CBIC Revises GSTR 3B Table 6.1 to include Previous Period Negative Liability Adjustments [Read Notification]

GSTR 3B Table 6.1 replaced with a new table

![CBIC Revises GSTR 3B Table 6.1 to include Previous Period Negative Liability Adjustments [Read Notification] CBIC Revises GSTR 3B Table 6.1 to include Previous Period Negative Liability Adjustments [Read Notification]](https://www.taxscan.in/wp-content/uploads/2024/07/CBIC-GSTR-3B-GST-Act-GSTR-CBIC-updates-Customs-GSTR-3B-Table-6.1-taxscan.jpg)

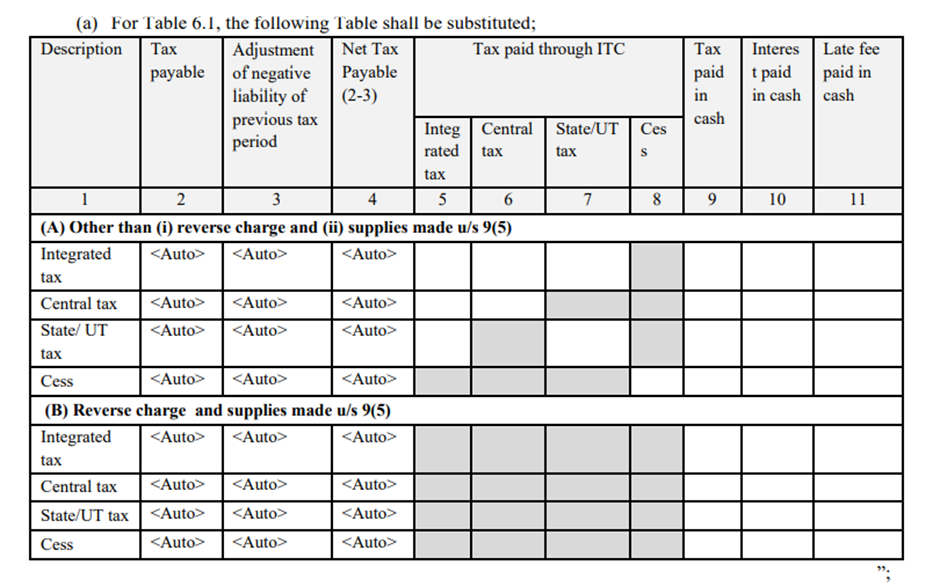

The Central Board of Indirect Taxes and Customs ( CBIC ) has revised Table 6.1 of the GSTR 3B to include the ‘Adjustment of negative liability of previous tax period’ for Reverse Charge and supplies under Section 9(5) of GST Act and other than Reverse Charge and supplies made under Section 9(5) of GST. The table was replaced with a new one.

The Section 9(5) of GST statute states about the services offered by the E-commerce operators. The government has notified the amendment, however the effective date is yet to be announced.

The following table is substituted for Table 6.1 :

In the table above, part ‘A’ is designated for normal taxpayers providing supplies and availing RCM, needs to enter information. Part ‘B’ is for GST Payers providing supplies under section 9(5) of GST law i.eE-commerce operators.

Earlier, Table 6.1 of GSTR 3B form has only the Description, tax payable, tax paid through ITC, Tax Paid in Cash, Interest Paid in Cash and Late fee paid in cash. As a new category of ‘Adjustment of Negative liability of previous tax period’, the taxpayers can remember the negative and can adjust manually against GST liabilities in next returns.

The new amendment also omitted table 6.2 completely in which the taxpayer has to disclose the TDS/TCS credit.

To Read the full text of the Notification CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Notification No: 12/2024 � Central Tax , 10 July 2024