CBIC temporarily disables Customs Duty Payments from ECL Credit for Maintenance

The Central Board of Indirect Taxes and Customs (CBIC) has disabled payments of Customs Duty from the credit in the Electronic Cash Ledger (ECL) temporarily for maintenance.

The Tweet in the Official Twitter handle of the CBIC stated –

“Dear User,

Please note that customs duty payments from credit in Electronic Cash Ledger are currently disabled due to maintenance. Kindly use Internet Banking or NEFT/RTGS mode during the downtime. We will update you as soon as ECL credit is available for payments.”

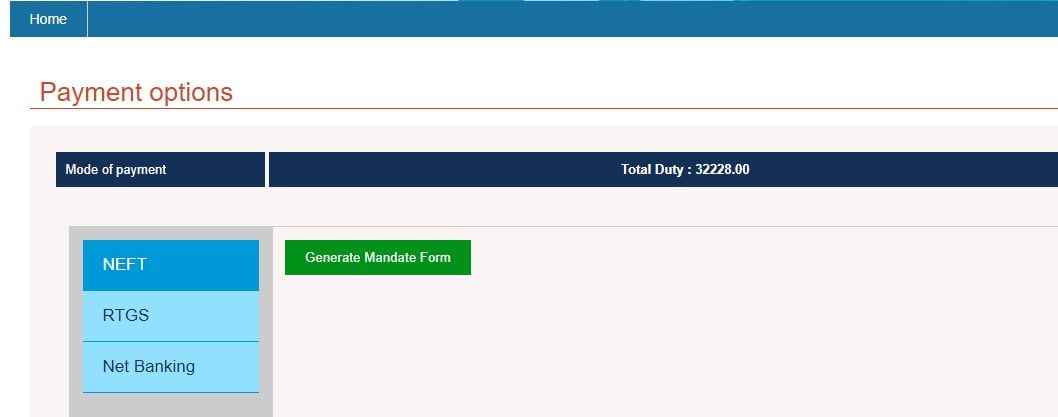

In reply to the grievances of stakeholders, the Central Board of Direct Taxes and Customs (CBIC) replied that the Customs Duty payments from credit in ECL are disabled currently, The tweet further suggested to use the Internet Banking of NEFT/RTGS mode of payment during the downtime.

The Payment option to use ECL Wallet was removed from the Customs Duty payment page without any prior notice to the stakeholders.

Some other payment issues were also faced by the taxpayers, who took it to twitter for redressal of their grievances.

Further, the CBIC itself, in a prior tweet had stated that the RBI NEFT/RTGS System will not be available on many days, resulting in stakeholder agony.

The payment of Duty through RTGS/NEFT is made possible only through the following banks by the Central Board of Indirect Taxes and Customs –

However, some faced were faced by the a holder of an SBI Account –

A disheartened taxpayer took it to twitter, stating how painful it is to make a payment of Customs Duty through the ICEGATE Portal : –

“All Sunday 72

2nd and 4th Saturday 36

National Holiday 3 days

Out Of 365 days ,111 days inconvenience.

How can India growth.?

See private sector run on full days and whole year except weekly off.”

Support our journalism by subscribing to TaxscanAdFree. Follow us on Telegram for quick updates.