Central Govt imposes Anti-Dumping Duty on Single Mode Optical Fiber for Period of 5 Years [Read Notification]

Central Govt imposes Anti-Dumping Duty on Single Mode Optical Fiber – Central Govt – Anti-Dumping Duty – Single Mode Optical Fiber – TaxscanCentral Govt imposes Anti-Dumping Duty on Single Mode Optical Fiber – Central Govt – Anti-Dumping Duty – Single Mode Optical Fiber – Taxscan

Central Govt imposes Anti-Dumping Duty on Single Mode Optical Fiber – Central Govt – Anti-Dumping Duty – Single Mode Optical Fiber – TaxscanCentral Govt imposes Anti-Dumping Duty on Single Mode Optical Fiber – Central Govt – Anti-Dumping Duty – Single Mode Optical Fiber – Taxscan

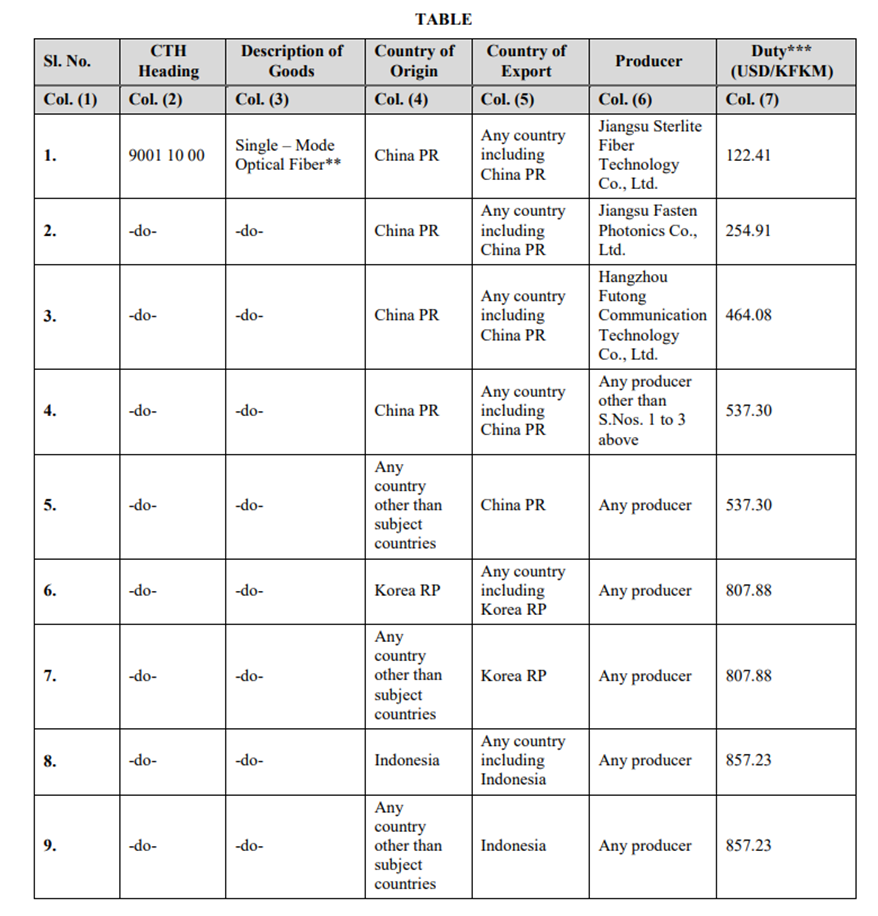

The Central Government vide notification No. 07/2023-Customs (ADD) G.S.R. 586(E) issued on 3rd August 2023 has imposed the anti-dumping duty on the Single Mode Optical Fiber for the period of 5 years.

The anti-dumping duty imposed under this notification shall be effective for a period of five years (unless revoked, superseded or amended earlier) from the date of publication of this notification in the Official Gazette, and shall be payable in Indian currency.

Whereas in the matter of ‘Dispersion Unshifted Single – Mode Optical Fiber’ (subject goods) falling under chapter heading 9001 of the First Schedule to the Customs Tariff Act, 1975, originating in, or exported from China PR, Indonesia and Korea RP, and imported into India, the designated authority in its final findings, vide notification No. 6/1/2022-DGTR dated the 5th May, 2023, published in the Gazette of India, Extraordinary, Part I, Section 1, dated the 5 th May, 2023 read with corrigendum notification Case No. AD(OI) – 01/2022 under F. No. 6/1/2022-DGTR dated 30th June, 2023, has come to the conclusion that—

- the subject goods have been exported to India from the subject countries below normal values;

- the domestic industry has suffered material injury on account of subject imports from subject countries;

- the material injury has been caused by the dumped imports of subject goods from the subject countries,

and has recommended imposition of an anti-dumping duty on the imports of subject goods, originating in, or exported from the subject countries and imported into India, in order to remove injury to the domestic industry.

Now, therefore, in exercise of the powers conferred by sub-sections (1) and (5) of section 9A of the Customs Tariff Act read with rules 18 and 20 of the Customs Tariff (Identification, Assessment and Collection of Anti-dumping Duty on Dumped Articles and for Determination of Injury) Rules, 1995, the Central Government, after considering the aforesaid final findings of the designated authority, imposed on the subject goods:

*** The product under consideration is "Dispersion Unshifted Single – Mode Optical Fiber" ("SMOF"). The product scope covers Dispersion Unshifted Fiber (G.652) and Bend insensitive single mode Fiber (G.657). Dispersion Shifted Fiber (G.653), Cut-off shifted single mode optical Fiber (G.654), and Non-Zero Dispersion Shifted Fiber (G.655 & G.656) are specifically excluded from the scope of the PUC.

*** The trading of this commodity occurs in FKM (fibre kilometre)/KFKM (1KFKM = 1000 FKM). The recommended ADD should be collected in this unit. Accordingly, steps may be taken to ensure the same.

To Read the full text of the Order CLICK HERE

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates