CBIC issues clarification on Utilization of Input Tax Credit under GST [Read Circular]

![CBIC issues clarification on Utilization of Input Tax Credit under GST [Read Circular] CBIC issues clarification on Utilization of Input Tax Credit under GST [Read Circular]](https://www.taxscan.in/wp-content/uploads/2018/04/Audit-Objection-Input-Tax-Credit-Taxscan.jpg)

The Central Board of Indirect Taxes and Customs ( CBIC ) has issued a clarification on the utilization of Input Tax Credit under Goods and Services Tax ( GST ).

The issue has arisen on account of order of utilization of input tax credit of integrated tax in a particular order, resulting in accumulatio for one kind of tax (say State tax) in electronic credit ledger and discharge of liability for the other kind of tax (say Central tax) through electronic cash ledger in certain scenarios. Accordingly, rule 88A was inserted in the Central Goods and Services Tax Rules, 2017 in the exercise of the powers under Section 49B of the CGST Act vide notification No. 16/2019- Central Tax, dated 29th March 2019.

In a circular issued by CBIC has said that "the newly inserted Section 49A of the CGST Act provides that the credit of Integrated tax has to be utilized completely before input tax credit of Central tax / State tax can be utilized for the discharge of any tax liability. Further, as per the provisions of section 49 of the CGST Act, credit of Integrated tax has to be utilized first for payment of Integrated tax, then Central tax and then State tax in that order mandatorily. This led to a situation, in certain cases, where a taxpayer has to discharge his tax liability on account of one type of tax (say State tax) through electronic cash ledger, while the input tax credit on account of other types of tax (say Central tax) remains un-utilized in electronic credit ledger".

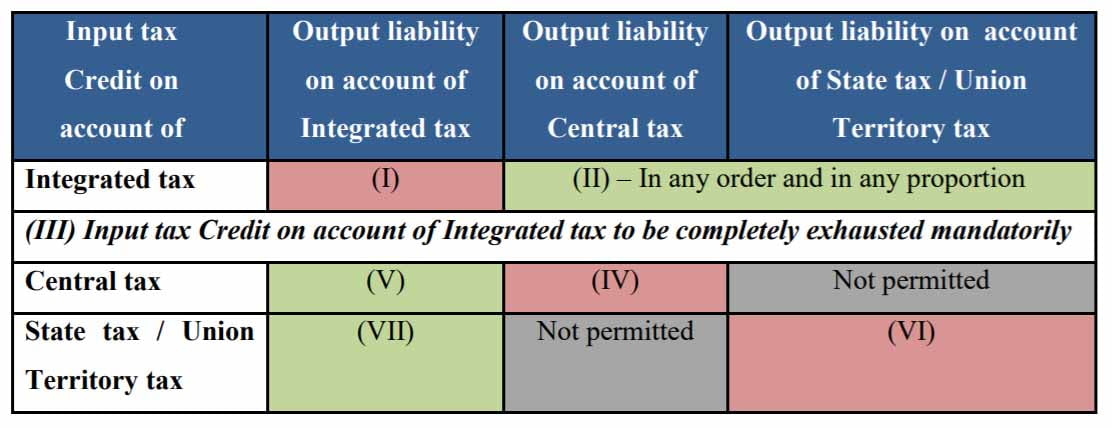

The newly inserted rule 88A in the CGST Rules allows utilization of tax credit of Integrated tax towards the payment of Central tax and State tax, or as the case may be, Union territory tax, in any order subject to the condition that the entire input tax credit on account of Integrated tax is completely exhausted first before the tax credit on account of Central tax or State / Union territory tax can be utilized. It is clarified that after the insertion of the said rule, the order of utilization of tax credit will be as per the order (of numerals) given below:

The CBIC has also clarified that, Presently, the common portal supports the order of utilization of input tax credit in accordance with the provisions before the implementation of the provisions of the CGST (Amendment) Act i.e. pre-insertion of Section 49A and Section 49B of the CGST Act. Therefore, till the new order of utilization as per newly inserted Rule 88A of the CGST Rules is implemented on the common portal, taxpayers may continue to utilize their input tax credit as per the functionality available on the common portal.

To Read the full text of the Circular CLICK HERE