CBIC replaces Form GST REG-08; Notifies CGST Fourth Amendment Rules [Read Order]

![CBIC replaces Form GST REG-08; Notifies CGST Fourth Amendment Rules [Read Order] CBIC replaces Form GST REG-08; Notifies CGST Fourth Amendment Rules [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/10/CBIC-replaces-Form-GST-REG-08-Notifies-CGST-Fourth-Amendment-Rules-TAXSCAN.jpg)

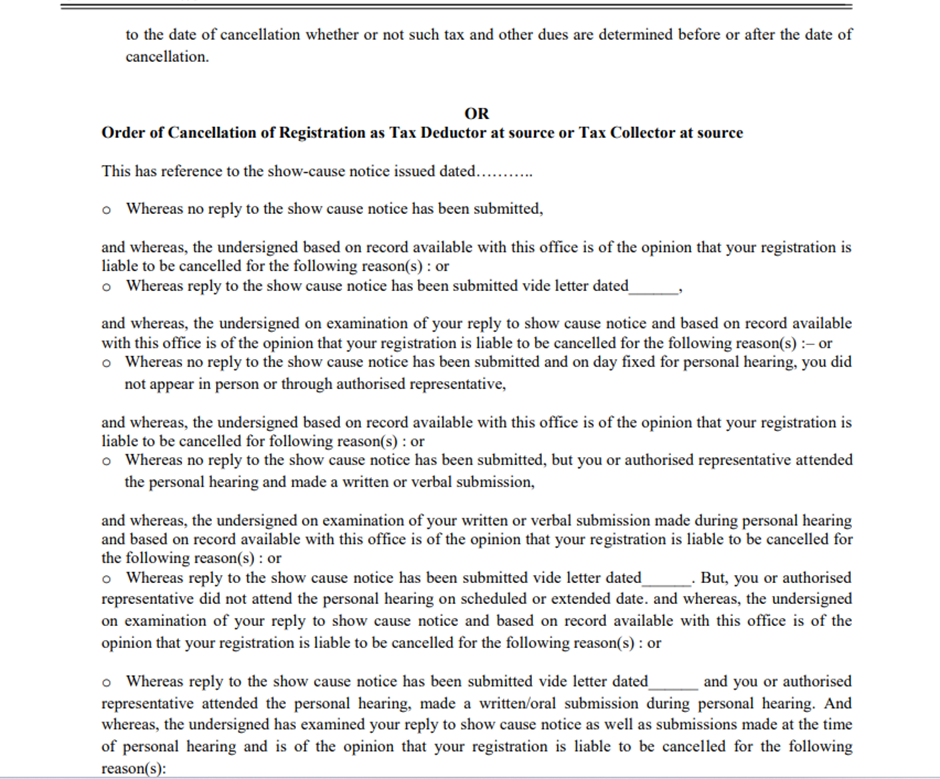

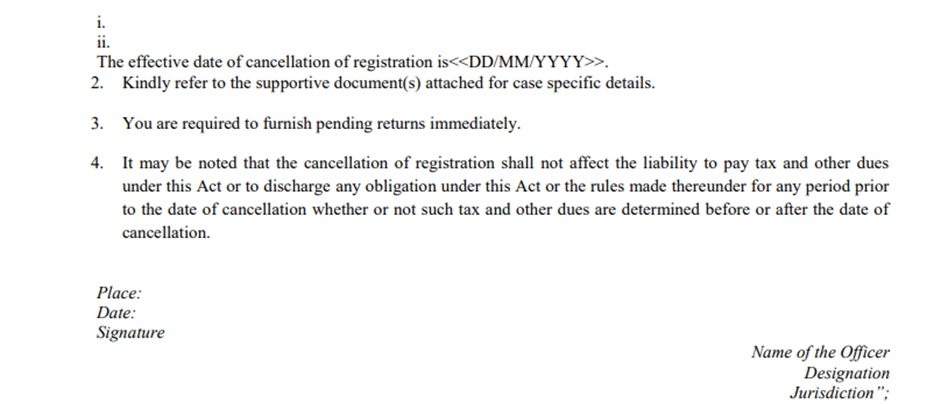

The Central Board of Indirect Taxes and Customs (CBIC), vide notification no. 52/2023 – Central Tax G.S.R. 798(E) issued on 26th October 2023 has substituted Form GST REG-08 which is used for the Cancellation of Registration as Tax Deductor at Source (TDS) or Tax Collector at source (TCS).

The CBIC has also amended the GST rules to facilitate valuation of corporate guarantees between related parties in furtherance of the Goods and Services Tax (GST) Council recommendations.

Read More: CBIC notifies Amendment in CGST Rules for Valuation of Corporate Guarantees between Related Parties

The board has also notified the addition of ‘One Person Company’ in Goods and Services Tax (GST) Registration form GST REG-01.

Read More: CBIC notifies Addition of ‘One Person Company’ for GST Registration in FORM GST REG-01

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Notification No: CBIC-20001/10/2023 , 26th October, 2023