CBDT Launches new E-Facility to link Aadhaar with PAN Card

With a view to simplify the process of link Aadhaar Card to the Permanent Account Number (PAN), which is a mandatory procedure for filing IT returns now, the IT department launched a new e-facility in their e-filing website.

Recently, the government, under the Finance Act 2017, has made it mandatory for taxpayers to quote Aadhaar or enrolment ID of Aadhaar application form for filing of income tax returns (ITR).

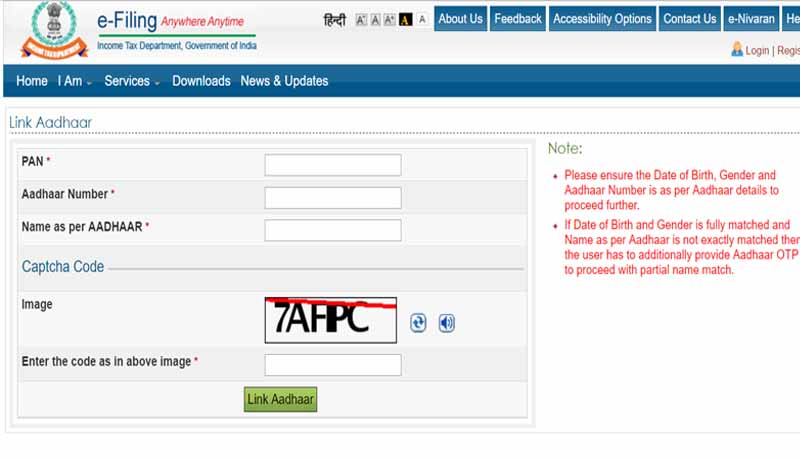

A new link is available in the homepage of the website—https://incometaxindiaefiling.gov.in/ —making it “easy” to link the two unique identities of an individual. The link requires a person to punch in his PAN number, Aadhaar number and the “exact name as given in the Aadhaar card”. “After verification from the UIDAI (Unique Identification Authority of India), the linking will be confirmed.

In case of any minor mismatch in Aadhaar name provided, Aadhaar OTP (one time password) will be sent on the registered mobile number and email of the individual. The department said in its advisory to taxpayers and individuals instructed to ensure that the date of birth and gender in PAN and Aadhaar are exactly the same, to ensure linking without failure

“There is no need to login or be registered on e-filing website (of the I-T department). This facility can be used by anyone to link their Aadhaar with PAN,” it said.

Aadhaar has been made mandatory for applying for permanent account number with effect from July 1, 2017. Reportedly, the department, till now, has linked over 1.18 Aadhaar with its PAN database. However, several petitions challenging the mandatory quoting of Aadhar for filing IT Returns are pending before the Supreme Court.