CBIC Imposes 5-Year Anti-Dumping Duty on Textured Tempered Glass Imports from China and Vietnam [Read Notification]

![CBIC Imposes 5-Year Anti-Dumping Duty on Textured Tempered Glass Imports from China and Vietnam [Read Notification] CBIC Imposes 5-Year Anti-Dumping Duty on Textured Tempered Glass Imports from China and Vietnam [Read Notification]](https://www.taxscan.in/wp-content/uploads/2025/05/Tempered-Glass-site-img.jpg)

The Central Board of Indirect Taxes and Customs (CBIC) has imposed a definitive anti-dumping duty for a period of five years on the imports of Textured Tempered Coated and Uncoated Glass originating in or exported from China PR and Vietnam.

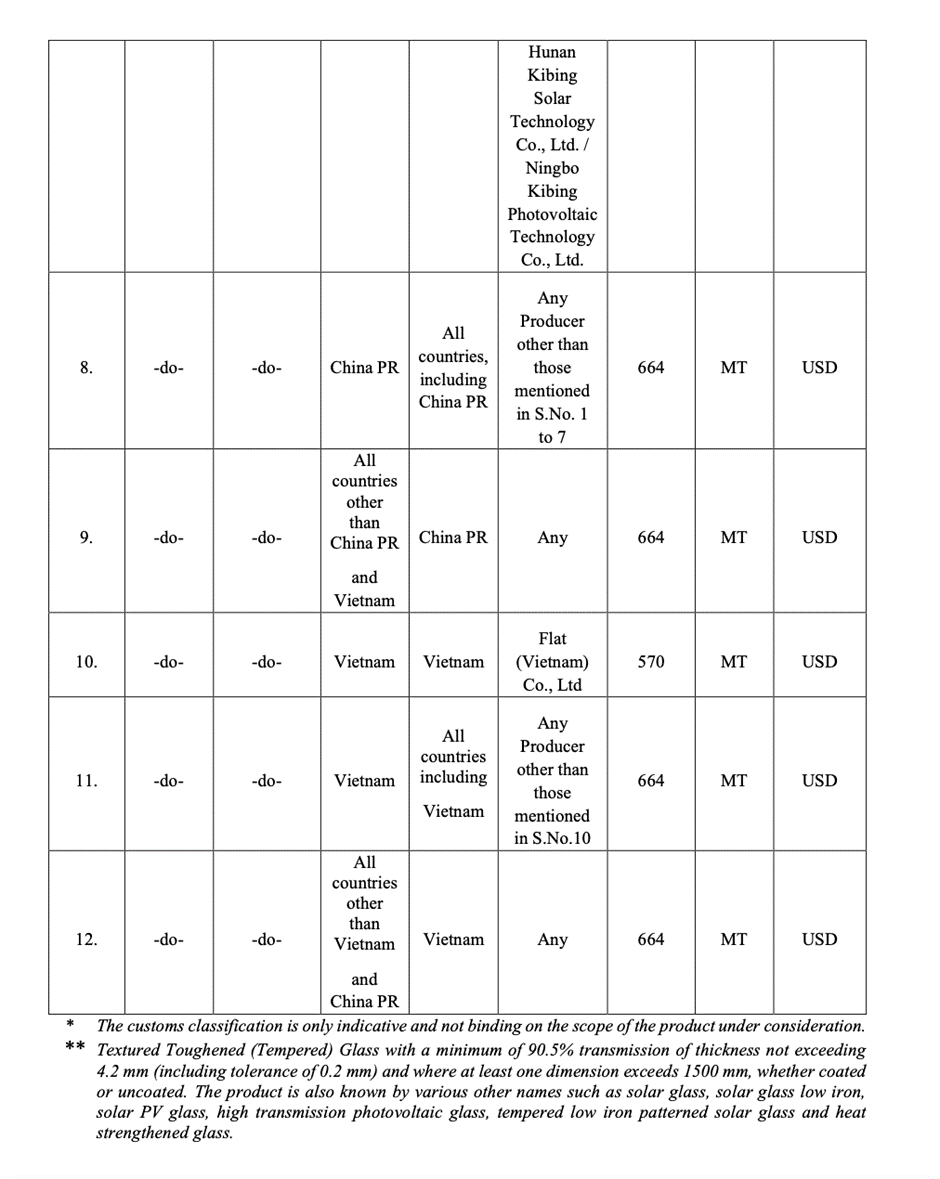

The subject goods, classified under tariff headings 7003, 7005, 7007, 7016, 7020, and 8541 of the First Schedule to the Customs Tariff Act, 1975, were earlier brought under provisional anti-dumping measures through Notification No. 26/2024-Customs (ADD), dated 4th December 2024. This provisional duty was based on the preliminary findings of the Directorate General of Trade Remedies (DGTR) vide Notification No. 6/29/2023-DGTR dated 5th November 2024.

Complete Guide on Bogus Purchases Under the Income Tax Act - Click here

Following a detailed investigation, the DGTR, in its final findings dated 10th February 2025, concluded that:

- There was a substantial increase in the volume of dumped imports of the subject goods from China and Vietnam during the injury period, both in absolute and relative terms;

- The imports were being dumped at prices lower than the normal value;

- The domestic industry suffered material injury due to these imports; and

- The injury was directly caused by the dumped imports of the subject goods.

Based on these findings, the authority recommended the imposition of a definitive anti-dumping duty to neutralize the injurious effects of dumping and protect the domestic manufacturers.

As per the official notification, the duty shall remain in force for five years from 4th December 2024, unless revoked, superseded, or amended earlier. The anti-dumping duty is payable in Indian currency.

The applicable rate of exchange for the calculation of the anti-dumping duty shall be the one notified by the Ministry of Finance under Section 14 of the Customs Act, 1962, and the relevant date shall be the date of presentation of the bill of entry under Section 46 of the said Act.

The landed value of imports will be the assessable value as determined under the Customs Act and will include all customs duties except those under Sections 3, 8B, 9, and 9A of the Customs Tariff Act.

The duty table is as follows;

To Read the full text of the Notification CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Notification No; 11/2025-CUSTOMS (ADD) , 08 May 2025