CBIC notifies due date for Form GSTR-1 for the months of October 2019 to March, 2020 [Read Notification]

![CBIC notifies due date for Form GSTR-1 for the months of October 2019 to March, 2020 [Read Notification] CBIC notifies due date for Form GSTR-1 for the months of October 2019 to March, 2020 [Read Notification]](https://www.taxscan.in/wp-content/uploads/2018/08/GSTR-1-Taxscan.jpg)

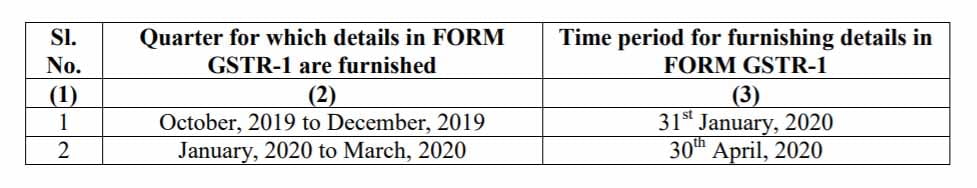

The Central Board of Indirect Taxes and Customs ( CBIC ) has notified due date for Form GSTR-1 for the months of October 2019 to March, 2020.

In Notification Number issued CBIC said that, “registered persons having aggregate turnover of up to 1.5 crore rupees in the preceding financial year or the current financial year, as the class of registered persons who shall follow the special procedure as mentioned below for furnishing the details of outward supply of goods or services or both”.

In the notification No.46 issued by CBIC said that, “the time limit for furnishing the details of outward supplies in FORM GSTR-1 of the Central Goods and Services Tax Rules, 2017, by such class of registered persons having aggregate turnover of more than 1.5 crore rupees in the preceding financial year or the current financial year, for each of the months from October, 2019 to March, 2020 till the eleventh day of the month succeeding such month”.

The Notification also said that “time limit for furnishing the details of return, as the case may be, under sub-section (2) of section 38 of the said Act, for the months of October, 2019 to March, 2020 shall be subsequently notified”.

GSTR-1 is a monthly or quarterly return that should be filed by every registered dealer. It contains details of all outward supplies i.e sales.

Every registered person is required to file GSTR-1 irrespective of whether there are any transactions during the month or not.

The following registered persons are exempt from filing the return:

- Input Service Distributors

- Composition Dealers

- Suppliers of online information and database access or retrieval services (OIDAR), who have to pay tax themselves (as per Section 14 of the IGST Act)

- Non-resident taxable person

- Taxpayer liable to collect TCS

- Taxpayer liable to deduct TDS