CBDT Introduces Form 10-IFA for Co-operative Societies Choosing Tax Regime under Section 115BAE of Income Tax Act, inserts new Rule 21AHA [Read Notification]

![CBDT Introduces Form 10-IFA for Co-operative Societies Choosing Tax Regime under Section 115BAE of Income Tax Act, inserts new Rule 21AHA [Read Notification] CBDT Introduces Form 10-IFA for Co-operative Societies Choosing Tax Regime under Section 115BAE of Income Tax Act, inserts new Rule 21AHA [Read Notification]](https://www.taxscan.in/wp-content/uploads/2023/09/CBDT-Introduces-Form-10-IFA-for-Co-operative-Societies-Form-10-IFA-CBDT-Introduces-Form-10-IFA-Tax-Regime-Income-Tax-Act-21AHA-taxscan.jpg)

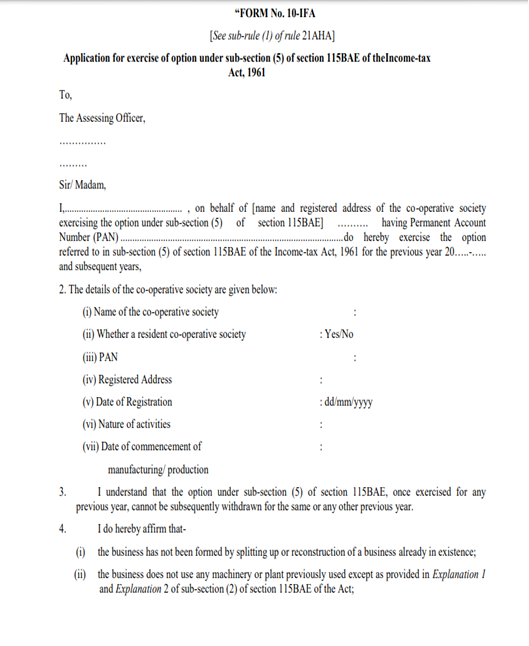

The Central Board of Direct Taxes (CBDT) vide notification no. G.S.R.702(E) issued on 29th September 2023 has notified Income-tax (Twenty-Third Amendment) Rules, 2023. The board has inserted new Rule 21AHA to Exercise Option under Section 115BAE(5) and also a new Form 10-IFA.

In the Income-tax Rules, 1962 , after rule 21AH, the following rule 21AHA shall be inserted, namely:–

“21AHA. Exercise of option under sub-section (5) of section 115BAE.

(1) The option to be exercised in accordance with the provisions of sub-section (5) of section 115BAE by a person, being a co-operative society resident in India, for any previous year relevant to the assessment year beginning on or after the 1st day of April, 2024, shall be in Form No. 10-IFA.

(2) The option in Form No.10-IFA shall be furnished electronically either under digital signature or electronic verification code.

(3) The Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems), as the case may be, shall, –

(i) specify the procedure for filing of Form No. 10-IFA;

(ii) specify the data structure, standards and manner of generation of electronic verification code, referred to in sub-rule (2), for verification of the person furnishing the said Form; and

(iii) be responsible for formulating and implementing appropriate security, archival and retrieval policies in relation to the Form so furnished.”

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Notification No: 83/2023 , 29 September, 2023