CBIC notifies GSTR 1A Form in 2024 CGST Amendment Rules: Everything you need to Know about Form Filing [Read Notification]

The instructions for filing GSTR 1A is provided

![CBIC notifies GSTR 1A Form in 2024 CGST Amendment Rules: Everything you need to Know about Form Filing [Read Notification] CBIC notifies GSTR 1A Form in 2024 CGST Amendment Rules: Everything you need to Know about Form Filing [Read Notification]](https://www.taxscan.in/wp-content/uploads/2024/07/CBIC-GSTR-GSTR-1A-CGST-CGST-Amendment-Rules-taxscan.jpg)

The Central Board of Indirect Taxes and Customs ( CBIC ) has notified the GSTR 1A form in the CGST Amendment Rules, 2014 dated 10th July 2024. The GST council approved the introduction of a new GSTR 1A form in its 53rd meeting.

The GSTR 1A form offers taxpayers the flexibility to revise or add records within the same month after filing GSTR-1, but before filing the GSTR-3B summary return.

NEWLY INSERTED PROVISO TO RULE 59(1) UNDER GST RULES

According to newly provision inserted in 59(1),

“Provided that the said person may, after furnishing the details of outward supplies of goods or service or both in FORM GSTR-1 for a tax period but before filing of return in FORM GSTR-3B for the said tax period, at his own option, amend or furnish additional details of outward supplies of goods or services or both in FORM GSTR-1A for the said tax period electronically through the common portal, either directly or through a Facilitation Centre as may be notified by the Commissioner.”;

(ii) in sub-rule (4), with effect from 1st day of August, 2024, for the words “two and a half lakh rupees” wherever they occur, the words “one lakh rupees” shall be substituted;

As per Rule 59(1)(4), which prescribes the Form and manner of furnishing details of outward supplies —

(a) invoice wise details of -

(i) inter-State and intra-State supplies made to the registered persons; and

(ii) inter-State supplies with invoice value more than one lakh rupees made to the unregistered persons;

(b) consolidated details of -

(i) intra-State supplies made to unregistered persons for each rate of tax; and

(ii) State wise inter-State supplies with invoice value up to one lakh rupees made to unregistered persons for each rate of tax;

(c) debit and credit notes, if any, issued during the month for invoices issued previously.

FORM GSTR 1A

The newly introduced GSTR 1A form includes:

1.Amendment of outward supplies of goods or services for current tax period

2.GSTIN

3. ARN & Date

4. Taxable outward supplies made to registered persons (including UIN-holders) other than supplies covered by Table 6

5. Taxable outward inter-State supplies to unregistered persons where the invoice value is more than Rs 1 lakh

6. Zero rated supplies and Deemed Exports

7. Taxable supplies (Net of debit notes and credit notes) to unregistered persons other than the supplies covered in Table 5

8. Nil rated, exempted and non-GST outward supplies

9. Amendments to taxable outward supply details furnished in FORM- GSTR-1 for the current tax periods in Table 4, 5 and 6 [including debit and credit notes issued during current period and amendments thereof]

10. Amendments to taxable outward supplies to unregistered persons furnished in FORM GSTR-1 for current tax periods in Table 7

11. Consolidated Statement of Advances Received/Advance adjusted in the current tax period/ Amendments of information furnished in current tax period [(Net of refund vouchers, if any)]

12. HSN-wise summary of outward supplies

13. Documents issued during the tax period

14. Details of the supplies made through e-commerce operators on which e-commerce operators are liable to collect tax under section 52 of the Act or liable to pay tax u/s 9(5) [Supplier to report]

14A. Amendment to details of the supplies made through e-commerce operators on which e-commerce operators are liable to collect tax under section 52 of the Act or liable to pay tax u/s 9(5) [Supplier to report]

15. Details of the supplies made through e-commerce operators on which e-commerce operator is liable to pay tax u/s 9(5) [e-commerce operator to report]

15A (I). Amendment to details of the supplies made through e-commerce operators on which e-commerce operator is liable to pay tax u/s 9(5) [e-commerce operator to report, for registered recipients]

15A (II). Amendment to details of the supplies made through e-commerce operators on which e-commerce operator is liable to pay tax u/s 9(5) [e-commerce operator to report, for unregistered recipients]

Also read: GST Council may Introduce a New Form GSTR-1A

INSTRUCTIONS FOR FILING GSTR-1A

- GSTR 1A is an additional facility provided to add any particulars of current tax period missed out in reporting in FORM GSTR-1 of current tax period or amend any particulars already declared FORM GSTR-1 of current tax period (including those declared in IFF, for the first and second months of a quarter, if any,for quarterly taxpayers)The form is an optional form without levy of late fees.

- The FORM will be available on the portal from the later of the due date or the actual date of filing FORM GSTR-1, until the filing of the corresponding FORM GSTR-3B for the same tax period. For quarterly taxpayers, FORM GSTR-1A will be available quarterly from the later of the due date or the actual date of filing FORM GSTR-1 (Quarterly), until the filing of FORM GSTR-3B for the same tax period.

- Details declared in FORM GSTR-1A and FORM GSTR-1 will be included in FORM GSTR-3B. For taxpayers filing quarterly returns, these details will be included in FORM GSTR-3B (Quarterly), along with information from FORM GSTR-1 and IFF of Months M1 and M2 (if filed).

- Amendment of a document which is related to change of Recipient’s GSTIN shall not be allowed in GSTR-1A.

- In addition to the GSTR-2B already generated, GSTR-2B shall also consist of all the supplies declared by the respective suppliers in GSTR-1A. However, supplies declared or amended in FORM GSTR-1A shall be made available in the next open FORM GSTR-2B. For example,

(i) a supplier issues two invoices INV1 and INV2 in the month of January 2023. Then he furnished the details of the invoice INV1 on 8th Feb 2023 in FORM GSTR-1. However, he misses one invoice INV2 and furnishes the details of the same in FORM GSTR-1A on 15th Feb 2023. In this case, INV1 will go to the FORM GSTR-2B of the recipient for the month of January made available on 14th Feb 2023. Further, INV2 will be made available in FORM GSTR-2B of the recipient for the month of February made available on 14th March 2023.

(ii) a supplier issues two invoices INV3 and INV4 in the month of January 2023. Then he furnished the details of the invoice INV3 on 15th Feb 2023 in FORM GSTR-1. However, he declared INV 4 in FORM GSTR-1A on 16th Feb 2023. In this case, both INV3 and INV4 will be made available in FORM GSTR-2B of the recipient for the month of February made available on 14th March 2023.

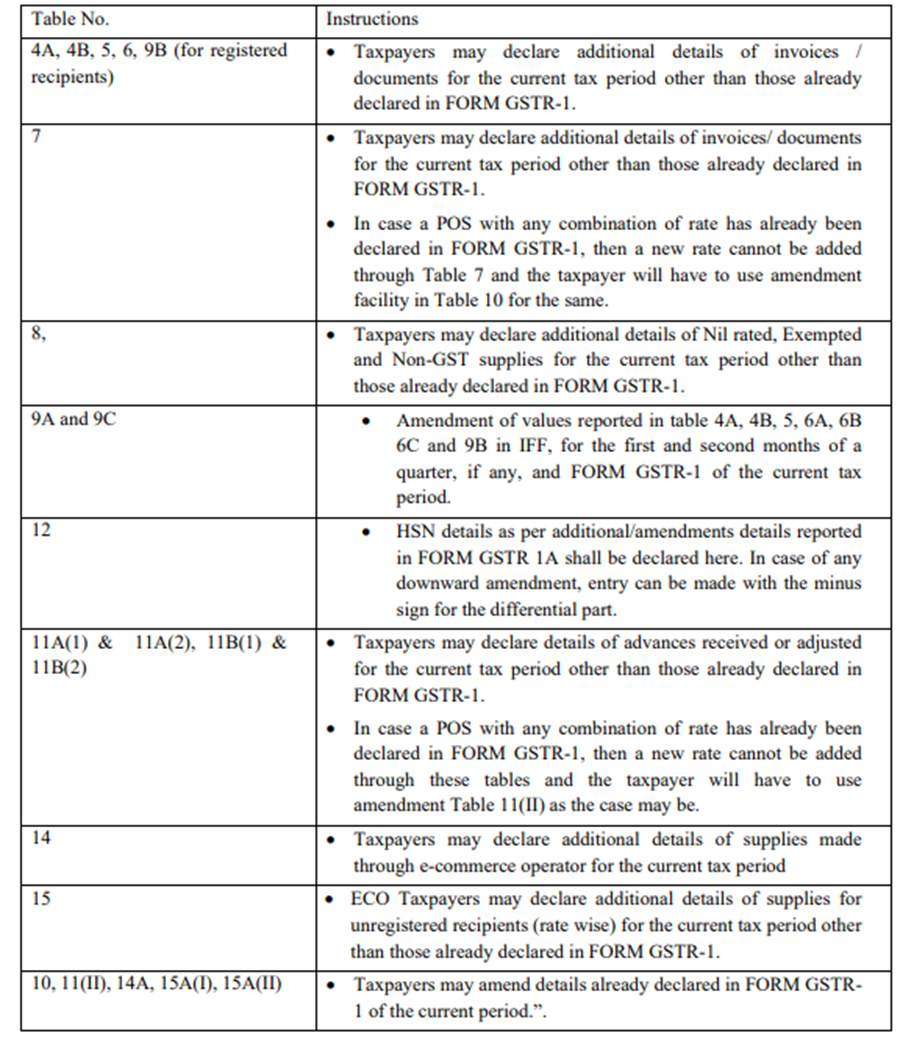

6. Instructions for specific tables:-

Also read: FM Confirms New GST Return Form GSTR-1A after 53rd GST Council Meeting

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Notification no: 12/2024 � Central Tax , 10th July 2024