CBDT Introduces new Form No. 56F to be Furnished by Assessee from Accountant u/s 10AA(8); Amends Income Tax Rules [Read Notification]

![CBDT Introduces new Form No. 56F to be Furnished by Assessee from Accountant u/s 10AA(8); Amends Income Tax Rules [Read Notification] CBDT Introduces new Form No. 56F to be Furnished by Assessee from Accountant u/s 10AA(8); Amends Income Tax Rules [Read Notification]](https://www.taxscan.in/wp-content/uploads/2023/10/CBDT-Introduces-new-Form-No.-56F-Assessee-from-Accountant-Income-Tax-Rules-taxscan.jpg)

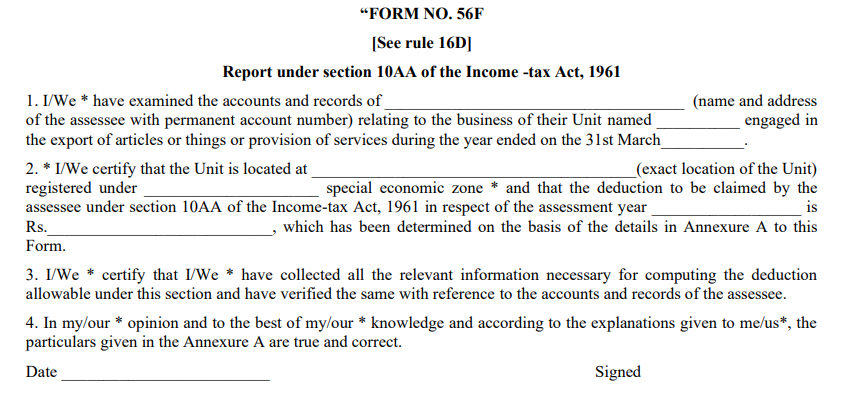

The Central Board of direct taxes (CBDT) vide notification no. G.S.R. 786(E) issued on 20th October 2023 has notified the insertion of new Form No. 56F, which shall be furnished by the assessee from his accountant under Section 10AA(8) of the Income Tax ACt, 1961. The new amendment has also inserted new Rule 16D.

According to the notification, these amendments shall be deemed to have come into force from the 29th day of July, 2021.

In the Income-tax Rules, 1962 (hereinafter referred to as principal rules), after rule 16CC, the following rule shall be inserted, namely:––

"16D. Form of report for claiming deduction under section 10AA.—The report of an accountant which is required to be furnished by the assessee, under sub-section (8) of section 10AA read with sub-section (5) of section 10A shall be in Form No. 56F."

3. In the principal rules, in rule 130,–

(a) in sub-rule (1), the figures and letter“16D”, shall be omitted;

(b) in sub-rule (2), the figures and letter“56F”, shall be omitted.

In the principal rules, in Appendix II, after Form No.56E [as it stood immediately before its omission by the Income-tax (21st Amendment) Rules, 2021], the following Form shall be inserted, namely:–

Notes:

1. *Delete whichever is not applicable

2. † This report is to be given by a Chartered Accountant within the meaning of the Chartered Accountant Act, 1949 (38 of 1949);

3. Where any of the matter stated in this report is answered in the negative or with a qualification, the report shall state the reasons therefor.

The notification is also attached with Annexure A which contains the details relating to the claim by the exporter for deduction under section 10AA of the Income -tax Act or the assessee.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Want to explore further? Check out our related book here:

Notification No: 91 /2023 , 19 October, 2023