2017

Power of Government to extend time limit in special circumstances —

(1) Notwithstanding anything contained in this Act, the Government may, on the recommendations of the Council, by notification, extend the time limit specified in, or prescribed or notified under, this Act in respect of actions which cannot be completed or complied with due to force majeure.

(2) The power to issue notification under sub-section (1) shall include the power to give retrospective effect to such notification from a date not earlier than the date of commencement of this Act.

Explanation.- For the purposes of this section, the expression “force majeure” means a case of war, epidemic, flood, drought, fire, cyclone, earthquake or any other calamity caused by nature or otherwise affecting the implementation of any of the provisions of this Act.

Grab your copy of the latest GST Bare Act here: GST Bare Act 2024 (Updated up to 1-11-2023)

At present, there is no such ground attributable to force majeure which affects the implementation of any of the provisions of the act (GST Act) throughout India. Thus the invocation of Section 168A is an act of grave misuse of legislative provisions.

Further, neither the press release nor the recent meeting minutes of the GST Council show any hint of discussion or recommendation regarding the extension of the time limit.

As per the Provisions of Section 168A, the Government may, on the recommendations of the Council, by notification, extend the time limits. However, as noted, the Press Releases of GST Council Meetings do not give any hint of any such recommendation whatsoever.

Read GST Council Meeting Minutes here: GST Council Meetings | Goods and Services Tax Council

Further, it is a major question of law to be answered as to whether the extended periods of limitation can override statutory time limits.

Suggested Reasons for Unconstitutionality and Ultra Vires nature of the limitation extension notification: –

Thus, in conclusion, the following grounds can be relied on while moving an appeal/petition against Section 73 demand orders that are issued invoking the extended period of limitation as per the said Notifications–

- No Force Majeure in existence, at the time of issuance of notification to extend the time limit.

- GST Council Meetings or Press Releases give no reference to recommending such an extension.

- Perpetual extension is possible, citing “Force Majeure”, giving a wide range of power to the government to act against honest GST taxpayers.

- Retrospective applicability of insertion of Section 168A can also be questioned, being detrimental to the assessee and oddly in favor of the revenue.

For the above stated reasons, the notification extending the deadline is both ultra vires of the Goods and Services Tax Act, 2017 and unconstitutional for grave deprivation of rights of GST Taxpayers.

The following case laws are also in favour of the assessee, even though only interim orders have been issued in the favour of the petitioners —

- M/s SRSS AGRO PVT. LTD. Versus UNION OF INDIA CITATION: 2023 TAXSCAN (HC) 1718

- M/s NEW INDIA ACID BARODA PVT. LTD. vs UNION OF INDIA

- GAJANAND MULTISHOP THROUGH PANKAJKUMAR ROSHANLAL GANDHI

[R/SPECIAL CIVIL APPLICATION NO. 20227 of 2023, Gujarat HC]

In summary, the recent notifications extending the time limits for issuing Goods and Services Tax demand orders under Section 73(9) raise significant concerns regarding their constitutionality and adherence to the statutory framework.

The basis for such extensions, as per Section 168A of the Central Goods and Services Tax Act, relies on the concept of force majeure, yet no such grounds are evident at the time of notification issuance. Moreover, the absence of any recommendation in GST Council meetings and press releases adds to the uncertainty surrounding the legitimacy of these extensions.

The potential for perpetual extensions under the guise of force majeure grants broad powers to the government, posing a serious risk of abuse against honest GST taxpayers. The retrospective applicability of Section 168A is also questionable, as it seems to favor revenue at the expense of the rights of taxpayers.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates