CBIC Extends GST Provisions to Cover Ministry of Railways (Indian railways) for Governmental Services; Notifies Additional Services [Read Order]

![CBIC Extends GST Provisions to Cover Ministry of Railways (Indian railways) for Governmental Services; Notifies Additional Services [Read Order] CBIC Extends GST Provisions to Cover Ministry of Railways (Indian railways) for Governmental Services; Notifies Additional Services [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/10/CBIC-GST-Provisions-CBIC-Extends-GST-Provisions-CBIC-Extends-GST-Provisions-to-Cover-Ministry-of-Railways-Ministry-of-Railways-taxscan.jpg)

The Central Board of Indirect Taxes and Customs (CBIC), vide notification no. 13/2023 Central Tax - (Rate) has notified the additional services provided to a Governmental authority. The notification also extended these provisions to cover the Ministry of Railways (Indian railways) with effect from October 20, 2023.

By virtue of the authority vested in it under subsections (3) and (4) of section 9, subsection (1) of section 11, subsection (5) of section 15, and section 148 of the Central Goods and Services Tax Act, 2017, the Central Government, after being convinced of the necessity in the public interest and in accordance with the Council's recommendations, hereby issues the ensuing amendment to modify the notification previously issued by the Government of India, Ministry of Finance (Department of Revenue). The original notification, No. 12/2017-Central Tax (Rate), dated June 28, 2017, was published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i), under reference number G.S.R. 691(E), also dated June 28, 2017.

In the said notification, in the Table, -

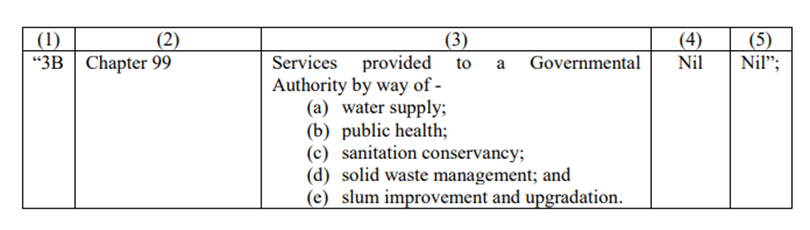

(1.) after serial number 3A and the entries relating thereto, the following serial number and entries shall be inserted, namely: -

(2.) against serial number 6, in column (3),in item (a), after the words “Department of Posts”, the words and brackets “and the Ministry of Railways (Indian Railways)” shall be inserted;

(3.) against serial number 7, in column (3), in the Explanation, in item (a), in sub-item(i), after the words “Department of Posts”, the words and brackets “and the Ministry of Railways (Indian Railways)”shall be inserted;

(4.) against serial number 8, in column (3)in the proviso, in item (i), after the words “Department of Posts”, the words and brackets “and the Ministry of Railways (Indian Railways)” shall be inserted;

(5.) against serial number 9,in column (3), in the first proviso, in item (i), after the words “Department of Posts”, the words and brackets “and the Ministry of Railways (Indian Railways)” shall be inserted;

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Notification No: 13/2023 , 19th October, 2023