DGFT Recommends Anti Dumping Duty on Chinese Wheel Loader Imports after Investigation at request of JCB India Ltd [Read Order]

Central Government- Recommends ADD – Final Report – ADD Investigation – Chinese Wheel -Loader Imports-TAXSCAN

Central Government- Recommends ADD – Final Report – ADD Investigation – Chinese Wheel -Loader Imports-TAXSCAN

On October 6th, the Directorate General of Foreign Trade (DGFT), under case No. AD(OI)–04/2022, released its conclusive results of an anti-dumping inquiry into Wheel Loader imports from China PR, initiated upon the request of JCB India Ltd.

Considering the nature of the product under consideration and the large number of PCNs involved, the Authority considers that it would be appropriate to recommend anti-dumping duty as a percentage of the CIF value of the import price of the subject goods.

M/s JCB India Limited (“domestic industry”) has filed an application before the Designated Authority (“Authority”), supported by M/s BEML Ltd. and M/s Eimco Elecon (India) Ltd on behalf of the domestic industry, in accordance with the Customs Tariff Act, 1975 (“Customs Tariff Act”) and the AD Rules, 1995 for initiation of anti-dumping investigation concerning imports of the “wheel loaders” (“product under consideration”, or the “subject goods” or “wheel loaders”) originating in or exported from China PR (“subject country”).

The Authority, on the basis of sufficient prima facie evidence submitted by the applicant, issued a public notice vide Notification No. 6/4/2022-DGTR dated September 30, 2022, published in the Gazette of India, initiating the subject investigation in accordance with Section 9A of the Customs Tariff Act read with Rule 5 of the AD Rules, 1995 to determine the existence, degree and effect of alleged dumping of the subject goods and to recommend the appropriate amount of anti-dumping duties, which if levied, would be adequate to remove the alleged injury to the domestic industry.

After examining the issues raised and submissions made by the interested parties and facts made available before the Authority as recorded in this finding, the Authority concludes that:

- The imports of the PUC from the subject country are at dumped prices.

- The domestic industry has suffered material injury due to dumping of the product under consideration from the subject country.

- Dumped imports from the subject country have declined in both absolute and relative terms during the POI. However, imports have increased in 2020-21 compared to the base year 2018-19. These imports may have been sold in the domestic market during the POI, thereby injuring the domestic industry during the POI.

- The profitability of the domestic industry declined significantly, and the domestic industry is incurring losses. The return earned by the domestic industry is negative.

RECOMMENDATIONS

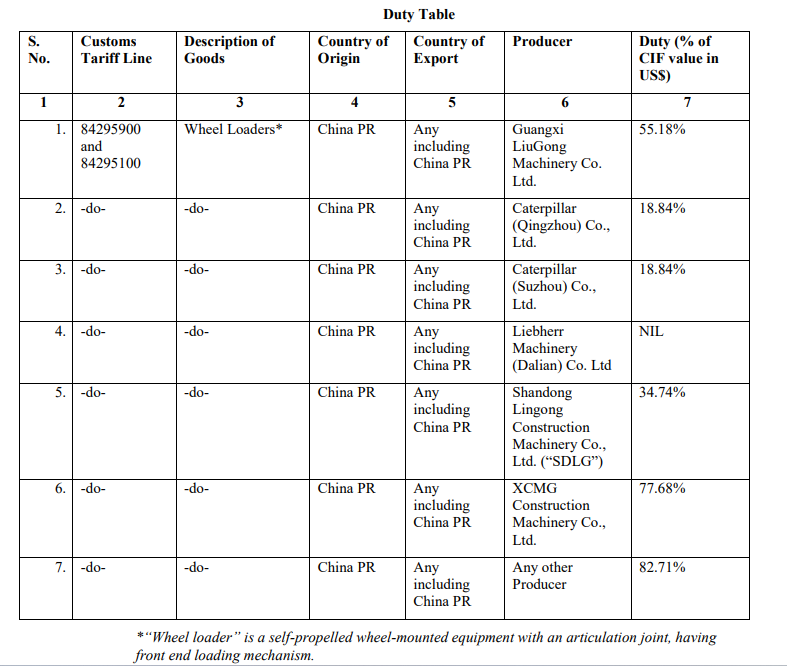

Considering the nature of the product under consideration and the large number of PCNs involved, the Authority considers that it would be appropriate to recommend anti-dumping duty as a percentage of the CIF value of the import price of the subject goods.

Further, having regard to the lesser duty rule as enunciated in Rule 17 (1)(b) of the Anti-Dumping Rules, the Authority recommends imposition of definitive anti-dumping duties equal to the lesser of margin of dumping or margin of injury, from the date of notification to be issued in this regard by the Central Government, so as to remove the injury to the domestic industry. Accordingly, definitive anti-dumping duties equal to the amount as percentage of CIF value indicated in Col 7 of the duty table given below is recommended to be imposed from the date of notification to be issued in this regard by the Central Government for a period of five (5) years:

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick update