CBIC releases Instruction on SOP for Preventive Vigilance Mechanism and to Prevent Flow of Suspicious Cash, illicit liquor, drugs, freebies and Smuggled goods during Elections [Read Instruction]

CBIC releases Instruction – CBIC releases Instruction on SOP – SOP – Preventive Vigilance Mechanism – Prevent Flow – Suspicious Cash – illicit liquor – drugs – taxscan

CBIC releases Instruction – CBIC releases Instruction on SOP – SOP – Preventive Vigilance Mechanism – Prevent Flow – Suspicious Cash – illicit liquor – drugs – taxscan

The Central Board of Indirect Taxes and Customs (CBIC) has issued an Instruction No. 22/2023-Customs regarding the Standard Operating Procedure (SOP) to enhance the Preventive Vigilance Mechanism employed by CBIC field formations at the jurisdictional level on 6th July 2023. The objective is to prevent the circulation of suspicious cash, illegal liquor, drugs/narcotics, freebies, and smuggled goods during elections.

The instruction was based on the concerns raised by the Election Commission of India (ECI). The ECI has raised the concerns regarding the potential use of smuggled goods, contraband items, and other illicit articles to entice voters during the electoral process. The ECI emphasized the need for law enforcement agencies, including those under the Central Board of Indirect Taxes and Customs (CBIC), to undertake measures to counteract such activities.

The ECI has stressed the significance of a coordinated and targeted approach, along with effective information sharing among field formations of the CBIC and other relevant agencies, to ensure the conduct of impartial and seamless elections.

In this regard, the Standard Operating Procedure (SOP) was issued and also is to be adhered to by CBIC formations to uphold the principles of free and fair elections.

According to the SOP issued, the Principal Chief Commissioners/ Chief Commissioners of Customs, Customs (Prev.) and Central Goods and Services Tax (CGST) Zones and the Principal Additional Director Generals (Pr. ADGs)/ Additional Director Generals (ADGs) of Zonal Units of Directorate of Revenue Intelligence (DRI) and Directorate General of Goods and Service Tax Intelligence (DGGSTI) should attend all the meetings called by the Chief Election Commissioner or Member(s) of the ECI or on their behalf.

It was also stated that Pr. DG, DRI and Pr. DG, DGGSTI shall establish a headquarters and a Control Room in each State/ UT concerned. Also shall designate a nodal officer.

The Pr. DG, DRI and Pr. DG, DGGSTI shall direct their intelligence units to gather information and develop intelligence to effectively prevent unfair and unauthorized practices that could vitiate the elections.

Likewise, Principal Chief Commissioners/Chief Commissioners of Customs, Customs (Preventive), and CGST Zones in question will establish an adequate number of Flying Squads and Static Surveillance Teams to ensure the efficient implementation of road and transit inspections on vehicles and the verification of warehouses, as necessary, to combat illicit and prohibited activities.

It was also mentioned that the above mentioned officers shall ensure against unauthorized diversion of liquor, cigarettes etc. special watch/ stock-taking should be kept/ carried out in the Custom Bonded Warehouses.

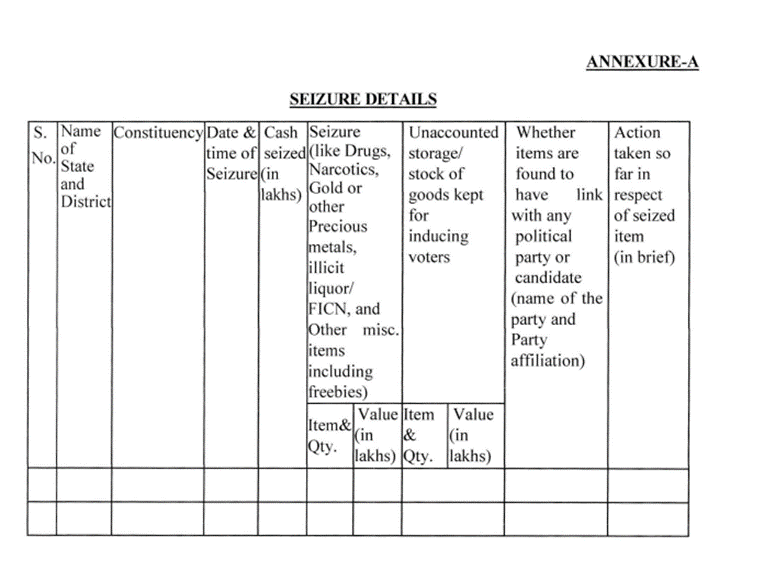

The detections made and results achieved are to be reported daily by the Customs, Customs

(Prev.) and CGST Zones and DGGSTI Zonal Units concerned, to the Nodal Officer of DRI headquarters in their State in the prescribed format attached as Annexure-A.

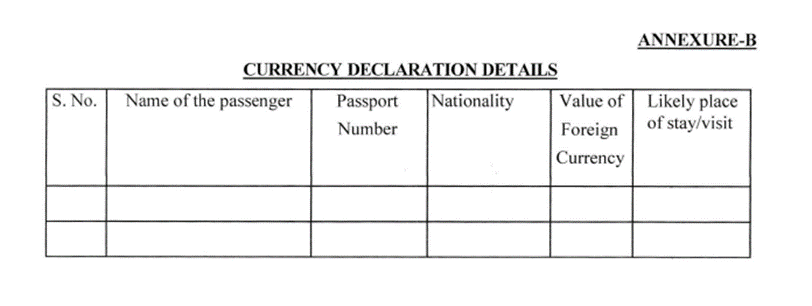

It was also directed in the SOP that the Pr. Commissioner/ Commissioner of Customs in-charge of Customs Airports in the concerned States shall furnish a daily report on the declaration of foreign currency in the format given at Annexure-B to the Nodal Officer of DRI.

This report shall also be given by all other Pr. Commissioners/ Commissioners of Customs-in-charge of Customs Airports to the Nodal Officer of DRI, in the State concerned but only in respect of passengers whose place of stay is in one of the poll bound states.

The mentioned SOP specified that the Directorate of Revenue Intelligence (DRI) should intensify its monitoring efforts along the international border and airports. It should also enhance its information gathering system to prevent the movement of foreign currency, gold, narcotics, and other illicit substances that may be exploited for illicit activities during the electoral process.

The CBIC has directed its officers to adhere strictly to the provided SOP and encourages them to provide suggestions for further strengthening monitoring efforts to effectively prevent any misuse.

Any suggestions made to enhance vigilance should be promptly communicated to the Commissioner (Investigation-Customs), CBIC, and the Commissioner (Investigation-GST). Furthermore, actions taken regarding preparedness and any seizures made should be reported on the same day.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates