CBDT Notifies ITR-2, ITR-3 and ITR 5 Forms for A.Y. 2024-25; Expands ITR Filing under EVC to Tax Audit Cases of Individual/ HUF

Individuals and Hindu Undivided Families (HUFs) subject to tax audit under section 44AB can authenticate their income tax return using an electronic verification code

The Central Government, through a notification dated January 31, 2024 (No. G.S.R. 83(E)), has officially released the revised Income Tax Return ( ITR ) forms 2, 3, and 5 for the Assessment Year 2024-25, incorporating changes introduced by the Finance Act, 2023.

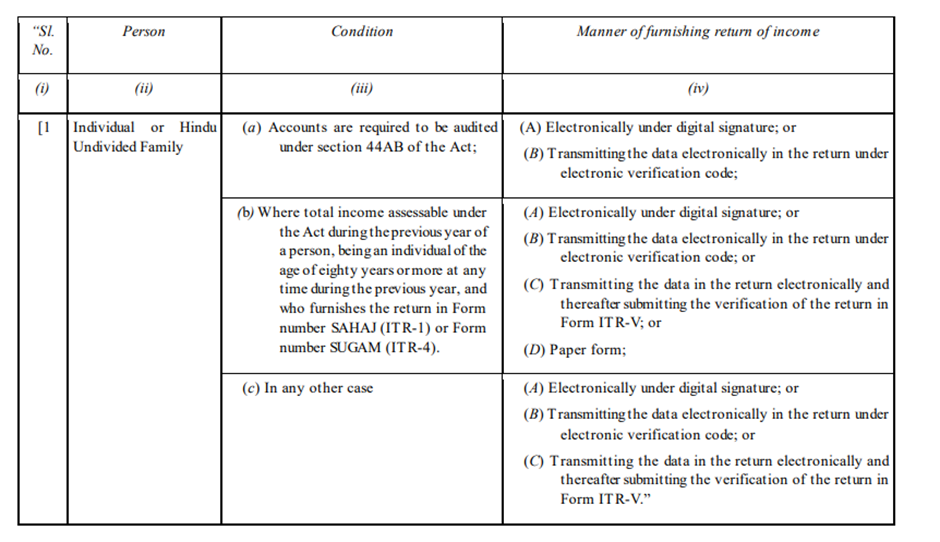

The board has amended the Rule 12 of the Income Tax Rules, 1962 which allowed the individuals and HUF, who are liable to tax audit under section 44AB, to verify return of income through electronic verification code . The rules shall come into force from 1st April 2024.

In the Income-tax Rules, in rule 12, in sub-rule (3), in the Table, for Sl. No. 1 and entries thereto, the following Sl. No. and entries shall be substituted, namely: -

ITR- 2

The ITR-2 form is intended for individuals and Hindu Undivided Families (HUFs) who do not have income from "Profits and Gains of Business or Profession." This form is applicable to individuals with income from sources such as salaries, house property, capital gains, and income from other sources. It is one of the Income Tax Return (ITR) forms used for filing tax returns with the income tax authorities in India.

ITR - 3

The ITR-3 form is applicable to individuals and Hindu Undivided Families (HUFs) who have income from 'Profits and Gains from Business or Profession.' It is specifically designed for taxpayers engaged in business or professional activities and is part of the Income Tax Return (ITR) forms used for filing tax returns with the income tax authorities.

ITR-5

The ITR-5 form is for individuals, Hindu Undivided Families (HUFs), firms (other than Limited Liability Partnerships), Association of Persons (AOP), and Body of Individuals (BOI). It is primarily used by entities other than companies that are not required to file their returns using other specialised ITR forms. The ITR-5 includes provisions for reporting income from various sources, making it suitable for a diverse range of non-corporate entities.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates