CBDT invites Comments on Form 6C for Inventory Valuation till 31st August 2023 [Read Notification]

![CBDT invites Comments on Form 6C for Inventory Valuation till 31st August 2023 [Read Notification] CBDT invites Comments on Form 6C for Inventory Valuation till 31st August 2023 [Read Notification]](https://www.taxscan.in/wp-content/uploads/2023/08/CBDT-CBDT-invites-Comments-Form-6C-Inventory-Valuation-Form-6C-for-Inventory-Valuation-taxscan-.jpg)

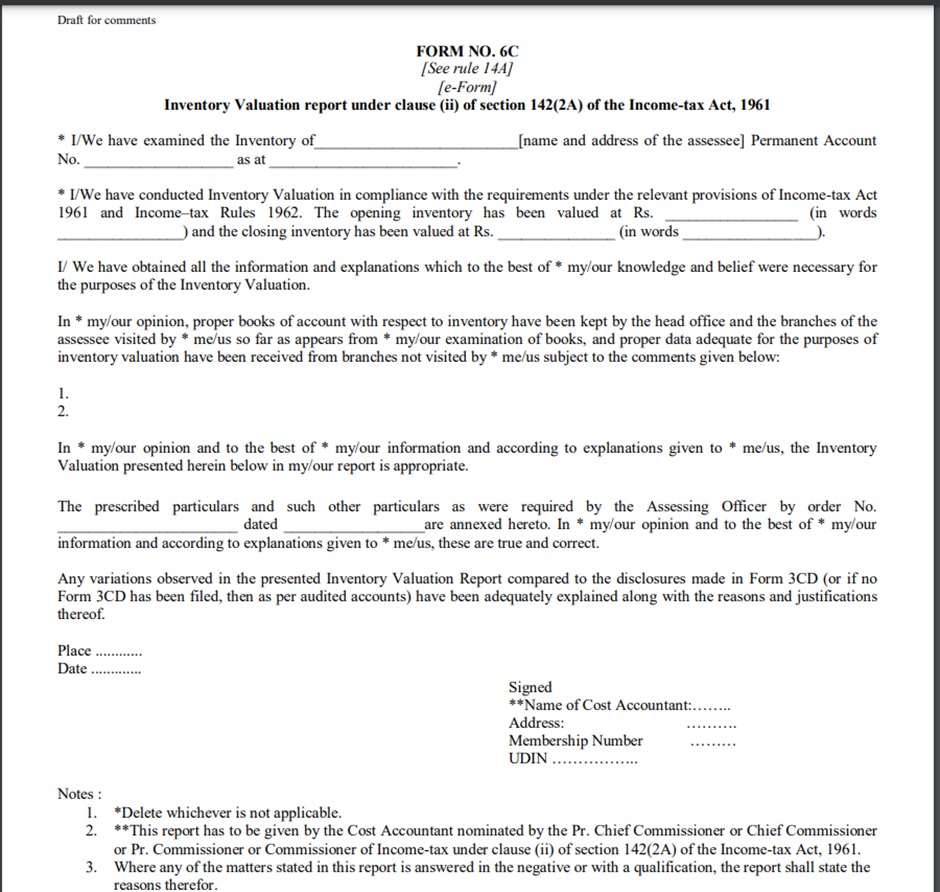

The Central Board of Direct Taxes (CBDT) has invited the comments on Form 6C for Inventory Valuation. The board has requested all the stakeholders as well as the general public to provide suggestions/ comments on draft Form No. 6C and send them at the email address ustpl3@nic.in latest by 31 st August, 2023.

The Section 142(2A) of the Income Tax Act, 1961 provided that if at any stage of proceedings before him, the Assessing Officer, having regard to the nature and complexity of the accounts, volume of the accounts, doubts about the correctness of the accounts, multiplicity of transactions in the accounts or specialized nature of business activity of the assessee, and the interests of the revenue, is of the opinion that it is necessary so to do, he may, with the previous approval of the Pr Chief Commissioner or Chief Commissioner or Pr Commissioner or Commissioner direct assessee to have their accounts audited by an accountant. Form No. 6B has been prescribed in the Income-tax Rules 1962 in this regard.

Vide Finance Act 2023, in order to ensure that inventory is valued in accordance with the various provisions of the Act, Section 142(2A) of the Income Tax Act was amended to enable Assessing Officer to direct the assessee to get inventory valued by a Cost Accountant, nominated by the Pr Chief Commissioner or Chief Commissioner or Pr Commissioner or Commissioner. The assessee is required to furnish the report of inventory valuation in the prescribed form duly signed and verified by the Cost Accountant.

The board has introduced essential modifications to Rule 14A and Rule 14B within the Income Tax Rules, enabling the implementation of the aforementioned provision. Furthermore, a draft version of Form No. 6C (the inventory valuation report form) has been developed, and input from concerned parties and the general public has been sought.

To Read the full text of the Notification CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Notification No: F. No. 370142/29/2023 , 16th August 2023