CBIC issues Circular Implementing Ex-Bond Shipping Bill in Indian Customs EDI System (ICES)[Read Circular]

![CBIC issues Circular Implementing Ex-Bond Shipping Bill in Indian Customs EDI System (ICES)[Read Circular] CBIC issues Circular Implementing Ex-Bond Shipping Bill in Indian Customs EDI System (ICES)[Read Circular]](https://www.taxscan.in/wp-content/uploads/2023/09/CBIC-issues-Circular-Implementing-Ex-Bond-Shipping-Bill-in-Indian-Customs-EDI-System-TAXSCAN.jpg)

The Central Board of Indirect Taxes and Customs (CBIC), vide Circular No. 22/2023-Customs issued on 19th September 2023 has been notified to implement ex-bond shipping bill in Indian Customs EDI System (ICES).

The reference was drawn to Sections 68 and 69 of the Customs Act, 1962 which deal with clearance of warehoused goods for home consumption and for export respectively. A bill of entry (BE) format for home consumption clearance of such goods is already available in the ICES. Such ex-bond BE is linked in the System with the original warehousing (into-bond) BE through which these goods were warehoused at the time of import into India.

So far, there was no format for ex-bond shipping bill (SB) in the System to cover export of warehoused goods. Due to this, the ledger of warehoused goods was not complete as all transactions of removal of cargo were not captured.

Now, a format for ex-bond SB has been developed on ICES for processing of export of warehoused goods from a bonded warehouse. The design and workflow are as follows:

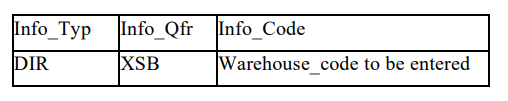

- While filing an ex-bond SB, the exporter needs to declare the warehouse code in the single window table, with following details, which will depict that it is a re export case:

This warehouse code would reflect the warehouse, from where the goods are to be exported. It may or may not be the warehouse where the goods were originally warehoused at the time of import.

- Once the above details are provided, in the next screen item-wise details of bill of entry (BE_Site, BE_No, BE_Date, BE_Inv_SrNo, BE_Item no) will have to be entered.

- In one shipping bill, only one warehouse code can be captured which means that goods lying in only one warehouse can be exported in a single shipping bill and separate shipping bills are required to be filed for export of bonded cargo from more than one warehouse.

- In ex-bond SB, for each item, details of into-bond BE i.e. BE No. and date, invoice no., sl. no. etc., shall be mandatory. For each item, only one into-bond BE can be captured. For example, if fifty units of the same item were warehoused under five different into-bond BE (ten units under each into-bond BE) and now the exporter wants to export these fifty items, he will have to declare these goods as five different items. Hence, the SB format will allow export of items imported under more than one into bond BE under one ex-bond SB to address the requests of the trade that goods imported separately may be cleared under one document.

- Once SB is filed, after successful verification, the system would debit the quantity exported in the ledger from the quantity imported. In case of cancellation of SB or purging of SB, the quantity would be re-credited automatically. Any amendment in the SB quantity has also been linked with the ledger quantity so as to update the ledger accordingly.

This specific shipping bill is exclusively designed for the export of goods stored in a bonded warehouse and cannot be utilized for any other type of goods. Furthermore, it is not intended for goods that have been manufactured or processed within a bonded warehouse under section 65. Nevertheless, in cases where goods that were initially imported into a warehouse with permission granted under section 65 are exported in their original condition, the mentioned ex-bond shipping bill can be submitted.

No incentive such as Drawback, RoDTEP/RoSCTL benefit, advance authorisation/EPCG etc. shall be available for such cargo and the SB would be a free SB.

Advisory from DG Systems follows. Officers facing any issues may email to saksham.seva@icegate.gov.in. Traders facing any difficulties may email to icegatehelpdesk@icegate.gov.in.

Suitable Public Notice may be issued so as to ensure that only ex-bond SB is filed for export of warehoused goods.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Circular No. 22/2023-Customs , 19th September, 2023