CBIC imposes Monetary Limits for Filing GSTAT, HC and Supreme Court Appeals and Applications by Department [Read Circular]

![CBIC imposes Monetary Limits for Filing GSTAT, HC and Supreme Court Appeals and Applications by Department [Read Circular] CBIC imposes Monetary Limits for Filing GSTAT, HC and Supreme Court Appeals and Applications by Department [Read Circular]](https://www.taxscan.in/wp-content/uploads/2024/06/CBIC-Monetary-Limits-Filing-GSTAT-HC-Supreme-Court-Department-taxscan.jpg)

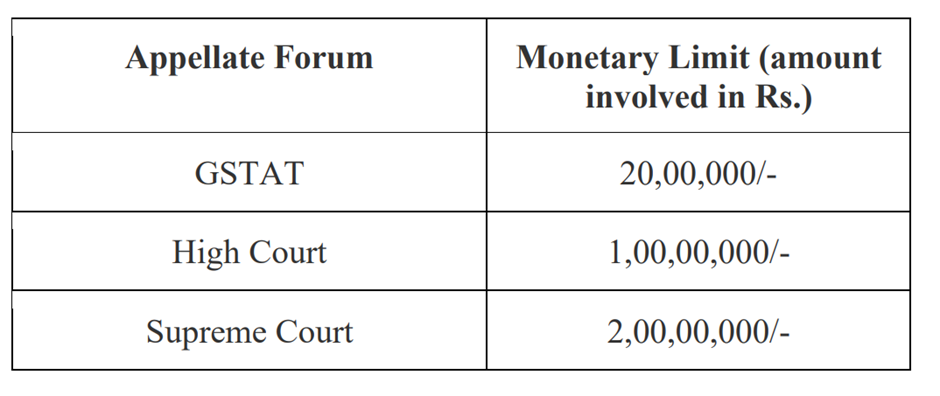

The Central Board of Indirect Taxes and Customs ( CBIC ) has issued a circular, imposing monetary limits on Goods and Services Tax appeals and applications by the department at Goods and Services Tax Appellate Tribunal ( GSTAT ), High Courts and the Supreme Court in line with the National Litigation Policy which was conceived with the aim of optimising the utilisation of judicial resources and expediting the resolution of pending cases.

Check out the live coverage of GST Council Meeting here: 53rd GST Council Meeting: Live Updates

Accordingly, in exercise of the powers conferred by Section 120 of the CGST Act read with section 168 of the CGST Act, the Board, on the recommendations of the GST Council, fixes the following monetary limits below which appeal or application or Special Leave Petition, as the case may be, shall not be filed by the Central Tax officers before Goods and Service Tax Appellate Tribunal ( GSTAT ), High Court and Supreme Court under the provisions of CGST Act as given below:

Determination of Cases beyond Monetary Limit

While determining whether a case falls within the above monetary limits or not, the following principles are to be considered:

i. Where the dispute pertains to demand of tax (with or without penalty and/or interest), the aggregate of the amount of tax in dispute ( including CGST, SGST/UTGST, IGST and Compensation Cess ) only shall be considered while applying the monetary limit for filing appeal.

ii. Where the dispute pertains to demand of interest only, the amount of interest shall be considered for applying the monetary limit for filing appeal.

iii. Where the dispute pertains to imposition of penalty only, the amount of penalty shall be considered for applying the monetary limit for filing appeal.

iv. Where the dispute pertains to imposition of late fee only, the amount of late fee shall be considered for applying the monetary limit for filing appeal.

v. Where the dispute pertains to demand of interest, penalty and/or late fee (without involving any disputed tax amount), the aggregate of amount of interest, penalty and late fee shall be considered for applying the monetary limit for filing appeal.

vi. Where the dispute pertains to erroneous refund, the amount of refund in dispute ( including CGST, SGST/UTGST, IGST and Compensation Cess ) shall be considered for deciding whether appeal needs to be filed or not.

vii. Monetary limit shall be applied on the disputed amount of tax/interest/penalty/late fee, as the case may be, in respect of which appeal or application is contemplated to be filed in a case.

viii. In a composite order which disposes more than one appeal/demand notice, the monetary limits shall be applicable on the total amount of tax/interest/penalty/late fee, as the case may be, and not on the amount involved in individual appeal or demand notice.

Exclusions

Monetary limits specified above for filing appeal or application by the department before GSTAT or High Court and for filing Special Leave Petition or appeal before the Supreme Court shall be applicable in all cases, except in the following circumstances where the decision to file appeal shall be taken on merits irrespective of the said monetary limits:

i. Where any provision of the CGST Act or SGST/UTGST Act or IGST Act or GST (Compensation to States) Act has been held to be ultra vires to the Constitution of India; or

ii. Where any Rules or regulations made under CGST Act or SGST/UTGST Act or

IGST Act or GST ( Compensation to States ) Act have been held to be ultra vires the parent Act; or

iii. Where any order, notification, instruction, or circular issued by the Government or

the Board has been held to be ultra vires of the CGST Act or SGST/UTGST Act or

IGST Act or GST ( Compensation to States ) Actor the Rules made thereunder;or

iv. Where the matter is related to -

a. Valuation of goods or services; or

b. Classification of goods or services; or

c. Refunds; or

d. Place of Supply; or

e. Any other issue, which is recurring in nature and/or involves interpretation of the provisions of the Act /the Rules/ notification/circular/order/instruction etc; or

v. Where strictures/adverse comments have been passed and/or cost has been imposed against the Government/Department or their officers; or

vi. Any other case or class of cases, where in the opinion of the Board, it is necessary to contest in the interest of justice or revenue.

To Read the full text of the Circular CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Circular No: 207/1/2024-GST , 26 thJune 2024