CBIC amends Customs Tariff Act with regards to Changes in Online Gaming [Read Notification]

CBIC-Customs-Tariff-Act-Online-Gaming-CBIC-amends-Customs-Tariff-Act-taxscan_

CBIC-Customs-Tariff-Act-Online-Gaming-CBIC-amends-Customs-Tariff-Act-taxscan_

The Central Board of Indirect Taxes and Customs (CBIC) vide notification no. 72/2023-Customs (N.T.) S.O. 4291(E) issued on 30th September 2023 has notified the amendment in Customs Tariff Act, 1975 in pursuant to the changes in online gaming. This notification shall come into force with effect from the 1st day of October, 2023.

In exercise of the powers conferred by sub-section (1) of section 11A of the Customs Tariff Act, 1975, the Central Government, on being satisfied that it is necessary in the public interest so to do, hereby makes the following further amendments in the First Schedule to the Customs Tariff Act, 1975, namely: -

In the First Schedule to the Customs Tariff Act,—

(a) in Chapter 22,—

(i) after Sub-heading Note, the following Supplementary Note shall be inserted, namely:— ‘Supplementary Note:

- For the purposes of tariff item 2207 10 12, “Spirits for industrial use” means rectified spirits which are used for industrial preparation of pharma, food, healthcare products or such other products, except for use in preparation of alcoholic liquors for human consumption.’;

(ii) in heading 2207, after tariff item 2207 10 11 and the entries relating thereto, the following tariff item and entries shall be inserted, namely: —

“2207 10 12 - Spirits for industrial use - 1 - 150% -”;

(b) in Chapter 98, —

(i) for the Chapter heading, the following Chapter heading shall be substituted, namely:—

“Project imports; laboratory chemicals; passengers’ baggage, personal importations by air or post; ship stores; actionable claims”;

(ii) after Note 7, the following Note shall be inserted, namely: —

‘8. For the purposes of heading 9807, the expressions “Online money gaming” and “specified actionable claim” shall have the same meaning as respectively assigned to them in clauses (80B) and (102A) of section 2 of the Central Goods and Service Tax Act, 2017(12 of 2017).

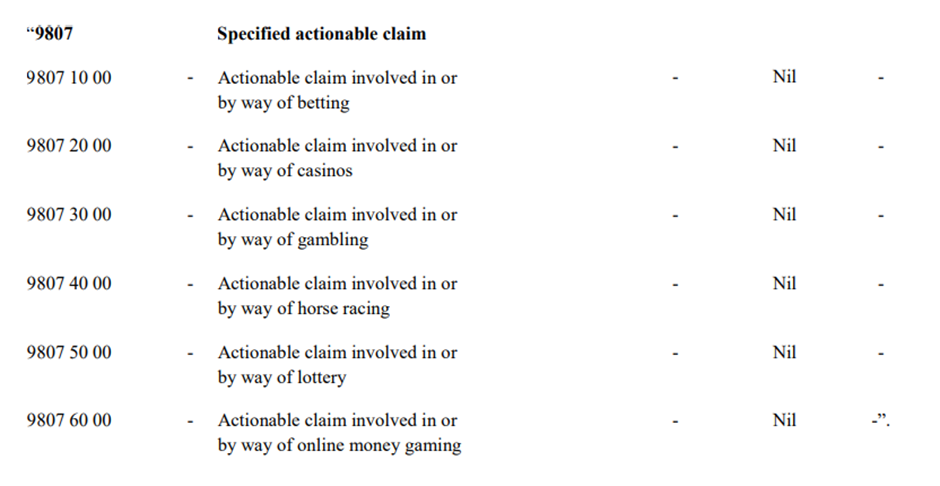

(iii) after tariff item 9806 00 00 and the entries relating thereto, the following shall be inserted, namely: —

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates